How has Huya fared in its transformation over the past year?

![]() 08/23 2024

08/23 2024

![]() 540

540

No turning back once you've started

Editor: Chu Yi

Fengpin: Shiwan

Source: Rhodium Finance - Rhodium Finance Research Institute

Change is the only constant.

In May 2023, Huya announced that Tencent Vice President Lin Songtao would succeed Huang Lingdong as Huya's Chairman. In August of the same year, it announced that the company was undergoing strategic transformation and had formulated a three-year plan. The main goal was to drive a shift in its commercialization roadmap by providing more game-related services such as game distribution, in-game item sales, and game advertising.

A year has passed, and it's time for Lin Songtao to present a progress report. On August 13, 2024, Huya disclosed its Q2 2024 financial results, reporting revenue of 3.046 billion yuan for the first six months of fiscal year 2024, a decrease of 19.86% year-on-year. Net profit attributable to shareholders was 100.6 million yuan, an increase of 67.98% year-on-year. Revenue for the second quarter was 1.542 billion yuan, a decrease of 16.1% year-on-year, and net profit under non-GAAP was 97 million yuan, a decrease of 17.1% year-on-year. The results are mixed, with both positives and negatives, and the overall performance is not outstanding.

Fortunately, concurrent with the release of the financial results, the company announced that it would distribute special cash dividends totaling approximately $250 million to shareholders. This announcement caused the share price to surge 14.13% on the day, closing at $5.09. However, it then began to fluctuate downward, closing at $4.26 on August 21, slightly lower than the $4.46 close on August 12.

Amid these ups and downs, how much patience does the market still have? What strategies does Huya and Lin Songtao have to boost morale and navigate through this transitional pain period?

01

Revenue Declines for 11 Consecutive Quarters

The Pain of Transformation

It's not an unreasonable expectation. According to Choice data, Huya's quarterly revenue has been declining since the fourth quarter of 2021, marking 11 consecutive quarters of decline.

Public records show that Huya Live was formerly known as YY Game Live and was renamed Huya Live in November 2014, adopting a strategy of premium content. With the development of esports, the platform has gathered numerous world champion teams and streamers, acquired live broadcast rights for domestic and international events, and developed exclusive IP events. It has also ventured into pan-entertainment live streaming through celebrity streamers and launched an all-star streamer strategy.

As evidenced by its positioning as "one of China's leading game live streaming platforms," game live streaming is Huya's core business. Benefiting from the sector's dividends, Huya enjoyed a comfortable period.

From 2017 to 2021, the company's revenue was 2.185 billion yuan, 4.663 billion yuan, 8.375 billion yuan, 10.91 billion yuan, and 11.35 billion yuan, respectively. Among them, live streaming revenue contributed 2.07 billion yuan, 4.443 billion yuan, 7.976 billion yuan, 10.312 billion yuan, and 10.186 billion yuan, accounting for 94.72%, 95.27%, 95.24%, 94.48%, and 89.73% of total revenue, respectively. Advertising and other revenue were 115 million yuan, 221 million yuan, 398 million yuan, 603 million yuan, and 1.165 billion yuan, accounting for 5.28%, 4.73%, 4.76%, 5.52%, and 10.27% of total revenue, respectively. Gross profit for the same period was 255 million yuan, 729.8 million yuan, 1.482 billion yuan, 2.268 billion yuan, and 1.6 billion yuan, respectively, with net profit attributable to shareholders of -80.97 million yuan, -1.938 billion yuan, 468.2 million yuan, 884.2 million yuan, and 583.5 million yuan, respectively.

It is not difficult to observe that revenue growth slowed and net profit declined in 2021, signaling a downward trend. In 2022 and 2023, the company's revenue decreased by 18.39% and 24.5% to 9.264 billion yuan and 6.994 billion yuan, respectively. Although live streaming still accounted for 88.47% and 92.23% of revenue, it significantly decreased to 8.196 billion yuan and 6.451 billion yuan, while advertising and other revenue were 1.068 billion yuan and 544 million yuan, accounting for 11.53% and 7.77% of total revenue, respectively. Net profit attributable to shareholders decreased by 193.86% and increased by 62.66% to -547.7 million yuan and -204.5 million yuan, respectively, during the same period.

It is important to note that the reduction in losses in 2023 was achieved through significant cost reduction measures. In 2022 and 2023, the company's research and development expenses were 684 million yuan and 579 million yuan, respectively; marketing expenses were 530 million yuan and 441 million yuan; general and administrative expenses were 341 million yuan and 321 million yuan; and operating expenses were 1.556 billion yuan and 1.34 billion yuan, respectively.

The reason for this is Huya's over-reliance on live streaming revenue. When the industry changes, the company suffers the consequences. To overcome this dilemma , new revenue streams are urgently needed.

