Extended range models disrupt joint venture vehicles' counterattack against domestic vehicles

![]() 08/26 2024

08/26 2024

![]() 676

676

Extended range models are gaining popularity due to the repeated record lows in battery prices and loading rates, causing inventory backlog. This has the ripple effect of advancing the demise of joint venture brands' new counterattack.

Avita and ZEEKR have both embraced extended range models, gradually fulfilling Li Xiang's prophecy, though not because of the superiority of extended range technology itself.

10 months ago, Li Xiang unexpectedly announced publicly that Chinese domestic auto brands persisting with multi-gear PHEV vehicles would switch to extended range technology within the next one to two years. This prediction can be verified by 2025.

Ten months later, it has all come true. Moreover, in addition to ZEEKR and Avita , Chery has already applied this technology to its Starway Star Age ET, and icar test vehicles are already on the road. Currently, except for Great Wall Motor, leading Chinese automakers such as Geely, Chery, and Changan have all started using extended range technology. Among new forces, only NIO, Tesla, and XPeng remain committed, though rumors of XPeng adopting extended range technology frequently emerge, indicating a potential shift.

The premature demise of joint venture vehicles' new offensive

“In just one year, the Chinese market has changed directions three times. It's really hard to keep up.” This was the helpless sentiment expressed by members of joint venture brand marketing teams when discussing ZEEKR and Avita 's adoption of extended range models. In their original plans, to keep pace with the rapid development of China's new energy vehicles, Chinese and foreign shareholders finally reached a tacit agreement to deepen localization and prepared pure electric vehicle models.

However, sales growth of pure electric vehicles in the Chinese automotive market has slowed, and in the first half of 2024, plug-in hybrid growth also began to gradually decline. Nowadays, more automakers are quickly turning to extended range models, which offer lower pricing, reduced losses, and high consumer interest. In other words, amid global economic growth issues, with both inflation and deflation present, the decline of consumerism is evident. The consumption outlook and values that encourage unrestrained consumption of material wealth and resources, viewing spending as the ultimate goal in life, are beginning to collapse.

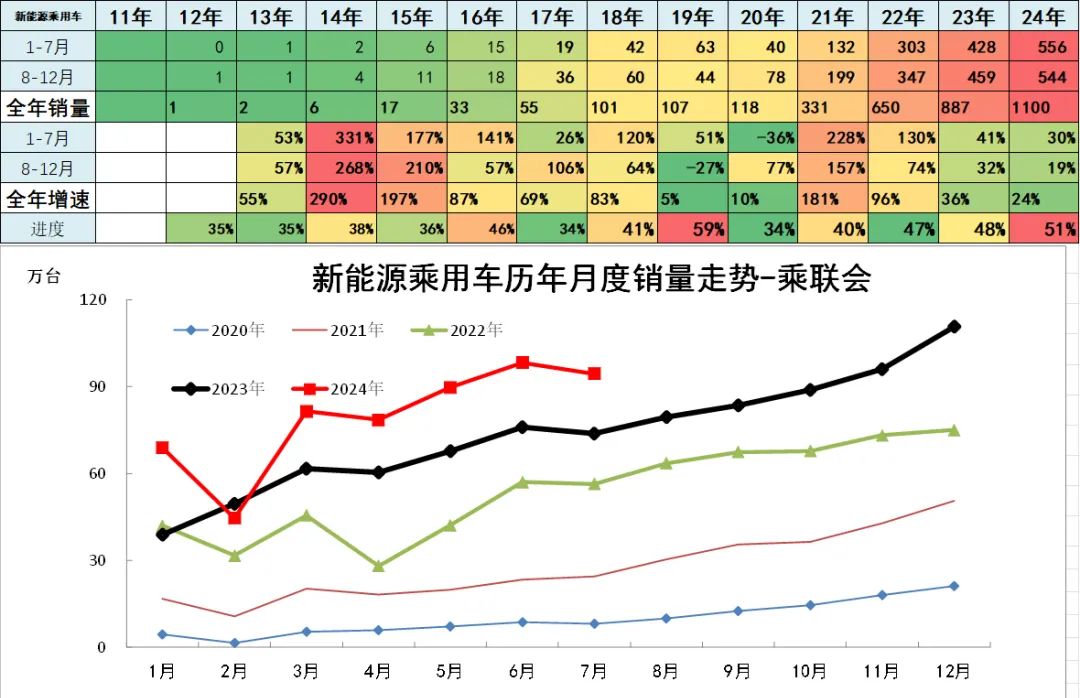

The 18-month-long price war, essentially catering to anti-consumerism while also removing inventory and competing for market share, highlights the current pressure on the entire automotive industry amid intense competition. On one hand, the penetration rate of new energy vehicles has exceeded 50% in both wholesale and insurance volumes. On the other hand, according to the China Passenger Car Association, battery loading rates continue to decline.

