Netease: From favorite among Chinese companies to castoff, has the pig farm really become a poor student?

![]() 08/26 2024

08/26 2024

![]() 612

612

Netease performed poorly in the second quarter, with its core gaming business falling short of market expectations. However, the issues encountered in the second quarter were largely anticipated, and management did not provide significant new negative guidance during post-earnings conference calls. Yet, the stock continued to decline by over 10% after the opening bell. What are investors fearing? Based on insights from various institutions, company communications, and the most pressing market concerns, Dolphin Insights delves into Netease's recent adjustments and shares our perspectives.

Specific observations include:

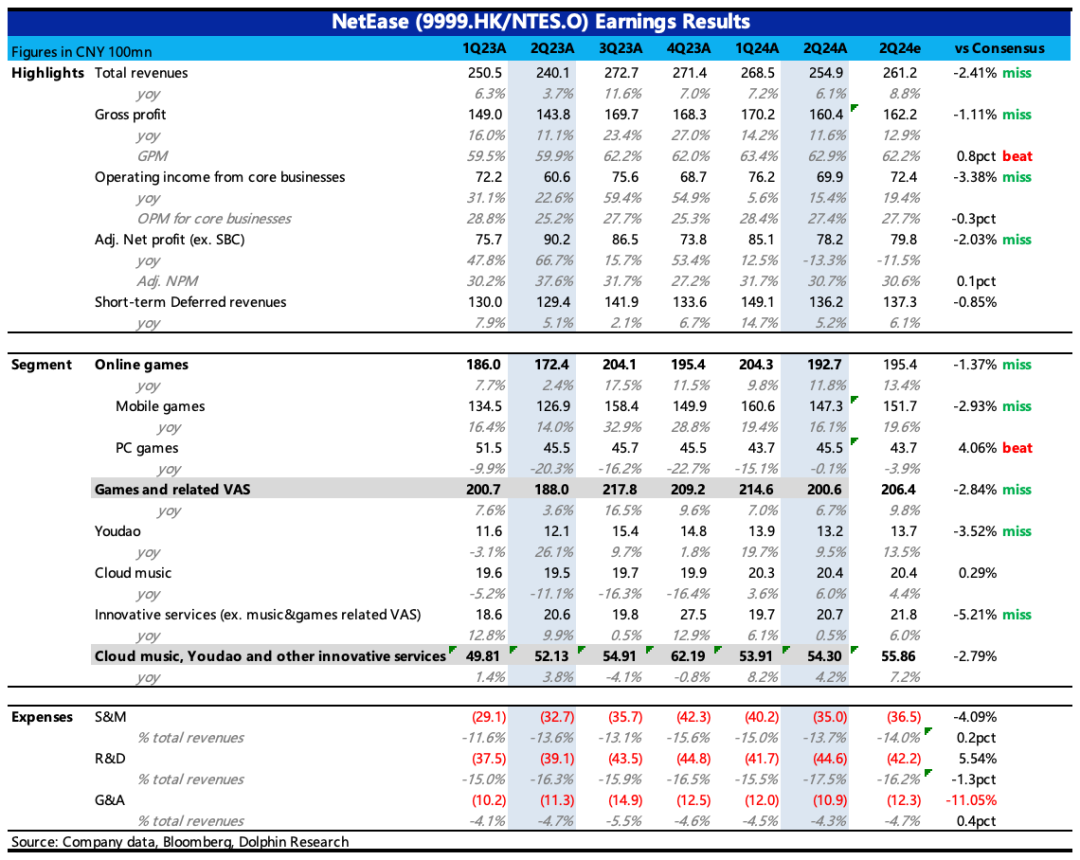

1. All revenue segments underperformed expectations: In the second quarter, Netease's gaming, Youdao, and NetEase Cloud Music revenues were average, falling short of market expectations to varying degrees. Since Netease's performance and valuation are heavily dependent on its gaming business, Dolphin Insights will focus our analysis on this sector.

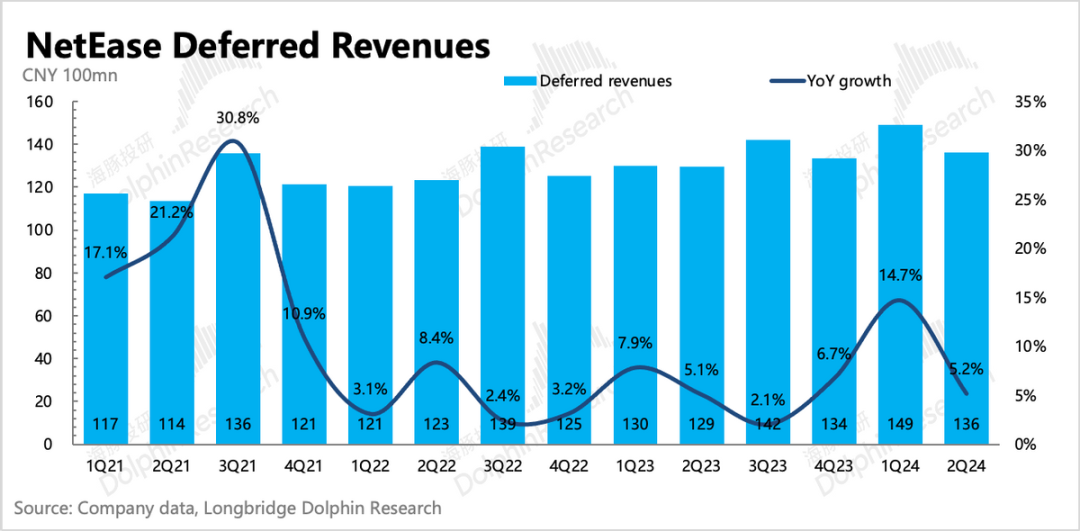

2. Additional pressure anticipated in the second half: Looking ahead to Q3 and Q4, we expect even greater pressure on Netease's revenue growth, particularly in gaming. Some indications can be seen in the change in deferred revenue, which declined more significantly quarter-over-quarter compared to previous years' seasonal declines:

1) The high base in the second half of last year due to the strong performance of "Counter-Strike: Global Offensive" and "Egg Party" makes it challenging to maintain growth this year without equally impressive new games.

