AI Toys: A Glimmer of Promise, Yet Success Remains Elusive

![]() 11/07 2025

11/07 2025

![]() 484

484

"Why is capital flocking to AI toys?"

Author | Jian An

Editor | Lu Xucheng

'Every industry deserves a makeover with AI.' This sentiment has been reaffirmed in the current AI boom, with AI toys serving as a prime example.

As AI technologies, exemplified by large language models, make significant strides, AI toys have gradually transitioned from mere concepts to tangible market offerings. Particularly this year, the emergence of several popular AI toys has propelled this sector into one of the fastest-growing, with 2025 being heralded as the 'Year of AI Toys.'

However, beneath the surface allure, a series of issues such as hardware constraints, distribution hurdles, and low user acceptance have surfaced. These underlying challenges indicate an undeniable fact: the AI toy market holds promise, but true success remains a distant dream.

A Carnival on the Horizon

The AI toy craze actually ignited last year.

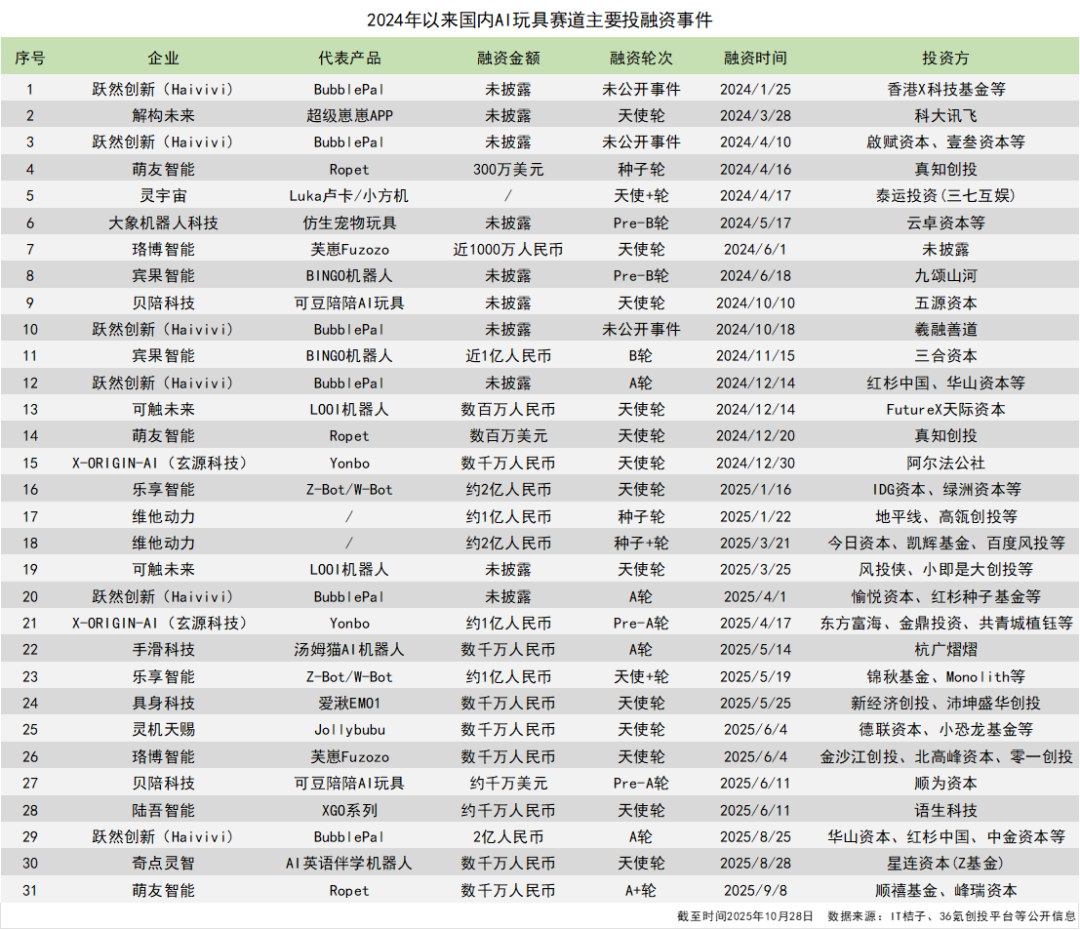

According to incomplete statistics from Lansha Finance, since 2024, there have been at least 31 investment and financing events in the domestic AI toy sector, with 16 major investments occurring in 2025 alone. These include several billion-yuan and multi-million-yuan investments, reflecting growth in both the number and scale of investments.

