China's "High-end Vehicles" Sweeping Through Singapore

![]() 08/23 2024

08/23 2024

![]() 570

570

Author | Tang Fei

Editor | Liu Jingfeng

Robinson Road is a major street in Singapore's core business district. This bustling financial street is lined with major brands on both sides, exuding an international feel and often attracting Hollywood movies to shoot here. In recent years, however, this street has gradually seen more Chinese elements, with BYD's showroom located right here.

BYD Showroom on Robinson Road

Unlike traditional car showrooms where vehicles are neatly displayed in a 'shelf-like' manner, this BYD showroom is filled with greenery and animal figurines, aligning with Singapore's advocacy for green travel.

Chua, a staff member at the store, said, "I think coming here is not just about buying a car, but also the beginning of experiencing green living!" Coincidentally, BYD has also brought its "Chinese-style marketing strategy" to Singapore. On August 4, 2023, BYD's urban showroom and cafe, BYD SUNTEC, officially opened in Singapore. In addition to BYD SUNTEC, BYD has also opened three brand-new BYD-branded restaurants in Singapore, located in Tanjong Pagar, Marisota, and Bukit Timah, respectively, managed by BYD by 1826. Similarly, in many overseas markets, Chinese new energy vehicle brands have become more than just a means of transportation but also a trendy lifestyle. After completing her master's degree in Singapore, Yu Jia, a post-90s woman, stayed to work locally. According to her observations, BYD vehicles are increasingly visible on Singapore's roads. Walking down the streets, the occasional sight of SAIC MG, SAIC MAXUS, and GAC Aion also catches the eye. And recently, Chinese new energy vehicle companies have made new moves. Geely's premium brand Zeekr announced in early August that its Zeekr X officially entered Singapore, with its first store set to open at the end of August. Almost simultaneously, Xpeng's premium model, the Xpeng G6, also began presales in Singapore. Behind the rising exposure is the solid market share of Chinese automakers in Singapore. In the first four months of this year, Chinese brands accounted for 18.4% of new car registrations in Singapore, ahead of South Korea (8.1%), non-German European brands (4.8%), and American brands (4%). The next level of China's new energy vehicle exports is accelerating.

On August 1, the Zeekr X was officially launched at Singapore's iconic ArtScience Museum. The ArtScience Museum has the reputation of being the "Welcoming Hand of Singapore." And the event was reportedly lively, attracting many young people to test drive the car.

Meanwhile, Zeekr's first store in Singapore, located at 9 Leng Kee Road, is also in the midst of intense preparations and is expected to officially open at the end of August. The store spans two floors, totaling approximately 1,300 square meters, with both sales and delivery functions. Additionally, officials stated that the Zeekr 009 is expected to go on sale in the Singapore market in September this year. Two days before Zeekr's debut in Singapore, Xpeng opened a pop-up store in Singapore's central business district. Customers can experience the Xpeng G6's space, intelligent interaction system, and intelligent driving system at the pop-up store. Simultaneously, Xpeng has also started presales of its products in the Singapore market.

It is reported that Xpeng plans to open its first official store in Singapore in September this year. This is Xpeng's latest overseas move following its entry into Hong Kong and Macau. Earlier, on March 28 this year, Singapore Harmony BYD Store grandly opened on Robinson Road. As mentioned at the beginning of this article, the new store showcases a technological and green concept from design to experience. BYD, Zeekr, and Xpeng sometimes have unclear positioning in the eyes of domestic consumers, as BYD and Geely have previously been known as suppliers of low-cost vehicles in China, but in recent years, they have all been launching premium models and sub-brands. However, their appearances in Singapore this year have given them a strong premium feel - from their store locations to their designs. And the most direct premium feel comes from the price - according to Zeekr's official WeChat account "Zeekr ZEEKR," the Zeekr X has a standard price of SGD 199,999 (approximately RMB 1,083,000) and a flagship price of SGD 214,999 (approximately RMB 1,165,000) in Singapore. In RMB terms, this is truly a "million-yuan luxury car."

