Weimob's growth repeatedly "hits a wall": Profit model has not yet been established, will CEO Sun Taoyong's share increase be effective?

![]() 08/27 2024

08/27 2024

![]() 577

577

Author | Xingxing

Source | Beduo Finance

Recently, Weimob Group (HK:02013, hereinafter referred to as "Weimob") released its 2024 interim performance report. Since the beginning of the year, cost reduction and efficiency enhancement, as well as focusing on core businesses, have remained the main themes of Weimob's operations. While effectively slowing down the loss rate and improving operational quality fundamentals, the company's various business scales have shown significant declines.

As traditional SaaS businesses reach their traffic ceiling, Weimob Group, once hailed as the "first SaaS stock," has also embarked on a path of transformation, seeking a way out in the newly popular sectors. However, with its growth repeatedly "hitting a wall," Weimob has fallen into a "trust crisis" in the secondary market, and its share price has continued to decline.

Facing an industry winter, whether Weimob Group can navigate through the cycle, find certainty in growth amidst numerous uncertainties, and thereby boost market confidence, only time will tell.

I. Unstable revenue growth, profitability not yet established

Public information shows that Weimob Group, founded in 2013, is a cloud-based business and marketing solutions provider committed to providing merchants with decentralized digital transformation SaaS products and full-link growth services to support sustainable business growth. Its products cater to various industries such as e-commerce retail, supermarkets, and fresh produce.

