Can Xiaomi Automobile complete the unfinished task of "pushing up" its smartphone business?

![]() 08/26 2024

08/26 2024

![]() 460

460

Xiaomi starts contributing revenue from its automotive business.

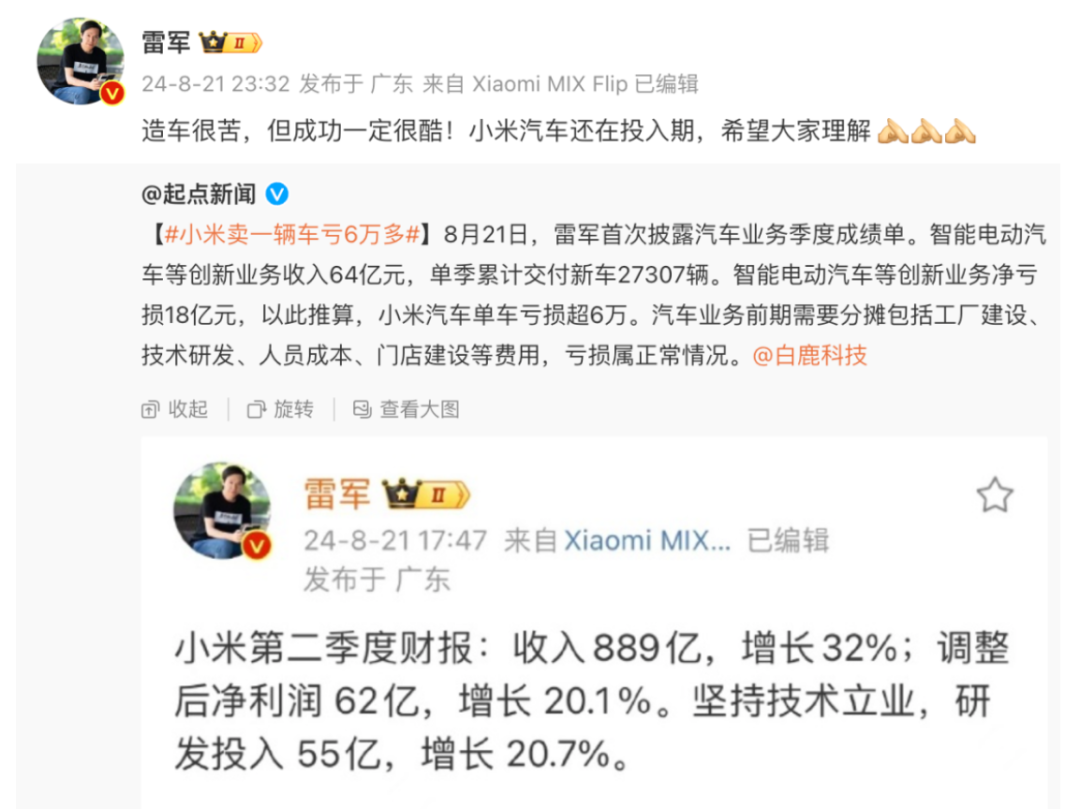

Xiaomi's recently released second-quarter financial report showed that its total revenue for the quarter reached 88.9 billion yuan, an increase of 32% year-on-year, setting a new record. Adjusted net profit was 6.2 billion yuan, up 20.1% year-on-year, maintaining a high growth rate.

These results exceeded market expectations. Bloomberg reported that analysts had previously expected Xiaomi Group's quarterly revenue to be 86.9 billion yuan with a net profit of 3.8 billion yuan, but the actual net profit for the quarter reached 5.07 billion yuan. Moreover, Lei Jun, founder, chairman, and CEO of Xiaomi Group, said, "This is Xiaomi's best quarterly report in history."

The quarter was the first full delivery quarter after the launch of Xiaomi Automobile, and the automotive and innovation business, listed separately for the first time in the financial report, generated revenue of 6.4 billion yuan. Among them, smart electric vehicle revenue was 6.2 billion yuan. The overall gross margin for the automotive and innovation business was 15.4%, with an adjusted net loss of 1.8 billion yuan (excluding 200 million yuan in related stock-based compensation expenses). In the previous quarter, this business generated 26 million yuan in revenue with a gross margin of 12.6%.

Three years after announcing its entry into the automotive industry, Xiaomi's automotive business began contributing revenue, boosting the company's push towards high-end products. The market has affirmed Xiaomi's initial success in automobile manufacturing with actual orders. Following the financial report's release, Xiaomi's share price surged by over 9% at the opening the next day, indicating optimism in the capital market about its future development.

▍Impressive Gross Margin Figures

"This is Xiaomi's best quarterly report in history! Thank you for your support!" Lei Jun posted on Weibo after Xiaomi released its financial results for the second quarter of 2024.

