小鹏十周年,致力于成为“六边形战士

![]() 08/27 2024

08/27 2024

![]() 512

512

Source | BohuFN

Last June, Xiaopeng Motors (hereinafter referred to as "Xiaopeng") Chairman He Xiaopeng expressed his expectations for the company at the China Automotive Blue Paper Forum. He believed that Xiaopeng had faced many challenges, but starting from the third quarter of this year (2023), the company would enter a weak positive cycle; by the third quarter of next year (2024), the positive cycle would accelerate; by the end of 2025, it would enter an ultra-high-speed positive cycle.

On the evening of August 20, Xiaopeng Motors released its mid-year results for 2024. Although delivery volumes have not yet rebounded significantly, Xiaopeng's losses have begun to narrow since the first quarter of this year, and gross margins have steadily improved, much better than the dilemma of selling one car at a loss in the third quarter of last year.

He Xiaopeng once said, "Car manufacturing is a long-distance race, and pressing the gas and brake pedals at the same time is a big no-no. It's about going steady and far, pursuing compound growth as a polygonal warrior that presents opportunities." So, has Xiaopeng Motors already overcome its darkest moments, and can it successfully turn things around now that its "health bar" has been replenished?

01 Strategies for profitability: Xiaopeng reduces losses

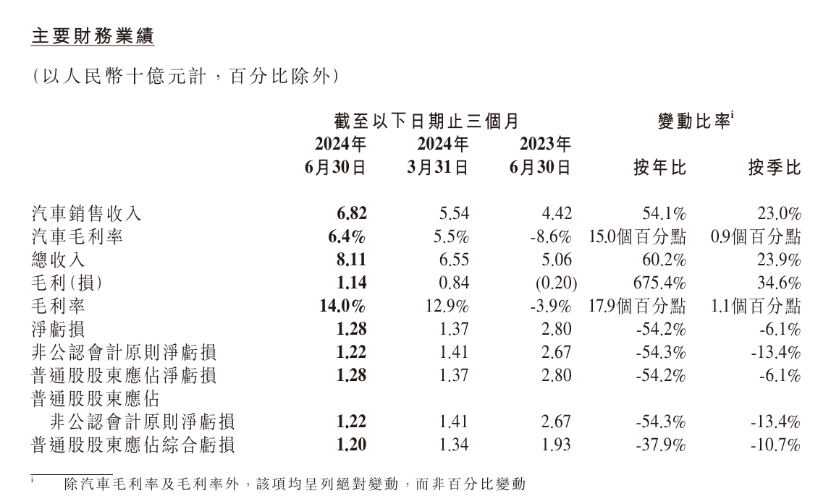

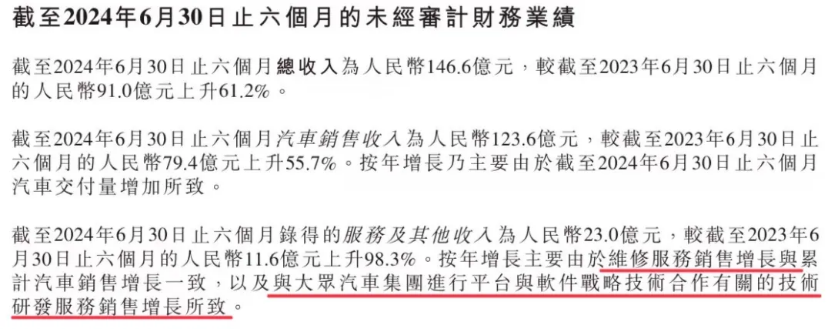

Data shows that Xiaopeng Motors' total revenue in the first half of 2024 was 14.66 billion yuan, an increase of 61.2% year-on-year. Of this, revenue in the first quarter was 6.55 billion yuan with 21,821 deliveries; revenue in the second quarter was 8.11 billion yuan, up 24% quarter-on-quarter, with 30,207 deliveries, up 38.4% quarter-on-quarter.

Overall, Xiaopeng's revenue and delivery volumes have increased compared to the first quarter, but they have not yet recovered to the same level as the same period in 2022. More importantly, compared to Xiaopeng's annual sales target of 280,000 vehicles, the completion rate for the first seven months of this year is less than 30%.

