Xpeng has no way back: Intelligent on the left, cost-effective on the right

![]() 08/22 2024

08/22 2024

![]() 530

530

Judging from sales data, Xpeng seems to be drifting further away from the top tier of new energy vehicle brands. However, upon reviewing its financial report, it becomes evident that several key indicators suggest the brand is gradually improving.

Recently, Xpeng released its second-quarter financial report for 2024. The report revealed that Xpeng generated revenue of 8.11 billion yuan in the second quarter, representing a year-on-year increase of 60.2%. Net losses amounted to 1.28 billion yuan, a significant decrease from the 2.8 billion yuan recorded in the same period last year, marking a reduction of over 50%.

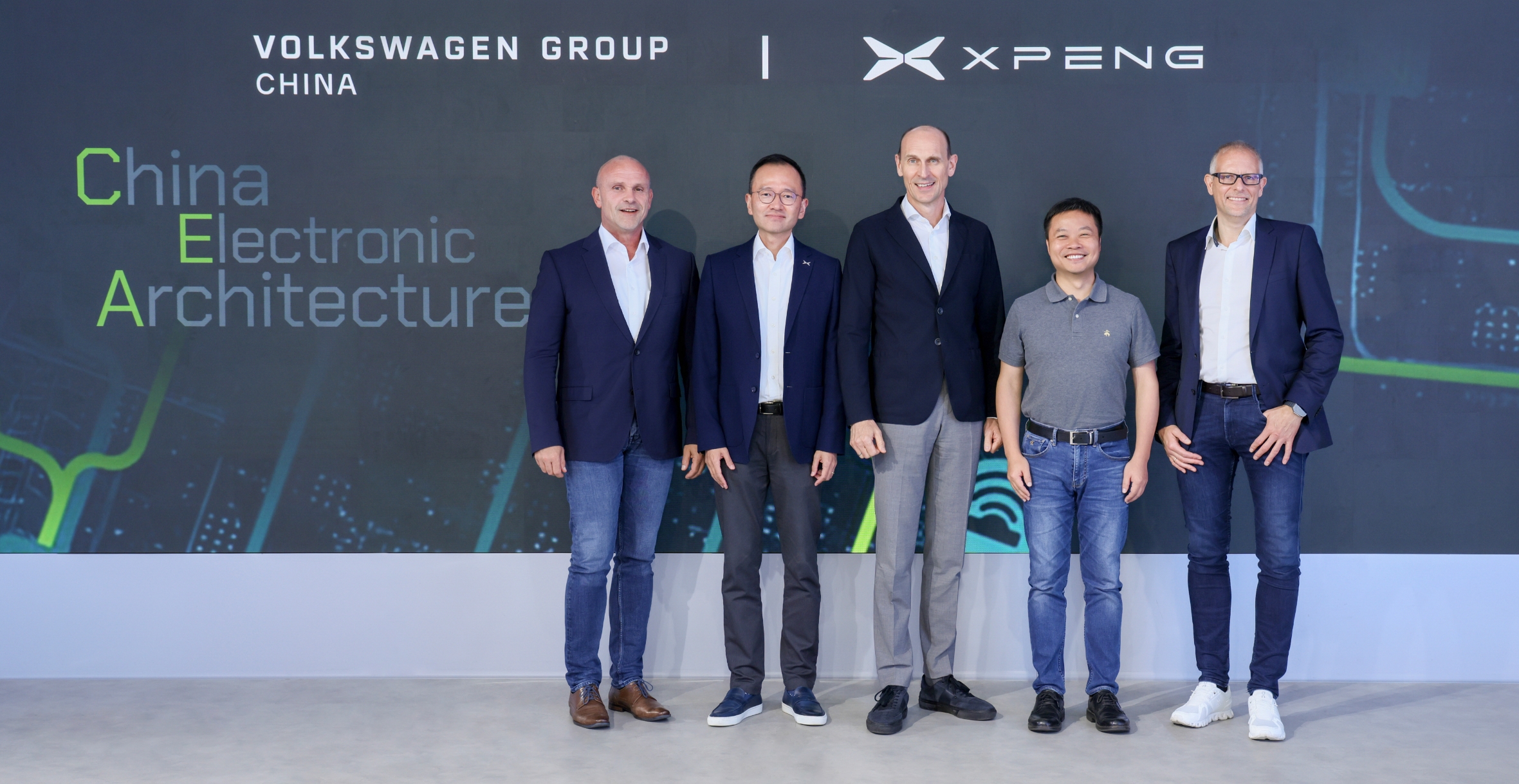

Notably, Xpeng's gross margin continued to rise in the second quarter, reaching 14.0%, a significant improvement of 17.9 percentage points compared to the same period last year. The company attributed this substantial increase in gross margin to cost reductions achieved through technological advancements and revenue generated from technology licensing agreements with Volkswagen.

