New energy vehicle business grows by over 100%, Huichuan plans to invest an additional 5 billion yuan to build a factory in Suzhou

![]() 08/29 2024

08/29 2024

![]() 586

586

On August 27, Huichuan Technology (hereinafter referred to as "Huichuan") released its semi-annual report for 2024. In terms of revenue and net profit attributable to shareholders, Huichuan's position as a leading industrial controller manufacturer remains stable, but the situation of "increasing revenue without increasing profit" has not changed.

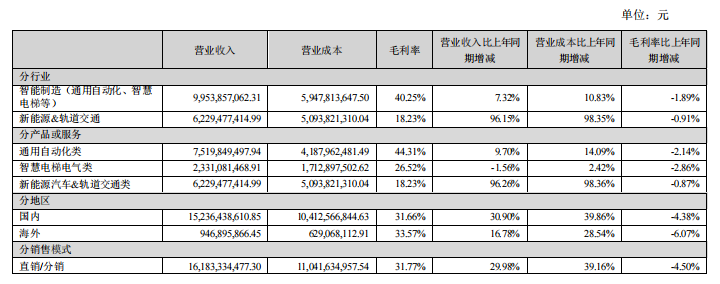

Financial report data shows that in the first half of the year, Huichuan achieved revenue of 16.183 billion yuan, an increase of 29.98% year-on-year; net profit attributable to shareholders was 2.118 billion yuan, an increase of 1.98% year-on-year; after deducting non-recurring gains and losses, net profit attributable to shareholders was 2.068 billion yuan, an increase of 10.77% year-on-year.

Regarding the growth in net profit after deducting non-recurring gains and losses, Huichuan attributes it to three aspects: faster year-on-year revenue growth, regulation of sales and R&D expenses, and a year-on-year decrease in the provision for bad debts and impairment losses on receivables.

Compared to its peers, Huichuan's half-year performance is quite impressive. However, from its own perspective, compared to the past four years, the growth rate of performance has slowed significantly.

Wind data shows that in 2020, Huichuan's revenue and net profit attributable to shareholders grew by 55.76% and 120.62% year-on-year, respectively. By the first half of this year, the corresponding growth rates were only 29.98% and 1.98%, respectively.

01

New Energy Vehicles Generate 6 Billion Yuan in Revenue

From a business perspective, Huichuan's main business encompasses four areas: general automation, new energy vehicles, smart elevators, and rail transit. The traditional general automation business, which is deeply rooted in the industry, remains Huichuan's primary revenue driver during the reporting period, generating approximately 7.5 billion yuan in revenue, an increase of about 10% year-on-year. Among them, the general inverter, general servo system, PLC&HMI, and industrial robot (including precision machinery) businesses, which are included in the general automation segment, generated revenues of 2.5 billion yuan, 3.0 billion yuan, 690 million yuan, and 580 million yuan, respectively.

Secondly, the new energy vehicle business, which is regarded as Huichuan's second growth engine, generated 6 billion yuan in revenue during the reporting period, an increase of over 100% year-on-year. The remaining smart elevator and rail transit businesses generated revenues of approximately 2.3 billion yuan and 220 million yuan, respectively, during the reporting period, with year-on-year growth rates of -2% and 8%, respectively.

Among the four business segments, all except smart elevators have shown varying degrees of growth, with the rapid growth of the new energy vehicle business being the main driver of Huichuan's performance growth over the past six months.

Screenshot from company announcement

To further support its new energy vehicle business, Huichuan announced plans to invest 5 billion yuan to build a production base for new energy vehicle components for its controlled subsidiary, Suzhou Huichuan United Power Systems Co., Ltd. (hereinafter referred to as "United Power"), in Suzhou. The construction will include production workshops and supporting facilities for stators, rotors, electric controls, power supplies, and assemblies.

In addition to focusing on niche markets, Huichuan Technology has also set its sights on the broader overseas market with significant growth potential.

02

Overseas Business Growth Falls Short of Expectations

"In the coming years, going overseas will be Huichuan's top strategy, with the overseas market being 3-4 times the size of the domestic market," said Zhu Xingming, Chairman of Huichuan, reaffirming the company's direction for seeking new growth and placing bets on the future amidst an increasingly competitive domestic market.

From a strategic perspective, 2023 marked the first time that Huichuan made going overseas its top strategy. Although it entered the overseas market later than some of its peers, it still managed to achieve considerable growth.

Financial report data shows that Huichuan's overseas business generated revenue of 1.74 billion yuan in 2023, an increase of 96.52% year-on-year, and its share of total revenue increased from 3.85% in 2022 to 5.72%.

The increase in the share of overseas revenue is closely related to Huichuan's strategies of "going overseas through industry lines" and "going overseas by leveraging existing partnerships."

Over the past year, through the "going overseas through industry lines" strategy, Huichuan has secured large orders in markets such as Southeast Asia, India, and Korea across industries including mobile phones, 3C, logistics, elevators, and textiles, and established demonstration sites in ceramics and wind power. Additionally, it has established partnerships with leading customers in the air conditioning and injection molding machine industries in the European market.

In the first half of this year, Huichuan established subsidiaries in Vietnam and built a new United Power factory in Thailand, while also opening ten new joint warranty centers. To date, Huichuan has 18 subsidiaries and offices, and 26 joint warranty centers worldwide.

At the end of July this year, Huichuan also announced the completion of its full acquisition of French industrial software company Irai.

This series of overseas moves has supported Huichuan's overseas revenue growth in the first half of the year. Financial report data shows that in the first half of the year, Huichuan generated overseas revenue of 950 million yuan, an increase of approximately 17% year-on-year, accounting for approximately 6% of the company's total revenue.

However, given the relatively small scale of the business, this revenue growth is not particularly impressive.

During the 2024 half-year results conference, Song Junen, Secretary to the Board of Huichuan, admitted, "The overseas business has fallen short of expectations. Huichuan entered the overseas market relatively late, and it takes time to accumulate experience and build a presence there. We expect future overseas revenue to account for 20% of our total revenue."

Moreover, regarding Huichuan's key market in Europe, the company's senior management believes that there are two main constraints to further expansion: the ability to provide product solutions, which requires multiple certifications, and the lack of brand recognition in the local market.

As a "newcomer" in the seemingly untapped overseas market, Huichuan may need to work hard to establish a foothold and achieve its revenue target of 20% share in this market.

Some images are referenced from the internet. If there is any infringement, please inform us for deletion.