Tiangong Stocks: Heavily dependent on major customers, controversial; foreign Zhu family 'dominates'

![]() 08/28 2024

08/28 2024

![]() 587

587

Recent information on the Beijing Stock Exchange's official website indicates that the listing committee will convene its 15th review meeting of 2024 on August 30, with the IPO of Jiangsu Tiangong Technology Co., Ltd. (abbreviated as Tiangong Stocks), a 'little giant' enterprise specializing in titanium alloys, scheduled to be discussed.

It is understood that Tiangong Stocks is a national-level specialized, refined, innovative, and unique 'little giant' enterprise that has experienced rapid growth in recent years. However, according to Caiwen News, Tiangong Stocks still faces numerous issues that need to be addressed during its IPO process, including heavy dependence on a single major customer, cash flow problems, accounts receivable risks, a singular shareholding structure, as well as challenges related to market competition and production capacity utilization. The company's path to listing is unlikely to be smooth sailing.

Significant decline in key financial indicators despite surging performance

Public information indicates that Tiangong Stocks primarily engages in the production, research and development, and sales of titanium and titanium alloy materials. The company processes raw material sponge titanium and other metal elements through proportioning, smelting, forging, and various precision processing steps to create products that maximize the technical performance of titanium and titanium alloy materials.

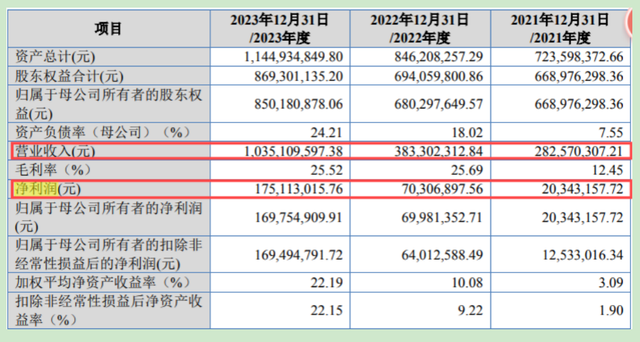

The prospectus reveals that Tiangong Stocks has experienced significant growth in recent years, with revenues of RMB 283 million, 383 million, and 1.035 billion, and net profits attributable to shareholders of the parent company of RMB 20.3432 million, 69.9814 million, and 170 million, respectively, during the reporting period (2021-2023).

The prospectus clearly shows that both revenues and net profits of Tiangong Stocks achieved rapid growth in 2023, with revenues increasing by 170.05% year-on-year and net profits attributable to shareholders of the parent company rising by 142.57% year-on-year.

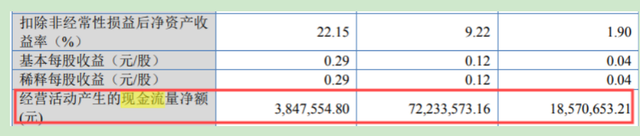

However, Caiwen News has found that this growth may be questionable. In stark contrast to the substantial increase in revenues, Tiangong Stocks' net cash flow from operating activities decreased by 94.67% year-on-year in 2023. In the first half of 2023, the net cash flow from operating activities was negative, and it fell significantly throughout the year, from RMB 72.2336 million in 2022 to RMB 38.4755 million in 2023, indicating that the company's cash inflows may not have kept pace with its revenue growth, raising concerns about the quality of its revenues.

Concurrently, Tiangong Stocks' accounts receivable have also grown rapidly. According to the prospectus, the company's accounts receivable increased by 292.55% year-on-year in 2023, with the ratio of accounts receivable to revenues continuing to grow from 8.51% to 26.15%. Additionally, the accounts receivable turnover rate declined from 8.24 in 2022 to 4.82 in 2023, potentially indicating a relaxed credit policy towards customers, resulting in longer collection periods and a risk of delayed receipt of accounts receivable.

Furthermore, fluctuations in Tiangong Stocks' gross profit margin have emerged. While the company's gross profit margin remained at 25.52% in 2023, it deviated from the industry average, and significant fluctuations in the gross profit margin may suggest instability in cost control or product pricing strategies.

Significant dependence on major customers poses significant risks

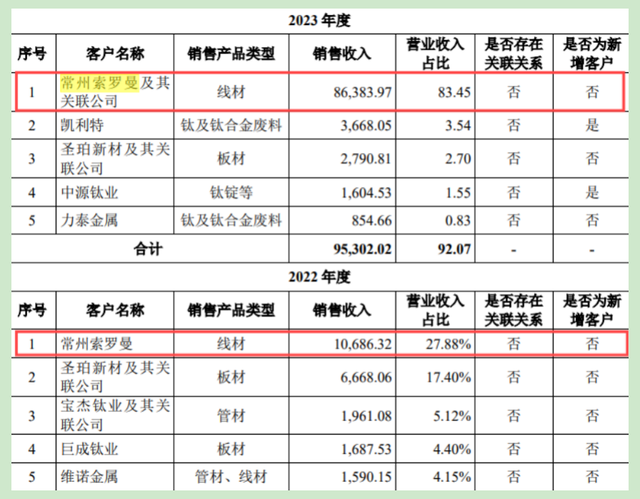

Why is it that while performance appears strong, some key financial indicators are poor? This phenomenon is closely related to Tiangong Stocks' recent emergence of a major customer, Changzhou Soloman, which has become a significant factor. According to Tianyancha, Changzhou Soloman was established in 2020 and rapidly emerged as Tiangong Stocks' largest customer within just two years.

