American Auto Market | Mexico June 2025: Demand Constrained, Chinese Brands Sustain Growth Momentum

![]() 07/21 2025

07/21 2025

![]() 551

551

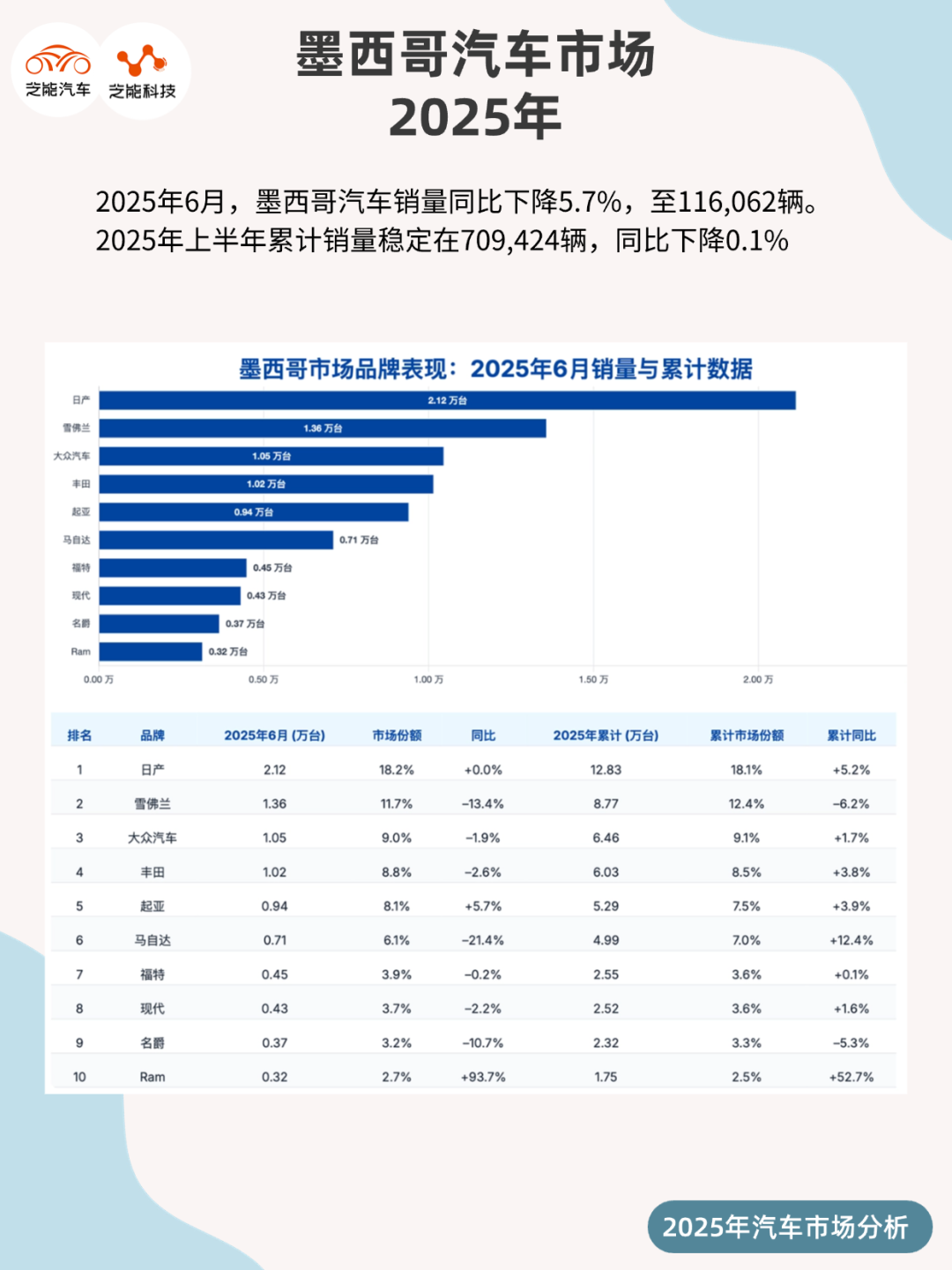

In June 2025, light vehicle sales in Mexico declined by 5.7% year-on-year, totaling 116,062 units, as the overall market struggled under economic pressure.

Regarding individual brand and model performance, Japanese brands maintained their stronghold, with Nissan leading the market with a 18.2% share. Amidst widespread sales declines, Chinese brands stood out, with Changan experiencing a remarkable 215.8% year-on-year growth, joined by JAC and MG in showcasing market resilience.

As the local market's preference for small pickup trucks and economy cars intensifies, Chinese brands are increasingly gaining traction due to their competitive pricing and configurations.

