AI office market fiercely competitive, how likely is Kingsoft to win?

![]() 08/23 2024

08/23 2024

![]() 731

731

With the arduous efforts of "China's first programmer" Qiu Boxun and "Zhongguancun Model Worker" Lei Jun, Kingsoft survived the double siege of Microsoft and piracy and successfully listed on the STAR Market in 2019 with Kingsoft Office as its main business.

As the country cracks down on piracy and places increasing emphasis on information security, the trend of domestic substitution has gained momentum, and Kingsoft Office has capitalized on this, achieving record-high performance year after year and once topping the STAR Market in market capitalization, exceeding 200 billion yuan.

According to the 2024 mid-year report released on the evening of August 21st, Kingsoft Office's revenue and net profit hit new highs for the same period, maintaining a positive growth trend every year since its listing.

Currently, the office SaaS sector is fiercely competitive, with Microsoft leading the way with Copilot and strong competitors like DingTalk, Feishu, and WeChat Work encircling it. Facing the dividend era of AIGC, Kingsoft Office is closely following the trend of technological change, with its AI products entering the gray-scale testing phase.

How likely is Kingsoft Office to win in the aftermath of AI commercialization?

[Grow Upward]

By breaking Microsoft's monopoly and carrying the banner of autonomy and controllability, Kingsoft is undoubtedly a respected enterprise.

Amid the wave of domestic substitution, Kingsoft Office listed on the STAR Market in 2019, becoming the first office SaaS enterprise to list on the A-share market, reigniting the popularity of WPS.

SaaS enterprises are characterized by heavy initial investments and the acceptance of losses, but reap long-term benefits later on. Salesforce, the global CRM leader, experienced 13 years of losses before emerging as a top SaaS giant. Adobe, Shopify, and Intuit have also followed this path.

In the context of autonomy and controllability, as the only domestic software with the potential to compete with Microsoft Office, WPS has received substantial financial and resource support. After Lei Jun's second return to Kingsoft, the company seized the opportunity to establish a foothold in the online mobile office scenario, which Microsoft had not yet ventured into.

Subsequently, riding on the wave of cracking down on piracy, protecting intellectual property rights, and removing IOE, Kingsoft Office achieved a complete turnaround, with its performance hitting new highs year after year.

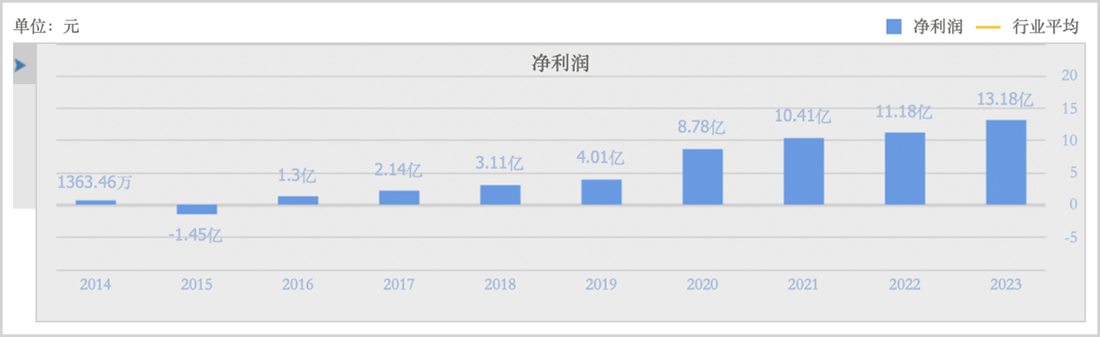

▲Kingsoft Office's net profit over the years, Source: Tonghuashun

After listing in 2019, Kingsoft Office continuously benefited from the dividends of the work-from-home trend during the pandemic and the AI wave, with its market capitalization once exceeding 200 billion yuan, making it the largest software company on both stock exchanges.

Annually, the company's revenue has grown from 1.58 billion yuan to 4.556 billion yuan, and its net profit has increased from 401 million yuan to 1.318 billion yuan, a 2.3-fold increase in four years.

In the first half of 2024, Kingsoft Office's revenue and net profit both grew, with revenue reaching 2.413 billion yuan, a year-on-year increase of 11.09%; net profit attributable to shareholders was 721 million yuan, a year-on-year increase of 20.38%, with profit growth outpacing revenue growth, and gross margin rising to nearly 85%.

