Apple Confronts AI Turmoil, Suppliers Grapple with 'Apple Chain' Dilemma

![]() 07/21 2025

07/21 2025

![]() 543

543

Could Apple Follow in Nokia's Footsteps?

Since the dawn of 2023, outsiders have grown increasingly skeptical about Apple's future, stemming from its entanglement in what has been dubbed 'the largest AI crisis in history.' This situation underscores Apple's undeniable innovation fatigue and aging management. Consequently, Apple's stock price has plummeted by approximately 16%, trailing significantly behind Meta's 25% increase and Microsoft's 19% rise.

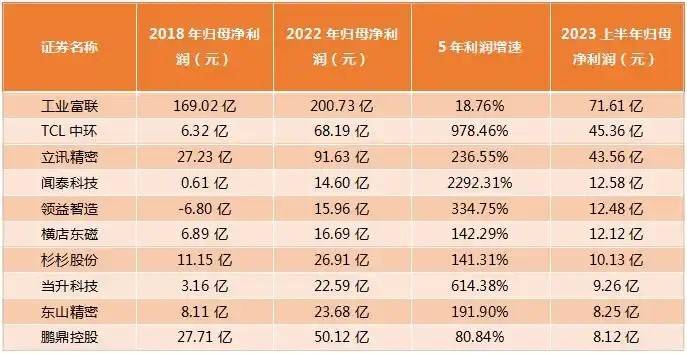

The alarm extends beyond Apple and Wall Street, encompassing China's supplier giants as well. Over the past decade, leading suppliers such as Luxshare Precision, GoerTek, and Lens Technology have solidified their positions within Apple's formidable supply chain, reaping the boundless benefits of Apple's rapid growth and expanding their operations. Nonetheless, if Apple falters in the AI era, the stronger the dependence on Apple, the greater the impact on these suppliers.

Escaping the Apple Chain has long been the strategic consensus and transformation direction for most supplier giants. However, in their quest to flee, they struggle to identify the next 'Apple.'

'Reducing Dependence on Apple' and 'Decoupling from China'

For an extended period, China has been the epicenter of Apple's supply chain, with approximately 50% of Apple's manufacturing partners situated there. These partners have thrived year after year, relying on Apple's orders, fostering a mutually dependent relationship. However, this dependency has gradually evolved into a 'crisis' for both parties, with one side busily 'reducing dependence on Apple' while the other accelerates 'decoupling from China.'

From a proportional standpoint, supplier giants have achieved initial success in shedding the 'Apple dependence syndrome.' According to financial report data, in 2024, GoerTek's sales to its largest customer accounted for 31.96%, down from 43.38% in 2023. Lingyi Intelligence's sales to its largest customer accounted for 22.07% in 2024, compared to 24.22% in 2023. Lens Technology's sales to its largest customer accounted for 49.45% in 2024, down from 57.83% in 2023 and a peak of 71% in 2022. Clearly, these companies' reliance on their largest customer, Apple, has decreased to varying degrees.

Lens Technology, in particular, has made a significant leap. From 2022 to 2024, the company's revenue from Apple decreased markedly, while the proportion of domestic brand customers soared from 18% to 41%. Simultaneously, export sales declined from 81.94% to 58.63%.

Relatively, Luxshare Precision's efforts to 'reduce dependence on Apple' have met with minimal success. In 2022, Luxshare Precision sold products worth 156.83 billion yuan to Apple, accounting for 73.28% of its total sales. In 2023, sales to Apple reached 174.48 billion yuan, with the proportion rising to 75.24%. In 2024, revenue from Apple amounted to 190.139 billion yuan, accounting for 70.73%. Although there has been a decline, the proportion remains above 70%.

Additionally, Sunwoda Electronic's 2024 financial report listed its operating revenue in the United States as 28.885 billion yuan, accounting for 82.20% of its total revenue.

Supplier giants have demonstrated varied performance in 'reducing dependence on Apple,' but it is undeniable that Apple remains the undisputed largest customer, dictating that these suppliers' development must closely mirror Apple's footsteps. Whatever Apple ventures into, they must follow suit.

For instance, regarding foldable screens, market news cited supply chain sources stating that Apple plans to finalize the foldable iPhone supply chain by April this year, with mass production of foldable iPhone components anticipated in the second half. From Lens Technology's prospectus, it is evident that the company's fund-raising intentions are largely aligned with its major customer's strategy, namely Apple's foldable phones.

In the Chinese market, foldable phones are already common, and Apple's late entry may not yield miracles, making it a risky bet for suppliers in the Apple Chain.

Compared to 'reducing dependence on Apple,' Apple's 'decoupling from China' process appears even more fraught with challenges. Last year, Tim Cook visited China and met with representatives from three major suppliers, BYD, Lens Technology, and Changying Precision, sparking speculation that Apple's supply chain might be returning to mainland China. This also hints at the significant setback Apple has faced in recent years due to its strategy of shifting orders to India and Vietnam to diversify its supply chain.