Leading investment firms and internet giants such as Sequoia Capital China, Shunwei Capital, ByteDance, and JD.com have all jumped on the bandwagon, betting real money on AI toys. According to incomplete statistics, over a hundred institutions are now investing in the AI toy sector.

Behind this capital enthusiasm lies the envisioned market size and consumption potential of AI toys.

According to Market Research Future, the global AI toy market size surpassed $11 billion in 2024 and is projected to reach $58 billion by 2030, with an average annual growth rate exceeding 20%.

The 'AI Toy Consumption Trend White Paper' jointly released by JD.com and the Shenzhen Toy Industry Association also forecasts that the global AI toy market size will exceed 100 billion yuan by 2030, with a compound annual growth rate exceeding 50%. The domestic market size is also expected to exceed 10 billion yuan, with a compound annual growth rate exceeding 70%.

Terminal consumption data directly reflects the popularity of AI toys: for instance, the AI pendant toy BubblePal launched by Yueran Innovation last year has sold over 250,000 units cumulatively, with single-product sales exceeding 100 million yuan. The second-generation AI interactive toy CocoMate, launched in August this year, sold out immediately upon release. Another brand, Luobo Intelligence's AI companion product Fuzozo, also performed well, selling 1,000 units within 10 minutes of its June 18th debut on JD.com, with total sales during the promotion period ranking second only to Pop Mart and Miniso's products in the JD.com trendy toy category.

JD.com platform data reveals that in the first half of 2025, AI toy sales surged sixfold month-on-month, with year-on-year growth exceeding 200%. In trendy tech experience stores in Shenzhen, Shanghai, and other cities, AI toys account for over 30% of the product range, with some stores launching over 10 new models per month.

Moreover, AI toys offer high profit margins (IP + AI + toys). Data shows that the gross margin in the traditional toy industry is typically 20%-30%, but after AI integration, prices are 5-10 times higher than traditional plush toys. According to investors from firms like Sequoia Capital China and GSR Ventures, this is due to the emotional value brought by IPs (such as Ultraman) and the technological premium brought by AI.

A data report from Forward Industry Research also highlights that basic AI toys priced at 300-400 yuan have a gross margin of approximately 50%-65%. Mid-to-high-end products priced at 1500-3000 yuan maintain a gross margin of 70%-85%, while individual high-end products like LOVOT and Tesla's robots even reach gross margins exceeding 90%.

Such vast market potential and huge profit margins have attracted an increasing number of players to enter the field. According to a Forward Industry Research report, as of June 2025, the number of active/operating AI toy enterprises in China has reached 1,766. Technology innovation companies, traditional toy manufacturers, internet tech firms, and IP holding companies are all vying for a piece of the 'AI toy' pie, trying to gain a first-mover advantage.

The Result of Multiple Resonances

Typically, a product or industry undergoing revolutionary change is driven by two factors: significant technological breakthroughs or notable shifts in user demand. The explosive growth of AI toys is the result of multiple resonances among technology, market, and user demand.

The core distinction between AI toys and traditional toys lies in their ability to utilize multimodal interaction, emotional computing, facial expression analysis, natural language processing, bionic memory, deep learning, and other technologies to achieve highly human-like interactions and responses, providing users with personalized, immersive learning, companionship, or entertainment experiences.

Breakthroughs in AI technology form the foundation for realizing these visions. In recent years, large language models like ChatGPT and DeepSeek have matured, coupled with technological advancements and cost reductions in hardware such as chips and sensors, enabling AI toys to evolve from simple command responses and pre-set answer interactions to deeper emotional connections and interactive companionship.

More critically, most AI toys achieve intelligent functions through API calls to large language models, significantly lowering the technical threshold. Previously, developing an AI toy required building an entire technology stack for speech recognition and natural language processing. Now, as long as one can call an API, they can create an AI toy.