However, there is still room for improvement in the company's business structure. Compared to Microsoft, Kingsoft Office's pay rate lags significantly. Its business structure relies heavily on C-end payments, accounting for nearly 67% of revenue, while Microsoft Office's B-end revenue is more than six times that of its C-end revenue.

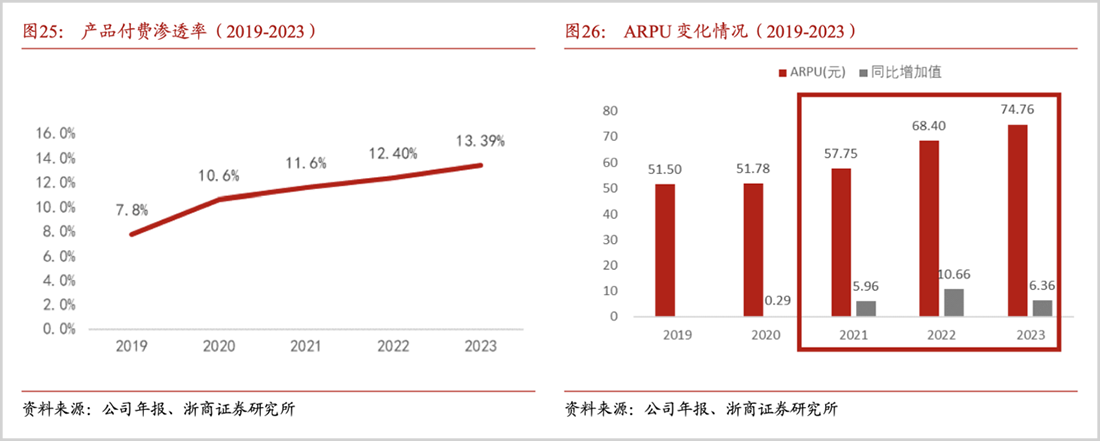

On the other hand, this also means that as the pay rate and ARPU (Average Revenue Per User) improve simultaneously, it will inject robust momentum into the company's performance.

Generally speaking, paid office subscriptions are mainly concentrated on the PC side. At the end of 2023, WPS's PC-side pay rate reached 13.39%, while MS Office's was around 25%, indicating significant room for improvement for Kingsoft Office's pay rate.

In 2023, the cumulative number of paid individual users reached 35.49 million, with an ARPU of 74.76 yuan for individual subscription products, an increase of 9.3% from 68.4 yuan in 2022. Looking at the data over the past five years, the paid amount has continued to increase with product upgrades, indicating that the user experience is continuously improving.

In the first half of this year, Kingsoft Office's cumulative annual paid individual users grew to 38.15 million, and the number of monthly active devices reached 602 million, both record highs.

Moreover, Kingsoft Office officially closed third-party commercial advertisements on December 20th last year, a move seen as actively removing "rotten meat" to provide users with a cleaner service.

It's important to note that internet companies require significant investments in the early stages and often rely on other businesses to fund their primary operations. In 2023, advertising revenue accounted for 32%, 62%, and 56% of Alibaba, Pinduoduo, and Baidu's revenues, respectively. Kingsoft initially ventured into games, dictionaries, advertising, and other businesses to support the research and development of office software iterations.

Now, by cutting out advertisements and restarting commercialization, the company must rely on quality services to win over customers.

According to the company's CEO Zhang Qingyuan, Kingsoft Office serves 97 central enterprises, 127 leading financial enterprises, 135 large private enterprises, and over 17,000 large customers, achieving 100% coverage of central enterprises.

While Microsoft primarily targets multinational corporations and overseas enterprises in China, with the increasing awareness of enterprise informatization, Kingsoft Office still has significant room for improvement.

In the first half of this year, personal subscription revenue was 1.53 billion yuan, a year-on-year increase of 22.17%; however, institutional subscription and service revenue was 443 million yuan, with a year-on-year increase of only 5.95%. Nevertheless, the company holds 2.685 billion yuan in contract liabilities, which will gradually convert into revenue and profit in the future.

In terms of profitability, the B-end is more valuable, with a gross margin nearly 10 percentage points higher than the C-end. Consequently, Kingsoft Office included B-end subscription business growth in its 2023 equity incentive plan for the first time, requiring a compound annual growth rate of at least 25% from 2023 to 2025, demonstrating the company's emphasis on institutional subscription business development.

As the business structure improves and the proportion of more valuable segments increases, Kingsoft Office's business flywheel will accelerate once again.

