HKEx: The warmth is “fleeting”, when will the next upturn come?

![]() 08/22 2024

08/22 2024

![]() 600

600

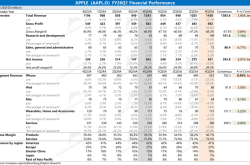

After the Hong Kong stock market closed on August 21st, Beijing time, the Hong Kong Exchanges and Clearing Limited (HKEx) released its financial results for the second quarter of 2024. The overall performance reflects an expected recovery, but since June, market sentiment has weakened again, putting pressure on the third quarter.

As most of HKEx's revenue is tied to market trading activity, which is largely public information and disclosed monthly on the company's official website, actual performance generally does not deviate significantly from expectations. Most positive and negative factors have already been priced in, so there is limited impact on valuation from the current quarter's results. This analysis focuses on further understanding the actual market conditions through the financial report and exploring significant changes within HKEx.

Specifically:

1. Overall flat performance: By "flat," we mean that the second-quarter results were neither surprising nor as strong as expected. While the trading volume in the Hong Kong stock market showed a marked recovery from the first quarter, this was already anticipated. There were still gaps between actual revenue from depositary receipts and market data fees and expectations.

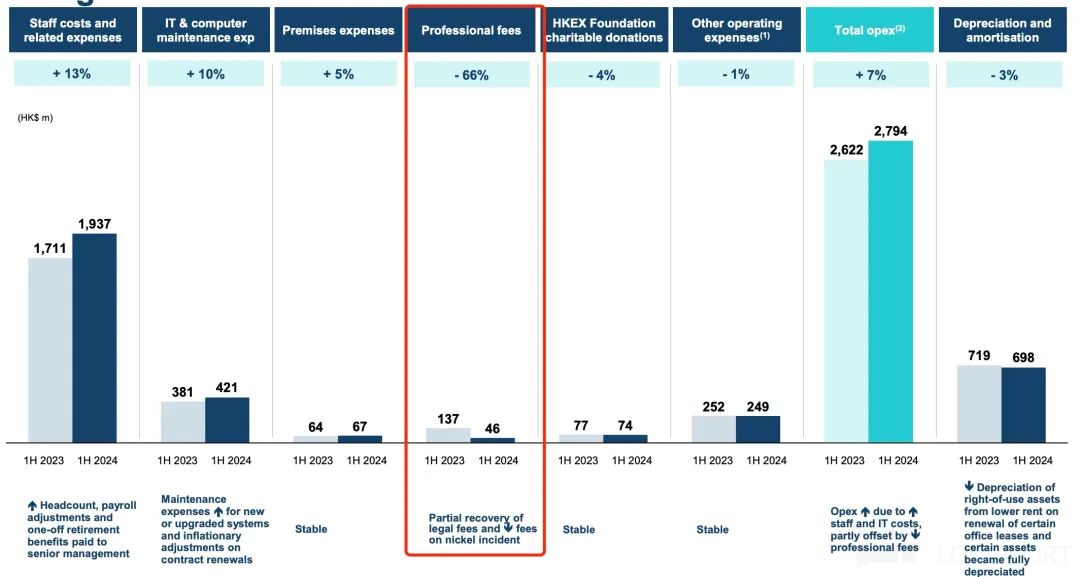

Operating profit appeared to slightly exceed expectations, primarily due to a legal fee refund related to the LME nickel market incident. Excluding this impact, actual performance was average and did not exceed expectations.

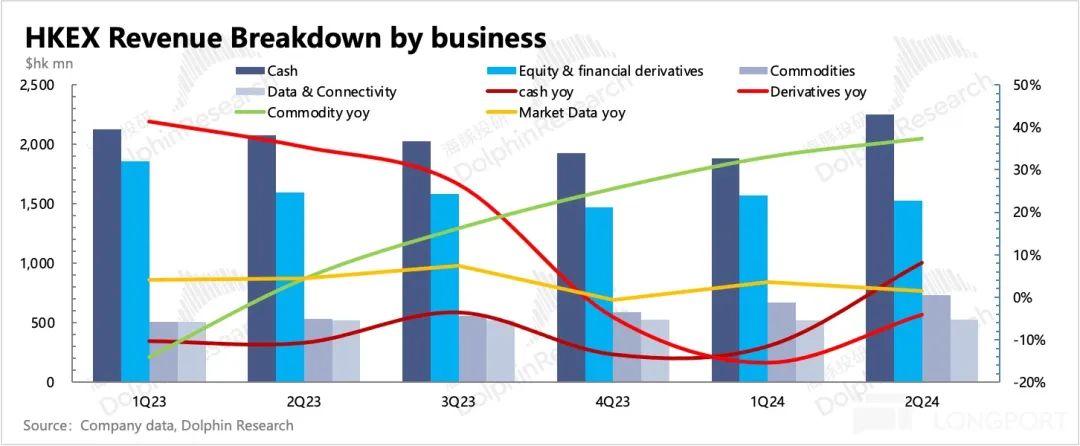

2. Expected recovery in equity and derivatives, but weakening in Q3: 70% of HKEx's revenue comes from equity and derivatives trading, so the recovery in these two markets in the second quarter drove a rebound in revenue growth.

