Futech Technology: Reappearance of Valuation Adjustment Mechanism; Leasing Operations; Need to Explain Relationship with NIO but Not Li Bin

![]() 08/23 2024

08/23 2024

![]() 641

641

author

Baker Street Detective

Among the many companies queuing up for IPOs, there are not a few that have valuation adjustment mechanisms (VAMs). Zhejiang Futech Technology Co., Ltd. (stock abbreviation: Futech Technology; stock code: 301607), which will be offered for subscription on August 26, is one of them.

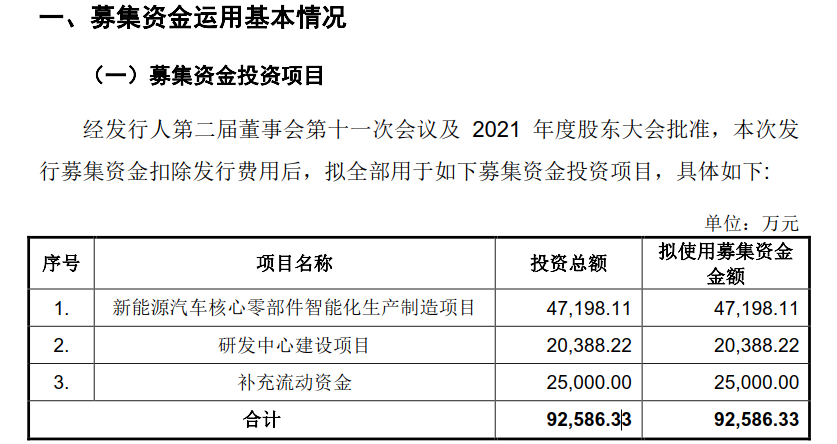

Upon reviewing the prospectus of Futech Technology, after deducting issuance expenses from the funds raised through issuance, the company plans to raise RMB 925.8633 million for the "Intelligent Manufacturing Project for New Energy Vehicle Core Components," allocating RMB 471.9811 million; RMB 203.8822 million for the "R&D Center Construction Project"; and RMB 250 million for "Supplementing Working Capital."

However, according to the company's announcement on its GEM listing and issuance, Futech Technology's issue price is set at RMB 14.00 per share, with a total of 23,590,597 shares offered both offline and online. Based on this, the estimated total funds raised are RMB 388.5510 million. After deducting the estimated issuance expenses of RMB 84.3196 million (excluding VAT), the net estimated funds raised are RMB 304.2314 million.

According to the company's prospectus, Futech Technology is a national high-tech enterprise primarily engaged in the R&D, production, and sales of high-voltage power systems for new energy vehicles. Its main products include on-board charging systems (OBCs), on-board DC/DC converters, and integrated on-board power systems, as well as off-board high-voltage power systems such as liquid-cooled supercharging pile power modules and intelligent DC charging pile power modules.

Prior to Futech Technology's IPO, in addition to inquiries about the company's VAMs, the stock exchange also focused on leasing operations, uncompensated losses, and whether there is a relationship between major customer NIO and its actual controller, Li Bin.

01

Whether the Valuation Adjustment Mechanism Should Recognize Financial Liabilities

According to the company's prospectus, after Futech Technology was established as a joint-stock company through an overall change, when introducing investors to increase their shareholdings, both Futech Technology and its shareholders at the time signed a shareholders' agreement with the investors, stipulating the special rights enjoyed by the investors and agreeing that these special rights, which may constitute legal obstacles or cause adverse effects on the listing, will automatically become invalid from the date Futech Technology receives the Notice of Tutoring Filing .

On December 13, 2021, the company and all its current shareholders signed the "Shareholders' Agreement of Zhejiang Futech Technology Co., Ltd." (hereinafter referred to as the "Shareholders' Agreement"), which replaces any agreements, investment letters of intent, memoranda of understanding, representations, or other obligations reached between the company and any shareholders regarding rights and obligations. It also contains the sole and complete agreement between the parties on matters under this agreement.