It is worth noting that the Zeekr X costs approximately RMB 179,000 to RMB 220,000 in China, meaning its price in Singapore is nearly five times higher. And this high price seems to be exclusive to Singapore at present: the starting price of the Zeekr X in Thailand is THB 1,199,000 (approximately RMB 244,000), MXN 799,000 (approximately RMB 321,600) in Mexico, and EUR 44,990 (approximately RMB 352,700) in Germany. Even in the UAE, considered a wealthy country, the starting price of the Zeekr X is only AED 170,900 (approximately RMB 335,000). Considering the different vehicle import policies across countries, along with logistics, tariffs, and other costs, as well as retained profit margins, it is understandable that the Zeekr X's overseas price is slightly higher than its domestic price. However, a nearly five-fold increase, transforming it into a "million-yuan luxury car," is still somewhat astonishing.

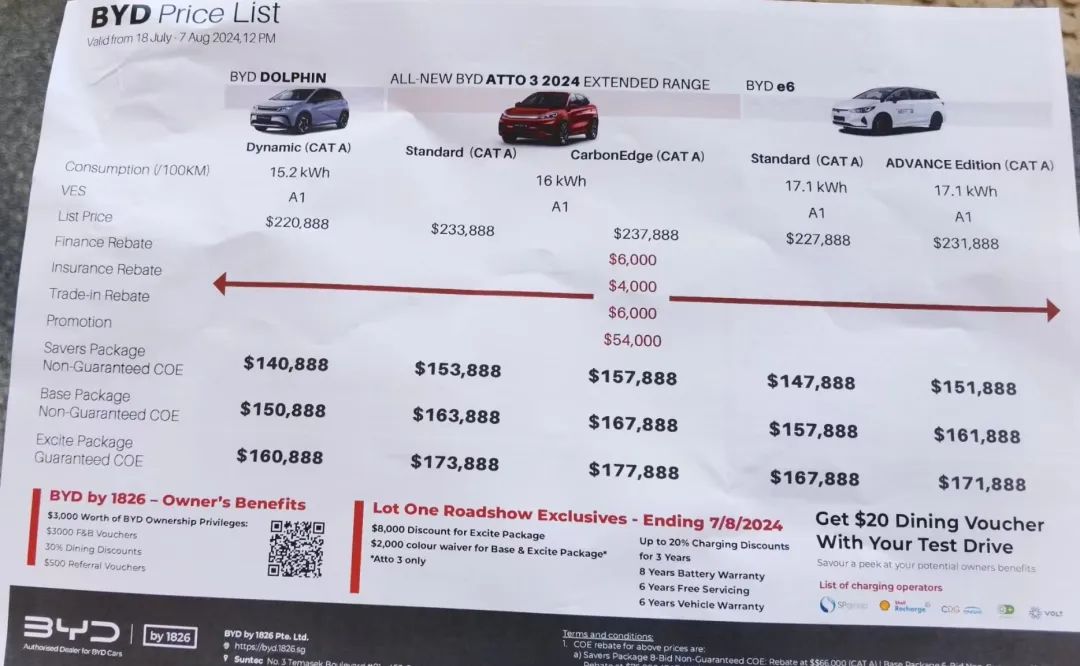

Prices of some BYD models in Singapore

In fact, not only the newly launched models but also other brands and models already established in Singapore have high prices. For example, the Tesla Model 3 costs approximately RMB 240,000 in China but SGD 230,000 (approximately RMB 1,242,000) in Singapore; the BYD Dolphin costs RMB 120,000 in China but SGD 140,000 (approximately RMB 760,000) in Singapore; and the BYD Yuan PLUS (known as the BYD ATTO 3 in Singapore) costs RMB 130,000 in China but SGD 150,000 (approximately RMB 1,050,000) in Singapore.

