Stock price 'halved'! Xpeng, worth 50 billion, has yet to 'escape'

![]() 08/22 2024

08/22 2024

![]() 484

484

The competition in the new energy vehicle industry has not yet come to an end, and the intense competition in the industry will continue.

For automakers, sales remain a core consideration.

Judging from the current market competition landscape, the “two superpowers and multiple strong players” scenario of BYD and Tesla remains relatively stable, but the competition among new automakers is still full of suspense.

Currently, Seres has “broken through” with AITO, and its continued sales growth demonstrates the brand's strong vitality. NIO, which led the way last year, has struggled this year but is fortunately already profitable. Xpeng and NIO are still struggling with sales, and the timeline for turning a profit remains unclear.

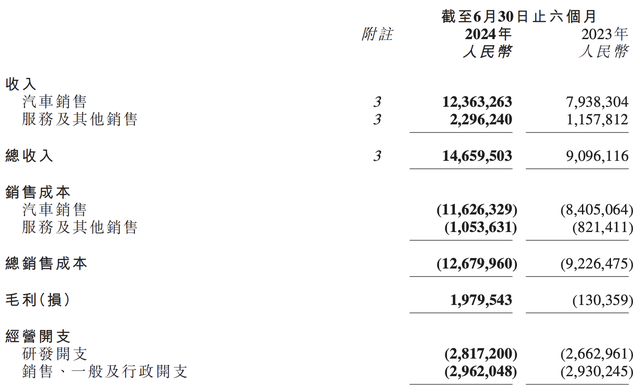

On August 20, Xpeng Motors released its 2024 interim results and second-quarter financial report. The report showed that in the first half of this year, Xpeng's total revenue was 14.66 billion yuan, an increase of 61.2% year-on-year; the net loss was 2.65 billion yuan, compared to 5.14 billion yuan in the same period last year, representing a 48.44% year-on-year narrowing.

Notably, the company's gross margin for the first half of this year was 13.5%, compared to -1.4% in the same period last year; the automotive gross margin was 6%, compared to -5.9% in the same period last year.

Although the data is positive, challenges remain.

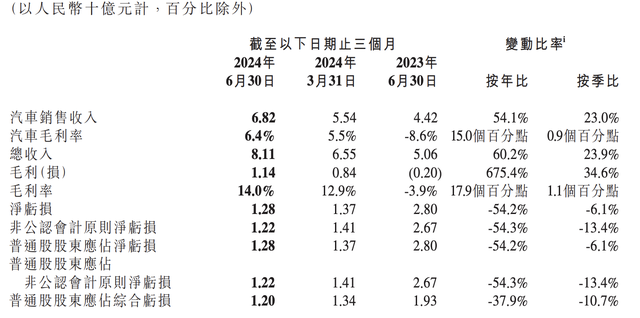

Specifically, in the second quarter, Xpeng's total revenue was 8.11 billion yuan, an increase of 60.2% year-on-year and 23.9% quarter-on-quarter. However, it is worth noting that the company's net loss in the second quarter still reached 1.28 billion yuan, but this represents a significant reduction in losses compared to the 2.8 billion yuan net loss in the same period last year.

Additionally, Xpeng's gross margin in the second quarter of this year reached 14.0%, a significant improvement in profitability compared to the -3.9% gross margin in the same period last year.

The improvement in overall revenue is attributed to the increase in sales.

It is reported that in the first half of this year, Xpeng delivered 52,000 vehicles, an increase of 25.6% year-on-year. In the second quarter, Xpeng delivered a total of 30,000 vehicles, an increase of 30.2% year-on-year. Xpeng expects to deliver 41,000 to 45,000 vehicles in the third quarter of 2024, representing an increase of 2.5% to 12.5% year-on-year.

However, overall, despite Xpeng's ongoing efforts to change the status quo, the gap remains significant. Relevant statistics show that in the first seven months of this year, Xpeng sold a cumulative total of 63,000 vehicles, achieving only 22.6% of its annual target. In comparison, Seres sold 282,600 vehicles, NIO sold 240,000 vehicles, and even NIO sold 107,924 vehicles in the same period...

In contrast, although Xpeng's sales have increased year-on-year and its gross margin has turned positive, the gap with other new automakers remains large. In terms of stock price, Xpeng has continued to decline, with a year-to-date decline of over 52%, resulting in a “halved” stock price and a current market value of only 51.1 billion Hong Kong dollars. If calculated from its peak, Xpeng's market value has evaporated by over 366 billion Hong Kong dollars.

For the current new energy vehicle industry, sales remain a decisive factor.

If sales continue to lag, it will not be long before the company falls out of the competition.

For new automakers, in addition to maintaining sales of popular models, launching new products is another solution to increase sales.

Xpeng, on the other hand, is placing more bets on the MONA M03. He Xiaopeng stated that starting from the launch of the MONA M03 in August, Xpeng has entered a robust product cycle and a period of rapid development.

He also mentioned that in the next three years, multiple competitive new products and models will be launched Intensive listing . The company's plans for AI technology and product innovation, combined with the results of technology cost reduction, will be reflected in these products, and will drive sustainable growth in sales through a stronger marketing system in both China and global markets.

Additionally, Xpeng plans to launch the P7+, equipped with a new generation of autonomous driving hardware platform, in the fourth quarter of this year.