From 2020 to 2023, battery loading rates were 76%, 70%, 54%, and 50%, respectively. Notably, in 2024, for the first time, new energy vehicle sales surpassed those of traditional fuel vehicles in both directions simultaneously, but the battery loading rate fell below the 50% threshold for the first time in history, reaching 47%.

“Batteries account for about 40% of the cost of an entire vehicle,” warned former Minister of Industry and Information Technology Miao Wei at the World Battery Industry Conference in June 2023. The continuous decline in battery loading rates reflects the stagnation in pure electric vehicle sales growth. It also signifies the pressure borne by battery giants like CATL behind the industry's rapid expansion. This is compounded by the continued decline in the price of lithium carbonate, a crucial raw material for batteries.

“Volkswagen has been quick to respond, but Japanese brands are lagging behind, and American brands are hardly worth discussing.” As trends continue to shift, the expected potency of the offensive originally brewed by joint venture brands is gradually waning.

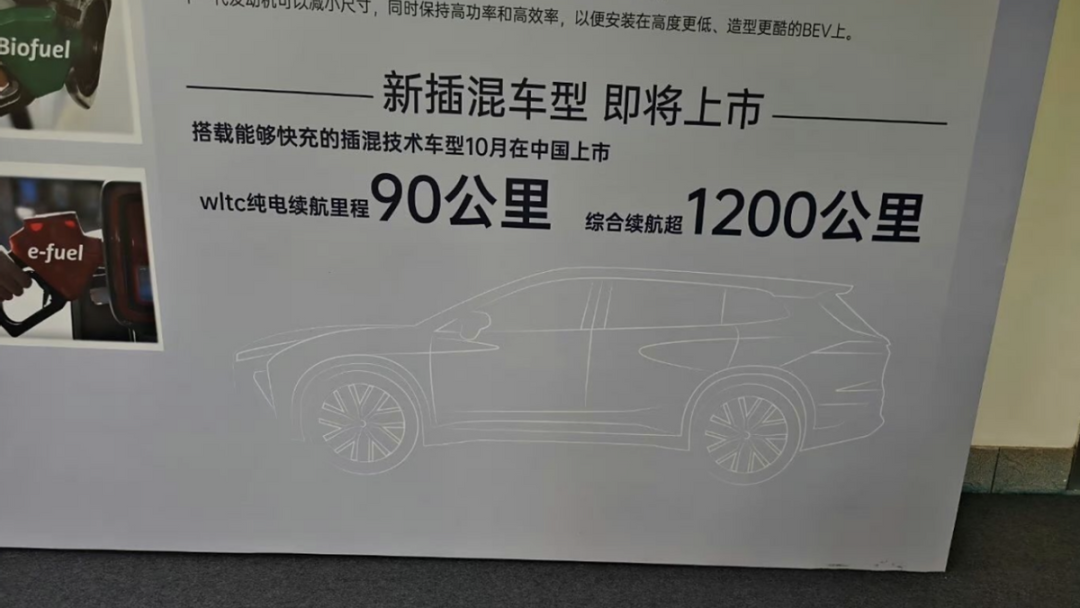

According to announced plans, German brands stand to be the biggest beneficiaries among joint venture brands amid the current shift in trends, while Japanese brands are focused on advancing pure electric plans and experimenting with new plug-in hybrids.

Toyota, the world's leading automaker, has a murky future regarding whether Lexus will become a wholly-owned domestic brand. Following GAC Toyota's Technology Day in June, a new round of technology and model launches is already underway.

In May 2024, Toyota refuted rumors of using BYD's DM-i technology and focused cooperation on pure electric vehicles. In June 2024, GAC Toyota held its Technology Day. Toyota's new offensive comprises three new models: bZ3C, bZ3X, and a potential locally produced Crown Signia plug-in hybrid. These models share a common thread: deeply embracing leading Chinese technologies while incorporating Toyota's design and quality stability, leveraging Toyota's joint venture production capacity for manufacturing and sales.

These include a pure electric B-segment SUV, a pure electric C-segment sedan, and potentially the Crown Signia as a locally produced plug-in hybrid. One model deeply integrates Huawei's lidar hardware and Momenta's end-to-end autonomous driving solution, while another integrates Huawei's intelligent cockpit. Additionally, Toyota's THS hybrid system evolves into a plug-in hybrid, adopting Huawei hardware and Chinese autonomous driving and cockpit technologies.