Meanwhile, with DeepSeek's open-source release in 2025 and price wars among large language models like Tongyi Qianwen, Baidu's Wenxin Yiyan, and Doubao, development costs have further decreased. An AI toy entrepreneur told Lansha Finance, 'Now we choose models mainly based on cost—whoever is cheaper, we use.'

The sustained growth in demand for emotional companionship has also fueled the further explosion in the AI toy market. Traditionally, toys were seen as functional or educational products 'exclusive to children.' However, today, fast-paced urban life, increasing solo living populations, aging trends, and even fan economies and 'goods economies' have spawned a massive demand for emotional companionship.

This superposition of demands has enabled AI toys to break free from the 'exclusive to children' stereotype, opening up a full-age market covering children, Gen Z young adults, solo living groups, and the elderly. In response, differentiated AI toy products targeting various consumer groups and usage scenarios have emerged in the market.

For example, Yueran Innovation's BubblePal and CocoMate focus on children's companionship and enlightenment. Luobo Technology's Fuzozo targets emotional companionship for adult women. Qidian Lingzhi's upcoming product focuses on English early education for children aged 3-8, guiding them to speak English through proactive interactions...

CocoMate AI Interactive Toy

Additionally, national policy support and the toy industry's well-established supply chain have created strong policy guarantees and favorable market conditions for the development of the AI toy industry.

The 2024 government work report proposed the 'AI+' action plan for the first time, emphasizing the use of AI technology and internet platforms to promote deep integration between AI and traditional and emerging industries. The 'Stimulating Consumption Special Action Plan' released in March this year also explicitly proposed carrying out the 'AI+' action to promote 'AI+consumption,' opening up new high-growth consumption tracks.

As the largest toy production base in China, Guangdong boasts over 20,000 toy manufacturing enterprises, forming a complete industrial chain from raw material supply to R&D design, mold manufacturing, packaging logistics, and channel sales. This means that in Guangdong, an AI toy can go from concept to product 'without leaving the province.'

