A loss of 60,000 yuan per SU7? Is Xiaomi making cars out of charity?

![]() 08/26 2024

08/26 2024

![]() 416

416

Recently, Xiaomi Group released its highly anticipated second-quarter financial report. As a "newcomer" in the automotive industry, Xiaomi and its chairman Lei Jun have become hot topics in the automotive circle since announcing their entry into the field.

The financial report shows that Xiaomi's total revenue for the second quarter of this year was 88.9 billion yuan, a year-on-year increase of 32%; net profit was 6.2 billion yuan, a year-on-year increase of 20%; and R&D investment was 5.5 billion yuan, a year-on-year increase of 20.7%. However, in terms of the automotive business, Xiaomi incurred a loss of 1.8 billion yuan. Based on Xiaomi's sales data of 27,307 vehicles, this equates to a loss of over 60,000 yuan per vehicle.

This news has sparked significant attention and heated debate. Some netizens have questioned why Xiaomi is losing money on the SU7 despite good sales. In response, Lei Jun retweeted the relevant news on Weibo and said that Xiaomi Automobile is still in the investment stage, hoping for understanding.

In reality, Xiaomi Automobile, as a long-term project, is still in the initial investment phase. While the profit per vehicle may not be low, the losses are mainly due to expenses related to automobile manufacturing plant construction, technological research and development, personnel costs, store construction, etc. When these costs are averaged out per vehicle, they appear exaggerated.

Regarding this matter, Lu Weibing, President of Xiaomi Group, discussed the reasons for Xiaomi SU7's losses in an interview. He stated that currently, Xiaomi Automobile's scale is relatively small, and the automobile industry is a typical industry with economies of scale. Xiaomi is confident in expanding its scale in the future. Additionally, Xiaomi's first vehicle is a pure electric sedan, which inherently has higher input costs, and it will take some time to absorb these costs.

In fact, Xiaomi's automotive business is not doing poorly at all. With a gross margin of 15.4%, Xiaomi Automobile far surpasses emerging automotive players like NIO and XPeng, and even outperforms Tesla. Previously, Lei Jun predicted that Xiaomi Automobile's gross margin would be between 5% and 10%. It now appears that Lei Jun was somewhat conservative in his estimate.

This is similar to opening a restaurant. There are significant upfront investments (building, decoration, ingredients, labor, operations, etc.), and each vehicle sold initially incurs a loss. It takes time and a certain volume of sales to recoup these initial investments. Of course, this presupposes that your vehicles sell well.

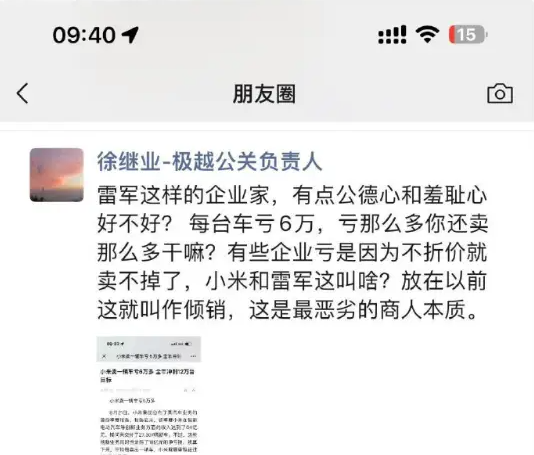

However, there have also been mocking voices regarding Xiaomi's automotive losses. Xu Jiye, suspected to be the head of public relations at Jiyue Automobile, posted on WeChat Moments, expressing dissatisfaction and stating, "Selling cars at a loss is dumping." What is your opinion on this matter? Welcome to leave your comments below.