The drivers were increased equity and derivatives trading volumes, with total average daily trading volume (ADV) exceeding HKD 120 billion, surpassing the key sentiment threshold of HKD 100 billion set by Dolphin Insights.

However, starting in June, the market turned downward again, performing poorly in July and August with cold sentiment. Consequently, the third quarter is likely to be under significant pressure. The hope now lies in the start of an interest rate cut cycle to improve liquidity and ease performance pressures.

3. Continued strength in commodities: Additionally, the commodity market maintained its strong trading volume, and with the "price increase" (raising trading and settlement fees) earlier in the year, both volume and price contributed to accelerated revenue growth.

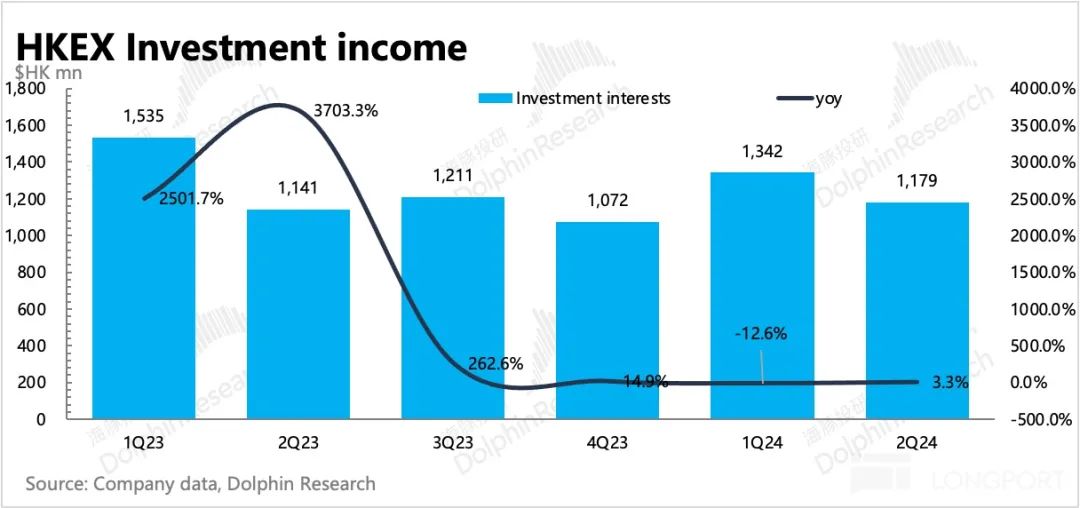

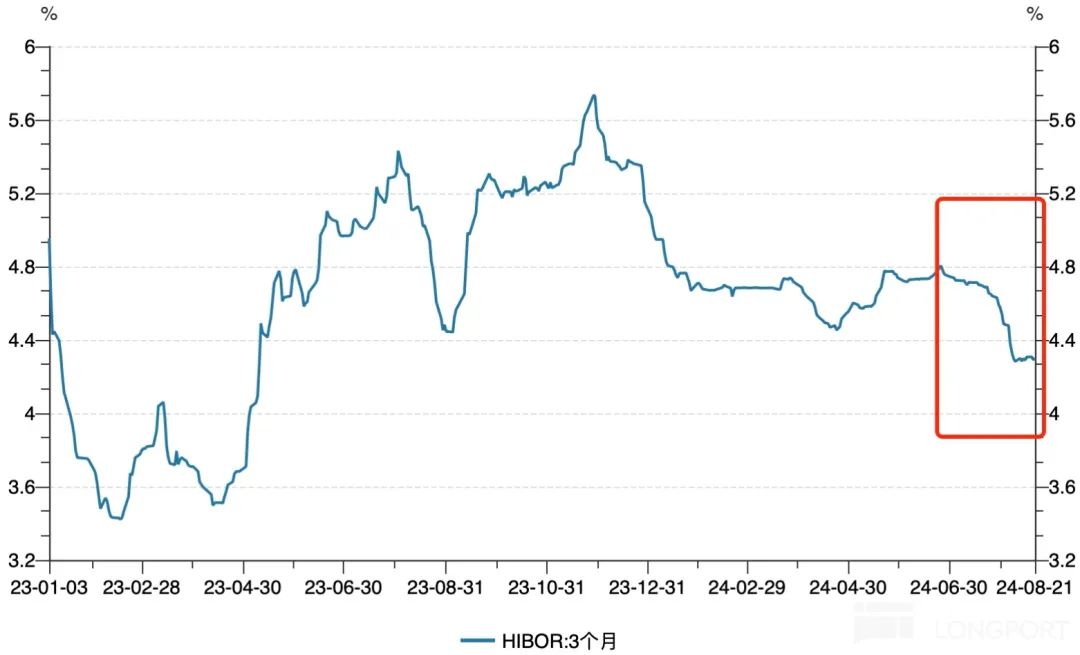

4. Slowdown in investment income: The net investment income, which performed well in a high-interest environment, slowed year-on-year in the second quarter due to declining market interest rates (HIBOR) and declined sequentially. Coupled with a reduction in margin size following the lowering of thresholds and poor performance of the investment portfolio, further declines are expected in the second half of the year.