However, gross margin is a highlight of Xiaopeng's financial report. Since the second half of last year, Xiaopeng's gross margin has been steadily improving, gradually increasing from -2.7% in the third quarter of 2023 to 14% in the second quarter of 2024. Gross margin is also one of the important indicators to measure a company's profitability.

Compared to Xiaopeng's better-performing second quarter of 2022, although revenue in the second quarter of this year lagged behind by about 120 million yuan, gross margin surpassed that period, increasing by more than 3 percentage points.

Xiaopeng attributes its continuous improvement in profitability to technical cost reductions and technology monetization through strategic cooperation with Volkswagen. In particular, the cooperation with Volkswagen has been crucial in boosting gross margin.

In July 2023, Xiaopeng and Volkswagen reached a technical framework agreement for the first time. Since then, the two parties have signed four agreements within a year, deepening cooperation in strategic technologies related to platforms and software, as well as electronic and electrical architectures.

According to the latest cooperation agreement, Xiaopeng will work with Volkswagen to develop the CEA architecture. He Xiaopeng stated that this electronic and electrical architecture will be installed in domestic Volkswagen models based on the CMP and MEB platforms, with mass production expected in 2026.

With Volkswagen as a financial backer, Xiaopeng's technology began to monetize. In the second quarter of this year, Xiaopeng's service and other revenues amounted to 1.29 billion yuan, up 28.8% quarter-on-quarter from 1 billion yuan in the first quarter; gross profit totaled 1.136 billion yuan, of which service and other gross profits were 701 million yuan, contributing more to profits than the automotive business.

It is worth mentioning that Xiaopeng and Volkswagen have two pricing models for their technological cooperation. From 2024 to 2025, Xiaopeng will earn "technical service fees" by exporting technology, with this income not tied to sales volume and a high gross margin of up to 90%. After the models jointly developed by the two parties enter mass production in 2026, technical earnings will be positively correlated with sales volume, but it is not yet clear whether they will be charged based on volume.

Therefore, even though Xiaopeng's sales volumes in the first half of the year were not stellar, the company's gross margin has reached its best level in nearly two years due to the high return on technology income. He Xiaopeng himself also stated that "technical service fees" are recurring, which will increase Xiaopeng's overall business gross margin. From another perspective, Xiaopeng undoubtedly holds a "golden egg" in the next two years.

Additionally, Xiaopeng's mention of "technical cost reduction" is another reason for the improvement in gross margin. For example, Xiaopeng's XOS Tianji intelligent cockpit system is integrated with the XGPT Lingxi large model. Through stronger perception and reasoning capabilities, it simplifies the development process of various functions and applications, significantly reducing costs.

Xiaopeng's recent self-reform is also a reason for the improvement in its gross margin. First, Xiaopeng's X9, which was launched in January this year, has achieved remarkable results, with cumulative sales exceeding 13,143 vehicles in the first half of the year, ranking first in pure electric MPV sales for six consecutive months.

As Xiaopeng's most expensive model, the X9 accounted for more than 25% of total sales in the first half of the year, significantly contributing to the company's gross margin increase.

Secondly, Xiaopeng's channel reform has also achieved initial results. Under the leadership of Wang Fengying, Xiaopeng has eliminated inefficient direct-sales stores and embraced dealer channels instead.

As of the end of June 2024, Xiaopeng's physical sales network had reached 611 stores, with about a hundred additional stores added since the beginning of the year, of which about 70% are dealer stores.

02 Technological competition begins to monetize

Since last year, there have been many voices suggesting that Xiaopeng has fallen behind among new energy vehicle makers, and opinions vary on Xiaopeng's obsession with the label of "intelligent driving."

For users, intelligent driving is not a necessary condition for car purchases, and Xiaopeng's significant investment in research and development for this purpose may not yield immediate returns. For Xiaopeng, making "intelligent driving" a prominent brand label has, to some extent, weakened the differentiation of other products, contributing to its lackluster sales in recent years.

However, He Xiaopeng does not seem concerned and has repeatedly emphasized in the media that he will focus more on improving intelligent driving technology and expanding into global markets. Currently, Xiaopeng does have a lead in hardware and software technologies for automobiles.

In terms of intelligent driving, its end-to-end technology research and development are visibly accelerating. In May, Xiaopeng launched the AI Tianji system, becoming the second and only domestic automaker globally to mass-produce end-to-end AI large models for vehicles. In July, Xiaopeng announced that the AI Tianji system would be rolled out globally, upgrading Xiaopeng's XNGP from "usable nationwide" to "excellent nationwide" after this update.