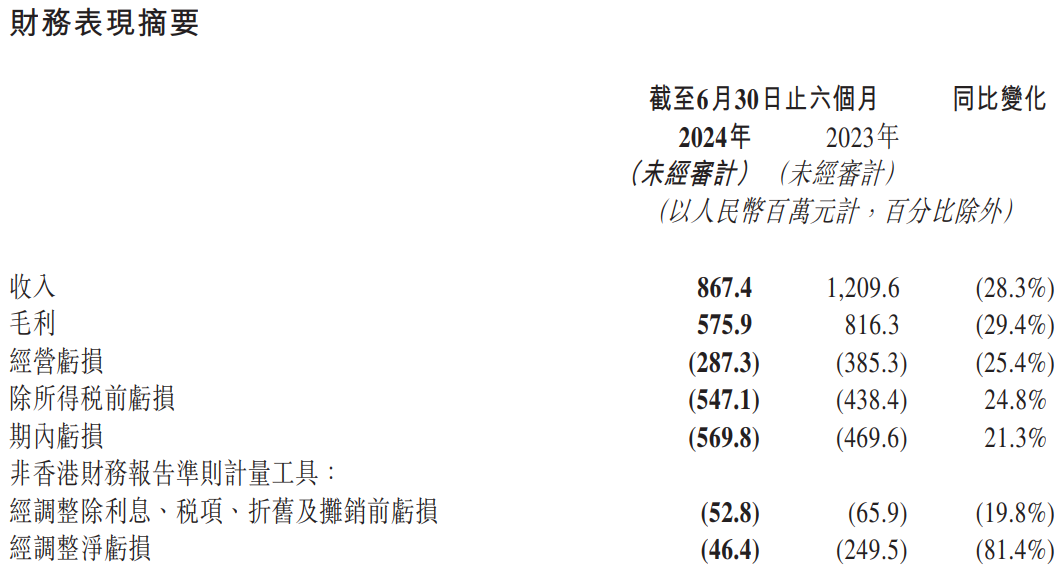

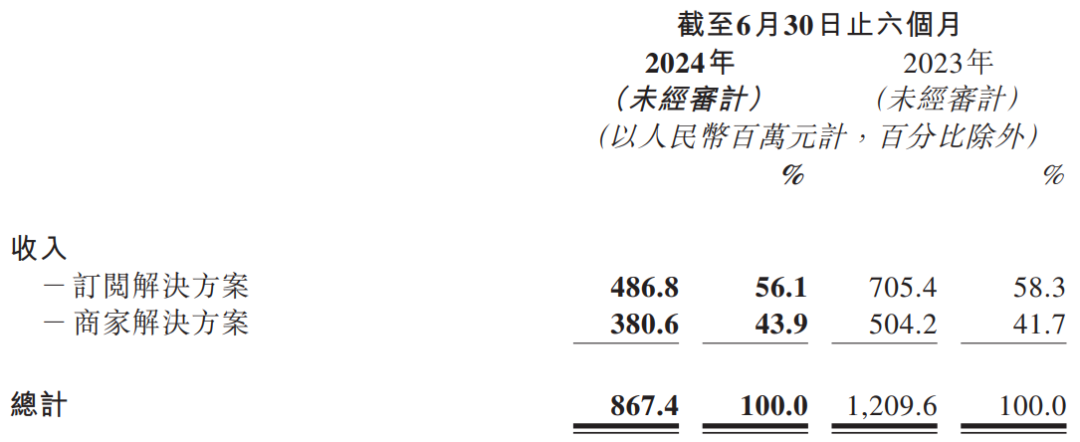

According to the financial report, Weimob Group's operating revenue for the first half of 2024 was 867 million yuan, a decrease of 28.3% from 1.209 billion yuan in the same period of 2023; gross profit was 576 million yuan, down 29.4% year-on-year; and consolidated gross margin also shrank by 1.1 percentage points to 66.4% compared with the same period in 2023.

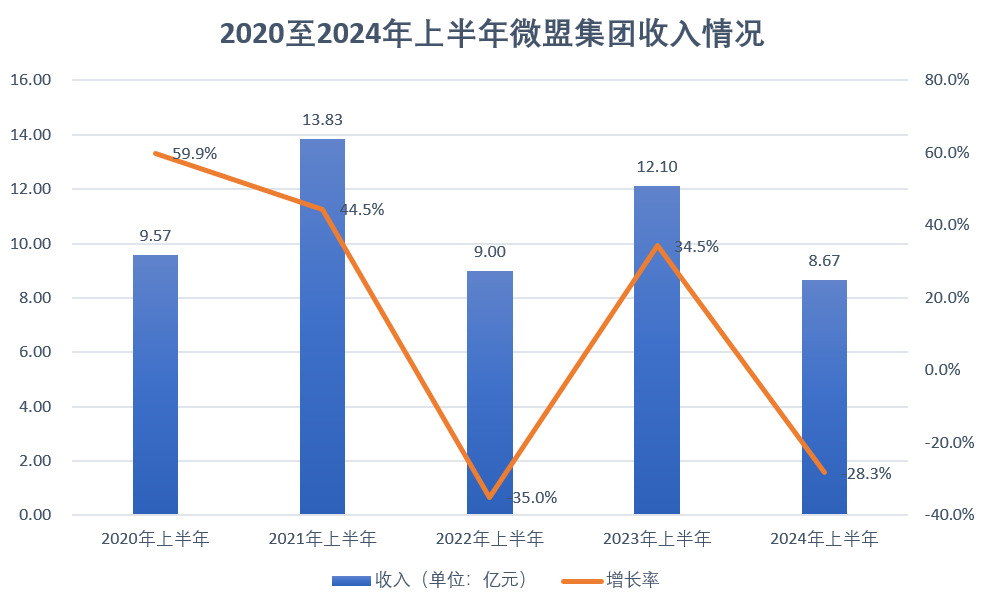

In the first half of 2023, Weimob Group's revenue increased by 34.5% to 1.21 billion yuan. In fact, Weimob's performance has been unstable in recent years, with revenues of 957 million yuan, 1.383 billion yuan, and 900 million yuan in the first halves of 2020, 2021, and 2022, respectively, representing growth rates of 59.9%, 44.5%, and -35.0%.

In other words, Weimob Group's revenue in the first half of this year was even lower than four years ago. On an annual basis, after achieving a new high of 2.686 billion yuan in revenue in 2021, Weimob's revenue plummeted by 31.5% to 1.839 billion yuan in 2022. Although it rebounded by 21.1% to 2.228 billion yuan in 2023, it still failed to recover to its peak level.

It is worth noting that Weimob Group has recorded losses for consecutive years, with net losses of 1.157 billion yuan, 783 million yuan, 1.829 billion yuan, and 758 million yuan from 2020 to 2023, respectively, accumulating to over 4.5 billion yuan in losses over the past four years. However, in 2019, the company briefly turned a profit, achieving a net profit of 311 million yuan.

Weimob Group's operating loss for the first half of 2024 was 28.73 million yuan, a year-on-year narrowing of 25.4%. Meanwhile, it recorded a net loss of 570 million yuan, an expansion of 21.3% year-on-year; and the net profit margin, which has been negative for four consecutive years, further expanded from -38.8% in the same period of 2023 to -65.7% currently.

In contrast, ChinaZan (08083.HK), which belongs to the same e-commerce SaaS sector as Weimob Group, achieved operational profitability in 2023. In the first half of 2024, ChinaZan's revenue was 686 million yuan, slightly lower than that of Weimob Group; its operating profit was approximately 2.586 million yuan, an increase of 123% year-on-year.