5. Financial Indicators Overview

Dolphin Insights' Perspective: HKEx's performance is heavily dependent on market conditions. Unlike essential utilities like water, electricity, and gas, HKEx's services are substitutable, and funds can freely exit. In the global capital market, HKEx's attractiveness does not have an absolute advantage at present, limiting its room for adjustment. With "revenue dependent on market conditions and rigid expenses," profit elasticity primarily stems from improved market sentiment. Thus, investment opportunities for HKEx that resonate with both performance and valuation primarily lie in identifying turning points in improving market sentiment.

In the short term, the third-quarter performance pressure is significant. On the one hand, market sentiment has weakened again, with equity and derivatives trading volumes falling rapidly. On the other hand, investment income, which has been a growth driver when trading-related income was under pressure in the past year, will be more significantly impacted in the third quarter due to the continued decline in HIBOR in mid-to-late July.

Currently, a potential upturn may occur in the fourth quarter with substantial interest rate cuts in the US, boosting Hong Kong stock market liquidity and, in turn, further improving market sentiment, pushing the average daily trading volume of securities back above HKD 100 billion.

Detailed Financial Report Analysis

1. Introduction to HKEx's Business

2. Overall Performance: Unspectacular

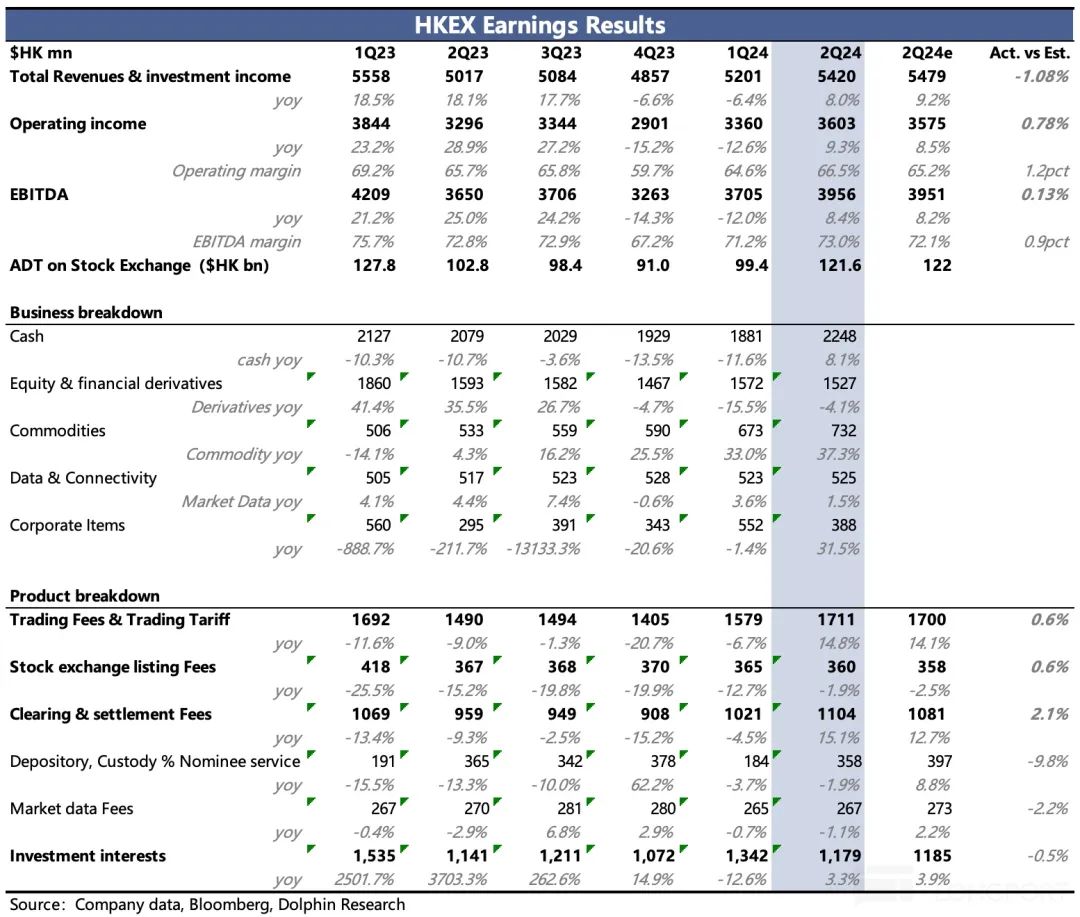

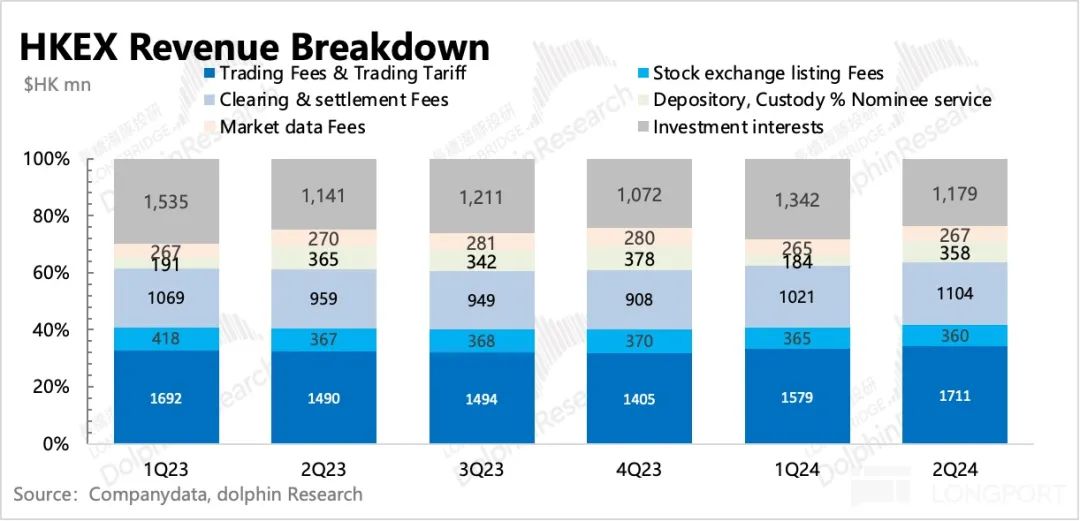

In the second quarter, HKEx generated a total of HKD 5.42 billion in revenue and other income, up 8% year-on-year, primarily driven by the recovery in stock and futures trading and the continued strength of the commodities market.

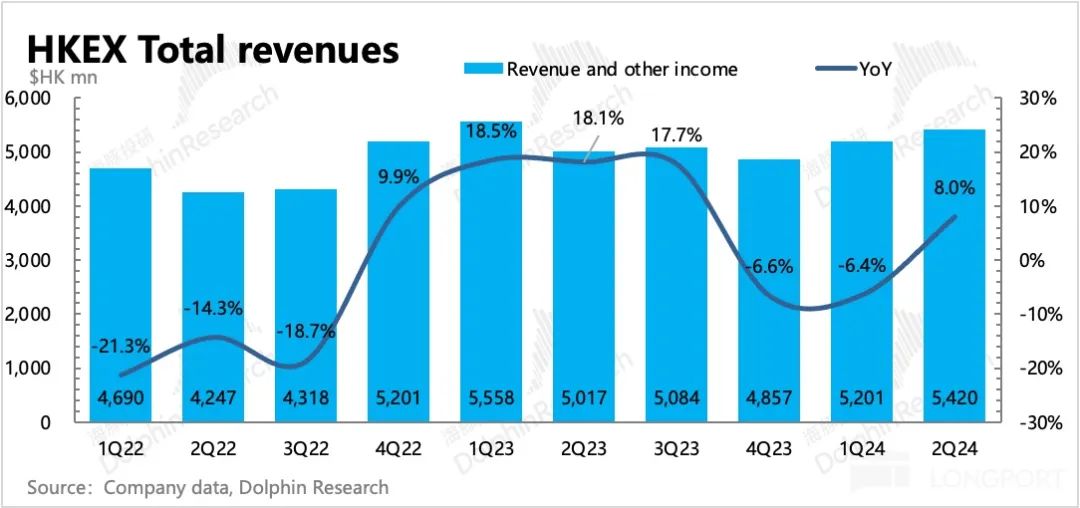

Operating profit reached HKD 3.6 billion, up 9.3% year-on-year, and EBITDA was HKD 3.96 billion, up 8.4% year-on-year. While these figures appeared to slightly exceed expectations, they were primarily due to a legal fee refund related to the LME nickel market incident. Excluding this impact, actual performance was average and did not exceed expectations.

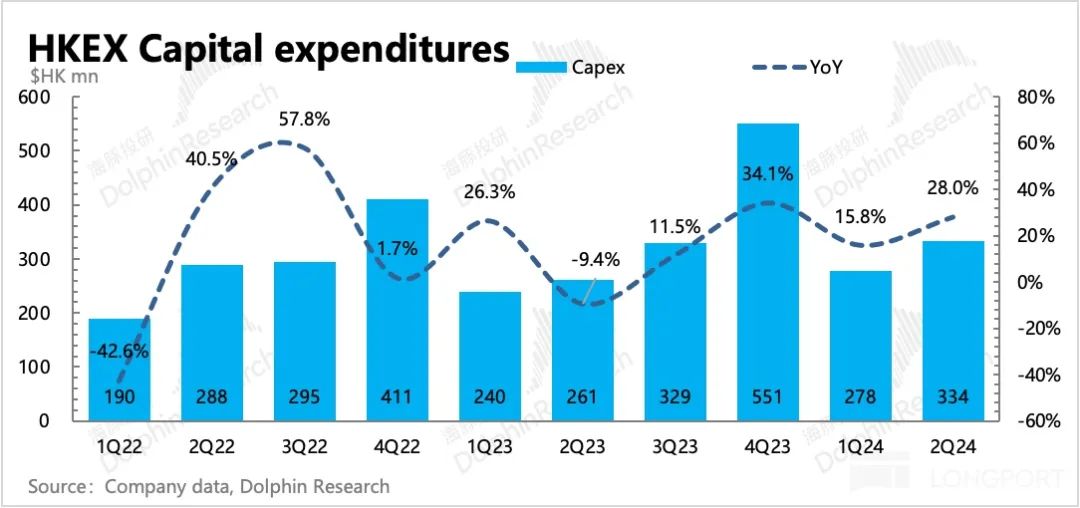

HKEx's expenses are generally relatively rigid, but in the past year, system upgrades and incentives for executive layoffs have temporarily increased overall expenses. When revenue is under pressure, the impact on profits is more pronounced. Currently, capital expenditures are still growing rapidly, and it is expected that the increase in expenses will continue for some time.