However, from a market perspective, Toyota's relatively aggressive plans have not significantly stimulated consumer demand. This is partly because these features have become standard in China's automotive market, with newcomers like NIO offering large SUVs at entry-level prices as low as RMB 161,800 for the pure electric version, undercutting even Toyota RAV4's entry-level price of RMB 176,800 by RMB 15,000.

The core issue lies in marketing, where joint venture brands struggle to keep up with the Chinese pace. Lei Jun maintains Xiaomi's SU7's popularity through daily tweets, while joint venture brands tend to engage in systematic communication only Approaching listing .

Unsustainable batteries mark a new turning point

Therefore, even though the sixth-generation RAV4 will be locally produced in China in 2025 with a greater focus on plug-in hybrids, there is little marketing information available. Toyota's chances of a successful offensive largely depend on whether it can forget its previous brand premium from the fuel era and set a shocking price while offering comparable features.

However, considering the growing popularity of extended range models and the near-turning point caused by over 30% declines in raw material prices and high inventory levels for batteries, it is highly unlikely that Toyota can offer a price point lower than similar Chinese extended range models.

Honda faces similar challenges as Toyota, at least in 2024. However, in contrast, Nissan's current new vehicle plans are hard to discern, leading to speculation that they are either holding back a big announcement or taking a more laid-back approach.

Honda's upcoming models include the pure electric Lingxi L, the heavily Huawei-integrated Ye, and a mid-cycle refresh of the gasoline-powered Civic. However, 2025 may bring opportunities, as the next-generation UR-V is expected to compete with models like Lixiang One L9 and WENJIE M9 as a plug-in hybrid with advanced features.

As for why Volkswagen stands to benefit from the shifting trends, it is because among all Chinese joint ventures, Volkswagen has transitioned relatively quickly without solely focusing on pure electric vehicles. News of the upcoming Passat and Magotan replacements already hinted at the swift follow-up of plug-in hybrid versions. In other words, relevant information about these vehicles could emerge as early as late 2024, with sales expected in 2025.

Furthermore, in late August, Volkswagen officially announced the consolidation of R&D activities from its three Chinese entities (Volkswagen (Anhui), FAW-Volkswagen, and SAIC Volkswagen) under Volkswagen (Anhui), its controlling entity, ending internal friction caused by traditional fuel vehicles.

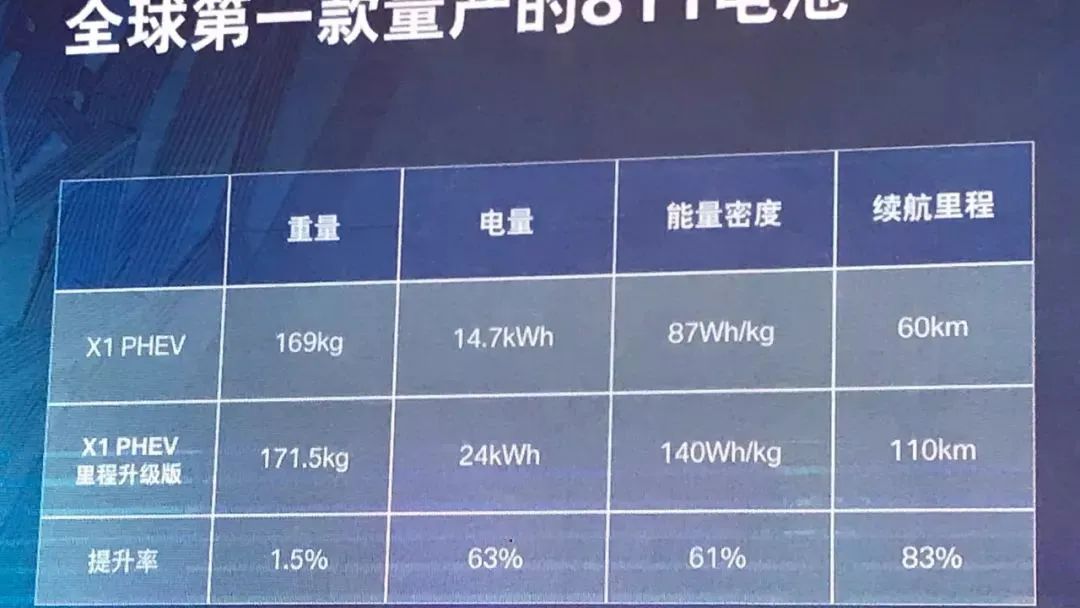

Unlike the fuel vehicle era, where gasoline and diesel were public resources, automakers only needed to focus on developing the three core components and powertrains. In the new energy vehicle era, automakers' lifeblood is beyond their control. The next technological advancements and offerings of battery companies, as well as their procurement prices for automakers, can even determine the survival of automakers.