He Xiaopeng believes that deliveries of the MONA M03 and P7+ will significantly increase Xpeng's market share, and he is confident that deliveries will grow substantially quarter-on-quarter in the third and fourth quarters, with a new delivery peak expected in the fourth quarter.

Of course, the market did not respond positively to Xpeng's financial results or He Xiaopeng's outlook for the future. After the release of the financial results, Xpeng's U.S. shares fell by 5.97%, while its Hong Kong shares saw a relatively smaller decline.

This indicates that the market's wait-and-see attitude towards Xpeng remains strong, but this does not mean that Xpeng has nothing to offer. Its cooperation with Volkswagen is also expanding.

On July 22, Xpeng announced on the Hong Kong Stock Exchange that following the signing of a strategic cooperation framework agreement with Volkswagen Group on April 17, 2024, the company has further signed a joint development agreement for strategic cooperation in electronic and electrical architecture technology with Volkswagen. Both parties will fully commit to developing industry-leading electronic and electrical architectures for Volkswagen's CMP and MEB platforms produced in China. The first model equipped with this technology is expected to enter mass production within approximately 24 months.

Two days before the official announcement of the upgraded cooperation, insiders revealed that hundreds of Volkswagen engineers had moved into Xpeng's headquarters in Guangzhou to learn technology from Xpeng, marking a comprehensive upgrade in their cooperation.

Kanjian Finance believes that the cooperation with Volkswagen has improved Xpeng's revenue to a certain extent. Its second-quarter revenue from services and other areas alone reached 1.29 billion yuan, opening up space for Xpeng's next stage of growth.

In addition, as of June 30, Xpeng's cash and cash equivalents, restricted cash, short-term investments, and time deposits totaled 37.33 billion yuan. This substantial cash reserve has enhanced Xpeng's ability to withstand risks.

Previously, Xpeng had a significant "bias" towards intelligence, and in terms of intelligence, Xpeng was once a "fanatic."

However, as the new energy vehicle industry has entered its "second half," all automakers are putting considerable effort into intelligence, gradually eroding Xpeng's advantages.

Facing declining sales, Xpeng hopes to regain ground through AI.

The MONA M03, launched by Xpeng in August, positions itself as a popularizer of global AI-driven vehicles. Advanced intelligent technology is the hallmark of this vehicle, which will be equipped with Xpeng's latest intelligent driving assistance system.

In terms of price, this is a low-cost vehicle. According to Autohome data, its selling price is 135,900 yuan. Previously, Xpeng investors stated that the starting price of the MONA M03 would be below 140,000 yuan.

In July this year, Xpeng's "end-to-end" large model was launched, and XNGP was opened to all cities. At the same time, based on changes in the intelligent driving technology roadmap, the company reorganized its organizational structure after dismantling it, focusing on the end-to-end model to accelerate the evolution of AI capabilities and the transformation of the organization towards AI.

Thus, misaligned price competition combined with AI will be key factors for Xpeng's future turnaround.

Admittedly, following a "technological" path and positioning autonomous driving vehicles in a sufficiently safe price range is a good strategy. However, given the intense competition in the market, Xpeng faces significant pressure. Despite the challenges, Xpeng's strategy of betting on intelligent driving and going all-in on AI remains correct.

According to its financial report, Xpeng's research and development expenses for the first half of this year were 2.82 billion yuan, an increase of 5.8% year-on-year. This expenditure was primarily used for intelligence and new model research and development, continuously strengthening its "long board" and reinforcing its core competitiveness in intelligence.

After the release of the financial report, Daiwa Capital Markets issued a research report stating that Xpeng's sales performance in the first half of the year was relatively weak compared to its competitors. Considering the potential tariffs that the European Union may impose on its exports and the slower-than-expected delivery of new vehicles, Daiwa downgraded its revenue forecasts for this year and next by 8% to 27% and lowered sales forecasts by 22% and 38%, respectively. The management revealed that two new products will be launched in the second half of the year, with the Xpeng M03 expected to start deliveries in August, and the company plans to launch the P7+ equipped with a new generation of ADAS in the fourth quarter. Therefore, Daiwa maintained a "buy" rating on Xpeng and downgraded its U.S. share price target from $11 to $8.90.

Citigroup issued a research report slightly raising its sales forecasts for Xpeng for 2024 to 2026 by 1% to 3% to account for the increase in MONA sales. However, due to the dilution of MONA's average selling price, it lowered its revenue forecasts for 2024 to 2026 by 5% to 7%. Therefore, the bank maintained a "neutral" rating on Xpeng and downgraded its share price target from HK$32.20 to HK$29.80.

BOCI Research issued a research report stating that Xpeng's second-quarter revenue increased by 23.9% quarter-on-quarter, slightly higher than expected, mainly due to a quarterly increase of approximately 200 million yuan in revenue from Volkswagen's technical services. Although the downward shift in product mix led to a significant quarterly decline in the average selling price per vehicle, the second-quarter gross margin for complete vehicles was better than the bank's expectations, and the consolidated gross margin also recovered to a historical high of 14%. On the other hand, cash flow performance was lower than expected, resulting in a net cash decrease of approximately 4 billion yuan in the quarter.

Not only that, but BOCI Research also downgraded its sales forecasts for Xpeng this year and next to 170,000 and 300,000 units, respectively, and maintained its forecast of a net loss of 3.3 billion yuan next year. Therefore, the bank maintained a "buy" rating on Xpeng but downgraded its share price target to HK$46.00.