Revenue Structure:

Over 50% of HKEx's revenue and other income are directly related to trading (trading fees, clearing fees), with 7% coming from listing fees, which are also influenced by current market sentiment. From the perspective of listed companies, they tend to list when sentiment is high to increase their market value.

Additionally, investment income benefits from the high-interest environment and remained at historically high levels in the second quarter. However, due to rising expectations of interest rate cuts and declining HIBOR, investment income declined sequentially from the first quarter.

3. Trading Fees: Benefiting from the May Recovery

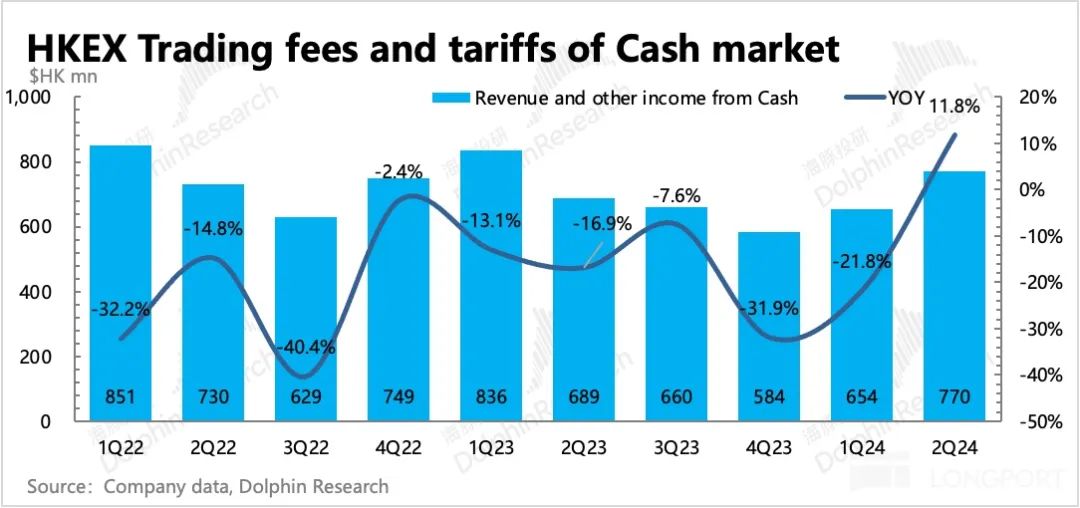

In the second quarter, expectations of interest rate cuts and mainland real estate support policies led to a recovery in extreme valuations from the first quarter, improving market sentiment and driving a 15% year-on-year increase in trading fees. This represents a notable recovery from the first quarter.

Trading fees are primarily derived from equity, derivatives, and commodity markets. Here's a closer look at each:

(1) Equity Market

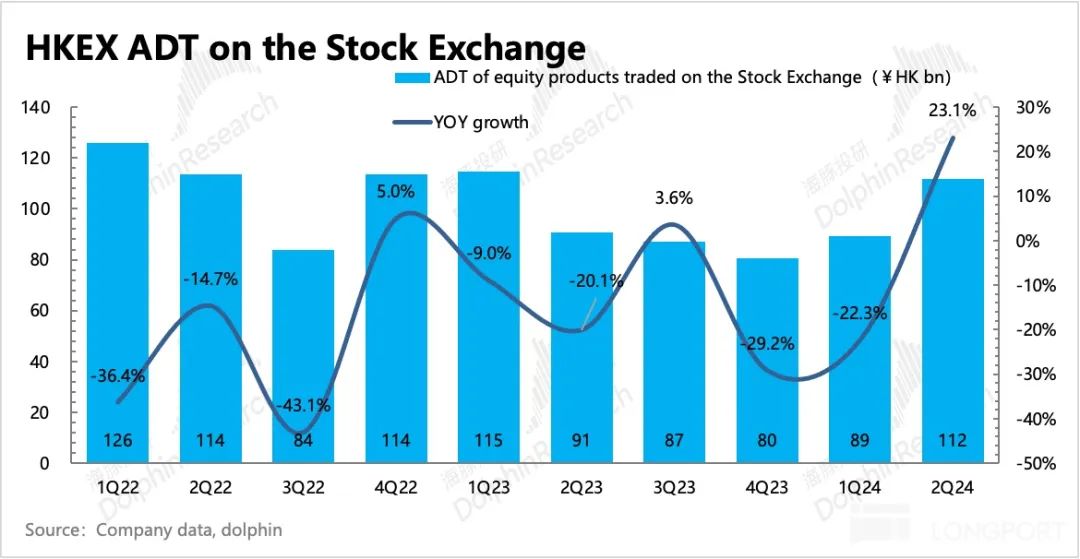

Trading volume (ADT) increased 23% year-on-year to HKD 118 billion per day, a significant improvement from the previous four quarters' levels below HKD 90 billion.