A more widely known example is that Chery Automobile previously introduced its "Chery QQ" model to Singapore. This small car, which costs only RMB 40,000 to RMB 50,000 in China, sells for approximately SGD 86,000 (approximately RMB 460,000) in Singapore. Netizens have joked that this tenfold price difference turns the "sparrow into a phoenix" overnight. However, even with price differences of several or even more than ten times, higher prices do not necessarily translate into higher profits for automakers.

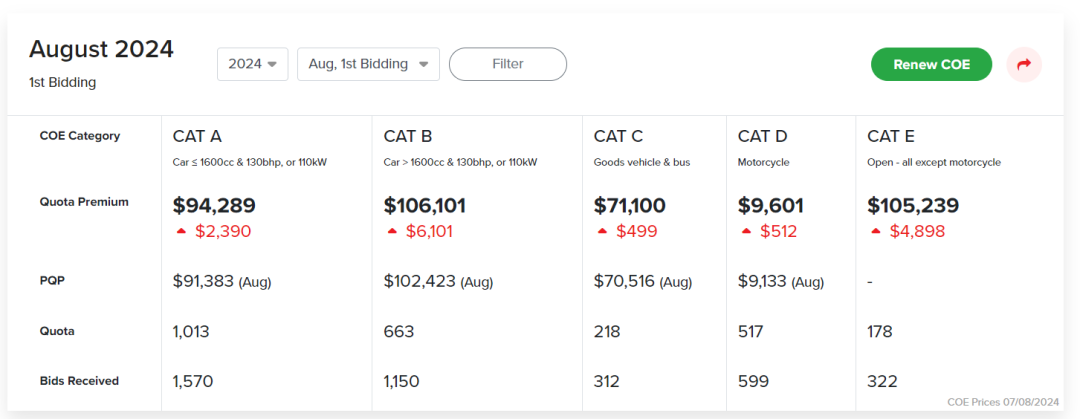

Why do models that cost around RMB 200,000 in China sell for millions in Singapore? As seen in previous examples, the prices of almost all cars sold in Singapore are the highest globally. The Julius Baer Group's "Global Wealth and Premium Living Report 2024" notes that car prices in Singapore are 155% higher than the global average, making it the most expensive city for car prices. The core reason is that Singapore has a small land area - only 735.2 square kilometers, slightly smaller than the combined areas of Chaoyang and Fengtai districts in Beijing, but home to nearly 6 million people. To alleviate traffic pressure, the government has strict restrictions on car growth. To own a car, one must first obtain a "Certificate of Entitlement" (COE) and face high taxes. Today, the price of this certificate can be staggering. In April this year, the price of COEs for large and luxury cars and the open category exceeded SGD 100,000 (approximately RMB 540,000), with the highest price reaching SGD 180,000 (approximately RMB 970,000). The latest data shows that the first tender price for COEs in the luxury car category (CAT B) rose again in August, reaching SGD 106,101. It's not an exaggeration to say that the price of just one COE is enough to buy a mid-range BBA in China. Through COEs alone, Singapore generated SGD 4.66 billion (approximately RMB 25 billion) in 2023.

COE first tender price in August 2024

COEs are generally bid on behalf of customers by dealers. Therefore, the price on the new car promotional poster can be understood as a "package price," with the COE potentially accounting for half of the SGD 199,999 price tag for the Zeekr X.

A portion of the price also covers shipping costs, as these vehicles need to be transported by sea to Singapore. Data from a shipping company shows that shipping prices to Singapore are charged per cubic meter, with the price from Shanghai to Singapore starting at RMB 2,000 per cubic meter (including pickup and customs clearance fees) for the first part and RMB 1,500 per cubic meter for subsequent parts. Heavy goods are converted based on 500KG per cubic meter, and any volume less than one cubic meter is calculated as one cubic meter. The Zeekr X weighs approximately 2,500KG domestically, so the shipping cost to the Singapore port would be RMB 8,000 (approximately SGD 1,500). Apart from COEs and shipping costs, other car-related taxes in Singapore are also quite expensive, such as customs duties (20% of CIF value), registration fees (over 100% of CIF value), excise taxes (9% of CIF value), and environmental taxes, which are also a significant expense for automakers. This does not even account for store construction costs and marketing expenses. Therefore, while car prices in Singapore may seem high, automakers do not necessarily earn higher profits than in China.

