"Baidu: Future or Present? Losing Sight of One for the Other?"

![]() 08/28 2024

08/28 2024

![]() 537

537

"Betting on the Future with AI, but Losing Sight of the Present"

"Baidu, a Pioneer in AI in China"

"Where Are We Now?"

"As the hottest concept on the planet, AI is undoubtedly a great story. Not only Baidu but also many tech companies listed on U.S. stock exchanges are talking about their AI investments and development achievements, with their market values riding the roller coaster of AI expectations. The market has always been concerned about whether Baidu's AI large models and cloud intelligence, which it has been fully developing in recent years, can actually generate profits. After all, you can't just keep shaking an empty bait when fishing."

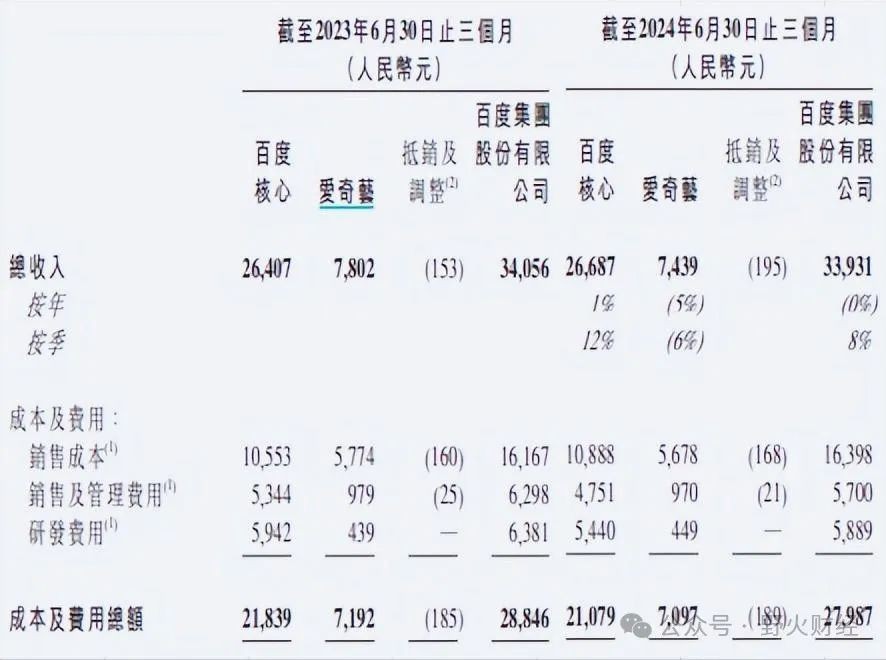

"The answer is that they have earned some profits, but not much. The explosion in demand for AI applications has driven Baidu's cloud business to grow 14% year-on-year to 5.1 billion yuan in Q2. The large models that Baidu has focused on in recent years have achieved certain results, with Wenxin's daily usage exceeding 600 million times."

"Baidu Intelligent Cloud leads the way among large model vendors in terms of market share, number of bids won, and amount. Even traditional businesses like search engines and Baidu Library have been reconstructed by AI, rejuvenating them. While it seems that Baidu AI has achieved commercialization in both AI and cloud computing, most of its revenue and profits come from AI+cloud business cooperation with enterprise B-ends."

"The self-driving business that stirred up the capital market a while ago is still in the cultivation stage, and the break-even point has not been reached, even dragging down the overall gross margin."

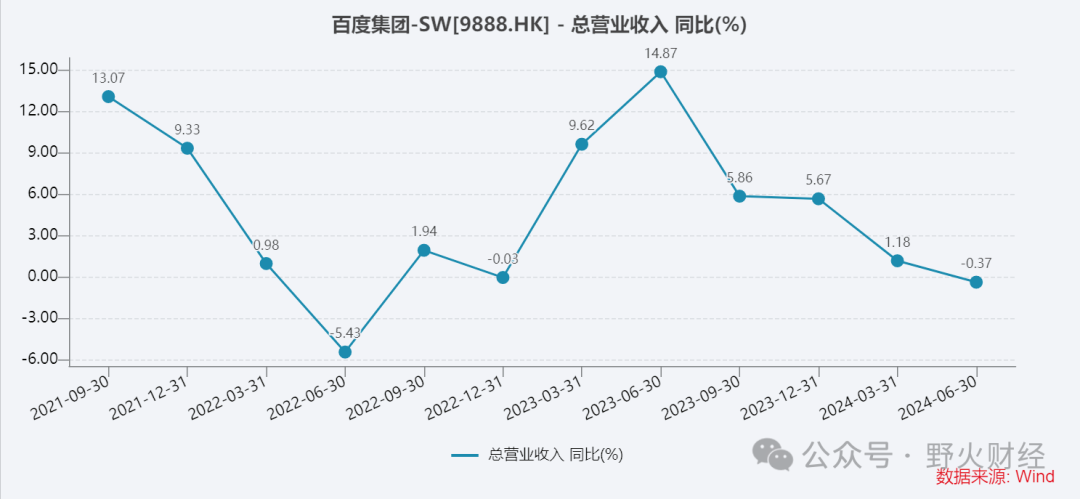

"At the same time, Baidu's advertising revenue, which accounts for the majority of its 26.7 billion yuan in core revenue, experienced negative growth. The double-digit growth of its multi-billion-yuan new businesses could not offset the decline in its core business, resulting in stagnant revenue in Q2. This is also the fourth consecutive quarter of declining revenue growth since the second quarter of last year."

"Losing sight of one for the other is the current situation of Baidu. Although AI commercialization has achieved initial success and Baidu is in the first tier domestically, globally, no company has achieved significant revenue from AI except for NVIDIA, which sells hardware. The full commercialization of AI will have to wait for the outbreak of application scenarios. On the contrary, traditional businesses are showing a declining trend and losing growth momentum. It is terrifying to have no fuel to keep the fire burning in the darkness before dawn."

"It is clear that Baidu is aware that this is a protracted battle and is actively reducing costs. In the second quarter, Baidu tightened its sales, administration, and R&D expenses, saving a total of 1 billion yuan from these areas."

"This enabled the company to achieve resilient growth in core operating profit despite stagnant core revenue. However, the market hopes to see an expansion of Baidu's core business market share, which would drive up gross margins and ultimately increase profits. When this desire is not met, the stock price will indicate the stance of investors."