The setback of "The Legend of Condor Heroes" (the revised version has not yet been released) and the uncertain delay of "Yanyun Sixteen Sounds" mean that even if "Naraka: Bladepoint Mobile" performs well, its impact will be limited due to differences in revenue streams between MMO and MOBA games. Thus, it is unlikely to replicate the short-term success of "Counter-Strike: Global Offensive" last year within 1-2 quarters.

2) Due to public opinion, "Egg Party" introduced enhanced minor protection measures in April (increased face recognition and daily spending limits), impacting revenue. Additionally, the "Fantasy Westward Journey" incident impacted revenue in April and May, reflecting only two months' impact. The drag on Q3 revenue may be more pronounced.

3) Fortunately, these issues are easing:

a. Management noted that the impact of "Fantasy Westward Journey" on revenue is gradually diminishing month-by-month, with adjustments now complete, implying a slower decline in Q4 compared to Q3.

b. After releasing its one-year anniversary expansion pack at the end of June, "Counter-Strike: Global Offensive" saw a rebound in July revenue (though still lower year-over-year due to the previous quarter's high base). Dolphin Insights expects revenue to stabilize at current levels.

c. Q3 will also see incremental revenue from Blizzard's return to PC gaming, primarily driven by "World of Warcraft" (with promising user data) in Q3. As "Hearthstone" and other titles return in Q4, the recovery and growth momentum will become more apparent.

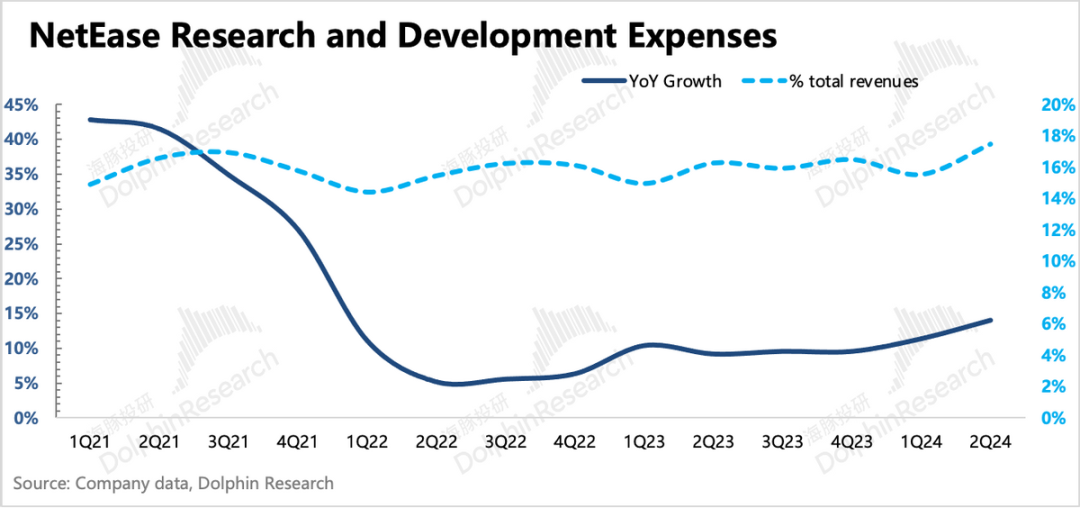

3. Is the countercyclical expansion of investments due to a product shortage? In our pre-market commentary, Dolphin Insights highlighted Netease's apparent countercyclical staff expansion, evidenced by the year-over-year increase in share-based compensation expenses, particularly for R&D teams.

While we anticipated the current revenue performance (also reflected in third-party data), we are more concerned about the increase in expenses reported in the financial statements, as it indicates a weakening of short-term profit margins, especially during a quarter with revenue pressure.

Management attributed the expansion to annual incentives (especially for "Counter-Strike: Global Offensive" team members) and additional R&D work for the anniversary expansion pack. Combined with the end of the current product cycle ("Yanyun Sixteen Sounds" delayed, mobile version not far behind PC, and mainly Marvel IP games remaining this year), Dolphin Insights speculates that Netease is entering a new investment cycle every 2-3 years.

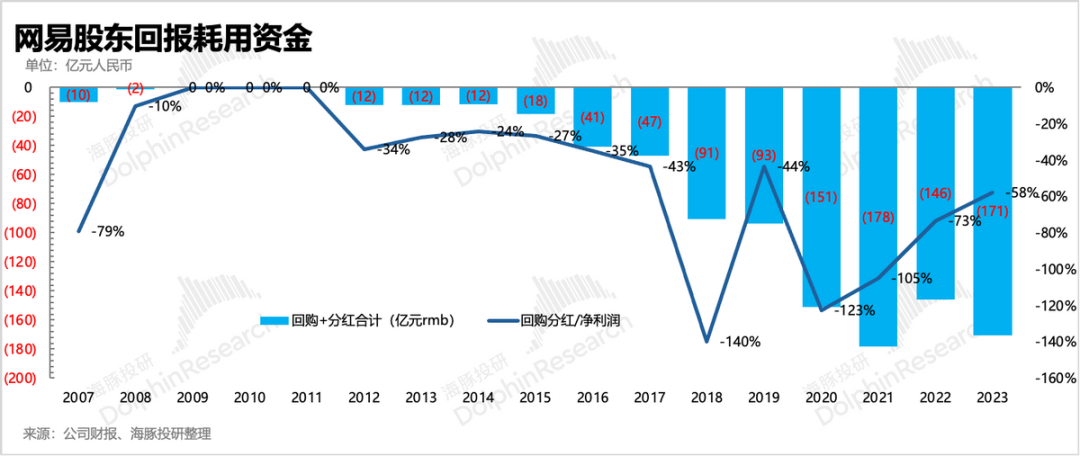

4. Stringent market value management; short-term repurchases expected to increase: Netease has ample cash (net cash of RMB 116.1 billion as of 2Q, up nearly RMB 3 billion QoQ) and USD for repurchases. Besides stable dividends, Netease's repurchases are primarily based on market value changes, increasing during share price pressure and decreasing during strong periods.

In Q2, Netease repurchased 3 million ADS, almost double that of Q1, for a total of USD 290 million at an average price of USD 97 per ADS. Given the current low market value, the company is expected to continue increasing repurchases.