Lin Xianping, Executive Deputy Secretary-General of the China Urban Expert Think Tank Committee, believes that the high prices of automakers' models in Singapore do not necessarily translate into high profits and require consideration of factors such as market competition, sales channel brand awareness, etc. Furthermore, competition in the new energy vehicle market extends beyond price to include technology, service, brand, and other aspects. Secondly, market competition is also an important factor affecting sales profits. While the electric vehicle market in Singapore is growing rapidly, competition is also intensifying. Japanese and German brands have a deep historical presence in Singapore, while Korean and American brands have also established a strong footing. Domestic brands need to compete with other international and local brands.

Financial reports from multiple new energy automakers also show that profits from vehicle sales alone are limited. In Q1 2024, Tesla and BYD's net profit margins were 5.37% and 3.82%, respectively, barely reaching profitability. Meanwhile, Zeekr and Xpeng, which have just entered the Singapore market, have net profit margins as low as -13.72% and -20.89%, respectively. Considering the promotional costs in new markets, their profit margins in Singapore may be even lower. For consumers, owning a car in Singapore also involves additional expenses such as electronic road pricing, insurance, and road tax, as well as average annual operating costs of SGD 9,000. Therefore, owning a car in Singapore is undoubtedly a "privilege of the rich." After working in Singapore for a few years, Yu Jia also considered buying a car, but the high prices dissuaded her. "The COE in Singapore is publicly bid on twice a month, and you need to entrust a bank or 4S store to bid for you. The process is complicated, requiring a deposit of SGD 10,000 before bidding," she added. She also emphasized the difficulty of parking in Singapore due to the scarcity of parking spaces. Commercial parking can cost SGD 2-5 per hour, adding up to RMB 70-80 for a 4-5 hour stay. After comprehensive consideration, she chose public transportation and short-term car rental services for family outings.

A Deloitte research report shows that consumers in Southeast Asian countries prefer to purchase cars through authorized dealer channels. BYD owner Young explained that in Singapore, one can buy a car either from an authorized dealer's 4S store or through a parallel importer. "The advantage of 4S stores is comprehensive after-sales service and guaranteed repairs, providing a one-stop solution for vehicle sales, parts, and official after-sales services, but their fees are relatively high. Vehicles sold by parallel importers are essentially the same as those sold by 4S stores, but at a lower price, typically SGD 10,000 to SGD 20,000 cheaper," said Young. In her impression, Singaporeans still have a low acceptance of Chinese brands and prefer Japanese and German brands. "Unless they are Grab drivers who need durable cars, they might choose BYD. Otherwise, most consumers prefer traditional automotive brands." (Note from the author: In 2017, BYD's e6 electric taxi was put into operation in Singapore, giving many local consumers the impression of "durability.")

BYD cars on the streets of Singapore

As for why Young chose BYD, the reason is simple - "Compared to other small cars, the BYD DOLPHIN is cheaper. Newly registered electric vehicles can also receive an additional 45% rebate on registration fees. Plus, the BYD by 1826 sales model is also interesting, so my family and I decided to place an order after experiencing it."

BYD by 1826, the theme restaurant mentioned by Young, is located inside the Suntec City Mall. Unlike the common 4S stores in China that prioritize car sales with catering as a secondary offering, this restaurant is a genuine dining establishment where customers can sit down and enjoy a meal. It offers a variety of cuisines and set meals, incorporating the names and information of BYD vehicles into its menus, and features small models of BYD cars around the premises. While setting up automobile showrooms in malls is common in China, it is less prevalent overseas. BYD can be considered the first automaker to open a store in a Singaporean mall. This idea, however, did not solely originate from BYD. According to information, BYD by 1826 is a collaborative effort between BYD and Singaporean automotive retailer Vantage Automotive, aimed at captivating local consumers with novel marketing strategies and promoting the concept of "changing lifestyles" in Singapore.