01 Overview of Mexico's Auto Market Structure and Brand Competition

In the first half of 2025, Mexico's cumulative light vehicle sales amounted to 709,424 units, virtually flat compared to the previous year with a slight 0.1% decline. June's sales figures reflected greater market pressure, with a 5.7% year-on-year drop, indicative of the end-demand constraints amidst high interest rates and economic uncertainty.

In terms of powertrain, the Mexican market remains heavily reliant on traditional fuel vehicles, with new energy vehicles having a low market penetration.

The slow pace of electrification is mainly attributed to insufficient charging infrastructure and consumers' sensitivity to high prices. The primary market focuses on A0-B-segment sedans, small SUVs, and small pickup trucks, where practicality is paramount in vehicle purchases.

Brand Performance:

◎ Nissan maintained its market leadership with June sales of 21,153 units, accounting for 18.2% of the market, nearly double that of second-placed GM.

◎ GM (Chevrolet) followed in second place with 13,584 units, experiencing a 13.4% year-on-year decline.

◎ Volkswagen (10,471 units), Toyota (10,162 units), and Kia (9,410 units) ranked third, fourth, and fifth, respectively. Notably, Kia posted a 5.7% year-on-year increase, demonstrating steady growth.

◎ Amidst the pressure on established brands, Ram, a highly localized pickup truck brand in the Latin American market, stood out with a 93.7% year-on-year growth to 3,154 units. Its 700 and 1200 models resonated with Latin American consumers' preference for affordable and practical vehicles.

Model Performance:

◎ The Nissan Versa retained its sales crown in Mexico, delivering 6,368 units despite a 20.2% year-on-year drop.

◎ It was followed by the Kia K3 (4,909 units, up 21.3% year-on-year) and the Nissan NP300 pickup (4,409 units).

Notably, most of the top 10 models were compact sedans and economy SUVs from brands like Nissan, Volkswagen, Kia, Hyundai, and Chevrolet, highlighting the Mexican market's reliance on entry-level models.

◎ The Hyundai Grand i10 and Nissan Sentra ranked sixth and seventh, with growth rates of 38.1% and 23.5%, respectively, indicating a vibrant economy car market.

◎ Volkswagen Saveiro, Jetta, and Nissan X-Trail also made the top 10, covering segments including sedans, hatchbacks, and SUVs.

02 Market Performance and Competitive Standing of Chinese Brands

It's worth noting that data for Chery and BYD in Mexico has not been disclosed.

Amidst the challenging market conditions, Chinese brands have defied the trend and delivered impressive performances.

◎ Changan Automobile emerged as the fastest-growing brand this month, with sales surging 215.8% year-on-year to 1,601 units, significantly outperforming the 507 units sold in the same period last year. This propelled it from 28th place last year to 16th this year, showcasing robust expansion.

◎ JAC maintained its 15th position, selling 2,044 units in June, a marginal 2.8% year-on-year decline, but still achieving positive cumulative sales growth.

JAC has a long-standing presence in Mexico, with Frison pickup trucks and SUVs as its mainstay, catering to both commercial and passenger vehicle markets. Its Frison sold 758 units in June, up 32.5% year-on-year, demonstrating market loyalty.

◎ Despite a 10.7% sales decline in June, MG ranked ninth overall with 3,665 units sold, positioning it as the largest Chinese brand in Mexico. Notably, the MG GT model excelled, selling 1,364 units this month, a year-on-year surge of over 15 times, signaling its rapid ascent in the compact sedan segment.

◎ Great Wall Motor sold 1,039 units in June, down 20.1% year-on-year, but still achieved a cumulative growth of 9.5% in the first half of the year. Its main models, such as the Pao series pickup trucks, appeal to small and medium-sized enterprise users in Mexico.

◎ Notably, Changan's new Deepal brand recorded its first sales this month, delivering 24 units, serving as a testing ground for future high-end new energy vehicles.

◎ SAIC IM Motors also ventured into the Mexican market, delivering 10 vehicles in June. While the volume is small, it represents a forward-thinking exploration by Chinese brands in intelligence and new energy.

At the model level, Chinese brands are primarily focused on pickup trucks and A-segment sedans.

◎ JAC Frison, MG GT, and MG 5 are particularly active in the economy segment.

◎ Although Changan currently lacks specific top-selling models, it is anticipated that its main products will continue to be CS series SUVs and UNI series new cars.

Given the high acceptance of cost-effective SUVs in Mexico, Changan's products still hold expansion potential in the future.

Summary

In June 2025, traditional Japanese and American brands dominated the Mexican auto market, but Chinese brands are gradually disrupting the status quo with flexible product mixes, robust cost control, and localization strategies. Changan's significant growth and MG GT's explosive performance underscore the strong competitiveness of Chinese brands in the entry-level market.