I recall He Xiaopeng waiting outside CATL's door for a week, hoping to increase supply and capacity. I also remember when CATL introduced its NCM811 battery, which directly affected a series of new vehicle launches due to high spontaneous combustion risks.

Currently, except for BYD, automakers like Geely, Great Wall Motor, and GAC Motor are replicating the safest model of self-research, self-production, and self-marketing. External variables are too significant. For instance, battery inventory has once again peaked.

Battery giants like CATL are offering lower prices and better technologies to automakers to quickly reduce inventory. For example, the current trend of embracing extended range models is a direct result of this situation.

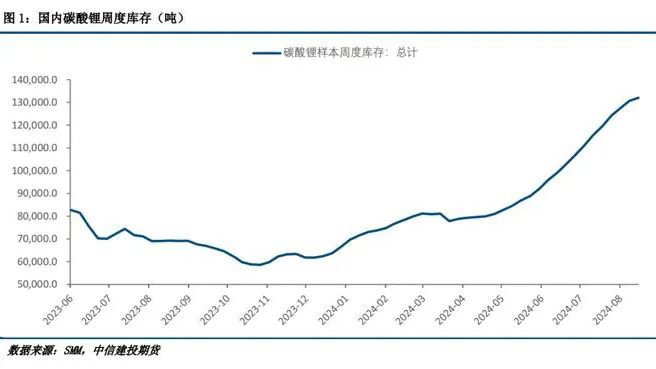

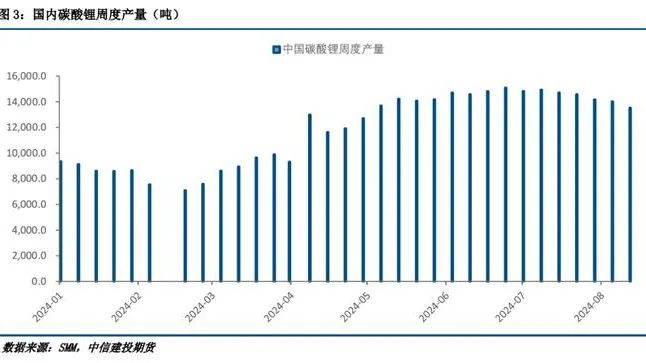

According to statistics completed and released by SMM and China Securities on August 20, as the price of lithium carbonate, a crucial raw material for batteries, plunges, inventory levels have significantly increased. The turning point for lithium carbonate prices has yet to emerge, with prices declining for four consecutive months since April, from over RMB 110,000 per ton to nearly RMB 70,000 per ton, a drop of 36%, and briefly surpassing the widely accepted cost support level of RMB 80,000 per ton among battery manufacturers.

In other words, mining lithium carbonate results in losses.

The second half of each year is a peak sales period for automobiles, so inventory levels are expected to decline. However, industry insiders generally believe that the decline will be limited. The pressure lies in the fact that after the surge in battery prices in the second half of 2023, most automakers have established corresponding advance guarantee systems, limiting their ability to absorb new batteries. Additionally, long-term supply and demand dynamics are shifting as Europe gradually eliminates subsidies, imposes tariffs on Chinese new energy vehicles, and as Elon Musk and Tesla show renewed interest in traditional energy sources.

According to data from the China Automotive Battery Industry Innovation Alliance, from January to July 2024, cumulative sales of power batteries reached 380.3 GWh, while cumulative loading reached 244.9 GWh, resulting in a discrepancy of 135.4 GWh. According to various sources, cumulative power battery inventory for the first seven months of this year was 276.9 GWh, including 199.5 GWh of LFP batteries and 125.6 GWh of NCM batteries.

Battery giants are eager to reduce inventory to avoid heavy losses in the event of new technological iterations, where the remaining inventory becomes a burden that must be internally digested. Currently, Contemporary Amperex Technology (CATL) has already initiated a series of new moves. On the day of its financial report release, it announced that the completion date of its 2022 private placement project, the "Guangdong Ruiqing Times Lithium-ion Battery Production Project Phase I," has been postponed from June 1, 2024, to December 31, 2026, an extension of two and a half years. Behind this decision lies a 11.88% year-on-year decline in revenue in the first half of the year, marking the third consecutive quarter of year-on-year declines, with declines of 10.16%, 10.41%, and 13.18%, respectively.