In terms of electronic and electrical architectures, Xiaopeng has already reached a cooperation agreement with Volkswagen to jointly develop the CEA architecture. Before that, Xiaopeng launched the SEPA2.0 "Fuyao" full-domain intelligent evolution architecture in 2023, which comes standard with a full-domain 800V high-voltage SiC platform, featuring "faster charging and more accurate range."

The Xiaopeng G6, released in the first half of this year, is the first all-new model based on the SEPA2.0 Fuyao architecture. Recently, He Xiaopeng personally tested the range of the Xiaopeng G6, which achieved an average electricity consumption of only 13.2kWh/100km and could recharge for 300km in ten minutes, making it one of the fastest charging models on the market.

Of course, behind these impressive achievements are Xiaopeng's significant investments in research and development. Xiaopeng's annual R&D expenditure guidance for 2024 is 7 to 7.5 billion yuan, with an estimated 3.5 billion yuan allocated to AI research and development centered on intelligent driving. It is expected that subsequent R&D expenditures will continue to rise.

In addition, Xiaopeng has also made advanced layouts in computing infrastructure. It currently has a maximum computing power reserve of 2.51 EFLOPS. For reference, Huawei's cloud training computing power is 3.3 EFLOPS, while Lixiang ONE's is 1.2 EFLOPS. He Xiaopeng once stated that the company would invest 700 million yuan annually in computing power, indicating that Xiaopeng is indeed very generous with its investments in AI.

Currently, He Xiaopeng's "generosity" is paying off. On the one hand, Xiaopeng's intelligent driving technology has begun to monetize. In addition to earning "technical service fees" through cooperation with Volkswagen, as the scale of intelligent driving continues to expand, its marginal costs are expected to further decrease, enabling high-level intelligent driving to be incorporated into vehicles priced below 200,000 yuan, making "equal access to intelligent driving" a new selling point for Xiaopeng.

He Xiaopeng has stated that in 2024, Xiaopeng plans to reduce the BOM cost of XNGP by 50% through technological innovation, making intelligent driving a standard feature across its entire product line and exploring flexible payment options such as software subscriptions for users.

On the other hand, the SEPA2.0 Fuyao architecture is also expected to enable Xiaopeng to enter the stage of platform-based vehicle production, achieving cost reduction and efficiency improvement in areas such as power systems, vehicle hardware, and supply chains.

For example, the SEPA2.0 Fuyao architecture can cover vehicle models with wheelbases ranging from 1800 to 3200mm, including various sedans, SUVs, and MPVs. Compared to traditional automotive platforms that can only target vehicles of a single class, the new electronic and electrical architecture can derive different classes and types of vehicles through modular arrangements and combinations.

First, it allows better control over the pace of product launches. For example, based on the Fuyao technology architecture, the development cycle of Xiaopeng's new models can be shortened by 20%.

Second, it can further amortize R&D expenses and fixed asset costs for the platform. Under the Fuyao architecture, the universalization rate of components for the architecture can reach up to 80%. Additionally, it can reduce production processes and human resource training costs, with larger production scales leading to lower marginal costs.

Entering the true stage of systematic vehicle production has always been He Xiaopeng's goal. As early as the 2022 annual report conference call, he stated that starting from 2023, Xiaopeng's pure electric vehicle platforms, electronic and electrical architectures, power systems, and intelligent driving software and hardware would all enter the stage of platformization.

It is not difficult to see that after continuously strengthening its intelligent driving technology and platform architecture, Xiaopeng has transformed from a mere automaker to a tech company, enabling it to create Xiaopeng products faster and at lower costs while further empowering other automakers.

03 Xiaopeng's "cards" yet to be played

However, despite Xiaopeng's continuously iterated core technologies and the release of two relatively strong financial reports, its share price performance has been below expectations. This year, Xiaopeng's share price has continued to decline, and after releasing its second-quarter report on August 20, it gapped down the following day in the Hong Kong stock market.

Behind this are not only the impacts of the sluggish secondary market but also investors' direct reactions to Xiaopeng's products. Investors' lack of recognition of Xiaopeng's current product line naturally leads to a lack of interest in the stock.