Meanwhile, a dividend of USD 0.435 per ADS was announced for Q2, representing a 26% dividend payout ratio (based on non-GAAP net profit), stable QoQ. However, Netease typically announces special dividends in Q4, boosting annual dividends.

Overall, Netease management traditionally views dividends and repurchases together. Last year, with a strong share price, repurchases were low, but dividends were increased to compensate. This year, with share price pressure, we expect significant repurchases, with overall dividends and repurchases exceeding last year's total (RMB 17.1 billion). Assuming RMB 18 billion, the return on Thursday's closing market value of RMB 53 billion would be approximately 5%.

5. Summary of Key Performance Indicators

Dolphin Insights Perspective

The second-quarter results were indeed disappointing, and while Dolphin Insights had previously warned of this possibility, market expectations did not fully adjust, leading to a larger-than-expected gap for short-term investors focused on quarterly results.

However, the sharp post-opening decline differs from that seen in Tencent Music, Kuaishou, and Bilibili, where declines were primarily due to guidance cuts. Netease management did not provide significant negative guidance during post-earnings calls but emphasized:

1) The impact of "Fantasy Westward Journey" on revenue is stabilizing.

2) Satisfaction with user data for "Naraka: Bladepoint Mobile".

3) Rebound in "Counter-Strike: Global Offensive" revenue after the expansion pack release.

4) Increased short-term repurchases.

From Dolphin Insights' perspective, these factors alleviated some concerns.

So, why the significant investor panic?

1) Market expectations for Q2 results were slightly optimistic, failing to fully account for the marginal slowdown in high-performing games like "Counter-Strike: Global Offensive" and "Egg Party" (due to minor protection measures and public opinion issues).

2) While concerns about H2 pressure were not new, they were not fully priced in. Game revenue is frequently disclosed by third-party platforms, and the challenges faced by "Naraka: Bladepoint Mobile" and "Egg Party" were well-known. Thus, the expected pressure in H2, especially Q3 with a high base, should not have come as a surprise.

Dolphin Insights believes the current valuation's significant post-earnings decline reflects short-term investors' failed bets on Q2 results exceeding expectations and heightened macro concerns amid disappointing guidance from other Chinese companies, leading to an overreaction and herd mentality.

In a more rational analysis, how does Dolphin Insights view Netease now?

First, while the current financial results raise concerns about product pipeline peaks and potential short-term profit margin erosion during the R&D investment cycle, the Q3 revenue pressure is anticipated, and management's updates on key games somewhat offset macro headwinds. Thus, the post-earnings decline appears exaggerated (with adjusted expectations, the current market value of USD 53 billion implies a 2025 P/E ratio of less than 13x on after-tax operating profit, or 10x excluding net cash of USD 15.2 billion).

We acknowledge that Netease will navigate a challenging performance and valuation period. Dolphin Insights hopes the company will accelerate share repurchases, similar to Tencent, to weather the difficult Q3 and await valuation recovery post-interest rate cuts. Over the medium to long term, we have confidence in Netease's R&D and product pipeline, believing it possesses the hard power to justify a 15x-20x valuation.

Detailed Financial Results Analysis Follows

I. Revenue Pressures Ahead of Schedule; All Segments Miss Expectations

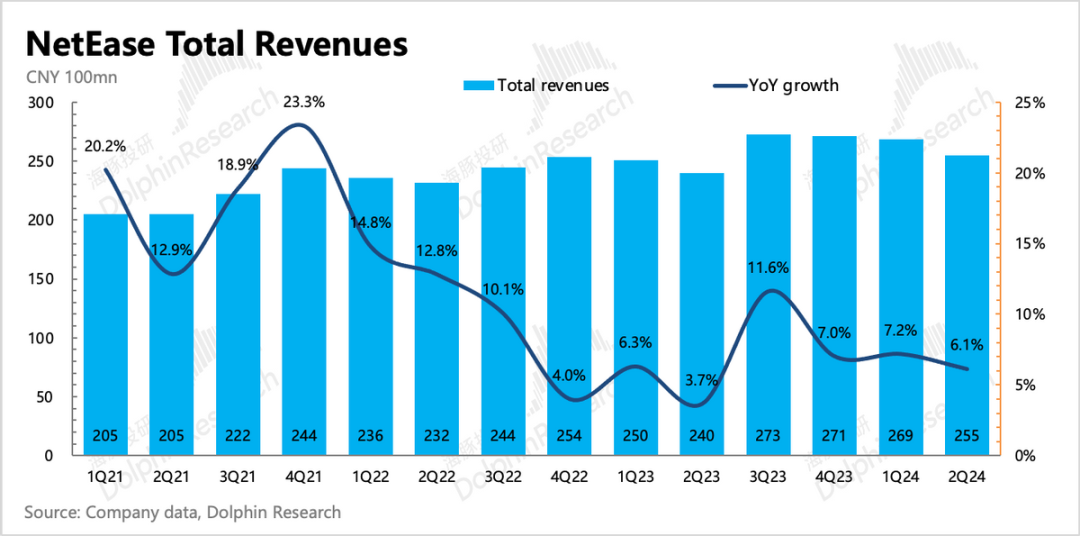

Netease reported total revenue of RMB 25.5 billion in Q2, up 6% YoY, with misses across mobile games, cloud music, and Youdao, except for PC games.

While Q2 challenges were largely anticipated, market expectations remained linear, leading to a wide gap:

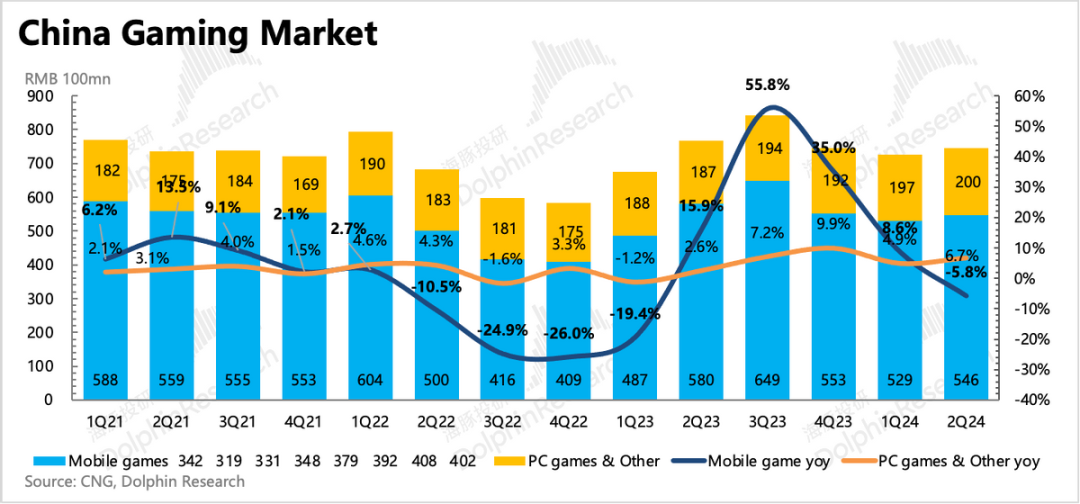

1) Gaming Slowdown: Will "Naraka: Bladepoint" Save the Day?

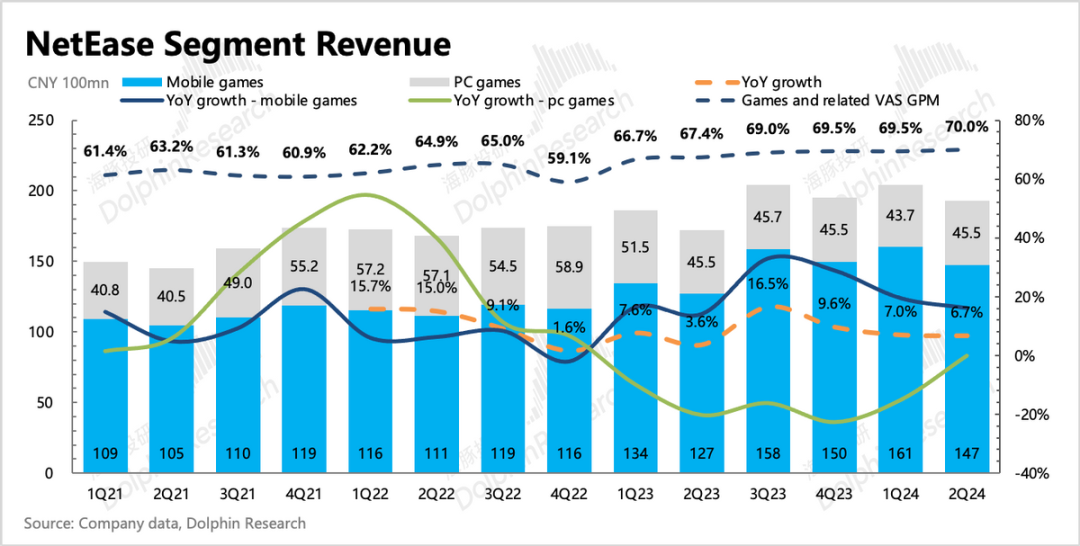

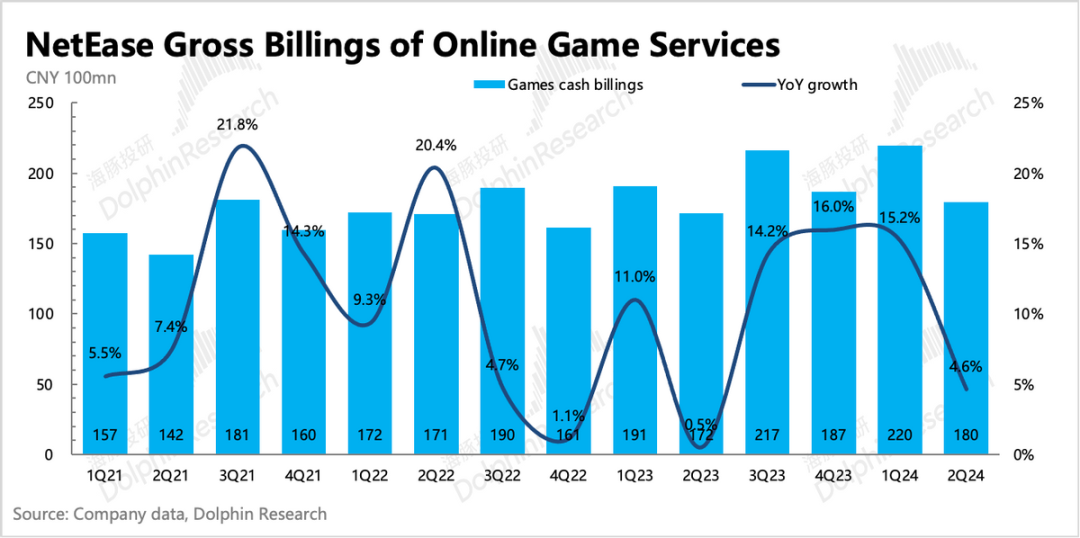

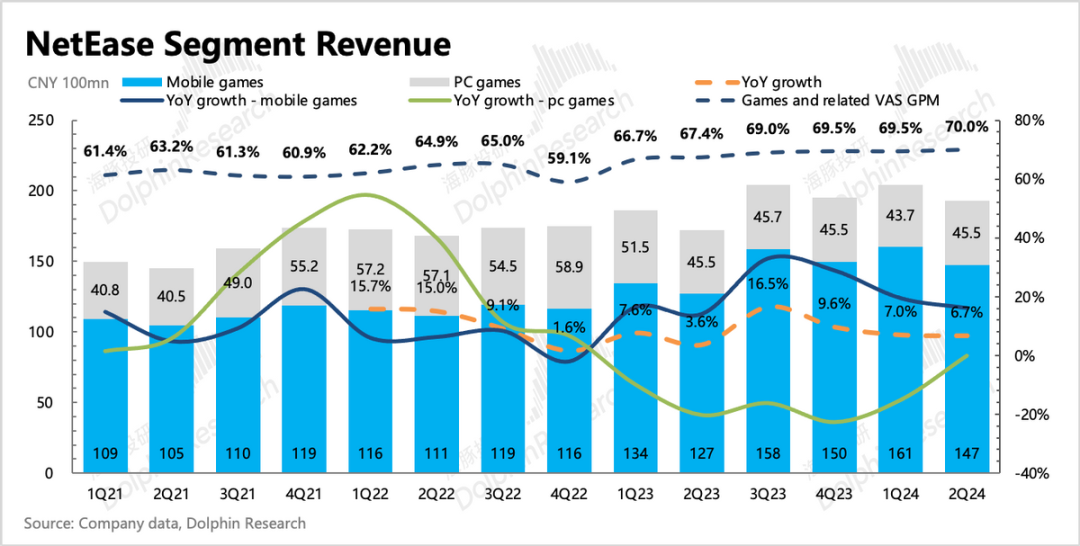

Q2 gaming and value-added revenue reached RMB 19.27 billion, up 11.8% YoY but below market expectations. Mobile games and CC live streaming missed targets.