Replicating an 'Apple Chain' in Southeast Asia may entail a much higher cost than anticipated.

No Next 'Apple' in the Automotive Industry

After accelerating their efforts to 'reduce dependence on Apple,' supplier giants in the Apple Chain have almost universally targeted another industry: new energy vehicles.

Since 2015, Lens Technology has been deploying in the new energy vehicle sector, developing and mass-producing automotive electronic glass and components, in-vehicle center consoles, dashboards, smart B-pillars, projection displays, and other products centered around the intelligent cockpit. Lingyi Intelligence acquired a 'vehicle chain' enterprise for 38 million yuan in 2021 and purchased a 66.46% stake in Jiangsu Keda this year, a company qualified as a tier-one supplier to multiple automakers.

Luxshare Precision's layout in the automotive industry is even more aggressive. As early as 2012 and 2013, it acquired Fuzhou Yuanguang and German SuK, respectively entering the automotive electronics and automotive parts fields. Last year, it invested approximately 525 million euros to acquire a 50.1% stake in German automotive wiring harness manufacturer Leoni and a 100% stake in its wholly-owned subsidiary Leoni K.

With the continuous decline in the smartphone market and the unstoppable rise of the new energy vehicle industry, it is not surprising that manufacturing giants like Lens Technology are pouring into the automotive supply chain. Moreover, in this round of automotive industry transformation, China has emerged as an absolute leader in technology and the market, presenting immense potential across the upstream and downstream supply chain. However, for now, although the automotive business is growing, its contribution to these companies is generally low.

In 2024, Lens Technology's smart cars and cockpits, smart head-mounted displays and wearables, and other smart terminals generated revenues of 5.935 billion yuan, 3.488 billion yuan, and 1.408 billion yuan, respectively, with the smart cars and cockpits business accounting for 8.49% of total revenue. In the first half of 2024, Lingyi Intelligence's automotive segment accounted for 5.33% of revenue and did not generate any profit.

From 2022 to 2024, Luxshare Precision's revenue from automotive connectivity products and precision components increased from 6.149 billion yuan to 13.758 billion yuan, representing the fastest growth. However, compared to the 190.139 billion yuan in revenue from Apple, it appears insignificant.

In the short term, there is still significant potential for growth in the automotive business for companies in the Apple Chain. However, in the long run, perhaps no automaker can create a new wealth-creation myth for them like Apple did.

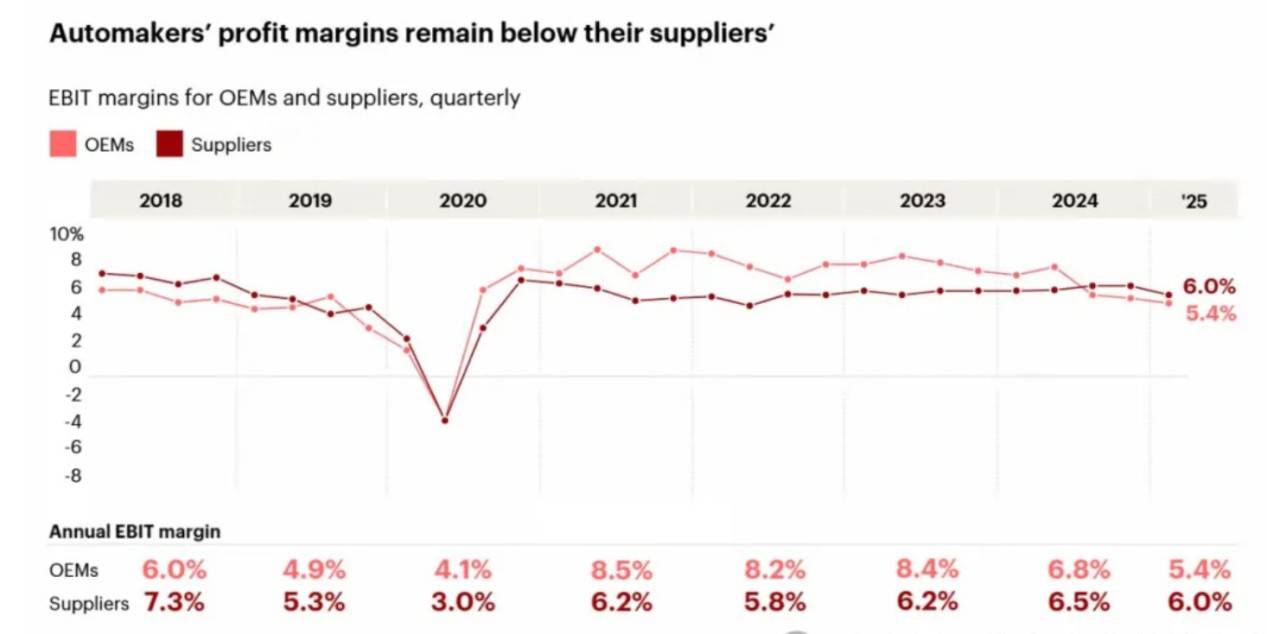

Simply put, Apple's appeal and influence in the smartphone market allow it to capture the vast majority of profits, and suppliers who 'follow' Apple also enjoy profit margins higher than the industry average, leading to a surge in profit scale and company assets within a few years. In contrast, in the new energy vehicle industry, the impact of price wars has already permeated the entire supply chain, causing profits to be constantly squeezed, and automakers continue to shift pressure onto suppliers, eliciting numerous complaints.