Since Lin Songtao initiated the strategic transformation, Huya has been restructuring its revenue streams since the first quarter of 2024, adjusting its advertising and other business segments to game-related services, advertising, and other revenue streams. The financial report reveals that "our strategic transformation plan will expand our influence in the gaming industry, and more game-related services are continuing to develop." In short, Huya is placing greater emphasis on game-related services, advertising, and other businesses.

Through continued efforts, this business segment generated revenue of 308.5 million yuan in the second quarter of 2024, an increase of 152.7% year-on-year and 26.6% quarter-on-quarter, accounting for 20% of total revenue. Huang Junhong, acting co-CEO of Huya, stated, "This strategic transformation initiative is continuing. We will continue to consolidate our foundation while exploring long-term possibilities in the game industry chain, driving growth through content and platform ecosystem upgrades, technological advancements, and product innovation."

While the results are noteworthy, the company's over-reliance on live streaming remains a concern. In the second quarter of 2024, live streaming revenue decreased by 28.1% year-on-year to 1.233 billion yuan, dragging down overall performance, yet it still accounted for nearly 80% of total revenue. Huya attributed this to the macroeconomic and industry environment, as well as business adjustments made to support its strategic transformation and prudent operations.

In terms of costs, Huya continues to adhere to the principle of cost reduction. According to Choice data, the company's research and development expenses decreased by 11.5% year-on-year to 129 million yuan in the second quarter of 2024; sales and marketing expenses decreased by 48% to 61.7 million yuan; and general and administrative expenses decreased by 21% to 63.7 million yuan. Nonetheless, net profit under non-GAAP still decreased year-on-year, while operating losses narrowed by a commendable 21% to 26 million yuan, but gross profit margin decreased from 15.7% in the same period of 2023 to 13.9%.

Clearly, Huya is still experiencing the pain of transformation. When will the dawn arrive, and what will usher it in? The outside world is still waiting for a definitive answer.

02

Moments of Glory and Challenges

As the helmsman, every decision is carefully considered, and Lin Songtao is no exception.

The era of "easy money" in the game live streaming industry dates back to 2014, when Amazon acquired Twitch, a US-based game live streaming platform, for $970 million. At the end of that year, a wave of esports fever swept through China's A-share market, with platforms like Huya, Douyu, Panda, Zhanqi, Dragon Ball, and Penguin Esports emerging rapidly, sparking the "Thousand Broadcast War." In 2015, veteran esports player Chen Qidong challenged Douyu with Dragon Ball Live, stating, "We have taken away 9 of the top 20 streamers from Douyu," illustrating the intensity of the competition.

Capital is inherently profit-driven, and tech giants like Tencent, Ping An, and Matrix Partners have all entered the fray. Taking Huya as an example, according to Qichacha, the company raised $75 million in Series A funding in 2017 from Matrix Partners, Yilian Capital, Ping An Overseas, Gao Rong Capital, and Huya's founders Li Xueling and former CEO Dong Rongjie. In 2018, it secured $460 million in Series B funding from Tencent.

With this support, Huya began burning money to recruit streamers and acquire broadcast rights, ultimately securing its place in the game.

According to the "2017 China Online Performance (Live Streaming) Industry Report," the overall market revenue reached 30.45 billion yuan in 2017, an increase of 39% year-on-year. However, by the end of 2017, there were approximately 200 companies engaged in online performance (live streaming) business nationwide, a decrease of nearly 100 from 2016 and 400 from 2011.