The prospectus reveals that Tiangong Stocks' revenues increased significantly year-on-year in 2022 and 2023, particularly in 2023, primarily due to a substantial increase in sales to Changzhou Soloman starting in November 2022.

In 2022, Tiangong Stocks' sales to Changzhou Soloman amounted to RMB 107 million, accounting for 27.88% of total revenues. In 2023, the cooperation between Tiangong Stocks and Changzhou Soloman further expanded, generating sales revenues of RMB 864 million, accounting for 83.45% of total revenues.

Naturally, the substantial contribution of a company established during the reporting period to the issuer's performance raises regulatory concerns. During the two rounds of inquiries by the Beijing Stock Exchange, the authenticity of Tiangong Stocks' sales to Changzhou Soloman was questioned.

The Beijing Stock Exchange pointed out that Changzhou Soloman was established during the reporting period and its purchases from Tiangong Stocks in 2022 exceeded its annual sales. Additionally, while the company's production capacity utilization rate was high during the reporting period, it chose to forgo cooperation with many major customers.

In response to the inquiry, Tiangong Stocks stated that its general manager, Jiang Rongjun, is acquainted with the shareholders of Changzhou Soloman, and both parties agreed on the promising application of titanium materials in the consumer electronics industry, actively planning to develop this business by combining resources from all parties. It is worth noting that Changzhou Soloman's holding company is Tiangong Soloman, which is also a shareholder of Tiangong Stocks, indicating a common owner between the two companies.

Tiangong Stocks also stated in the prospectus that it expects sales to Changzhou Soloman to continue accounting for a significant portion of its revenues in the future, indicating a certain degree of dependence on Changzhou Soloman for its operating performance.

Apart from the suspected use of related-party transactions to boost performance, this high customer concentration may also pose risks to the company's cash flow and operational stability, as a reduction in orders or financial problems from this customer could severely impact Tiangong Stocks' performance, creating hidden dangers for future growth.

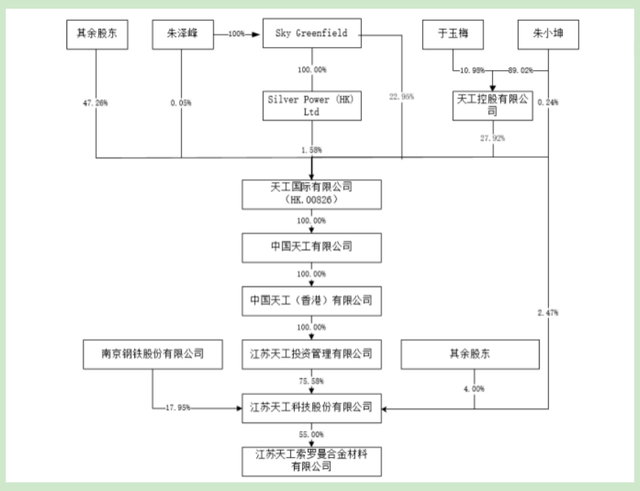

Strong family business color, foreign chairman

In terms of shareholding structure, Tiangong Stocks has a concentrated shareholding pattern, with the current chairman holding foreign citizenship. According to the prospectus, Zhu Xiaokun, Yu Yumei, and Zhu Zefeng are the actual controllers of the company, collectively holding 78.05% of the company's shares directly and indirectly. Zhu Xiaokun and Yu Yumei are husband and wife, and Zhu Zefeng is their son.

In November 2022, due to the company's strategic development plan and succession planning, Zhu Xiaokun resigned as chairman but continued to serve as a director. Subsequently, the board of directors elected Zhu Zefeng as the new chairman. According to Tiangong Stocks' disclosed resume, Zhu Zefeng, male, born in January 1982, holds Canadian citizenship and obtained an advanced diploma in business operations management from Centennial College, Canada, in 2008.

It is understood that Zhu Zefeng acquired Canadian citizenship in May 2015 and holds senior positions in several companies, including President and Chief Investment Officer of Tiangong International, a Hong Kong-listed company. His foreign citizenship and positions in multiple companies may influence Tiangong Stocks' operations and decision-making.

Moreover, a concentrated shareholding structure with familial characteristics may give rise to issues such as the risk of undue control by the controlling shareholder. If the controlling shareholder exerts undue influence over the company's personnel and operational decisions, it may adversely affect the company.

Apart from the aforementioned issues, Tiangong Stocks faces challenges in market competition due to the highly concentrated nature of its downstream applications. In 2023, 83% of its revenues came from the consumer electronics sector, and this trend is expected to continue in the foreseeable future. This high concentration exposes the company to market fluctuations, and a decline in demand in the consumer electronics market could directly impact its performance.

Simultaneously, Tiangong Stocks' production capacity utilization rate remains inadequate, not exceeding 80% throughout the reporting period, raising questions about its production capacity utilization capabilities. Despite this, the company plans to raise RMB 360 million through its IPO to fund the construction of a production line with an annual output of 3,000 tons of high-end titanium and titanium alloy bars and wires, further exacerbating concerns about its future production capacity utilization.

In summary, Tiangong Stocks still faces numerous issues that need to be addressed during its IPO process. Otherwise, its path to listing is unlikely to be smooth sailing, and Caiwen News will continue to closely monitor the situation.