Therefore, even if companies in the Apple Chain successfully enter the electric vehicle supply chain, it won't be easy money.

According to Bain & Co., the profit margin of original equipment manufacturers (OEMs) continued to decline to 5.4% in the first quarter of 2025. This result also marks the third consecutive quarter that supplier profit margins have exceeded those of OEMs, but supplier profit margins are estimated to be only 6%.

Of course, the era of high growth and high profits for suppliers in the Apple Chain is over, which is why manufacturing giants are eager to escape.

Taking Luxshare Precision as an example, relevant data shows that in 2015, Luxshare Precision's gross profit margin was as high as 22.88%, and its net profit margin was 11.16%. However, in the following years, both gross and net profit margins declined.

In the AI Era, Whose Legs Should Suppliers Embrace?

Within the industry, there has long been a pessimistic view towards Apple, but this year's narrative is tinged with greater pessimism and disappointment. Due to multiple setbacks, Apple's lag in AI technology has become an indisputable fact, significantly shaking its leading position in cutting-edge technology. If Apple cannot secure a 'ticket' to the AI era, the giant built by Steve Jobs' innovative power may fade into obscurity.

Therefore, in the AI era, suppliers in the 'Apple Chain' are not putting all their eggs in the Apple basket:

GoerTek is betting on AI-driven smart hardware (VR/MR devices and AI glasses), while Luxshare Precision's experience in high-end head-mounted display manufacturing has been transferred to the AI glasses sector. Lens Technology is deeply involved in the development of humanoid robots and is also deploying in AI/AR glasses.

Among them, GoerTek's transformation has already yielded initial results. This year, Meta released its third-generation AI glasses, followed by Xiaomi and Huawei, with Apple planning to enter the market in 2026. Amid the 'hundred glasses war,' GoerTek has quietly become a core supplier to giants like Meta and Xiaomi.

In the past two years, the rise of global AI technology represents not only a technological leap but also drives the implementation and popularization of AI smartphones, AI PCs, AI glasses, and other intelligent terminals at an unprecedented speed and scale. If the next revolutionary intelligent terminal emerges from these new products, regardless of who ultimately becomes the 'king,' suppliers who seize the benefits of the AI era will reap immense profits.

However, the current issue is that the wave of smart hardware, from AR/VR devices to AI glasses, rises and falls, and once the heat subsides, it can easily lead to chaos.

Similarly, Foxconn (Hon Hai Precision), which is deeply tied to Apple, has firmly clung to NVIDIA's leg, standing firmly at the forefront of the trend. Compared to consumer-facing enterprises or brands, NVIDIA is the 'giant' standing behind the scenes, and in the AI era, it was NVIDIA that took the lead. As the 'exclusive foundry' for NVIDIA's AI hardware, Foxconn has already secured a share of the pie.

According to Morgan Stanley data, nearly 30% of NVIDIA's AI server orders in 2024 flowed to Foxconn, with GB200 and GB300 foundry shares as high as 40%, almost monopolizing the production of high-end AI hardware. Orders from NVIDIA have also propelled Foxconn's performance back on the fast track. According to published data, Foxconn's revenue reached NT$1.797 trillion (approximately RMB 445.1 billion) in the second quarter of 2025, a year-on-year increase of 15.82%.

With Apple on one hand and NVIDIA on the other, Foxconn can be said to have precisely stepped onto the right path. Even if Apple declines, NVIDIA will become the next 'pillar,' and it may also be the first giant to exit the 'Apple Chain.' According to foreign media reports, Foxconn Chairman Liu Yangwei predicts that the company's server business revenue will surpass iPhone business revenue within two years.

Of course, if Foxconn becomes overly dependent on NVIDIA, the 'Apple dependence syndrome' may morph into a 'NVIDIA dependence syndrome.'

Automotive, smart hardware, humanoid robots... These industries, representing the world's top technological levels, naturally require top-tier manufacturing capabilities to match. Supplier giants in the Apple Chain are extending their business tentacles into these areas, betting on the next future. However, not everyone can find the next 'Apple,' and perhaps there is no next 'Apple' that can bring another revolution to the entire electronics consumer market and manufacturing sector.

Dao Zong You Li, formerly known as Wai Da Dao, is a new media outlet focusing on the Internet and technology circles. This article is original and prohibits any form of reproduction without retaining the author's relevant information.