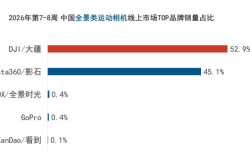

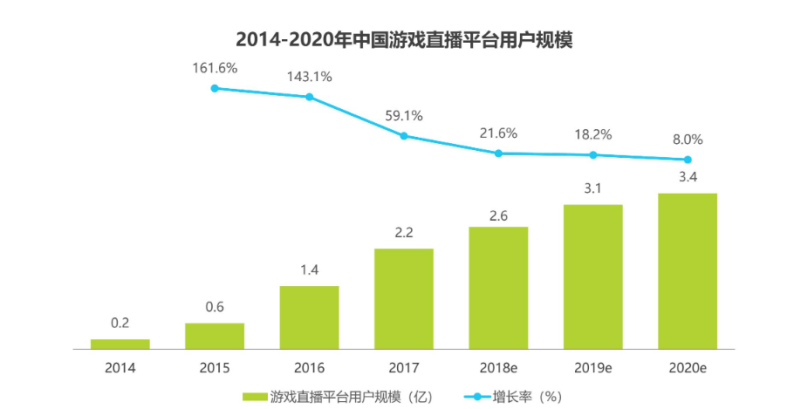

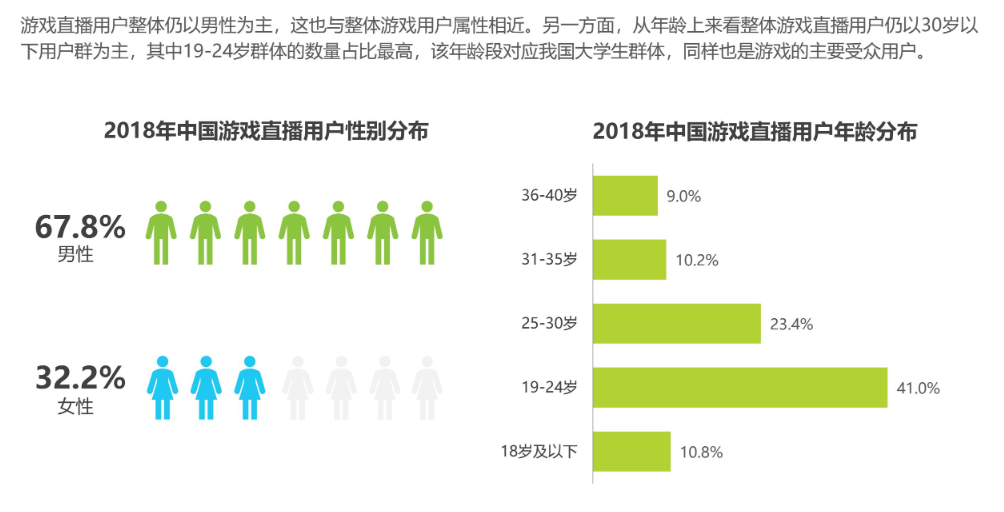

According to Huxiu, in just November 2017, 11 top streamers left Douyu, with most joining Huya. According to the "2018 China Game Industry Report," China's game user base grew from 517 million to 626 million from 2014 to 2018. According to iResearch data, the number of game live streaming users in China increased from 20 million to 260 million during the same period. With multiple growth opportunities, Huya reached 116.6 million monthly active users in the fourth quarter of 2018, becoming a leading player in the industry.

However, the iResearch report also shows that game live streaming users are predominantly under 30 years old, with the 19-24 age group accounting for the largest proportion. Due to a lack of financial resources, their willingness to pay is relatively low, with only 4.8 million paying users for Huya in the fourth quarter of 2018. Fortunately, the industry was on an upward trajectory, offsetting these shortcomings.

However, the industry changed in 2021. In July, the issuance of game licenses was suspended, restricting the number of hit games and plunging the industry into a winter.

In addition to increased regulatory pressure, the saturation of user benefits is also a crucial factor. According to CNG Data, while China's game user base continued to expand from 2018 to 2023, the growth rate gradually slowed, decreasing from 7.28% in 2018 to 0.61% in 2023, and even registering negative growth in 2022. According to AskCI, by the end of 2023, China had 816 million online live streaming users, of which 297 million were game live streaming users, almost stagnant compared to 2018.

As an industry leader, Huya was the first to be affected by these changes, although it has only disclosed mobile monthly active users since 2020. For example, the average monthly active mobile users in the fourth quarters of 2021-2023 were 85.4 million, 85.5 million, and 85.5 million, respectively, with paying users of 5.6 million, 5.5 million, and 4.3 million.

In the second quarter of 2024, Huya's average monthly active mobile users increased from 82.9 million in the same period of 2023 to 83.5 million, and with the expansion of game-related services, paying users reached 4.5 million. These positive signs are encouraging, but Huya still has a long way to go to return to its peak performance or the levels of 2018.

03

Fierce Competition at a Crossroads

In April 2020, Tencent increased its stake in Huya to 36.9%, giving it 50.9% voting rights. During this period, Tencent's stake in Huya exceeded 60% at one point.

Since 2016, Tencent has repeatedly sued ByteDance for copyright infringement. In 2019, the court found that Tencent had sufficient evidence to prove that Douyin's Xigua Video App was broadcasting "Honor of Kings," and ruled that TouTiao Limited and two other companies must cease broadcasting the game by January 31, 2019.

Benefiting from this, Huya consolidated its position in the industry through live broadcasts of Tencent-owned games such as "Honor of Kings." In 2020, there were even plans for a merger between Huya and Douyu.

However, in July 2021, the State Administration for Market Regulation announced that the merger was prohibited due to potential anti-competitive effects, which could harm fair market competition, reduce consumer benefits, and impede the healthy and sustainable development of the online game and live streaming markets.