In fact, many Chinese automotive brands take partnering with local dealers as their first step when entering the Singapore market. Premium Automobiles, the dealer for Zeekr and Xpeng, is a locally established dealer since 1999 and the exclusive Audi dealer in Singapore. Vincar, another dealer, currently represents GAC Aion and Nezha Automobile.

Vincar is also a Singaporean brand that started as a used car dealer in 1989 before expanding into new car import/export and representing various European and Japanese car models. Vertex Automobile, on the other hand, represents Chery Automobile's Omoda and Jaecoo brands. Great Wall Motors has chosen to collaborate with Cycle & Carriage Group to introduce its Ora Good Cat model to the Singapore market. Depending on the model, BYD's dealers in Singapore include Sime Darby, E-Auto, and Vantage Automotive. Sime Darby, one of Malaysia's oldest multinational corporations, entered the Singapore market in 1982 and is one of the world's largest BMW and Rolls-Royce dealers. These partnerships facilitate the rapid establishment of Chinese new energy vehicles in Singapore.

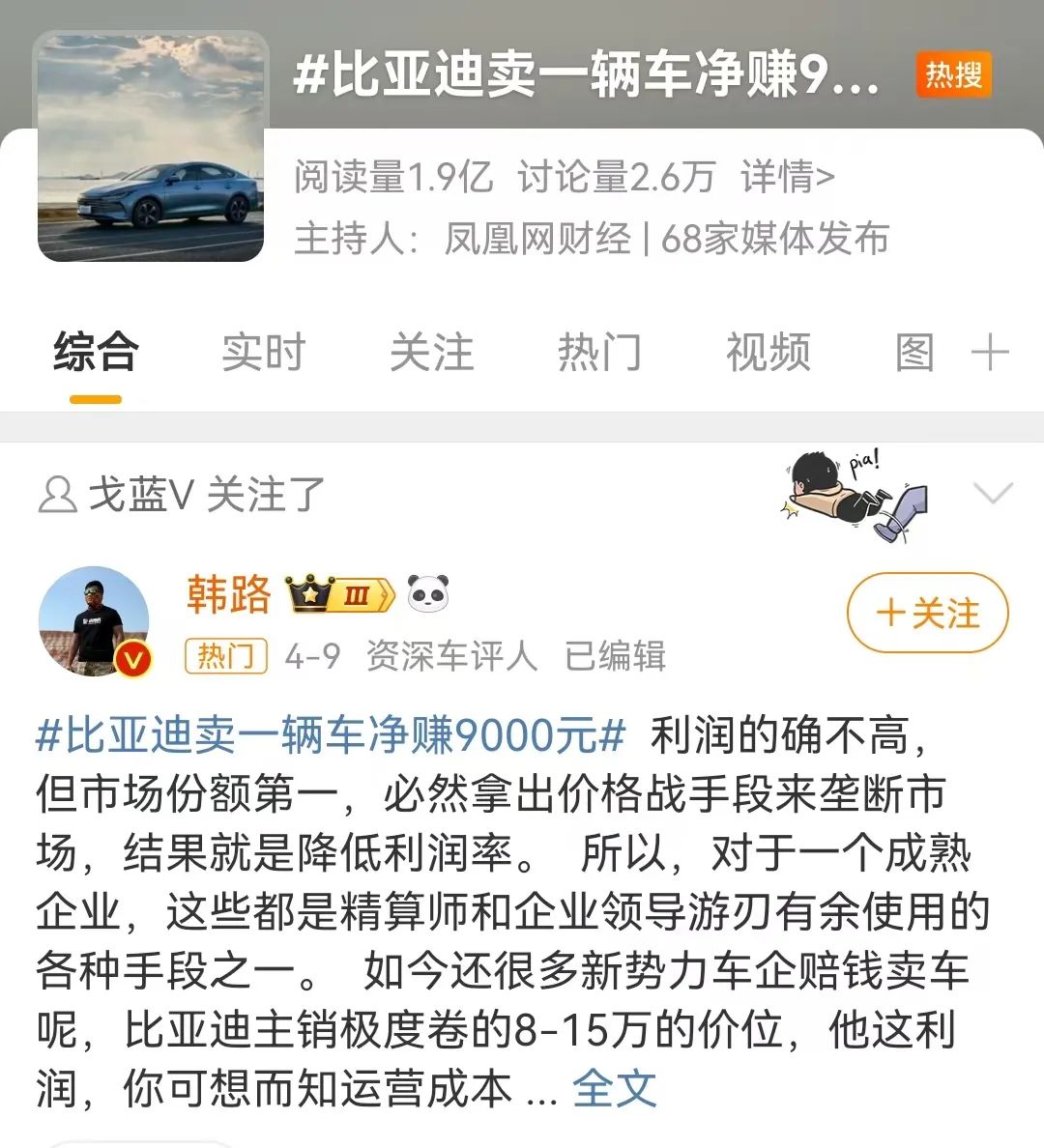

Jiang Kunping, CEO of Dongxi Jingwei New Energy (Chengdu) Co., Ltd., believes that entering a new market through dealer channels offers two significant advantages: reducing risk by quickly validating local brand acceptance and minimizing the OEM's capital investment by allowing dealers to manage inventory. Additionally, local channels have a deeper understanding of local culture and an existing customer base, enabling them to leverage resources effectively. However, partnering with dealers also poses a challenge—profit sharing. In April this year, the topic "BYD earns RMB 9,000 per vehicle" trended on Weibo. In fact, this figure may be conservative; in 2023, BYD sold 3.024 million vehicles, generating a net profit of RMB 30 billion, translating to approximately RMB 8,600 in net profit per vehicle at an average price of RMB 159,800.

Image source: Weibo

Of course, this is the average global profit margin for BYD, and the actual figure in Singapore may be lower due to dealer commissions, which typically range from 3% to 8% of the vehicle price. For example, dealers earn approximately SGD 10,000 for each BYD ATTO 3 sold.