Changjiang NIO Industry Fund, Shuangchuang Investment, Huaqiang Ruizhe, Runke Shanghai, Hongda Hi-Tech, and Xiaomi Changjiang Industry Fund are priority investors, while Changgao Electric New Energy, Guangqi Zhongyong, Xingzheng Cizi, Xingzheng Leiyu, Zheng Meilian, Yisheng Investment, Liu Xiaosong, Jin Hangyu, Jiaxing Linlong, and Guangdong Qigang are ordinary investors (collectively referred to as "Investors" with priority investors). The Investors enjoy special rights under the Shareholders' Agreement, including veto rights, repurchase rights, preemptive subscription rights, preemptive purchase rights, co-sale rights, liquidation preferences, anti-dilution rights, and drag-along rights.

Futech Technology stated in the inquiry letter that the supplementary agreement to the VAM has stipulated that the rights clauses involving the company's repurchase rights are invalid from the beginning. According to the "Supplementary Agreement to the Shareholders' Agreement of Zhejiang Futech Technology Co., Ltd." signed by the company and all its current shareholders on December 30, 2021 (hereinafter referred to as the "Supplementary Agreement"), all obligations under the "Rounds of Shareholders' Agreements" (including the Shareholders' Agreement and other invalidated shareholder agreements previously signed by the company for previous funding rounds but replaced by the Shareholders' Agreement) that may result in the company incurring cash payments or specific returns beyond those stipulated in the company's articles of association and/or not meeting listing regulatory requirements shall irrevocably terminate as of December 31, 2021, and shall be deemed invalid from the outset. Under no circumstances will the Investors claim any rights from the company based on the aforementioned clauses in the Rounds of Shareholders' Agreements.

At the same time, the company does not need to recognize financial liabilities in accordance with the "Guidance on the Application of Regulatory Rules - Accounting Category 1." Futech Technology's relevant accounting treatment is accurate. Referring to the definition of financial liabilities in Article 4 of the "Accounting Standards for Business Enterprises No. 22 - Recognition and Measurement of Financial Instruments" and the relevant guidance in "1-1" of "Guidance on the Application of Regulatory Rules - Accounting Category 1" regarding "Equity Investment with Put Options," for equity investments with put options, in addition to voting rights and dividend rights consistent with those of common shareholders, investors also have a put option. If the investee fails to meet specific targets, the investor has the right to require the investee to repurchase the equity at the investment cost plus annualized returns, resulting in a contractual obligation for the investee to inevitably deliver cash to the investor, which should be accounted for as a financial liability. That is, when the repurchase clause results in a contractual obligation for the investee to inevitably pay cash to the investor, such investment funds should be recognized as financial liabilities rather than equity instruments.