However, Weimob Group's adjusted net loss under non-Hong Kong Financial Reporting Standards was 46.4 million yuan, a narrowing of 81.4% compared with 250 million yuan in the same period of 2023; the adjusted net profit margin also rebounded from -20.6% in 2023 to -5.3%. The company's adjusted EBITDA also improved, narrowing by 19.8% year-on-year to 52.8 million yuan.

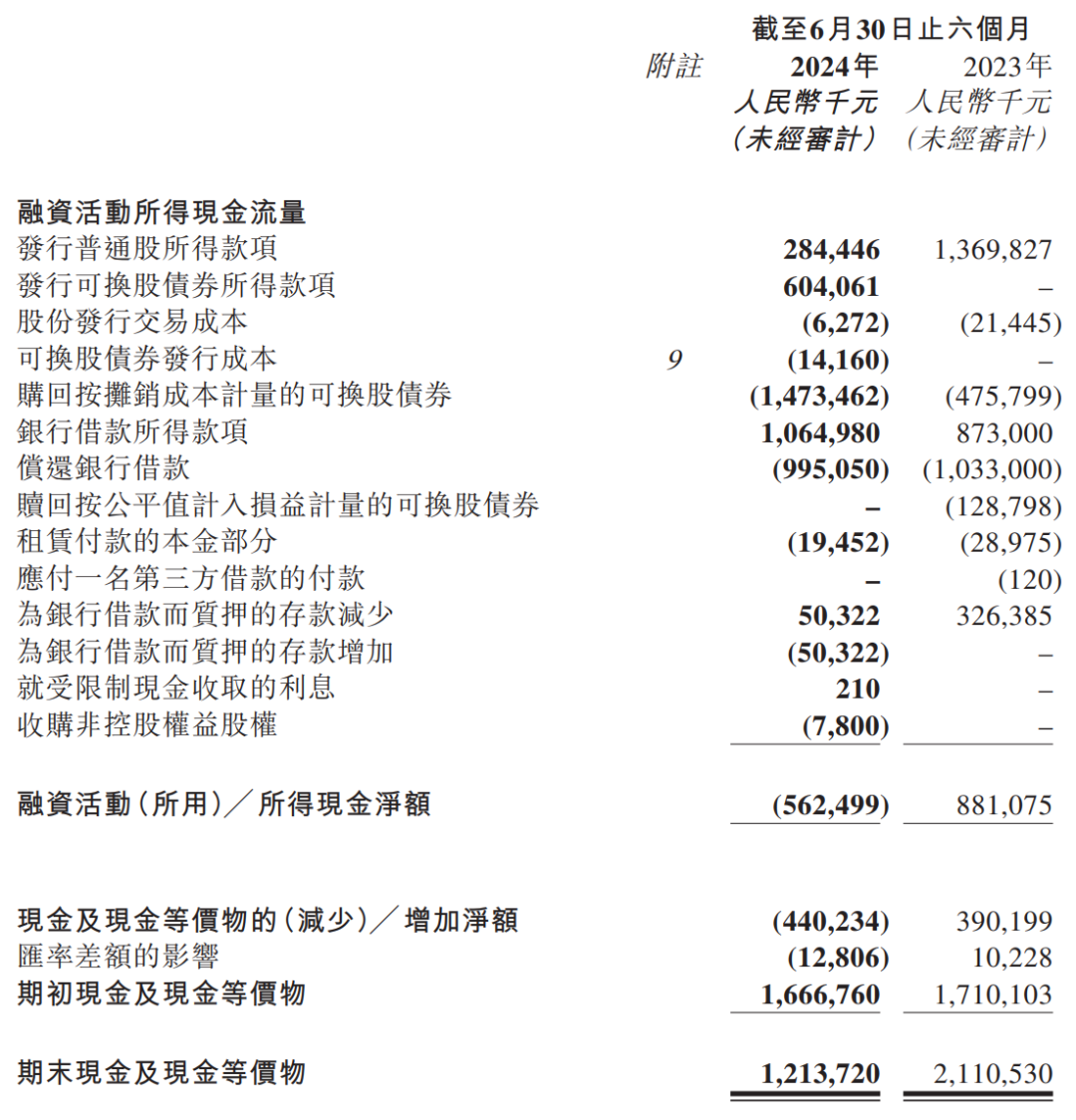

As of the end of June 2024, Weimob Group's operating cash flow was 29.498 million yuan, achieving positive cash flow for two consecutive half-year periods. However, the company's cash and cash equivalents at the end of the same period were 1.214 billion yuan, nearly halved from 2.111 billion yuan in the same period of 2023; total assets also decreased by 5.05% to 7.471 billion yuan.