A securities analyst told Xiaguangshe that Southeast Asian countries prefer joint ventures, local factories, and branch offices due to their ability to protect local industries, promote economic development, and enhance local employment. These models facilitate economic integration and are thus more popular. However, some insiders express concern about the "trading company + overseas general agent" model, which has low entry barriers and funding requirements but struggles with after-sales service and brand control. The "trading company + local dealer system" model, on the other hand, requires significant investment and local management capabilities, posing higher risks. Automakers must clarify their short- and long-term goals to choose the right strategy for sustainable local development.

While Chinese new energy vehicle brands boast technological advantages, they face challenges in brand recognition, after-sales networks, localized operations, consumer psychology, and supply chains. "The next 3-5 years will be crucial for Chinese EV brands to expand into Singapore and the Southeast Asian market," said an insider. Wang Peng, an associate researcher at the Chinese Academy of Social Sciences, believes that the primary issue for Chinese new energy vehicles going abroad is their low export ratio in the high-end market, which is currently dominated by traditional automakers like Mercedes-Benz and Audi. Chinese automakers need to enhance their mid-to-high-end models' services and brand recognition. Furthermore, building the Chinese automotive brand globally is essential to telling China's story effectively.

Even for Chinese consumers, Chinese new energy vehicles are moving towards high-end status, but Chua's perception of Chinese brands remains influenced by negative impressions from over a decade ago, such as relatively backward technology and lax quality control. His opinion shifted after working at BYD for some time. "The large battery capacity, long range, ultra-fast charging, and smooth human-machine interaction interface made me appreciate the advantages of Chinese automotive brands for the first time. Features like automatic cruise control, automatic parking, and cost-effective pricing made BYD Singapore's top-selling pure electric brand," said Chua. Data shows that in 2023, Singapore sold 5,465 pure electric vehicles, with BYD leading the sales chart at 1,416 units, 475 more than second-placed Tesla. Beyond products, Chinese automakers also bring comprehensive industrial chain solutions to Singapore.