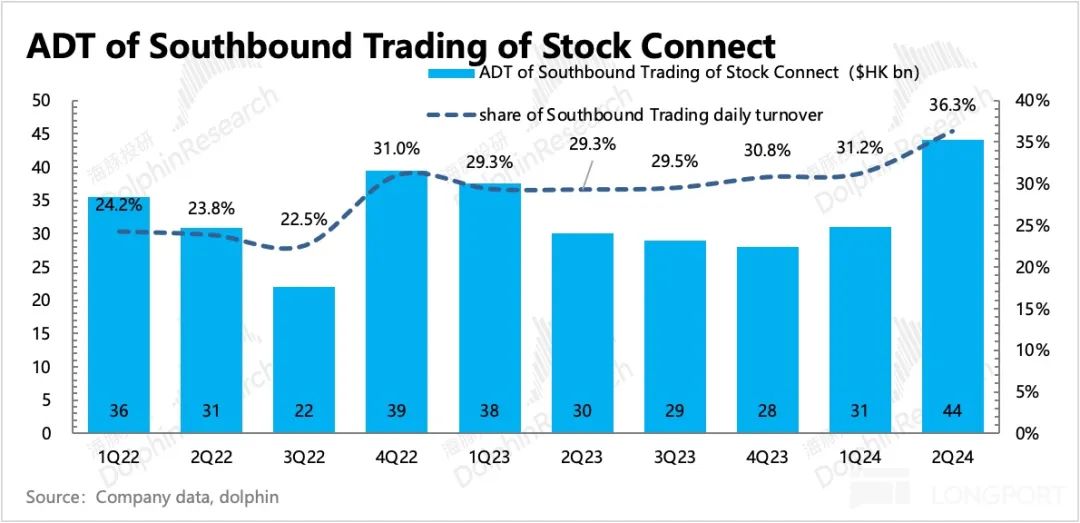

Notably, the proportion of mainland capital trading increased significantly, up 5 percentage points from the previous quarter. In contrast, capital flowing from Hong Kong to the mainland market did not increase significantly and even declined slightly. This aligns with the underlying investment logic:

During interest rate cut cycles, the US dollar depreciates relatively, improving capital market liquidity and preferentially flowing into emerging markets, particularly those with low valuations and high-quality companies. Compared to the A-share market, the Hong Kong stock market offers lower valuations and includes many high-quality internet and technology companies, making it more attractive to investors under this logic.

Ultimately, equity market trading fees generated HKD 770 million, up 12% year-on-year. The significant recovery in Hong Kong market trading fees offset the impact of reduced A-share trading fees to some extent.

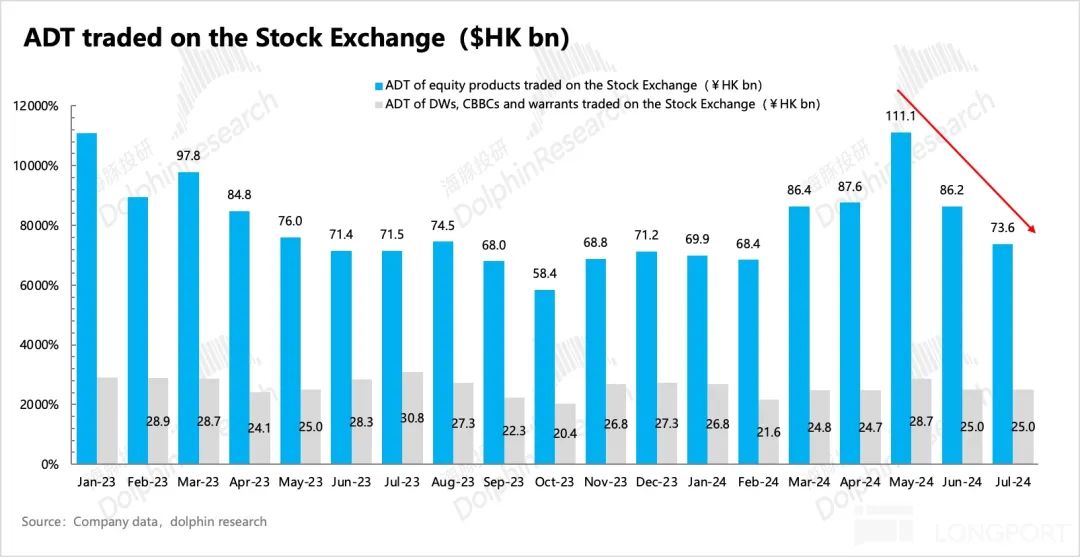

However, as the largest component of revenue, trading sentiment since June may significantly impact third-quarter revenue. Monthly data shows that average daily trading volume fell below HKD 90 billion starting in June and even declined to HKD 73.6 billion in July.

