“Xiaopeng MONA M03” wants to defeat others with others' martial arts. Is that possible?

![]() 08/29 2024

08/29 2024

![]() 462

462

New Energy Concept (ID:xinnengyuanqianzhan) original

With the continuous boom in the new energy vehicle market, more and more models are joining this fierce competition. The two most notable ones recently are Xiaopeng MONA M03 and NIO's Ledo L60, with starting prices of RMB 119,800 and RMB 219,900, respectively.

For price-sensitive consumers, these two models are highly competitive in their respective segments. Both Xiaopeng MONA M03 and Ledo L60 are targeted at young consumers, one a sedan and the other an SUV, aiming to attract more potential buyers through lower price thresholds.

However, in terms of battery selection, the entry-level models of MONA M03 and Ledo L60 both use BYD's Fudi batteries, which to some extent changes the competitive landscape.

In the competition of the automotive consumer market, it won't show mercy just because you use its batteries. After all, BYD not only produces batteries but also vehicles.

1. Can you win by using your own spear to attack your own shield?

On August 27th evening, Xiaopeng's Chairman He Xiaopeng announced at the new car launch event that the Xiaopeng MONA M03 was officially launched, offering three versions with a starting price of RMB 119,800. It is reported that approximately one hour after the launch, MONA M03 received over 10,000 firm orders.

Image/Xiaopeng MONA M03 Receives 10,000 Firm Orders

Source/Screenshot from Internet & Renewable Energy Insights

News about the other car came earlier. On May 15th this year, NIO's subsidiary brand Ledo officially launched its first model, the Ledo L60, in Shanghai and began presales at a pre-sale price of RMB 219,900. The new car will be officially launched and delivered in September.

Image/Ledo L60

Source/Screenshot from Internet & Renewable Energy Insights

According to the 384th batch of "Announcement of Road Motor Vehicle Manufacturers and Products" issued by the Ministry of Industry and Information Technology, both the entry-level models of MONA M03 and L60 use batteries from Fudi Battery, a wholly-owned subsidiary of BYD. Whether it's Nanning Fudi or Wuwei Fudi, they are both wholly-owned subsidiaries of Fudi Battery and grandchild companies of BYD.

Image/Xiaopeng and Ledo Models

Source/Screenshot from Internet & Renewable Energy Insights

In other words, these two affordable new cars both use LFP batteries sourced exclusively from BYD, which is markedly different from Xiaopeng's original diversification strategy in the battery supply chain.

Xiaopeng previously attached great importance to collaborations with different battery suppliers. From Contemporary Amperex Technology Co., Limited (CATL) to Zhongchuangxinhang, Sunwoda, and EVE Energy, they were all important battery suppliers to Xiaopeng, with Sunwoda specifically providing 4C power batteries for some Xiaopeng G9 models. Additionally, Xiaopeng has also collaborated with other battery manufacturers such as BAK Battery and Leadray Power Solutions.

These suppliers provided battery types including LFP and NCM batteries to cater to the diverse needs and performance characteristics of different vehicle models, helping Xiaopeng meet market expectations for high-performance electric vehicles.

Xiaopeng's Chairman He Xiaopeng once stated, "The first model in the MONA series is a product with high aesthetics, intelligence, and cost competitiveness within the RMB 200,000 price range. It will become a superstar in the A-segment pure electric market."

Image/Xiaopeng MONA M03

Source/Screenshot from Internet & Renewable Energy Insights

Relying solely on a single battery supplier, especially one that also manufactures vehicles like BYD, will make Xiaopeng's costs competitive? The reality may not be so optimistic. The market will soon reveal whether choosing a single supplier or a diversification strategy will make Xiaopeng more competitive.

In a price-sensitive market, consumers often prioritize cost-effectiveness over brand influence. BYD's dominance in the RMB 100,000-200,000 price range stems from its ability to control costs due to its integrated vehicle and battery manufacturing capabilities.

This poses a challenge to automakers hoping to reduce costs and enhance competitiveness through battery technology, especially for these two new, affordably priced models.

One of Xiaopeng MONA M03's main competitors, GAC Aion S, also adopts a diversification strategy, primarily using batteries from Zhongchuangxinhang, CATL, and Farasis Energy. It understands the importance of not relying solely on one supplier and the risks of choosing a supplier that could become a competitor.

After the official launch of Xiaopeng MONA M03, some online users compared it to BYD Qin PLUS EV, claiming that Xiaopeng is "aiming its gun at BYD." Similarly, Ledo L60's pricing overlaps with BYD Song L EV and Tang New Energy models.

It's unclear what they're thinking. Setting aside whether the "gun" is aimed accurately, are the bullets even yours? If you have more space, I'll lower my price; if you're faster, I'll lower my price; if you're more energy-efficient, I'll still lower my price. So, let's predict: Qin PLUS EV will likely offer discounts to both new and existing customers soon.

2. The double-edged sword of dual identities

Choosing BYD seems like a double-edged sword: on one hand, it offers relatively reliable technical support; on the other hand, it may put you at a disadvantage in price competition. Clearly, Xiaopeng and NIO struggle to compete with BYD in cost control and face a more complex competitive landscape.