As of August this year, Singapore had approximately 6,200 charging stations, with nearly 18,000 electric vehicles on the road, resulting in an overall station-to-vehicle ratio of approximately 3:1, far below the target of 1:1. Singapore lacks the concept of designated parking spaces, making the promotion of home charging stations challenging. Operating charging stations to address charging issues and drive car sales has become a strategy for Chinese automakers entering the Singapore market. In November 2023, BYD and Zhongtong Bus won the largest electric bus procurement contract from Singapore's Land Transport Authority (LTA).

Upon receiving the order, BYD commenced construction of supporting bus charging facilities. Earlier, when introducing the BYD e6 as taxis in Singapore, BYD collaborated with HTC to establish 10 charging stations with 85 charging points. In addition to automakers, Sinopec and PetroChina have also ventured into the charging business. Sinopec launched its POWERINTIME electric vehicle charging service at its Singaporean gas stations last November. PetroChina's subsidiary, Singapore Petroleum Company, signed a charging cooperation agreement with local state-owned enterprise SP Group to install fast charging stations at five of its gas stations. According to Singapore's Green Plan 2030, the number of charging infrastructure is projected to increase from 28,000 to 60,000 by 2030, presenting an opportune moment for Chinese charging stations to expand into Singapore.

BYD buses on Singapore streets

Through in-depth collaborations with local enterprises, Chinese companies not only provide products to the market but also participate in technological innovation at a deeper level. For instance, BYD signed a cooperation agreement with the Institute for Infocomm Research, Singapore, to jointly develop driverless electric vehicle technology. NIO and Li Auto have also established R&D centers in Singapore. According to reports, Li Auto's Singapore team focuses on SiC power chip development, while NIO collaborates with local research institutions to establish an AI and autonomous driving R&D center.

Cui Dongshu, Secretary-General of the China Passenger Car Association, believes that automakers should maintain their industrial chain advantages when expanding overseas. The best strategy is to "go abroad in groups," where leading automakers take their supply chain partners with them when investing in overseas factories. Conversely, being a supplier or service provider to these automakers is also an effective strategy. Yang Hong, Chairman and President of Hangsheng Electronics, echoed this sentiment at the 2024 Partner Conference, emphasizing that automotive exports must involve the entire industry chain, including production capacity, services, brands, and supply chains, for a successful "new overseas expansion." To become a global player and a century-old enterprise, automotive component companies must expand overseas, leverage global technology, resources, and talents, and build localized R&D, production, and supply chain capabilities to establish cost and supply chain advantages.

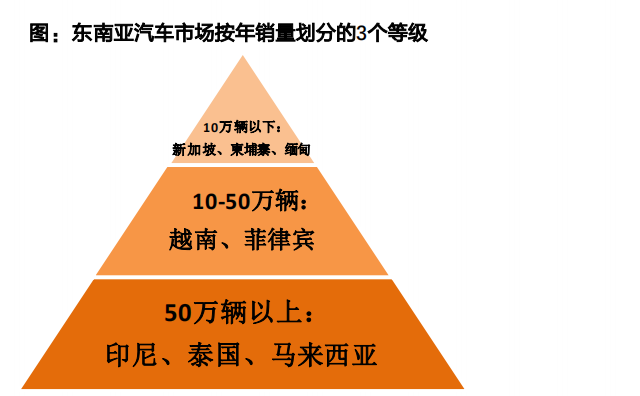

In a Tianfeng Securities research report, the automotive market in Southeast Asia is divided into three tiers based on annual sales volume, with Singapore, Cambodia, and Myanmar at the bottom with annual sales of 100,000 vehicles or less.

Image source: Tianfeng Securities

Given its small market size, potentially lower profits, and the need to share profits with dealers, why are Chinese automakers still interested in entering the Singapore market?