Xiaopeng's product positioning confusion has always been a major criticism. Its products cover sedans, SUVs, and MPVs in four sizes: small, compact, medium, and large, but it has not been able to establish a clear brand image in consumers' minds, leaving only the label of "intelligent driving."

This is also one of the reasons why He Xiaopeng invited Wang Fengying to join Xiaopeng last year, hoping to help address Xiaopeng's product and brand positioning issues. Currently, Xiaopeng's product image is gradually becoming clearer.

For example, the X9, which focuses on the high-end MPV market; the G6, which focuses on technology and applies high-level intelligent driving to vehicles priced around 200,000 yuan; the upcoming MONA series, a pure electric sports sedan "designed specifically for young people," to be launched in August; and the P7+, the first model to carry Xiaopeng's pure vision intelligent driving solution.

Currently, He Xiaopeng seems confident about the two unplayed cards—the P7+ and M03. He expects total deliveries in the third quarter of this year to reach 41,000 to 45,000 vehicles, with a new high in the fourth quarter.

So, can these two new models help Xiaopeng achieve its goal of a true turnaround and a sales rebound? Currently, Xiaopeng is well-prepared in terms of production capacity, marketing, and market strategy.

In terms of production capacity, Xiaopeng is avoiding repeating past mistakes. Last year, the Xiaopeng G6 received over 40,000 orders within just one month of its launch, attracting many users with its cost-effective intelligent driving system. However, production capacity failed to keep up, and many users backed out due to the long 12-week delivery period.

Therefore, regarding the delivery of the Xiaopeng MONA M03, He Xiaopeng has learned from last year's G6 experience. He stated that he and supply chain partners have made adequate preparations to ramp up production capacity quickly.

Next, Xiaopeng will focus on enhancing horizontal scalability across supply chain, production, marketing, sales, and delivery to address the challenges of potentially launching multiple new models over the next three years.

In terms of hardware and software integration, according to 36Kr, Xiaopeng has successfully taped out its self-developed intelligent driving chip. Designed for AI needs and end-to-end large models, this chip supports a central computing architecture that integrates cabin and driving functions, with "AI computing power close to that of three mainstream intelligent driving chips."

In terms of marketing, He Xiaopeng has shouted the slogan of "not being one-sided." During the second-quarter earnings call this year, He Xiaopeng stated that Xiaopeng used to be a one-sided company and would prioritize enhancing its business capabilities. He also previously stated that marketing would be a top priority going forward.

Recently, He Xiaopeng has been more actively appearing in public. For example, he recently completed his debut live stream, personally testing the Xiaopeng G6 on the road, and has become more frequent in interacting with peers on social media, such as releasing videos of conversations with Li Bin. For this tenth anniversary, Xiaopeng also invited various industry leaders to deliver speeches, following in the footsteps of Lei Jun.

In terms of the market, Xiaopeng has also disclosed its latest overseas expansion progress. As of July this year, Xiaopeng has entered 30 countries and regions through dealer partners, including Europe, the Middle East, Latin America, etc. In the second quarter of this year, Xiaopeng's overseas sales accounted for more than 10% of its total sales for the first time, and the company predicts that this proportion will reach 15% in the third quarter of this year.

The overseas market has always been an important part of Xiaopeng's intelligent driving strategy. When setting intelligent driving goals at the beginning of the year, Xiaopeng revealed that in addition to achieving "excellent nationwide," it would also start developing high-speed NGP globally this year and XNGP globally in 2025.

It is not difficult to see that intelligent driving technology is a sharp tool for Xiaopeng to enter overseas markets. Whether facing internal or external competition, Xiaopeng is firmly committed to achieving high-quality "competition" through intelligent driving technology and differentiating itself from other automakers that are also aggressively expanding overseas.

In the past, Xiaopeng was often seen as having a good reputation but lackluster sales. It has the technology and is willing to invest heavily, but its technological accumulation has not translated into substantial sales. This can be attributed to missteps in product definition, subpar delivery teams, and failed marketing strategies, but it can also be seen as a matter of timing—despite being in an era where software defines automobiles, automakers find it difficult to profit from software.

After 10 years of establishment, XPeng is reversing past mistakes. After all, in today's market, a well-rounded competitor far outperforms a specialist.

* The cover image and illustrations belong to their respective copyright owners. If the copyright owners believe that their works are not suitable for public viewing or should not be used free of charge, please contact us promptly, and we will make corrections immediately.