[Facing the Red Ocean]

If WPS's previous competitors were only Microsoft and piracy, now it can be said that it is surrounded by formidable rivals, each with a significant background.

With the entry of giants, the online office and enterprise OA sectors have entered a fierce competition stage. Moreover, Kingsoft Office's pace in developing collaborative office solutions lags behind those of Feishu, DingTalk, and WeChat Work. The latter three had already embarked on the B-end competition before 2022, while Kingsoft Office only launched WPS 365 for enterprises last year.

By the end of last year, DingTalk had acquired 700 million users and 25 million enterprise users, with 120,000 of them paying customers. According to QuestMobile statistics, in September 2023, DingTalk had a monthly active user base of 220 million, ranking first, followed by WeChat Work with 110 million and Feishu with 8.4 million.

Moreover, each of the major players has its unique advantages. Alibaba leverages its cloud capabilities to attract customers and boasts a vast network of partners; Tencent relies on its WeChat traffic and ecosystem; ByteDance gains popularity through the free and open access of Feishu; and there are also players like Youdao Note, Evernote, Shimo, and Tencent Docs, which compete fiercely in the document writing space alone.

From a blue ocean to a red ocean, while Kingsoft Office may lag behind internet giants in terms of traffic acquisition, collaboration (due to a later start), ecosystem development, and user insights, its 35 years of accumulated advantages remain intact.

First, there is a strong technical barrier. It is worth noting that Qiu Boxun, who wrote over 122,000 lines of code single-handedly to create WPS 1.0, laid the foundation. Today, WPS boasts an extensive range of functions, including format conversion, OCR, beautification, and more, with over 50 million lines of code, making it one of the largest monolithic software in the world. It would be challenging for other vendors to develop a similar software in a short period.

For example, Tencent Docs lacks many functions compared to WPS Docs, especially when it comes to writing professional documents such as theses, tenders, and business plans. Tencent Docs may struggle in these scenarios.

Secondly, once users settle on a preferred office software, they are unlikely to switch easily, especially paid users who have a higher level of stickiness. Switching software involves significant transition costs, including installation, learning, and cloud storage migration, which may deter potential switchers.

Kingsoft Office currently has 600 million monthly active users. WPS Academy is present on major social media platforms and actively promotes its educational version. Through events like the WPS 365 campus tour, college students who graduate and enter the workforce will gradually become loyal WPS users.

Moreover, Kingsoft has covered virtually all domestic CPUs (Loongson, Phytium, Zhaoxin, Shenwei, Kunpeng, Haiguang, etc.) and operating systems (Kylin, KylinOS, Zhongke Fangde, Deepin, Tongxin, etc.). Compatibility with domestic systems is crucial for employers seeking autonomy and controllability.