From the perspective of inventory reduction, the breakdown of new energy vehicle sales growth rates is as follows:

Taking July as an example, domestic new energy passenger vehicle sales reached 853,000 units, with pure electric vehicle sales totaling 551,000 units, a year-on-year increase of 2.6%. Plug-in hybrids, including extended-range vehicles, sold 438,000 units, a year-on-year increase of 80.7%;

From January to July, pure electric vehicle sales totaled 3.57 million units, a year-on-year increase of 10.1%; plug-in hybrids, including extended-range vehicles, sold 2.361 million units, a year-on-year increase of 84.5%.

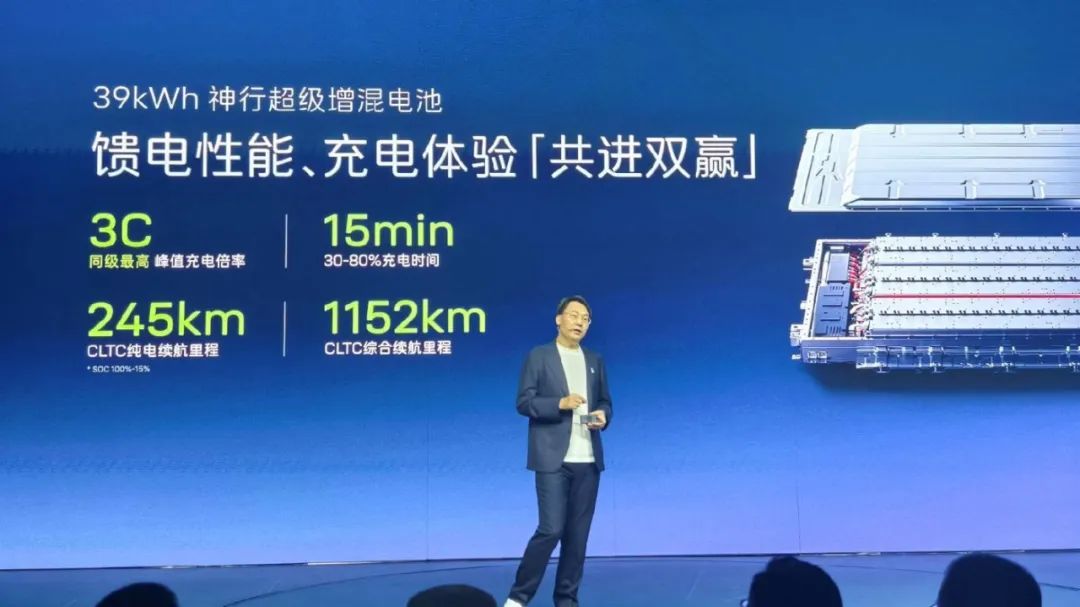

It is evident to all that reducing inventory through pure electric vehicles is becoming increasingly difficult. The increasingly popular extended-range vehicles represent a relatively better alternative to plug-in hybrids. Consequently, with the launch of Avitar's Kunlun extended-range technology, featuring premium 3C dedicated extended-range batteries, and the anticipated debut of 4C extended-range batteries in 2025, more and more automakers will adopt related cutting-edge technologies. This trend will undoubtedly include leading players in niche markets such as Li Xiang, WENJIE, and Leapmotor.

Final Thoughts

Once a trend is established and validated as successful and replicable, it attracts a swarm of followers. This underlying logic is similar to Li Xiang's tweet strategy years ago.

Originally, there was a competition between extended-range and plug-in hybrid vehicles. However, with the introduction of BYD's fifth-generation DM technology, plug-in hybrids have demonstrated their ability to cover extended-range driving conditions at low costs.

However, with the added benefits of high battery inventory and low prices, the cost issue associated with large batteries, which was previously a challenge for extended-range vehicles, is gradually being resolved. As a result, the advantages of plug-in hybrids are diminishing. Furthermore, in the mid-to-high-end market, the extended-range technology is currently more popular than plug-in hybrids.

Among the current top 10 plug-in hybrid sales, all are BYD DM models, while Geely occupies four spots in the 11-15 ranks. In other words, only two giants are currently recognized by the consumer market in the plug-in hybrid segment.

The situation is different for extended-range vehicles. With only three models selling over 10,000 units per month, competition is relatively less intense, yet sales rewards are achievable. For instance, the Shenlan G318 achieved over 10,000 pre-orders within five days, underscoring its appeal to established automakers.

However, for multinational automakers, who tend to be slower to adapt to changes, extended-range technology is already considered transitional and outdated. Consequently, it occupies a marginal position in global R&D efforts. In other words, to adopt this technology in China, automakers must either redevelop it from scratch or collaborate with local partners.