Compared to the first quarter of this year, Xpeng's revenue and gross margin in the second quarter showed year-on-year growth, and the total revenue for the second quarter met the forecast made in the first quarter's financial report (ranging from 7.5 billion to 8.3 billion yuan). Speaking about Xpeng's plans for the second half of the year, founder He Xiaopeng remained optimistic, noting that planned AI technology and product innovations, coupled with cost reductions through technological advancements, would drive sustainable sales growth for the brand.

However, upon closer examination of the financial report, there are still aspects that warrant attention.

Q2 Cash Flow Declines Sharply, Laying Foundation for Second Half

From a product lineup perspective, Xpeng's second-quarter performance was unimpressive, with the launch of only the Xpeng G6 Dark Knight Edition. Nevertheless, the brand still experienced a certain degree of sales growth.

Specifically, Xpeng delivered a total of 30,207 vehicles in the second quarter, marking a 30.2% increase from the 23,205 vehicles delivered in the same period last year. While this increase in sales undoubtedly contributed to the overall revenue growth, it is noteworthy that the revenue increased by 60% despite sales growth of only 30%, indicating that Xpeng has successfully raised its average vehicle price while controlling costs.

In the second quarter of 2023, the Xpeng P7 was the brand's flagship model, but its dominance gradually declined in the second quarter of this year, with the emergence of the Xpeng G6, Xpeng G9, and Xpeng X9.

While the Xpeng G6 has been instrumental in boosting sales figures, its market penetration strategy relies on offering a high level of equipment at a low price point. The real drivers of Xpeng's revenue growth are the flagship models, the Xpeng G9 (priced around 300,000 yuan) and the all-new MPV Xpeng X9 (priced around 400,000 yuan), which sold 7,438 and 5,271 units respectively in the second quarter, significantly contributing to raising the brand's average vehicle price.

It is worth noting that as of June 30, 2024, Xpeng's cash flow stood at 37.33 billion yuan, down from 41.4 billion yuan at the end of the first quarter, a difference of over 4 billion yuan. Although Xpeng only launched the Xpeng G6 Dark Knight Edition in the second quarter, leaving little room for significant expenditures, considerable resources were allocated to the promotion of MONA M03.

Following the success of the Xpeng P5, Xpeng challenged the A-segment market once again with MONA M03. He Xiaopeng has high expectations for MONA M03, an affordable electric sedan priced below 200,000 yuan that boasts intelligent driving capabilities, advanced infotainment systems, and impressive range. In fact, He Xiaopeng revealed that MONA's pre-sales orders have surpassed those of the G9 from the same period last year, which is expected to stimulate sales and exports in the second half of the year.

During the conference, He Xiaopeng announced that "multiple new products and vehicles will be launched before 2026," including MONA M03, which is scheduled for release on August 27, and the Xpeng P7+, which will be introduced in the fourth quarter based on the brand's new-generation autonomous driving hardware platform.

With two new vehicles on the horizon, He Xiaopeng is optimistic about sales in the second half of the year.

Looking ahead to the third quarter, Xpeng expects to deliver between 41,000 and 45,000 vehicles, representing a year-on-year growth of 2.5% to 12.5%. Total revenue is projected to range from 9.1 billion to 9.8 billion yuan, marking a year-on-year increase of 6.7% to 14.9%.

According to official figures, Xpeng delivered 11,145 vehicles in July, a month-on-month increase of 4%. Considering that MONA M03's delivery timeline is set for September, there will be minimal changes in the brand's sales composition in August, with Xpeng anticipating sales of around 12,000 vehicles for the month.