Deferred revenue grew 5.2% YoY but declined 8% QoQ, with estimated current-quarter revenue of RMB 18 billion, down 18% QoQ. This steeper decline highlights Q2 issues and market concerns.

a. Mobile Games: RMB 14.7 billion, up 16% YoY but below the market's 19.6% growth expectation (based on Q1's momentum).

"Egg Party" hit an all-time high in Q1 but faced minor player restrictions in Q2, impacting revenue. Similarly, "Counter-Strike: Global Offensive" cooled from Q1 peaks, with its annual expansion pack released in late June, offering no Q2 boost. Thus, the market's Q2 revenue decline expectation of RMB 1.3 billion was optimistic.

b. PC Games: RMB 4.55 billion, flat YoY but exceeding expectations.

The "Fantasy Westward Journey" incident impacted revenue in April, with weekly revenue declining 20%. However, swift adjustments and other PC game contributions limited the overall impact. Notably, only two months of the incident were reflected in Q2 results, with a more pronounced effect likely in Q3. Management notes that adjustments are complete, and revenue is stabilizing but won't match last year's peaks.

"Fantasy Westward Journey" contributes around 40% of Netease's annual PC game revenue (nearly RMB 20 billion), with higher profit margins due to no channel sharing. Assuming an 80% operating margin on RMB 8 billion revenue, it generates RMB 6.4 billion in operating profit, accounting for nearly 20% of Netease's total profit. Any instability here significantly impacts performance. Management's update on "Fantasy Westward Journey" reassures Dolphin Insights.

With Blizzard's return, "World of Warcraft" launched on August 1, exceeding user expectations with nearly 40% new users. "Hearthstone" is expected in late September, supporting Q4 PC game revenue. However, Netease's profit margins on Blizzard games are lower due to higher royalty sharing, limiting profit growth.

In summary, Q2 gaming faced pressures, but the industry's worse YoY decline suggests Netease maintained market share. Looking ahead, the summer's intense game launches and Netease's limited mobile offerings ("Naraka: Bladepoint Mobile" and uncertain "Marvel's Avengers") may erode market share. While "Seven Days" performed well, significant growth relies on the upcoming mobile version. "Yanyun Sixteen Sounds" will likely launch in Q4, with limited short-term impact.

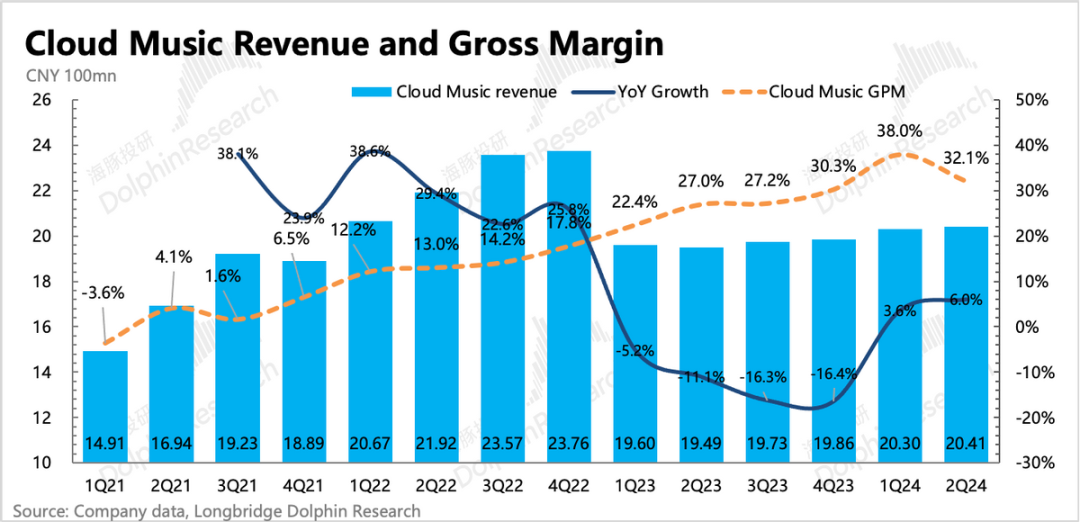

2) Cloud Music Follows Big Brother's Footsteps

As Tencent Music's little brother, Cloud Music's recent changes mirror its older sibling's – strong subscription growth, live streaming adjustments, cost optimizations, and margin improvements. Q2 subscription revenue grew 27% YoY and accelerated QoQ. Unlike Tencent Music, Cloud Music relies on subscriber volume growth rather than price hikes due to weaker competitive positioning.