The failed merger, combined with the aforementioned "winter" in the gaming industry, dealt a heavy blow to Huya. In 2023, prominent Huya streamers like "Big Brother Zhang" (Zhang Daxian) and outdoor streamer Mu Yingying left the platform. According to Sina Tech, Huya signed Zhang Daxian from Douyu for 52 million yuan and amassed nearly 30 million followers due to his exceptional gaming skills and charming personality. Huya suffered a significant loss with his departure.

Meanwhile, competitors like Douyin, Kuaishou, and Bilibili, with their stable user bases, began to poach users from Huya and Douyu. Both Zhang Daxian and Mu Yingying eventually joined Douyin. According to Sina Tech, fans claimed that "in Zhang Daxian's Douyin live stream, over a million people competed for a single lucky bag, which was over ten times the number on Huya." His Douyin debut attracted over 60 million viewers and peaked at over 2 million concurrent viewers. Fans showered him with gifts like "Carnival" and over 4,000 people subscribed to his exclusive 98-yuan membership. Based on these estimates, Zhang Daxian earned over 400,000 yuan in revenue that night.

By May 2020, Kuaishou's game live streaming monthly active users (MAU) exceeded 220 million, with over 300 million MAU for game short videos, far surpassing Huya. In 2020, Douyin announced that its daily active users reached 600 million.

In early 2024, "Honor of Kings" officially announced that its Douyin live streaming rooms would be fully opened from January 21, marking the official "thawing" of relations between Tencent and Douyin. Financial News quoted industry insiders as saying that this would lead to a major reshuffle among streamers, agencies, and even platforms. The upside is that platforms with existing strength and competitiveness will open up more traffic opportunities and policies for agencies and streamers, fostering a better ecosystem. The downside is that it will disrupt the existing ecosystems of platforms like Kuaishou, Bilibili, Douyu, and Huya, potentially leading to the loss of streamers and users, which will test the resilience of these platforms.",

Lin Songtao, who previously held management positions across various Tencent business lines including QQ, Qzone, Open Platform, Guangdiantong, and Yingyongbao, continued to oversee Yingyongbao after becoming Chairman of Huya.

Yingyongbao is reportedly China's largest third-party app download platform, with game distribution being a significant source of revenue. Lin Songtao has stated that the transformation aims to "promote our commercialization roadmap by offering more game-related services such as game distribution, in-game item sales, and game advertising, while optimizing content creators' revenue structures to enhance their financial returns and better align our content costs with revenues."

In December 2023, Huya acquired 100% of a global mobile app service provider from Tencent for a total cash consideration of US$81 million, aiming to strengthen Huya's capabilities in promoting and distributing game apps globally and create synergies with its overseas game live streaming platform, Nimo TV.

Taking the newly launched Dungeon & Fighter: Origin (DNF Mobile) in Q2 as an example, Huya's 'Game Center' section dedicated a special area for pre-registration, downloads, and game news, complemented by themed programs, exclusive items, and gift promotions. A corresponding anchor recruitment campaign effectively boosted the platform's popularity.

In Q2 2024, Huya's revenue from game-related services, advertising, and other operations increased by 152.7% YoY, accounting for 20.0% of total net revenue. The average monthly mobile MAUs for live streaming rose to 83.5 million. Acting Co-CEO and VP Huang Junhong attributed this growth primarily to the success of several e-sports events organized by the company. Huya has started selectively offering its live streaming and video content on other platforms to expand its reach and influence.

At Huya's Live Star Awards Extraordinary Forum in April 2024, Lin Songtao noted that the game live streaming industry has entered a new era of competition and cooperation, with multi-platform content sharing becoming a future trend. "Huya will continue to strengthen its core live streaming business while promoting game-related services, leveraging multi-platform strengths to create a new live streaming ecosystem and drive a new round of upgrades and transformations in the industry. With the steady implementation of our strategic transformation, we are confident in our future business prospects."

Judging from the improved Q2 data, Lin Songtao's words ring true as Huya's transformation progresses steadily.

However, the market evolves rapidly, and competitors are active. The transformation's success ultimately depends on tangible results. The decrease in R&D, sales and marketing, and administrative expenses in Q2 indicates Huya's efforts but also highlights challenges like net loss widening, revenue decline, and gross margin contraction, testing the precision and efficiency of its transformation.

As of June 30, 2024, Huya's cash and cash equivalents, short-term deposits, short-term investments, and long-term deposits totaled RMB 8.1933 billion, down from RMB 9.4198 billion at the end of March.

This RMB 1.2 billion decrease in just three months underscores the urgency for more precise and efficient strategies.

Once embarked on a transformation, there's no turning back, and the journey is fraught with risks.

This article is original content from Rhodium Finance. For reprints, please leave a message.