02

Inquiries on Leasing Operations and Uncompensated Losses

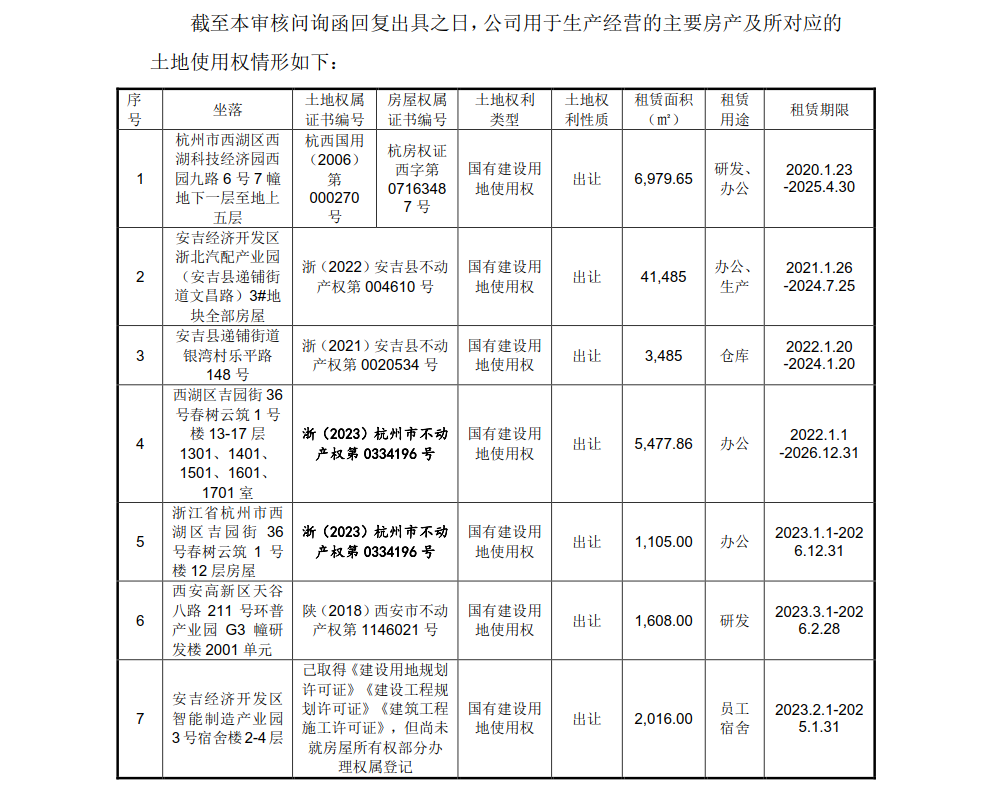

According to the prospectus, Futech Technology and its subsidiaries do not own land use rights and operate through leased premises.

Among Futech Technology's fundraising projects, the Anji Economic Development Zone Management Committee (hereinafter referred to as the "Anji Management Committee") is responsible for constructing the factory for the Intelligent Manufacturing Project for New Energy Vehicle Core Components and leasing it to Futech Technology. The R&D Center Construction Project involves leasing and renovating part of a building on two plots in Xihu District, Hangzhou.

The company has signed contracts with the Anji Management Committee for the first and second production bases in Anji. The Anji Management Committee will construct all factories and other buildings and provide a three-year rent-free period. After the rent-free period expires, Futech Technology has the right to purchase the relevant real estate and may also purchase it in advance.

Currently, the real estate for the first production base in Anji has been delivered to Futech Technology for use and is still within the rent-free period. The second production base in Anji is one of Futech Technology's fundraising projects, and the relevant real estate has not yet been fully constructed.

According to the second round of inquiry responses, as of June 30, 2022, the book value of Futech Technology's right-to-use assets was RMB 129.4472 million, of which the book value of the buildings and land use rights for the first production base in Anji was RMB 84.0490 million, accounting for 9.96% of the total assets.

Futech Technology stated that its production processes primarily involve surface mount technology (SMT), dual in-line package (DIP), assembly, testing, and other stages. The requirements for the site mainly include internal space, power and water supply, temperature and humidity control, and electrostatic protection, which are common needs in the automotive components manufacturing industry. Therefore, if relocation is necessary, the company will not face substantial obstacles in finding new rental premises in the surrounding area. The company's office spaces and employee dormitories only need to meet general office and accommodation needs, and there are alternative housing options nearby. In summary, the company's leased assets are replaceable.

In the second round of inquiry responses, Futech Technology stated that the second property listed in the table is the company's main production site. The company has signed the "Investment Contract for Enterprises Entering Anji County" with the number "Investment Promotion 2018011" and the "Supplementary Agreement for the Annual Production of 1.2 Million On-Board Chargers and On-Board DC/DC Converters for New Energy Vehicles by Futech Technology" with the Anji Economic Development Zone Management Committee. It has also signed a "Factory Rental Contract" and a "Supplementary Contract to the Factory Rental Contract" with the property owner, Anji Liangshan Hi-Tech Industrial Park Development Co., Ltd., clarifying that after the three-year rent-free period expires, the company has the right to decide whether to purchase the relevant real estate or continue to lease it. The company also has the right to purchase it in advance. Therefore, the company's use of this property is stable.