In a subsequent conference call, Lu Weibing, president of Xiaomi Group, also stated that Xiaomi's outstanding performance was due to two main factors: the comprehensive improvement in Xiaomi's high-end smartphone market share, which to some extent increased the overall gross margin of the smartphone business, and the better-than-expected performance of Xiaomi's automotive business. Lu Weibing added that currently, Xiaomi Automobile's 15.4% gross margin is almost entirely attributed to hardware contributions, "If we consider this, I believe our gross margin is at a good level."

Xiaomi CFO Lin Shiwei believes that the automotive business's gross margin exceeding expectations is mainly due to higher-than-expected delivery volumes, supply chain support, and contributions from peripheral automotive ecosystem products.

This financial report is also Xiaomi's first public disclosure of its automotive business performance.

In the second quarter, Xiaomi's smart electric vehicle business and other innovation businesses generated a total revenue of 6.4 billion yuan. During the quarter, Xiaomi delivered 27,307 new Xiaomi SU7 series vehicles, achieving a gross margin of approximately 15.4% for automobile manufacturing, which is impressive in the current automotive industry.

For comparison, Xpeng's second-quarter gross margin was 14%, with a hardware gross margin of 6.4%; Li Auto and NIO have not disclosed their latest data, but their gross margins in the previous quarter were 20.6% and 9.2%, respectively. BYD's first-quarter gross margin was 21.9%, and Tesla's quarterly automotive business gross margin was 18.5%.

However, Xiaomi Automobile's innovation business is still losing money, with a loss of 1.8 billion yuan in the second quarter, roughly estimating a per-vehicle loss of approximately 66,000 yuan. Regarding Xiaomi Automobile's future profitability, Lu Weibing stated that on the one hand, Xiaomi Automobile's scale is still relatively small, as the automotive industry typically requires scale effects to drive profitability. On the other hand, Xiaomi has invested heavily in the initial stages of its first vehicle, and it will take some time to amortize these costs.

The financial report shows that the capital expenditure for Xiaomi's smart electric vehicles and other innovation businesses was 298 million yuan in the quarter, accounting for approximately 21% of the total capital expenditure. This expenditure decreased significantly from 2.335 billion yuan in the first quarter.

Currently, Xiaomi Automobile maintains its target of delivering 120,000 vehicles in 2024. As Xiaomi's automotive sales steadily increase in the third and fourth quarters, there is still room for its gross margin to rise. Optimistically, Xiaomi Automobile's 15.4% gross margin has already surpassed Xiaomi's flagship smartphone business (12.1%). Although still incurring losses, it is believed that as the scale expands and costs are amortized, it may become Xiaomi Group's most profitable business segment.

▍The automotive business drives Xiaomi towards high-end products

As Xiaomi Automobile surpassed the monthly delivery threshold of 10,000 vehicles in June and maintained this level in July and August, the industry is optimistic about Xiaomi Automobile's prospects, believing that it has the potential to drive the entire group towards high-end products.

In recent years, Xiaomi has been answering the question with its products: can cost-effectiveness coexist with high-end positioning? In Lei Jun's view, there is no separation between brand high-end positioning and product high-end positioning. High prices are a necessary perceptual aspect of high-end positioning, a result rather than a means. Previously, Lei Jun invested billions of yuan as capital to enter the high-end market, but the market response was not ideal. With the emergence of Xiaomi Automobile, Xiaomi Group now has a "trump card" for its high-end aspirations.

According to previous survey data released by Xiaomi, Xiaomi Automobile has become a choice for some luxury car owners. Among the buyers of Xiaomi SU7, nearly 30% are former owners of BMW, Mercedes-Benz, or Audi vehicles. Meanwhile, as Xiaomi SU7 supports both Carplay and iPad integration, Apple users account for 51.9% of buyers.

It can be seen that Xiaomi hopes to achieve synergy between its smartphones and automobiles through the popularity of SU7. Furthermore, Xiaomi aims to create a closed-loop "human-vehicle-home ecosystem" using SU7, leveraging vehicles to drive Xiaomi Group's overall high-end strategy rather than just within a single product category.

In this regard, multiple securities firms, including CICC and China Securities, have given full affirmation in their research reports: "optimistic about the long-term growth potential of the automotive business" and "optimistic about Xiaomi's growth potential under the 'human-vehicle-home ecosystem' strategy."

Foreign institutional analysts also expressed optimism about Xiaomi's future performance, noting that while the company's overall business is stable and only the automotive business is in an uncertain period, the market remains optimistic despite current losses. Xiaomi Automobile's subsequent performance will be crucial in determining Xiaomi Group's valuation.

Typesetting by Yang Shuo | Image sources: Xiaomi Group, Xiaomi Automobile, Lei Jun's Weibo