US$3.1 Billion Deal Sealed: SES Acquires Intelsat, Accelerating Satellite Internet Reshuffle

![]() 07/21 2025

07/21 2025

![]() 711

711

Recently, the Federal Communications Commission (FCC) of the United States approved the transfer of Intelsat's FCC licenses to SES, paving the way for SES to complete its acquisition of Intelsat for a whopping US$3.1 billion. Prior to this, on June 10th, the European Commission granted unconditional approval for the merger of SES and Intelsat, aiming to create a European satellite industry leader.

Following the approval, SES officially announced on July 17th in a press release that it had successfully completed the high-value acquisition of Intelsat. This merger has created a global leading satellite operator with an expanded constellation of 120 satellites across two major orbits. The newly merged entity will leverage its experienced team and deep vertical expertise to provide integrated, multi-orbit, multi-band satellite and connectivity solutions for global enterprises and governments, generating approximately 60% of its revenue from high-growth areas.

With this major acquisition, which has garnered significant industry attention, finally settled, the satellite industry is undergoing dramatic changes. The merger of SES and Intelsat marks a turning point in the integration of the space communication market, poised to have a profound impact on the future market landscape.

Traditional Satellite Operators Face Intense Competitive Pressure

As the acquired party, Intelsat boasts a 60-year history. Its predecessor was the International Telecommunications Satellite Organization (INTELSAT), an intergovernmental organization headquartered in Luxembourg. In 1965, Intelsat launched its first commercial global satellite communication system. In 2001, Intelsat completed its privatization and became a private company, listing on the New York Stock Exchange in 2013.

Years of experience made Intelsat the world's largest satellite service provider at one time. However, due to the emergence of new satellite startups and the impact of the pandemic, Intelsat filed for bankruptcy reorganization in May 2020. At the time, Intelsat stated in its bankruptcy announcement that it hoped to participate in the accelerated C-band spectrum clearance, as per FCC instructions, to support the expansion of the United States' 5G wireless infrastructure. If completed by the FCC's deadline, Intelsat could receive compensation of US$4.87 billion. In 2022, Intelsat emerged as a private company once again after its bankruptcy reorganization.

SES, the acquiring party, is a leading global space solutions enterprise founded in 1985 and headquartered in Luxembourg. It is the world's second-largest satellite operator. In terms of technological innovation, SES continues to promote the application of high-throughput satellite (HTS) technology, providing users with higher bandwidth, lower latency, and supporting communication needs in remote areas. In 2024, the company participated in the EU's Iris² space program as a core member of the SpaceRISE consortium, leading the design and operation of the satellite system.

SES and Intelsat have roughly the same revenue scale, with SES's fiscal year 2024 revenue at US$2.2 billion and Intelsat's at US$2 billion. This transaction establishes a stronger financial foundation for SES: the estimated annual revenue after the merger will reach €3.7 billion, with a projected compound annual growth rate of low to mid-single digits from 2024 to 2028. Additionally, the estimated adjusted EBITDA is €1.8 billion, expecting mid-single-digit growth (including synergies) and planning to achieve adjusted free cash flow of over €1 billion by 2027-2028 (excluding the Iris² project). Behind this robust financial outlook is a contract backlog of over €8 billion, providing clear visibility for future revenue.

This acquisition was completed amidst increasing competitive pressure on traditional satellite operators. With the popularity of terrestrial fiber-optic networks and streaming media over linear broadcasting, the demand for content distribution services of traditional satellite operators is declining, leading to a drop in revenue. At the same time, they face competition from faster and higher-capacity low Earth orbit (LEO) operators like Starlink.