In contrast, BYD, with its battery technology and vehicle manufacturing capabilities, can better integrate supply chain resources and gain a cost advantage. BYD thinks, "You use my batteries and want to compete with me? You might already be losing at the starting line."

BYD is not just a battery supplier; it's a company with a mature vehicle manufacturing system. This means BYD can leverage its manufacturing experience and technological advantages to provide more competitive cost structures for its own products.

Furthermore, BYD can prioritize providing its own brands with the latest battery technologies and solutions, increasing the competitive pressure on other automakers using BYD batteries.

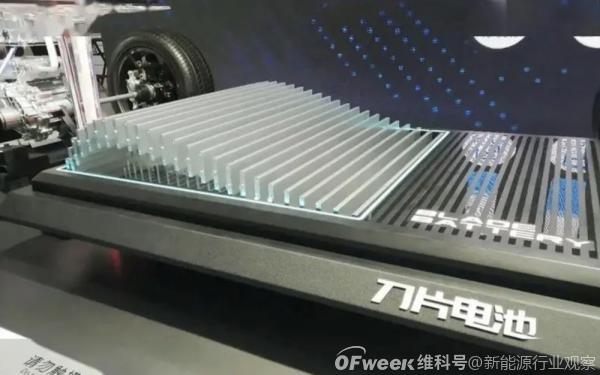

Image/BYD Blade Battery and Two-Way R&D for New Energy Vehicles

Source/Screenshot from Internet & Renewable Energy Insights

Take Xiaomi as an example. The entry-level version of Xiaomi SU7 uses BYD Fudi's LFP Blade Battery, while one of Xiaomi SU7's main competitors is BYD Han EV. Although Xiaomi chose BYD batteries primarily due to their low cost, it's evident that BYD prioritizes its own brands over external customers in terms of supply.

You think the cost is low – lower than for my own child? Therefore, in market competition, Xiaomi SU7's low-end model can only treat the power battery as a disadvantage and find other ways to stand out, such as user experience and smart connectivity features, to attract consumers who prioritize technology and personalization.

This demonstrates that BYD's dual identities give it significant advantages in cost control and technological innovation, while other automakers choosing BYD batteries may find themselves at a disadvantage in price-sensitive markets. In the future, these brands need to carefully consider their battery supplier choices to maintain competitiveness in fierce market competitions.

In contrast, battery suppliers like Sunwoda, Zhongchuangxinhang, and CATL focus solely on battery R&D and production, without vehicle manufacturing businesses.

This single-focus strategy allows them to concentrate resources on technological innovation and service optimization, providing stable product supplies and customized solutions tailored to different customer needs, helping automakers gain advantages in cost control and technological innovation.

For automakers seeking diversified battery supply sources, these specialized suppliers offer more flexible options.

Xiaopeng and NIO's decision to use BYD batteries puts them at a greater competitive disadvantage. BYD can offer optimal cost structures for its own brands and leverage its battery technology to further consolidate its market position. For Xiaopeng and NIO, this means less flexibility in battery cost control, making it difficult to gain an advantage in price wars.

This can be evidenced during year-end promotions.

3. Is it unethical to use someone else's rice and still try to steal their job?

As the electric vehicle market matures, advancements in battery technology and cost control become increasingly important. Future competition will not only focus on who has the best battery technology but also on who can provide the most reasonable overall solutions. For emerging brands, choosing the right battery partner is crucial.

To better understand the impact of different battery supplier choices on automakers, let's refer to some practical cases:

Tesla initially collaborated with Panasonic to develop batteries, leveraging Panasonic's technological advantages and Tesla's design philosophy to advance electric vehicle development. This partnership significantly enhanced Tesla's performance and cost control capabilities. Later, Tesla diversified its battery supply chain, especially after deepening its presence in the Chinese market by partnering with CATL to more flexibly meet its high delivery demands.

Image/Tesla's Collaboration with CATL

Source/Screenshot from Internet & Renewable Energy Insights

Volkswagen chose to collaborate with Hefei Guoxuan High-tech Co., Ltd. to accelerate its electrification process in the Chinese market through the latter's battery technology expertise.

These cases demonstrate that choosing the right battery supplier is crucial for automakers' success. By partnering with specialized battery suppliers, automakers can not only receive technical support but also better navigate market competitions.

Xiaopeng and NIO's choice to use BYD Fudi batteries, while providing short-term technical support, may put them at a disadvantage in long-term competitions due to limitations in cost control and technological innovation.

As the electric vehicle market evolves, the choice of battery suppliers will become even more critical. Not just for Xiaopeng and NIO's new products or brands, but for all new energy automakers, finding battery suppliers that offer the best cost-benefit ratio and technical support will be key to maintaining competitiveness.

After all, in the battle for various price segments, they all have to contend with BYD, and to achieve significant growth, they must compete for BYD's market share.

Therefore, in the future, we may see more automakers seeking partnerships with specialized battery suppliers to navigate increasingly fierce market competitions. Meanwhile, with technological advancements, reducing battery costs will become possible, further reshaping the competitive landscape of the electric vehicle market.