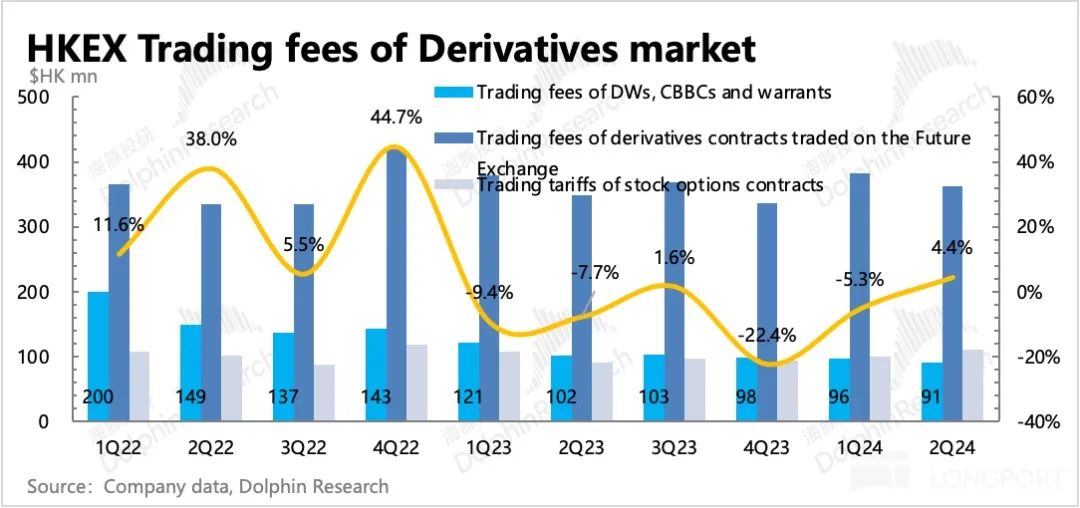

(2) Derivatives Market

Derivatives trading was active in the Hong Kong Futures Exchange (HKFE) and Stock Exchange of Hong Kong (SEHK) options, while warrants and callable bull/bear contracts were relatively subdued.

The number of contracts traded in the HKFE and SEHK options increased by 14% and 25% year-on-year, respectively. Although the average daily trading volume of warrants and callable bull/bear contracts declined nearly 20% year-on-year, this does not indicate extremely low trading activity. Based on the number of transactions, there was only a slight 3% decline.

Since most fees are based on the number of contracts traded, the performance of warrants and callable bull/bear contracts did not affect the overall rebound in derivatives trading fees at HKEx.

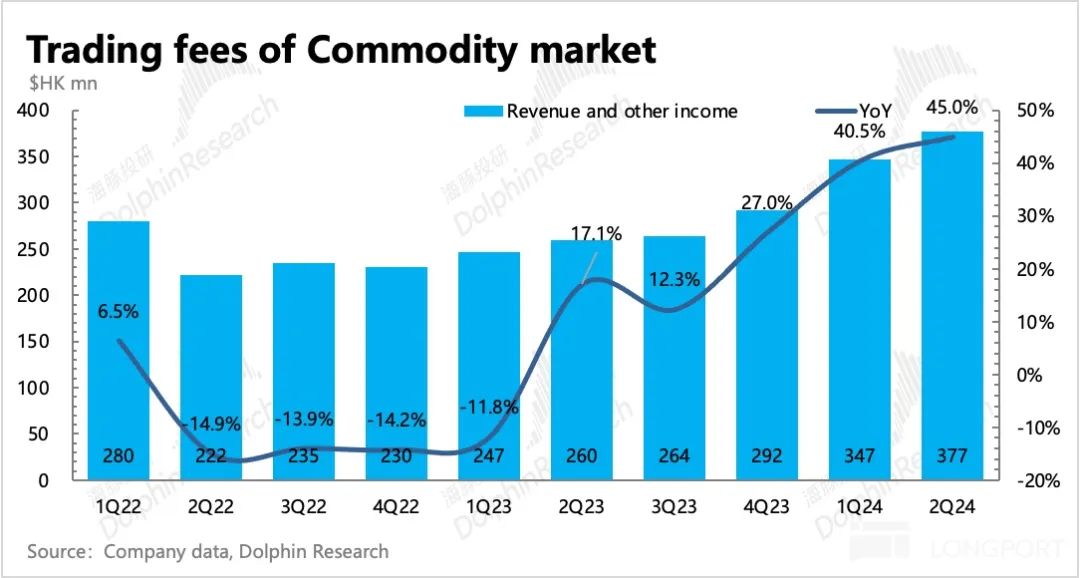

(3) Commodities Market

In the second quarter, while the natural recovery cycle from the previous suspension of nickel trading in the metals commodities market (LME) had passed, high trading activity due to significant price fluctuations (initially rising sharply then falling) and increased trading fees at the beginning of the year drove a 45% increase in trading fees, continuing the strong growth momentum.

By segment, all metal sectors showed varying degrees of year-on-year growth. Nickel trading doubled year-on-year due to the introduction of a new product in the first half.

However, starting in June, the commodities market continued to adjust, and it is expected that trading volume will decrease somewhat in the third quarter due to subdued market conditions.

