“Ruthless” Pinduoduo starts shorting itself?

![]() 08/28 2024

08/28 2024

![]() 569

569

Produced by Radar Finance | Written by Li Yihui | Edited by Shenhai

On August 26, Pinduoduo's share price fell by 28.51%, erasing $55.37 billion in market value in a single day, equivalent to approximately RMB 394.6 billion, marking the largest single-day decline since its IPO.

Behind this record-breaking decline, Pinduoduo's second-quarter revenue fell short of expectations. During the same period, non-GAAP net profit increased by 125% year-on-year to approximately RMB 34.4 billion, but the growth rate was lower than the more than 200% increase in the first quarter.

In addition to disappointing earnings, management warnings further dampened market confidence. Both in the financial report and earnings call, Pinduoduo's management emphasized that due to intensifying competition and external challenges, revenue growth would inevitably face pressure in the future. Meanwhile, the management stated, "As we continue to firmly invest, we are prepared to accept short-term sacrifices and potential declines in profitability."

Over the past period, e-commerce growth has been sluggish, and the industry has entered a challenging phase. Pinduoduo is also in a new investment phase, fortunately maintaining impressive growth. However, the second-quarter results revealed that Pinduoduo's domestic main site growth fell short of expectations, and challenges in its global business have intensified, leaving investors' concerns unaddressed.

Under these circumstances, Pinduoduo's management took the initiative to cut costs and decided to continue "rolling up its sleeves," focusing investments on long-term factors such as building a sustainable ecosystem and nurturing high-quality merchants. In the past, Pinduoduo's low-price strategy helped it achieve remarkable results, but in this era of price wars, the company needs to find new competitive advantages.

Share Price Plummets After Earnings Release

According to Tianyancha, Pinduoduo's domestic entity is Shanghai Xunmeng Information Technology Co., Ltd., which has completed eight rounds of financing.

On August 26, Pinduoduo released its second-quarter financial report for 2024, ending June 30.

In the second quarter, Pinduoduo achieved total revenue of RMB 97.06 billion, an 86% increase from the same quarter in 2023, but still falling short of market expectations of RMB 99.985 billion, narrowly missing the RMB 100 billion revenue milestone.

This growth rate is impressive in the context of this year's generally low single-digit revenue growth across the e-commerce sector. However, compared to Pinduoduo's own performance, this is the first time in the past four quarters that its quarterly revenue growth rate has fallen below 90%.

According to iFinD data from Tonghuashun, Pinduoduo's revenue growth rates were above 90% in the third quarter of 2023 and the first quarter of 2024, at 94%, 123%, and 131%, respectively.

In addition to slowing revenue growth, Pinduoduo's profit growth rate also decelerated quarter-over-quarter.

The financial report showed that Pinduoduo's net profit attributable to ordinary shareholders was RMB 32.009 billion in the quarter, an increase of 144% year-on-year. Excluding the impact of equity incentive expenses and changes in the fair value of long-term investments, non-GAAP net profit attributable to ordinary shareholders was RMB 34.432 billion, an increase of 125% year-on-year, exceeding market expectations of RMB 30.1 billion.

In contrast, in the first quarter of 2024, Pinduoduo's net profit attributable to ordinary shareholders increased by 246% year-on-year; on a non-GAAP basis, the increase was 202%.

Upon the release of these results, Pinduoduo's share price plummeted by nearly 30% overnight, marking its largest single-day decline since its IPO, erasing nearly RMB 400 billion in market value in a single day.

Goldman Sachs believes that this sharp negative reaction may stem from three factors. First, investor expectations were high before the earnings release. As the market anticipated strong results, Pinduoduo's share price had risen by approximately 20% since late July, while the KWEB Index, which tracks Chinese internet companies listed overseas, had fallen by 4% over the same period.

Second, Pinduoduo's online marketing services growth showed the first signs of normalization, with year-on-year growth slowing to 29%, below market expectations. However, Goldman Sachs believes that Pinduoduo's performance still significantly outperformed Alibaba's customer management revenue growth of 1% and the median growth rate of Kuaishou's e-commerce advertising.

Finally, management comments spooked the market. In the earnings call, Pinduoduo's management pointed out that due to intensifying competition and potential declines in long-term profitability to drive high-quality development, revenue growth is expected to slow down in the future at the expense of short-term profits. Pinduoduo plans to invest RMB 10 billion over the next 12 months to support high-quality merchants. As the company is still in an investment phase, it will not conduct buybacks or dividend distributions in the coming years.

Traditionally, the two pillars driving Pinduoduo's revenue growth have been the increase in revenue from its overseas business, Temu, and the growth of domestic advertising revenue. However, these two engines are now slowing down.

Specifically, Pinduoduo's online marketing services and other services (advertising) revenue was RMB 49.12 billion in the second quarter, with a year-on-year growth rate of 29%. Transaction services revenue (commissions) was RMB 47.94 billion, up 234% year-on-year.

Among them, online marketing services and other revenue come from fees paid by merchants to Pinduoduo for purchasing advertising slots and search keywords on its platform to increase sales. These fees are based on user preferences such as search keywords and browsing locations and are therefore considered an indicator of the domestic main site's business performance.

In the previous quarter, Pinduoduo's online marketing services revenue and other revenue grew by 56% year-on-year. According to Dolphin IQ, the median expectation for this quarter's growth rate was around 40%, but Pinduoduo's core advertising revenue growth rate was only 29% this quarter, substantially below expectations.