The answer lies in Singapore's strategic location and influence. As a predominantly Chinese island nation, Singapore is known as the "Shadow Capital of Southeast Asia," being one of the world's smallest yet wealthiest countries, with the highest per capita income in Southeast Asia and a high proportion of ethnic Chinese. Despite its small size, Singapore is a major industrial powerhouse in Southeast Asia, serving as the world's third-largest oil refining center and a significant base for electronic equipment and precision machinery manufacturing. Singapore is also a financial hub, akin to the "Swiss Bank" and "Wall Street" of Southeast Asia, facilitating capital flows for overseas Chinese. Approximately a quarter of China's total investment in countries participating in the Belt and Road Initiative flows through Singapore. According to Zhang Xiaorong, Dean of the Institute of Deep Tech Research, while Singapore's market size is small, its status as an international financial center and technological innovation hub offers unique value for Chinese automakers.

Singapore's open policy environment, robust infrastructure, and abundant cooperation resources provide comprehensive support for Chinese automakers in R&D, production, and market testing. Additionally, Singapore's proactive policies and market acceptance of electric vehicles present favorable business opportunities. Singapore is not only attractive to Chinese enterprises but also serves as an offshore center for many Southeast Asian countries, hosting companies from Japan, India, and Thailand. According to the Enterprise Singapore, over 7,000 multinational corporations had established operations in Singapore as of 2022, with 4,200 setting up regional headquarters. As a core ASEAN member, Singapore's market influence extends throughout Southeast Asia, according to Zhan Junhao, a renowned strategic positioning expert and founder of Fujian Huace Brand Positioning Consulting.

After establishing a foothold in Singapore, Chinese automakers can leverage their geographical advantages and market experience to rapidly expand into neighboring countries. BYD's K9 electric bus, for example, has been operating in Singapore since 2016. Its zero-emission, zero-fuel consumption, comfortable driving, and excellent passenger experience have made it popular among local drivers and passengers. The K9's fuel consumption costs are over two-thirds lower than similar products, saving approximately RMB 230,000 in annual operating costs. Following its success in Singapore, the K9's influence extended to India, securing 290 electric bus orders in 2018 and another 1,000 in the following year. Today, BYD holds over 80% of the Indian electric bus market. As mentioned by Lee Hao Lun, Managing Director of Premium Automobiles, Singapore's status as a "star" market in Southeast Asia provides an important showcase. If Chinese EV manufacturers can establish themselves in Singapore, they will have the opportunity to showcase their products and brand image to Southeast Asian consumers, opening up broader market opportunities in the region.

From the perspective of the path, Chinese automakers will also go through a similar process. Cui Dongshu believes that the opportunities currently facing Chinese automakers are even greater than those faced by Japanese automakers in the 1970s. "In the context of the oil crisis, with high oil prices, Japanese automakers ushered in development opportunities, but the essence is still homogeneous competition, while Chinese automakers currently have an advantage in electric vehicles that is more biased towards differentiated competition." In the future, the ability to provide quality services combined with product differentiation will be the key to determining the success or failure of Chinese automakers going overseas. The reason why Japanese cars can occupy a large share in many Southeast Asian countries is inseparable from their excellent system capabilities and service capabilities.

Automakers represented by Toyota and Honda focus on teamwork overseas, with automakers and parts companies working together. The information system of trading companies transmits more than 60,000 customer intelligence every day, forming a powerful cross-cultural service capability. However, Chinese automakers entered Southeast Asian countries relatively late, with insufficient 4S stores, and better locations have been occupied by Japanese 4S stores, so their system capabilities are inferior to Japanese automakers. In addition, the parts of Chinese automakers still need to be transported from China, posing a huge challenge to the timeliness of maintenance services. Chinese new energy vehicle brands that are eager to go overseas are not only concerned about sales and rankings, but also urgently need to work with partners to build a service system with the ability to view, test, buy, and repair cars in one go, so as to gain the favor of more consumers in the future. Singapore, a high-consumption market in Asia and even the world, is the testing ground for Chinese automakers to forge service capabilities globally.