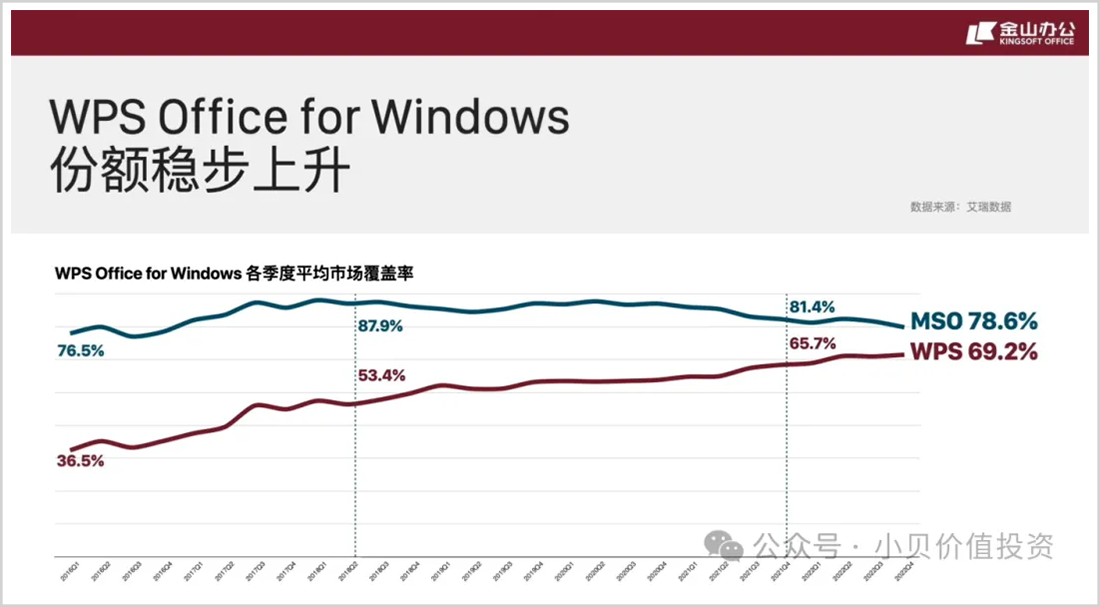

As evident from iResearch data, Microsoft Office and WPS's market shares in China exhibit a mutually exclusive trend. With more cost-effective services and user habits tailored to Chinese users, surpassing Microsoft in the office software sector is not impossible.

From a blue ocean to a red ocean, Kingsoft, adept at fighting tough battles, is unafraid of any competitor in this fiercely competitive landscape.

[The Battle for AI]

As the era of AIGC arrives, AI+office has become the commanding height of industry competition.

Last May, Microsoft announced at the Build developer conference that it would introduce an AI assistant called Copilot in Windows 11.

Powered by AI, Microsoft's performance soared. In fiscal year 2024, Microsoft generated $245.1 billion in revenue and $88.1 billion in net income, representing year-over-year growth of 16% and 22%, respectively. Since its launch, Copilot has captured 77,000 users, contributing significantly to the 13% growth in Office 365 commercial revenue.

To keep up with Microsoft, WPS AI was unveiled in November last year. CEO Zhang Qingyuan revealed that WPS AI targets three strategic development areas: AIGC (Content Creation), Copilot (Smart Assistant), and Insight (Knowledge Insight).

In April this year, Kingsoft Office launched the upgraded WPS 365, a new productivity platform, featuring a refreshed WPS Office, WPS AI Enterprise Edition, and WPS Collaboration. The AI capabilities integrate AI Hub (Intelligent Infrastructure), AI Docs (Intelligent Document Library), and Copilot Pro.

Office+AI has inherent advantages. Currently, Kingsoft Office's AIGC-related functions include AI-powered text in Word and intelligent document creation in AIGC. Copilot (Smart Assistant) includes functions like formula writing in Excel, one-click PPT generation in PowerPoint, and smart tables. Insight (Knowledge Insight) encompasses PDF chat and smart form data insights in PDF.

Compared to Office Copilot, WPS AI covers a similar range of functions with comparable ease of use, achieving a leading position in functions like Excel formula writing.

In terms of path selection, Microsoft relies on its investment in OpenAI, DingTalk leverages AliGroup's knowledge graph, Baidu has ERNIE Bot, iFLYTEK has the Spark Cognitive Model, while Kingsoft Office has chosen a strategy of "large model collaboration + self-developed small model," collaborating deeply with Minimax, Zhipu AI, iFLYTEK, AliGroup, and Baidu.

This approach offers advantages such as leveraging the strengths of various partners, quickly addressing technical shortcomings, flexibly matching usage scenarios, and effectively reducing the cost of independently developing large models.

It is understood that its AIGC capabilities rely on partnerships, while Copilot and Insight-like functions are primarily realized through self-developed small models, allowing for overall control of computing power costs.

In July, WPS AI 2.0 was updated, and the self-developed 13B-level government model (Kingsoft Government Office Model 1.0) made its debut, tailored for government office scenarios. The WPS AI government edition has also been implemented in Pudong New Area, Shanghai.

Currently, mainstream AI products generally adopt a monthly subscription fee model. For users, usability is the primary consideration, but for B-end enterprises, procuring useful products at a reasonable cost is crucial.

WPS AI charges based on token usage (the number of basic units used to measure input and output in large models). Kingsoft Office has designed an AI tool similar to a "water meter," allowing enterprises to track and verify AI tool usage, presenting the data in charts for enterprises to purchase computing power on demand.

Although AI products entered the market later, Kingsoft has always had the genes to fight uphill battles since its inception.

Considering that Office Copilot may not be fully accessible in China due to legal and compliance factors, WPS AI is well-positioned to seize the opportunity. After WPS AI's official commercialization, it is expected to unlock new performance ceilings.

Disclaimer

This article contains content related to listed companies based on the author's personal analysis and judgment based on information disclosed by listed companies in accordance with legal requirements (including but not limited to temporary announcements, periodic reports, and official interaction platforms). The information or opinions in this article do not constitute any investment or other business advice. Market Value Observer shall not be liable for any actions taken based on this article.

—END—