Transaction services revenue refers to commission income, which Pinduoduo earns as a percentage of transaction amounts for each completed order by merchants. This quarter, Pinduoduo's transaction services revenue was also lower than expected, with Bloomberg consensus estimates around RMB 50 billion. In the previous quarter, the company's revenue from this source grew by 327% year-on-year.

It is worth noting that transaction services revenue primarily consists of revenue from Temu, the overseas business, but also includes commission revenue based on transaction volumes from the main site and commissions from Pinduoduo's community group buying business.

Considering that the commissions from the main site and community group buying business are relatively stable, the slowdown in Pinduoduo's transaction services revenue in the second quarter implies that revenue growth from its overseas business, Temu, is decelerating.

High Growth Faces Pressure

Judging from its share price performance, Pinduoduo's decelerating growth rate did not satisfy the market. However, the company's management remains cautious about the future.

"In the past quarter, our revenue growth rate slowed down quarter-over-quarter. Looking ahead, due to intensifying competition and external challenges, revenue growth will inevitably face pressure," said Liu Jun, Pinduoduo's Chief Financial Officer, in the earnings release. "As we continue to invest firmly, profitability may also be affected."

During the post-earnings conference call, Lei Chen reiterated that profit growth in the past few quarters was the result of a mismatch between short-term investment cycles and reporting cycles and should not be taken as a long-term indicator. Furthermore, the company's business is currently facing intense competition and external environmental factors, which will inevitably bring fluctuations to business development and slow down revenue growth.

The reasons for slower revenue growth are evident from management's statements. On the one hand, domestic market competition continues to intensify, and on the other hand, uncertainty in overseas business has increased.

Zhao Jiazhen, Executive Director and Co-CEO of Pinduoduo, stated that "competition" is inevitable in the e-commerce industry and has been intensifying over the past few quarters. In such a competitive environment, Pinduoduo's revenue growth may slow down, as evidenced by the recent second quarter, indicating that high growth is unsustainable.

Regarding its overseas business, since the launch of Temu in September 2022, the business has grown rapidly. Lei Chen noted that compliance has always been a crucial prerequisite for Temu's development.

However, as the business expands, the company has noticed that changes in the external environment are accelerating, and the global business operations have been disrupted by abnormal commercial factors, significantly increasing uncertainty.

Lei Chen pointed out that the current intense industry competition combined with external environmental factors will inevitably bring fluctuations to future business development.

Goldman Sachs also believes that Pinduoduo's international business has seen quarterly increases in profit margins due to reduced subsidy levels in mature markets like the US and strict control over procurement prices. However, it noted that geopolitical headwinds may be stronger than expected when entering Europe and other developed markets with strong consumer spending power.

Sacrificing Profit for Increased Investment

To address market competition, Pinduoduo considers this year as a crucial period for increased investment, but increased investment also means compressing profit margins.

According to Lei Chen's latest statements, Pinduoduo has entered a new investment phase, and improving its ecosystem is not an overnight task. However, the management has reached a consensus to be prepared to sacrifice short-term profits for long-term investments.

To support the sustainable development of its platform ecosystem, Pinduoduo plans to increase investments and support high-quality merchants over the next 12 months. In this scenario, the company's short-term profits may fluctuate, but a gradual decline in profits is inevitable.

Pinduoduo recognizes that high-quality merchants are crucial to the healthy development of its platform ecosystem. Therefore, this round of investments focuses on this area.

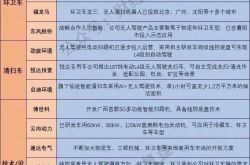

On the supply side, Pinduoduo will invest tens of billions of resources to support innovative merchants and industrial clusters with product technology capabilities, significantly reducing transaction fees for high-quality merchants. On the other hand, the platform will resolutely govern its ecosystem with merchants, cracking down on fraudulent merchants and strictly managing low-quality merchants.

A noteworthy phenomenon is that domestic e-commerce platforms once followed Pinduoduo's low-price strategy, leading to low-price competition across all platforms this year. However, in the last two quarters, Pinduoduo has no longer emphasized low prices as its core focus.

Radar Finance notes that in May, the State Administration for Market Regulation announced the "Interim Provisions on Anti-Unfair Competition in Network Transactions," which defines and assigns responsibility for various business irregularities in the e-commerce industry and will take effect on September 1 this year.

According to the Beijing Municipal Market Supervision and Administration Bureau, on August 22, under the guidance of market supervision departments in Beijing, Zhejiang, and Shanghai, JD.com, Taobao, Pinduoduo, Douyin, and Kuaishou jointly signed the "Self-Discipline Convention for Compliant Operation in Online Transactions," proposing initiatives in five areas: fulfilling platform responsibilities, protecting consumer rights, prohibiting unfair competition, regulating pricing behavior, and promoting collaborative governance between government and enterprises.

Industry analysts believe that under policy guidance, major e-commerce platforms are de-emphasizing low-price strategies and focusing more on GMV, investing in optimizing user rights, services, and merchant ecosystems.

As the entire industry moves away from low-price strategies, Pinduoduo, which originated from a "cost-effective" approach, needs to find competitive advantages on more multidimensional levels. This may be one of the reasons why it emphasizes increasing investments in directions conducive to the platform's long-term and healthy development.

However, such investments to alleviate competitive pressure also make Pinduoduo's high profits unsustainable. After investors "voted with their feet" and erased nearly RMB 400 billion in market value, will Pinduoduo's development reach a turning point? Radar Finance will continue to monitor the situation.