Around the same time as the official announcement of SES's acquisition of Intelsat, Starlink also announced that it will launch its third-generation satellites next year. Each third-generation satellite will have impressive communication capabilities, providing downlink capacity exceeding 1 Tbit/s and uplink capacity of 200 Gbit/s, which are 10 times and 24 times that of the second-generation satellites, respectively. This significant performance improvement is likely to offer users an unprecedented high-speed network experience, making high-definition video streaming, large file downloads, and real-time online gaming smoother and more efficient. Furthermore, the third-generation satellites will operate in a lower orbit, resulting in lower latency and faster response. Starlink's extensive satellite network coverage has enabled it to have over 6 million paying users, and the performance enhancement next year will undoubtedly bring greater pressure to competitors.

The European Commission's unconditional approval of the merger of SES and Intelsat also aims to integrate resources to compete against emerging satellite internet giants and enhance the global competitiveness of the European satellite industry.

New Giant Strengthens Global Multi-Orbit Satellite Network Capabilities

What capabilities does the new giant possess after the merger? Before the merger, SES operated a constellation of 43 geostationary orbit (GEO) satellites and 26 medium Earth orbit (MEO) satellites, while Intelsat had a constellation of 57 GEO satellites. Both companies primarily used the C-band, Ku-band, and Ka-band to operate their satellite networks. After the merger, the new company will be the only satellite provider with a reliable MEO satellite constellation and a powerful GEO satellite fleet that has achieved commercial success, while also having strategic access to LEO solutions.

To maintain their past dominant position, traditional satellite operators have not only expanded satellite capacity but also actively adjusted their connectivity strategies in recent years. Specifically, they have pursued a multi-orbit and hybrid connectivity strategy, relying on their proprietary ecosystem to provide more flexible and resilient services to meet diverse usage scenarios.

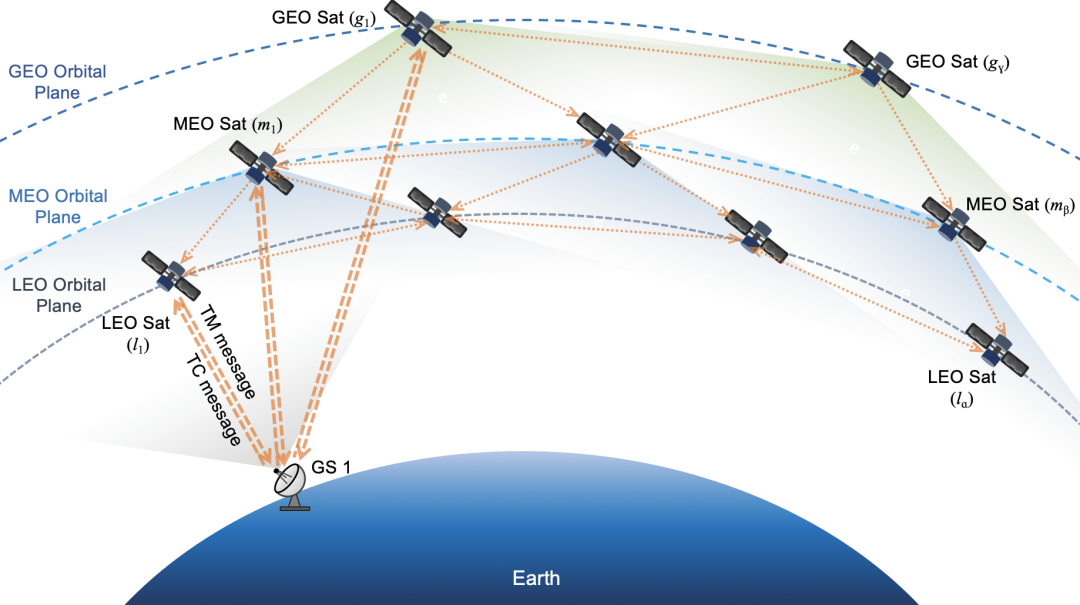

Earth satellite orbits are primarily divided into three types: low Earth orbit (LEO), at a circular orbit of about 200-2000 kilometers above the ground; medium Earth orbit (MEO), at a circular orbit of about 2000-20000 kilometers above the ground; and geostationary orbit (GEO), at a circular orbit of about 36,000 kilometers above the ground. Satellite connections in these three orbits have their respective advantages and disadvantages. For instance, while MEO and GEO satellites solve the Earth's coverage problem, equivalent to the 2/3G network of mobile communications, providing only basic voice and low-capacity data services, they cannot meet the interconnection capacity demand of a large number of global users and have strict requirements for ground terminals. In contrast, LEO satellites offer advantages such as short distance, low transmission delay, low link loss, flexible launch, rich application scenarios, low overall manufacturing cost, and low terminal cost, enabling low-cost global interconnection services.