The company has continuously leased the first property listed in the table for production and business activities since 2015, and the lease term will expire on April 30, 2025. The lease terms for the fourth and fifth properties listed in the table will expire on December 31, 2026, and the lease term for the sixth property listed in the table will expire on February 28, 2026. For these leased properties, Futech Technology stated that all the company's major leased properties are legally constructed and do not pose a risk of being demolished due to violations, ensuring the stability of the company's leased use.

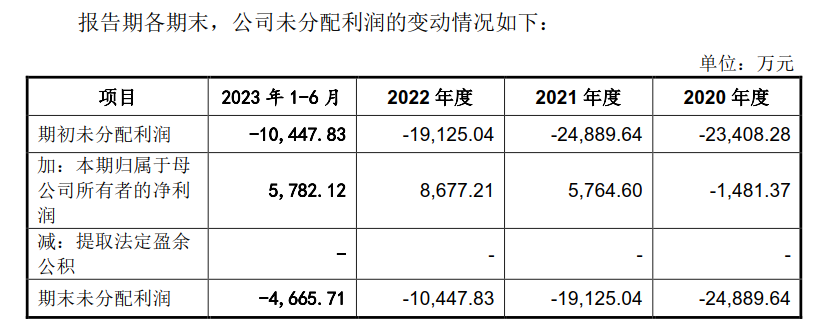

According to the prospectus, as of December 31, 2021, Futech Technology's consolidated financial statements showed an undistributed profit of -RMB 191.2504 million. Futech Technology stated that the main reasons for this were the significant R&D expenses required for product technology upgrades and the substantial credit impairment losses incurred due to the deterioration of the company's early customers' operating conditions caused by changes in the competitive landscape of the new energy vehicle industry in previous years.

Futech Technology stated that the company had accumulated uncompensated losses at the end of the most recent period, with an undistributed profit of -RMB 46.6571 million in its consolidated financial statements. Although the company achieved profitability during the reporting period due to the expansion of its business scale, there were still accumulated uncompensated losses in its consolidated financial statements as of the end of the reporting period due to the significant losses incurred in the early stages.

Futech Technology attributed the losses primarily to the significant R&D expenses required for product technology upgrades, combined with the fact that the company's business scale was still small at the time, preventing it from realizing economies of scale. Additionally, changes in the competitive landscape of the new energy vehicle industry led to the deterioration of the operating conditions of some of the company's early customers, resulting in substantial credit impairment losses.

Futech Technology believes that over the years, the company has established a compensation system and performance appraisal system that adapts to market changes and has formed a talent team covering R&D, production, marketing, finance, and other fields. In December 2021, the company further implemented equity incentives for core management and employees to stabilize the talent team. Therefore, the company's accumulated uncompensated losses at the end of the reporting period will not have a significant adverse impact on attracting talent and maintaining team stability.

03

Doubts About the Relationship Between Major Customers and Actual Controllers

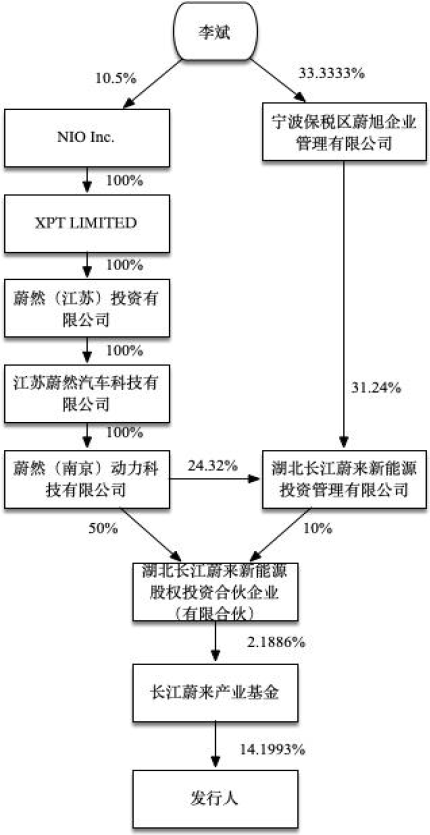

Regarding major customers, the stock exchange noted that Changjiang NIO Industry Fund holds more than 5% of Futech Technology's shares and is thus a related legal entity. However, Li Bin does not control Changjiang NIO Industry Fund, so he is not a related natural person to Futech Technology, and NIO, which is controlled by Li Bin, is therefore not a related party to Futech Technology.