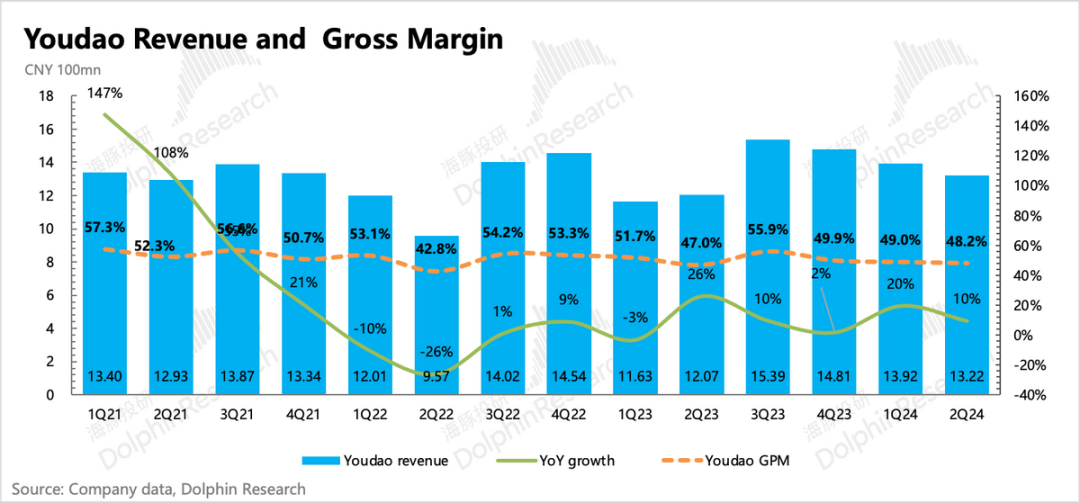

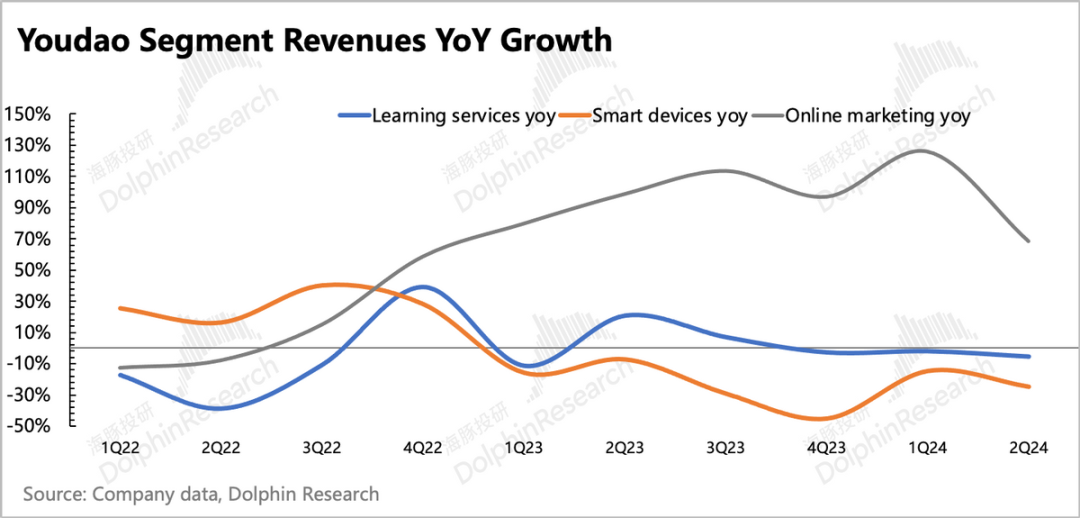

"Advertising Drives Youdao's Loss Reduction and Acceleration"

In the second quarter, Youdao's revenue growth was primarily driven by advertising, with year-over-year growth remaining high at 68%. Revenue from learning courses declined year-over-year primarily due to a high base period. However, there has been no significant improvement in smart hardware, with a year-over-year decline of 25%.

Market expectations were relatively conservative, so the results ultimately exceeded expectations. Due to the increased proportion of high-margin advertising revenue, the overall loss reduction continued. The market anticipates a turnaround to Non-GAAP operating profitability for the full year.

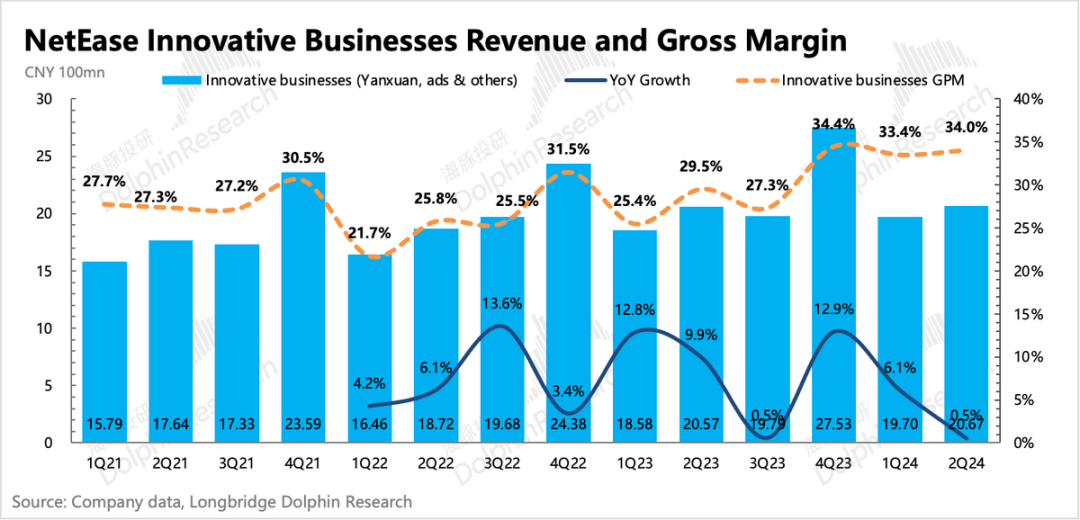

"NetEase Yanxuan Struggles During Peak Season"

Despite being in the peak season for e-commerce, NetEase Yanxuan, the company's other innovative business, showed almost zero year-over-year growth. The intensifying competition and low-price focus in e-commerce this year did not favor Yanxuan, which lacks a price advantage, resulting in its underperformance.