The 'multi-orbit satellite solution' aims to combine the low latency and high throughput of LEO satellites with the wide geographic coverage of GEO satellites into a single service, enabling satellite IoT providers to meet a wide range of IoT use cases, including data-intensive and LPWA (low-power, wide-area) connections. SES is one of the main drivers of this multi-orbit and hybrid connectivity strategy.

GEO-MEO-LEO Multi-Orbit Satellite Constellation Diagram

GEO-MEO-LEO Multi-Orbit Satellite Constellation Diagram

The merger not only optimizes the multi-orbit network but also releases more financial resources to invest in new network capacity, technology, and services. SES plans to maintain robust investments in future growth, with annual capital expenditures averaging €600 million to €650 million between 2025 and 2028. This will enable the company to continuously enhance its network and explore emerging growth markets, including the Internet of Things (IoT), satellite direct connectivity, satellite-to-satellite data relay, space situational awareness, and quantum key distribution.

Opportunities and Challenges Coexist in the Future

Some industry insiders have expressed concerns about this transaction, as the merged company will control the vast majority of satellite media distribution capabilities in the United States. While many areas can transmit content through fiber optics and other means, the C-band is irreplaceable for program transmission, and in remote areas, fiber services may be more expensive and less reliable.

However, the FCC noted in its ruling that while SES and Intelsat are indeed responsible for over 95% of C-band video program transmission in the United States, "other important alternative paths" exist, such as other frequency bands and fiber optics, which are expected to become more widely available in the coming years. If SES/Intelsat attempts to raise prices, their customers may choose to switch to other methods. The FCC also independently conducted a technical feasibility analysis, including calculating the distance from each ground station to broadband service providers with gigabit download speeds. The results showed that "about 65% of C-band ground stations are within 200 meters of gigabit broadband access points, and 94% are within 1 mile," indicating that transitioning to fiber-optic connections is realistically feasible in most cases.

Furthermore, considering that the FCC currently has the authority to redistribute and auction new spectrum (including an additional 100 MHz of C-band), during the review of this transaction, the FCC also confirmed that SES and Intelsat have "significant excess C-band capacity" in North America, noting that "SES has indicated the ability to release over 100 MHz of additional C-band resources".

In other business areas such as in-flight connectivity, cellular backhaul, and government services, the FCC believes that the merger will not cause significant competitive harm as these areas are likely to be dominated by LEO service providers in the future, and the capacity share of SES and Intelsat in these businesses is insignificant compared to LEO service providers. Data from SES and Intelsat show that by 2032, LEO operators are expected to account for about 80% of cellular backhaul and relay service revenue.

In summary, the FCC accepted the argument of both companies that "the merger will help enhance their competitiveness against Starlink and other LEO service providers." Moving forward, this new giant will focus on helping customers solve real-world challenges, driving technological progress, and exploring the future of space communications.

References:

FCC approves SES-Intelsat merger, Rcrwireless; SES Completes Acquisition of Intelsat, Creating Global Multi-Orbit Connectivity Powerhouse, SES; Market Size of SES Surges! What Makes Satellite IoT Win?, IoT Wisdom; To Earn US$3 Billion, the World's Largest Satellite Service Provider Intelsat Applies for Bankruptcy Protection, 21st Century Business Herald; Starlink's Third-Generation LEO Satellites to be Launched Soon, with 1 Tbps Downlink and 200 Gbps Uplink, 5G & 6G