It was also noted that Futech Technology has significant transaction amounts with NIO and that its gross margin on these sales is higher than its overall gross margin. In the first half of 2022, while reducing product prices annually, NIO additionally paid chip compensation to Futech Technology.

As of the date of this inquiry response, Li Bin indirectly holds 16,939 shares of Futech Technology through Changjiang NIO Industry Fund, accounting for 0.0203% of the company's total share capital.

Futech Technology stated that Changjiang NIO Industry Fund holds more than 5% of its shares and is controlled by its general partner, Hubei Changjiang NIO New Energy Equity Investment Partnership (Limited Partnership) (hereinafter referred to as "GP"), which in turn is controlled by Hubei Changjiang NIO New Energy Investment Management Co., Ltd. (hereinafter referred to as "UGP"). Li Bin cannot control UGP or the voting rights of the shares held by Changjiang NIO Industry Fund, so he does not belong to the related parties indirectly holding more than 5% of Futech Technology's shares.

Futech Technology further explained that according to the Partnership Agreement of Changjiang NIO Industry Fund, GP is the general partner and managing partner of the partnership. GP enjoys exclusive and exclusive execution rights over partnership affairs. The partnership adopts a management method of entrusted management, with GP and/or its designated third-party fund management institution (i.e., UGP, Hubei Changjiang NIO New Energy Investment Management Co., Ltd.) serving as the manager of the partnership, providing services such as investment management, administrative management, and daily operation management to Changjiang NIO Industry Fund in accordance with applicable laws, regulations, and instructions from the general partner from time to time.

The affairs of the partnership are managed by GP. To improve the professionalism and quality of investment decisions, GP establishes an Investment Decision Committee (hereinafter referred to as the "Investment Decision Committee"), whose members are appointed by GP.

Therefore, Changjiang NIO Industry Fund is controlled by its general partner, Hubei Changjiang NIO New Energy Equity Investment Partnership (Limited Partnership) (i.e., GP), which is in turn controlled by Hubei Changjiang NIO New Energy Investment Management Co., Ltd. (i.e., UGP). Li Bin cannot control the largest shareholder of UGP, Ningbo Free Trade Zone Weixu Enterprise Management Co., Ltd., and therefore cannot control UGP or Changjiang NIO Industry Fund.

According to relevant regulations such as the "Company Law," "Accounting Standards for Business Enterprises No. 36 - Disclosure of Related Parties," and the "Shenzhen Stock Exchange Growth Enterprise Market Listing Rules" (hereinafter referred to as the "Listing Rules"), Changjiang NIO Industry Fund, which holds more than 5% of Futech Technology's shares, is a related legal entity to Futech Technology.

As mentioned earlier, the number of shares held indirectly by Li Bin accounts for a relatively small proportion of Futech Technology's total share capital and is far below 5%. Li Bin cannot control Changjiang NIO Industry Fund or the voting rights of the shares held by Changjiang NIO Industry Fund. Therefore, Li Bin does not belong to the related parties indirectly holding more than 5% of Futech Technology's shares, and NIO, which is controlled by Li Bin, does not constitute a related party to Futech Technology.

According to the documents disclosed by NIO Inc. (Hong Kong stock code: 9866, NIO's parent company) upon its listing on the Hong Kong Stock Exchange in February 2022 and its 2021 annual report, NIO Inc. did not identify Futech Technology as a related party nor disclose transactions between NIO and Futech Technology as related party transactions.

In summary, Fute Technology has sufficient grounds for not recognizing NIO, controlled by Li Bin, as a related party.

© THE END

All materials are from official public information and prospectuses

This article is for sharing and learning only and does not constitute any investment advice.

This article is originally created by Baker Street Detective. Please do not reproduce without permission.