II. Continuous cost reduction and business "shrinkage" evident

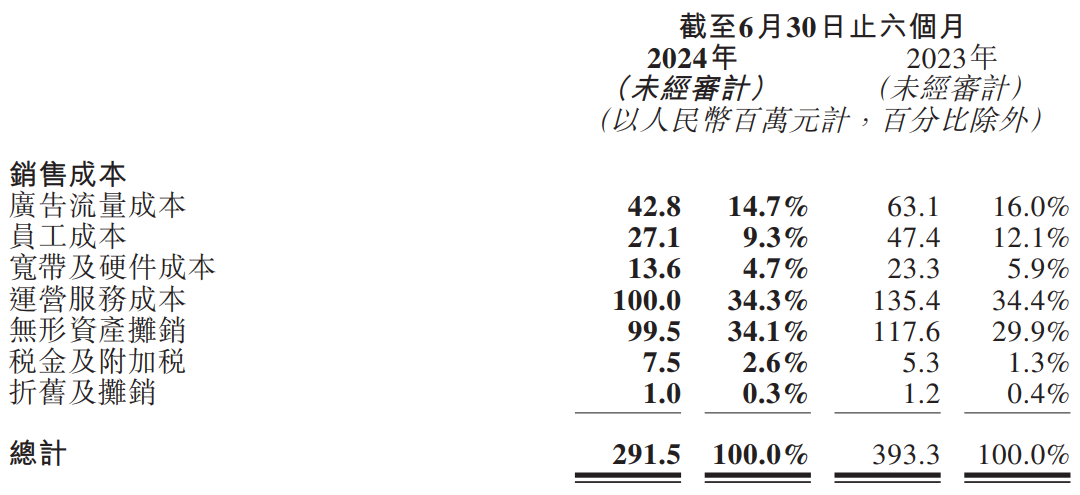

Weimob Group explained in its financial report that the decline in revenue was mainly due to its adherence to cost reduction and efficiency enhancement, as well as focusing on core businesses, by proactively reducing non-core and low-quality businesses, thereby lowering business scale and cutting costs and expenses. Specifically, Weimob's total sales cost decreased by 25.9% from 393 million yuan in the first half of 2023 to 291 million yuan.

Among them, the reduction in employee costs was particularly significant, with a nearly 50% decrease from 47.4 million yuan to 27.1 million yuan. Behind this reduction were Weimob Group's continuous layoff measures. As of the end of June 2024, Weimob Group had 3,952 full-time employees, nearly one-third fewer than the 5,704 at the end of the same period in 2023.

Previously, rumors circulated that Weimob Group would dissolve its Wuhan office. Although Weimob responded that there was no plan to disband the Wuhan office, only a change in business model with the introduction of the "Super Partner Plan," internal turmoil left the outside world questioning the sustainability of Weimob's business model.

Beduo Finance found that Weimob Group's various expenses in the first half of the year also showed varying degrees of "reduction," with sales and distribution expenses, general and administrative expenses, and research and development expenses amounting to 565 million yuan, 287 million yuan, and 234 million yuan, respectively, representing year-on-year decreases of 33.0%, 24.5%, and 26.8%.

Indeed, cost reduction and revenue enhancement can help Weimob Group optimize asset quality and reduce losses, but it also significantly drags down revenue scale. By business segment, the company's subscription solutions revenue declined by 31.0% year-on-year to 487 million yuan in the first half of 2024; merchant solutions revenue also decreased by 24.5% to 381 million yuan.