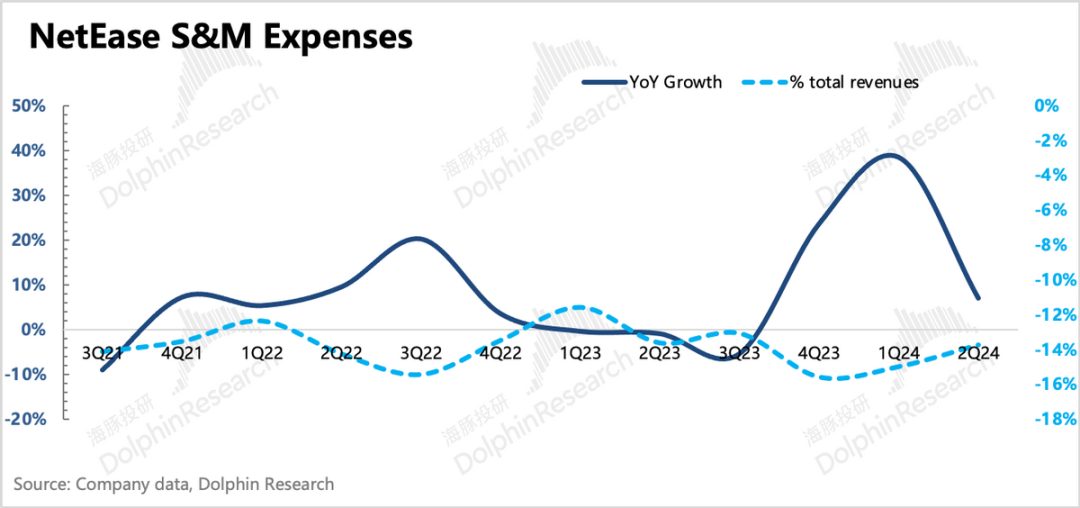

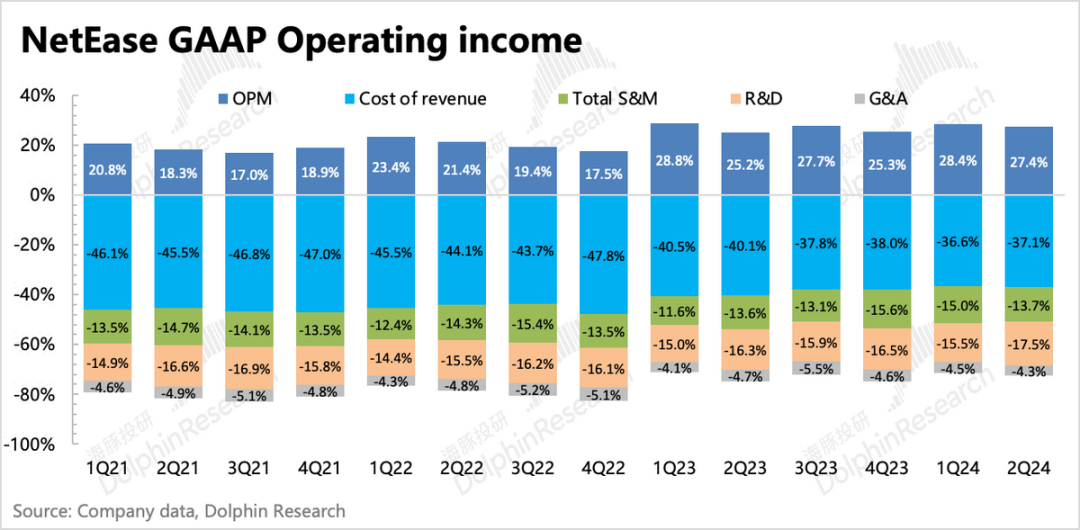

"II. Substantial Increase in SBC: Sign of a New Investment Cycle?"