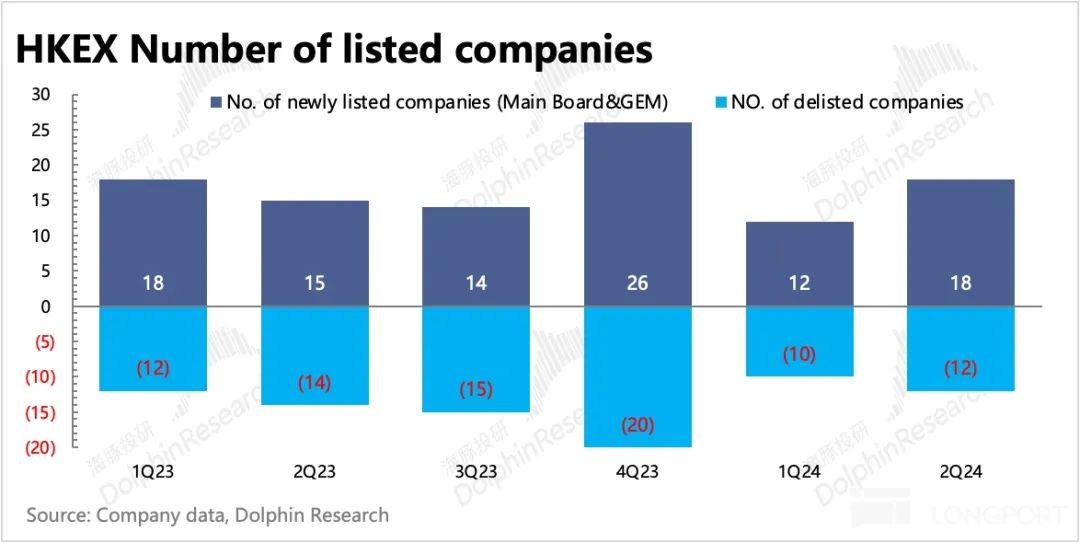

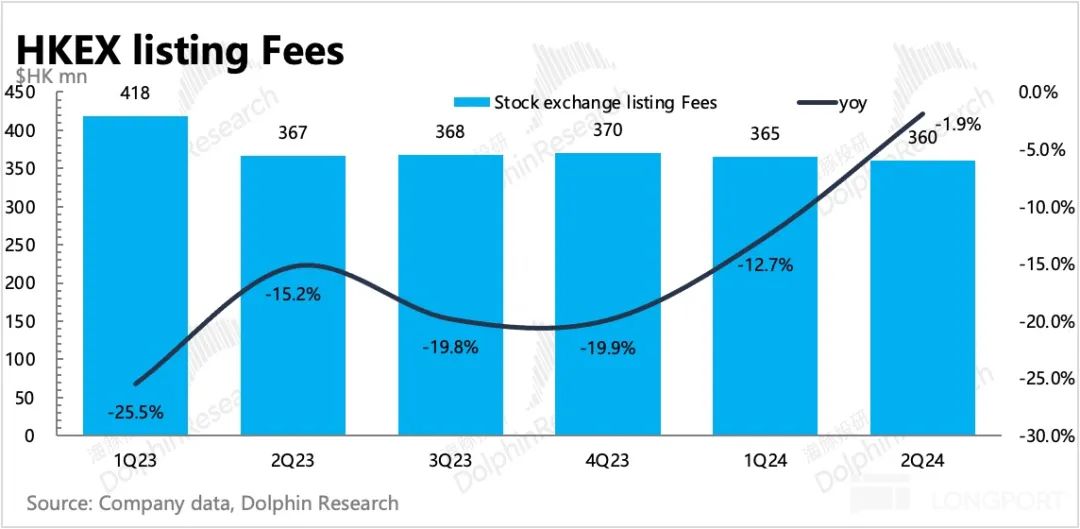

4. Listing Fees: Recovery in New Listings but Also Delistings

The number of new Hong Kong stock listings in the second quarter reached 18, a recovery from 12 in the first quarter. Meanwhile, 12 companies were delisted during the same period, maintaining short-term stability. Ultimately, the total number of listed companies grew by 6 to 2,617 (including the Main Board and Growth Enterprise Market) by year-end.

Since listing fees are not just paid by companies at IPO but also annually by existing companies, which often accounts for a larger portion (75-80%), overall listing fees remained below last year's levels. However, with three fewer delistings than last year, the year-on-year decline is rapidly narrowing. Ultimately, listing fees in the second quarter decreased by 2% year-on-year to HKD 360 million, still the lowest level in recent years.

5. Marginal Decline in the Bonus of Investment Income

In a high-interest environment, bond and margin income performs better, providing some support when equity and derivatives markets underperform due to high-interest rates. Conversely, as the interest rate cut cycle begins, this income stream is also subject to marginal decline.

Investment net income in the second quarter was HKD 1.18 billion, still at historically high levels but declining sequentially. With further declines in HIBOR rates in July, investment income is expected to decline significantly year-on-year in the third quarter.

- END -

// Repost Authorization

This article is an original article of Dolphin Investment Research. Please obtain repost authorization if necessary.