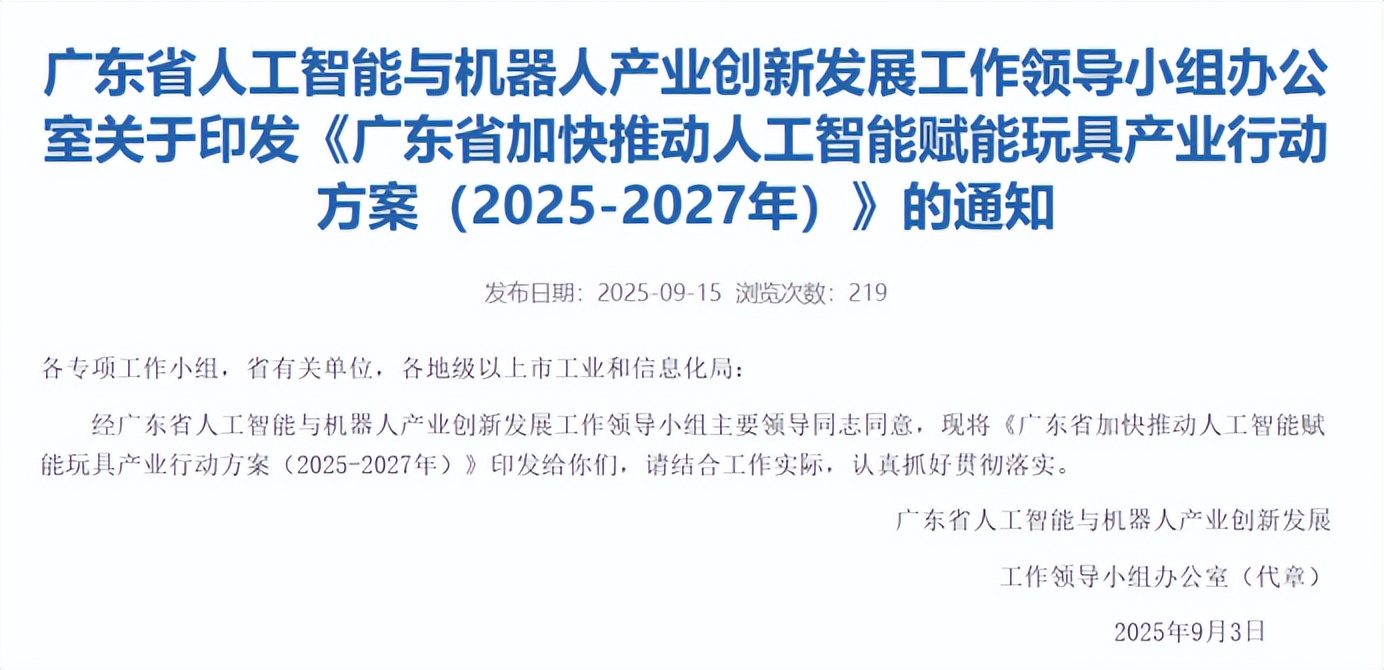

Not long ago, Guangdong officially announced its '100 Billion AI Toy Industry Plan,' accelerating the empowerment of the toy industry with AI and focusing on cultivating and building key industrial clusters in Shantou, Dongguan, and Shenzhen, which will provide more complete supply chain support for the development of AI toys.

With multiple favorable factors, AI toys have become one of the most promising consumption tracks today.

Still Far from Success

Despite the vast prospects, from the current industry status, AI toys are not an easy business. At least so far, no blockbuster product with annual sales exceeding one million units has emerged in the market, forming a stark contrast with the capital market's fervor.

Meanwhile, the success rate of AI toy startups is also low. An AI hardware entrepreneur stated in a media interview that out of the forty to fifty AI toy startups he has spoken with, only 2-3 have survived. A closer look reveals that behind the high attrition rate are several insurmountable hurdles for the AI toy industry.

The first is the 'hardware pit.' While the cost of calling large language model APIs is low, achieving 'smooth interaction' and 'accurate empathy' in AI toys requires powerful hardware support. High-performance chips, precision sensors, long-lasting batteries, and stable network modules—any issue in these areas can directly impact user experience and even become a fatal flaw for the product.

For example, the accuracy of sensors. To achieve emotional interaction, AI toys rely on cameras, microphones, touch sensors, etc., to collect user expressions, voice, and movements. However, limited by cost and size, most AI toys have limited sensor precision, often leading to misidentifications and slow responses, significantly detracting from the user experience.

The collection and storage of user expressions, voices, and movements also raise concerns about data security and privacy protection. Although most AI toy manufacturers emphasize valuing data security, consumer doubts about 'data leakage,' 'information misuse,' and 'privacy protection' persist. How to truly reassure consumers in practice is an urgent issue for companies to resolve.

Sales channels also pose a major obstacle to the development of the AI toy industry. Although AI toys have achieved intelligent interaction and emotional companionship through AI technology, they are still essentially hardware products with the ultimate goal of 'selling out.'

However, the current situation is that while online channels have developed rapidly, their traffic dividends have peaked, and 'selling relies mainly on paid traffic' has become an industry consensus. Yet, conversion rates are not fully guaranteed, and customer acquisition costs remain high. Offline channels have high entry costs and limited coverage, heavily relying on agents, which requires grassroots marketing efforts that many current AI toy startup teams lack experience in. Compared to 'creating,' 'selling' AI toys seems even more difficult.

Currently, while some AI toy products have quickly gained market share and even achieved product premiums by leveraging influential IPs, for consumers, IP is merely a 'bonus' that adds value but is not a core factor influencing purchasing decisions. Whether AI toy products can truly retain users ultimately depends on the product's interaction experience and practical value.

More importantly, there is the issue of low user acceptance. On social media, complaints about AI toys far outweigh praise, with 'interaction lag,' 'mechanical responses,' 'irrelevant answers,' and 'AI stupidity' being frequent criticisms. A consumer who purchased a certain AI toy bluntly stated, 'I spent 499 yuan on a piece of junk.'

Additionally, issues such as unreasonable pricing models, unstable network connections, and poor after-sales service have further amplified user dissatisfaction, directly leading to low user retention and high return rates for AI toys. Some media reports indicate that return rates for AI toys are as high as 30%-40%.

In conclusion, while AI toys hold promise with technological breakthroughs, demand upgrades, capital enthusiasm, and a vast market, they still have a long way to go from hype to maturity. This journey requires not only technological breakthroughs and capital support but also patience, focus, and a deep understanding of user needs.