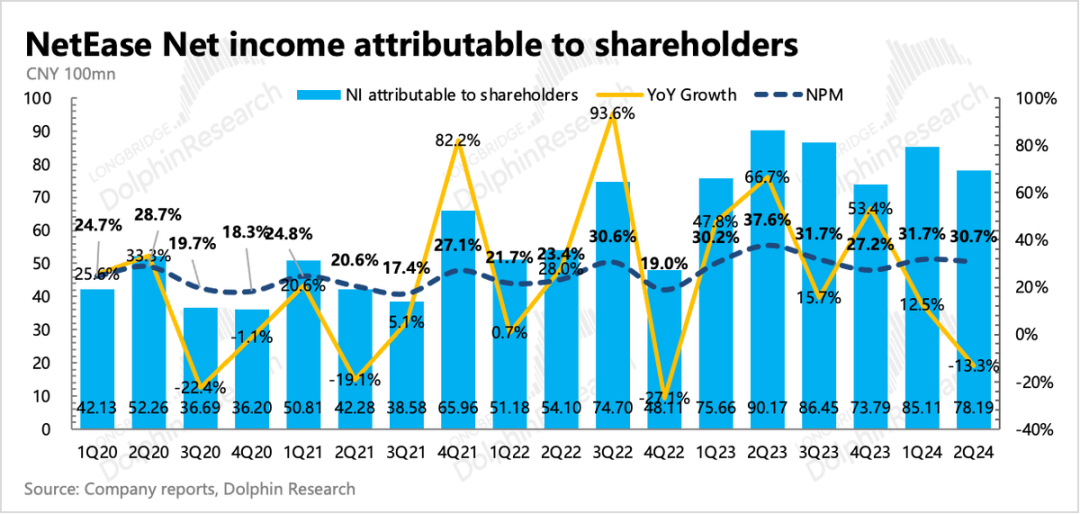

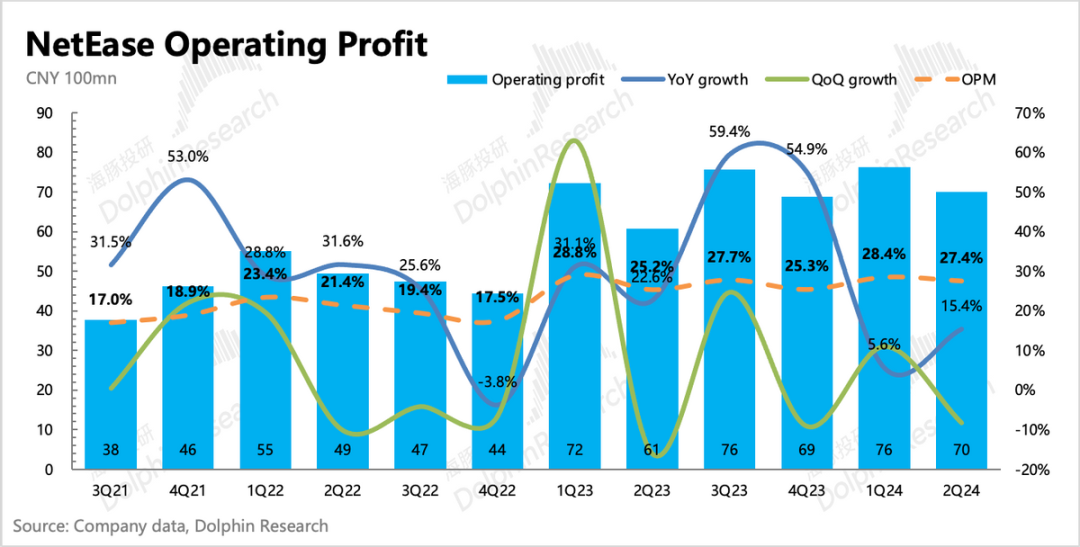

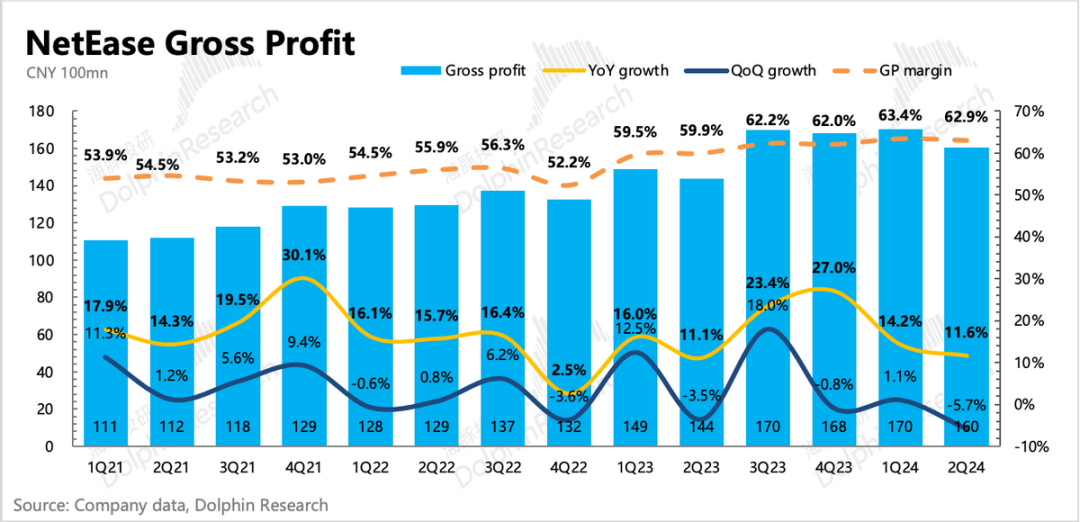

NetEase's second-quarter Non-IFRS net profit attributable to shareholders was RMB 7.8 billion, down 13% year-over-year, primarily due to fluctuations in foreign exchange gains and losses. Excluding non-operating impacts and focusing solely on core Non-IFRS operating profit, it increased by 18% year-over-year and accelerated sequentially.

A notable change in the second quarter was the increase in share-based compensation (SBC) for employees, which typically accounts for around 3% of revenue but rose to 4.2% this quarter. SBC expenses related to research and development increased by 50% year-over-year, and R&D expenses continued to accelerate. Apart from the annual incentive for "Ni Shui Han," this may indicate an expansion of the R&D team.

Therefore, excluding noise but retaining SBC, which is considered essential for maintaining the current business model, we also analyze core operating profit.

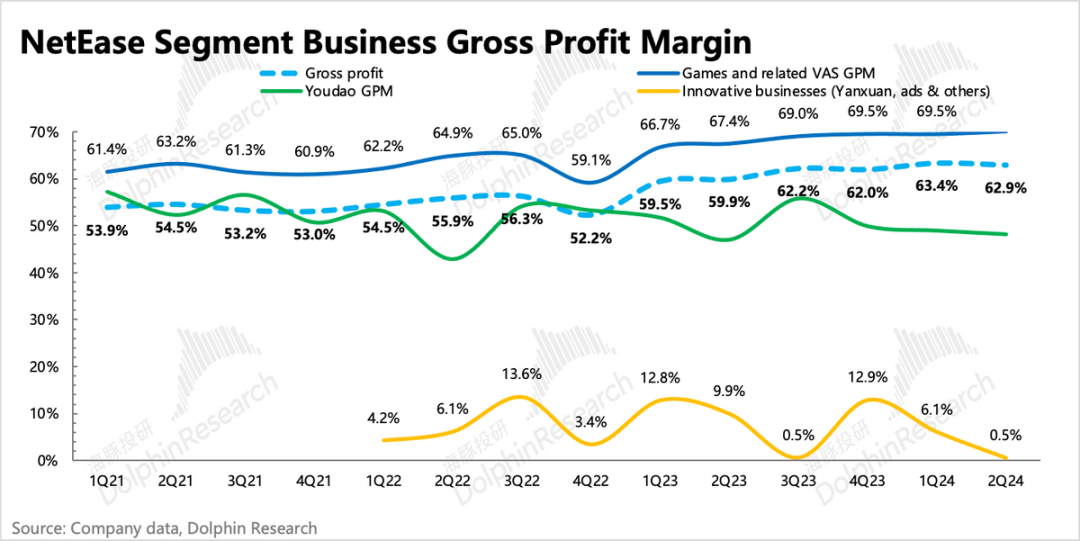

The core operating profit of the main business in the second quarter was RMB 7 billion, lower than market expectations, primarily due to revenue shortfalls and additional R&D expenses. Gross margin slightly exceeded expectations due to improved monetization efficiency in gaming and cloud music.

Channel changes were a significant factor in improving gaming gross margin. Tencent's challenge to Android channels with DNFM mobile games was a breakthrough point. NetEase acted swiftly to introduce official servers, with a third of revenue for some existing games coming from these servers.

However, apart from evergreen games, most of NetEase's games, especially new ones, still rely on third-party channels. If Android channels could reduce their share from 30%-50%, there would be significant profit potential for NetEase. While this change may take time, we eagerly await developments.

In addition to gaming, cloud music's gross margin improved due to steady growth in subscription services and ongoing optimization of copyright costs, resulting in an overall increase in gross margin amid changes in revenue structure.

Marketing expenses in the second quarter were RMB 3.5 billion, down sequentially but up 7% year-over-year. The commercial battle with "Yuan Meng" earlier in the year was not the norm, and with "Yuan Meng" settling down, "Dan Zai" also ceased its counterattacks. However, with the upcoming launch of "Yong Jie Wu Jian Shou You" in the third quarter, marketing expenses are expected to increase.