Combining the official cumulative sales figures with July's performance, it can be inferred that Xpeng's expectations for MONA M03's monthly sales are relatively conservative, with an estimated incremental sales of approximately 6,000 vehicles.

Regarding the Xpeng P7+, scheduled for release in the fourth quarter, the company has stated that this new model will be the first to achieve a 25% reduction in technology costs and boasts significant technological innovations, with a projected profit margin reaching double digits. Unsurprisingly, the P7+'s primary selling points will be its technology and pricing. As the fourth quarter coincides with the traditional peak sales season in the domestic automotive market, Xpeng believes that the P7+'s launch will help the brand achieve a monthly sales target of 30,000 vehicles.

He Xiaopeng stated, "We will no longer solely focus on sales growth as we did in the past but instead strive for high quality and efficiency." Indeed, maintaining high quality and efficiency is crucial for automakers to improve net profits and gross margins, marking a sign of maturity for the enterprise. Ultimately, however, only sales can generate revenue and instill confidence in the capital market.

High quality and efficiency are fundamental for automakers, ultimately aimed at boosting sales. "Making technology more accessible" is the core strategy for Xpeng's development.

On July 30, Xpeng fully rolled out the XOS 5.2.0 version of its AI Tianji system, upgrading XNGP from "available nationwide" to "convenient nationwide," achieving full nationwide availability without restrictions on cities, routes, or road conditions.

The company revealed that after this version's release, core indicators such as user penetration rate and mileage penetration rate improved by at least 20%. Currently, Xpeng is the only domestic brand to offer end-to-end autonomous driving capabilities. With technological advancements, Xpeng's autonomous driving capabilities are expected to improve by several fold next year. Coupled with cost advantages, Xpeng's advanced intelligent driving technology has the potential for wider adoption.

Regarding when XNGP, which relies solely on a vision-based approach, will reach the same level of advanced driving capabilities as solutions with LiDAR, this information will be disclosed by the end of October.

In summary, Xpeng is pinning its hopes on MONA M03 and the Xpeng P7+ for the second half of the year. However, there are concerns that these two models operate in highly competitive market segments, and there is a possibility of experiencing similar issues to the Xpeng G6, where initial momentum fades. Furthermore, with no official product roadmap for 2025 disclosed, relying solely on these two new models and the existing product matrix to sustain sales growth in the future may not be entirely foolproof.

Closing Remarks

During the earnings call, in addition to discussing second-quarter results and plans for the second half of the year, Xpeng also shared more information about its Robotaxi ambitions. As a brand focused on intelligent new energy vehicles, Xpeng seems well-aligned with the concept of Robotaxi. However, despite the hype surrounding Robotaxi, Xpeng has yet to make significant moves in this area.

It has been revealed that Xpeng is indeed planning its own Robotaxi service, but with a focus on providing a comprehensive autonomous driving experience rather than just offering good experiences within a limited area. The company believes that current Robotaxi services suffer from high costs and suboptimal user experiences.

Of course, this is merely a "small ambition" for Xpeng. Achieving a comprehensive autonomous driving experience will require advanced technologies and comprehensive legal and regulatory support.

Reviewing Xpeng's second-quarter financial report, it showcases the brand's notable progress, with a strong emphasis on completing tasks and planning for the third quarter, such as deepening cooperation with Volkswagen Group, launching AI-driven driving technology, and introducing MONA M03. From products to the enterprise as a whole, Xpeng exudes a positive and proactive attitude.

While Xpeng is among the first batch of new energy vehicle startups in China, its current focus is on steady and grounded progress. The timing for becoming a top-selling brand is not yet on the agenda for Xpeng.

With the successful realization of cost reductions through technological advancements, Xpeng's current challenge lies in its "mature" product lineup. Sales figures for April, May, and June stood at 9,393, 10,146, and 10,668 vehicles respectively, consistently ranking outside the top spots in monthly and weekly sales charts. Gradually, Xpeng is being surpassed by pure electric vehicle brands such as Zeekr, Xiaomi, and Nezha, and is even being closely challenged by ARCFOX and Luoshe. This places Xpeng at a considerable distance from the first tier of brands.

With less than a week until MONA M03's official debut, it remains to be seen whether, with its strengths in intelligence and cost-effectiveness, Xpeng can reclaim its place among the top tier of new energy vehicle brands.

Source: Leitech