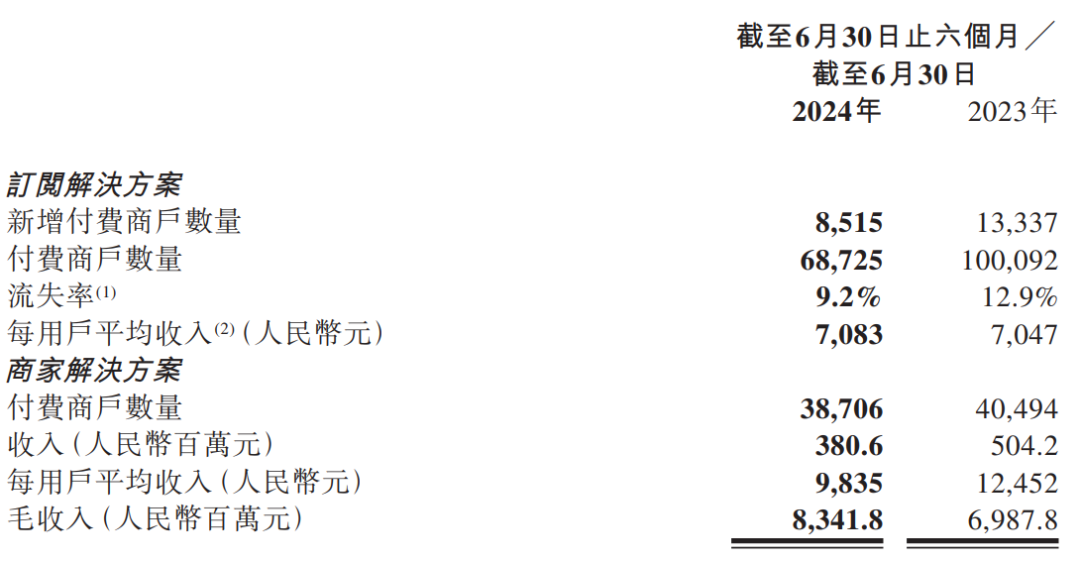

Moreover, the number of paying merchants for Weimob's subscription solutions shrank by 31.3% to 68,700, and the number of new paying merchants in the first half of the year was only 8,515, far from covering the number of lost users. The number of paying merchants for the company's merchant solutions also decreased to 38,700, a year-on-year reduction of 1,788.

In Weimob Group's key smart retail and other large customer business segments, the average revenue per user in the first half of the year was 7,083 yuan, a mere 0.5% year-on-year increase; smart retail revenue was 304 million yuan, representing an endogenous growth of 3.1% year-on-year, but the actual business scale declined by 2.6% year-on-year.

It is foreseeable that while focusing on core businesses and optimizing organizational structure can alleviate Weimob Group's cost pressure to a certain extent, both the sudden decline in operating income and the continuous reduction in the number of paying users call into question the long-term feasibility of Weimob's cost reduction and efficiency enhancement strategy.

III. Laying out in multiple areas, yet failing to boost market confidence

In fact, as major platforms represented by WeChat have successively established closed-loop ecosystems, the SaaS membership system is no longer the only way for small and medium-sized enterprises to convert public domain traffic. Consequently, the e-commerce SaaS service business has entered a "retreat period." Facing a challenging market environment, proactive change has become the only option for Weimob.

In May 2023, Weimob Group launched Weimob WAI to expand "AI+SaaS" service touchpoints. It is reported that Weimob WAI is currently applied to more than 10 large models, meeting enterprises' needs for online store opening, content marketing, private domain operations, and covering various marketing scenarios such as home decoration, finance, education, and tourism.

While betting on the AI concept, which has gained popularity in recent years, Weimob Group has also targeted the short video sector. In March of this year, it made a strategic investment in Shanghai Banfan Information Technology Co., Ltd. (hereinafter referred to as "Banfan Technology"); it also signed a contract with Google CPP, becoming a first-tier agent in China and an official partner of Apple Ads.

At present, Weimob Group can be described as "going wherever there is heat." However, regardless of the capital consumption of the initial preparations for new areas, the market's confidence in Weimob has long since waned without an established commercial profit model and the ability to operate independently and generate revenue.

On January 16, Weimob Group announced its plan to transfer more than 50% of the equity of Shanghai Weimob Culture Media Co., Ltd. (hereinafter referred to as "Shanghai Weimob") based on an overall valuation of the target company estimated to be no less than 3.6 billion yuan, seeking to achieve partial or full listing of Shanghai Weimob in the domestic capital market.

Weimob Group believes that this move can reduce the impact of Weimob's marketing working capital on its cash flow and facilitate Shanghai Weimob's financing as an independent entity, exhibiting a strategy of "sacrificing pawns to protect the king." However, the market did not respond positively, and the company's share price plummeted significantly the day after the announcement, closing at HK$1.98 per share, a decrease of 11.61%.

Ultimately, Weimob reluctantly announced the termination of the potential transaction plan, citing "a series of constructive feedback from shareholders regarding the potential transaction." The Weimob board also announced that it would choose an appropriate time to repurchase Weimob shares, and the management team, represented by CEO Sun Taoyong, would increase their shareholdings, attempting to boost market confidence.

However, the reality is that the day after Weimob released its half-year report, its share price fell by more than 10%. As of the close on August 23, 2024, Weimob Group was trading at HK$1.13 per share, with a total market value of only HK$3.477 billion. The former glory has vanished, and the opportunities left for Weimob by the market and investors are dwindling.