Is Meituan the True Anchor for the Market?

![]() 08/29 2024

08/29 2024

![]() 478

478

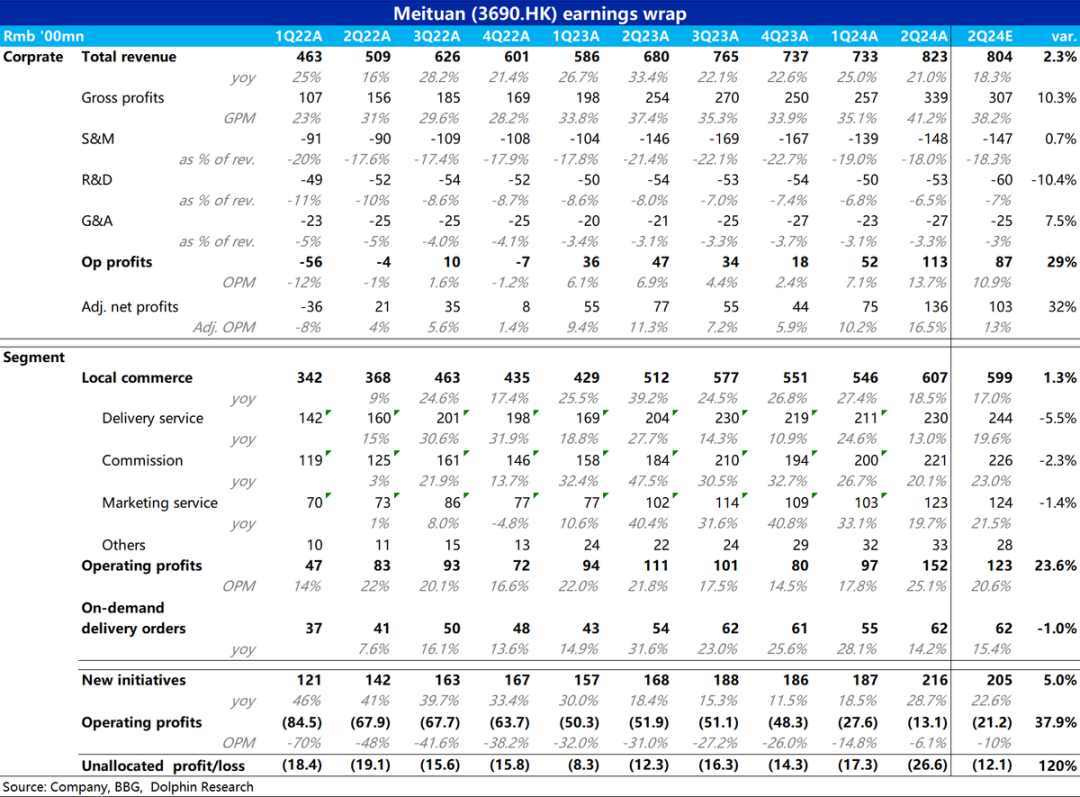

After the Hong Kong stock market closed on August 28, Meituan released its second-quarter financial report for 2024. Against the backdrop of widespread struggles in the broader consumer sector, Meituan's performance this quarter stood out, achieving both revenue and profit beats. Specifically:

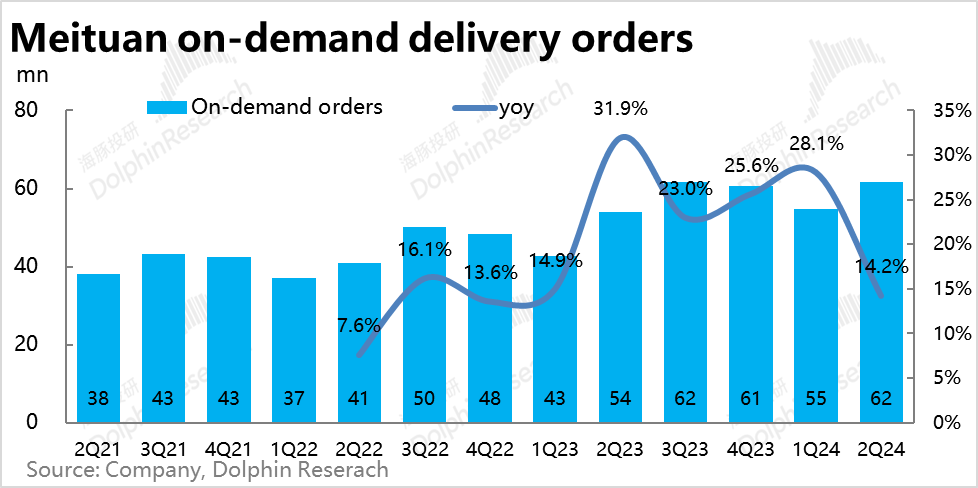

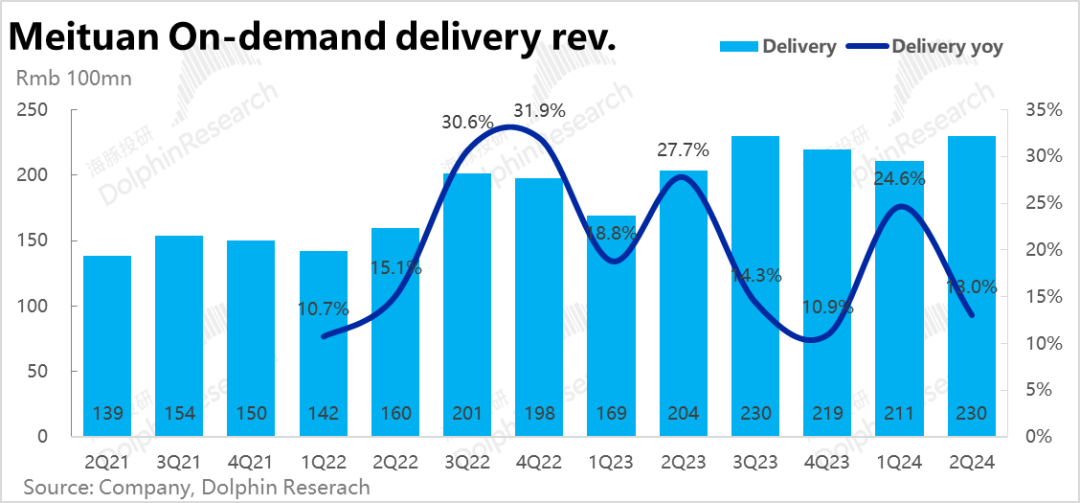

1. Steady growth in home delivery services: Mainly reflected in delivery data for home delivery services (food delivery + instant shopping). The total number of orders in this quarter was approximately 6.2 billion, representing a year-over-year increase of 14.2%, slightly meeting guidance and market expectations. Judging from the order growth rate, the growth in home delivery services was not exceptional. Similarly, the year-over-year growth rate in delivery revenue was 13%, without notable surprises. However, the gap between order growth and revenue growth has narrowed significantly to just 1.2 percentage points, suggesting that the average delivery revenue per order has stabilized. Dolphin IQ believes this could be due to reduced delivery fee discounts and subsidies or a weaker dilution effect from low-priced meal deals. Regardless of the reasons, it indicates potential improvement in Meituan's delivery unit economics.

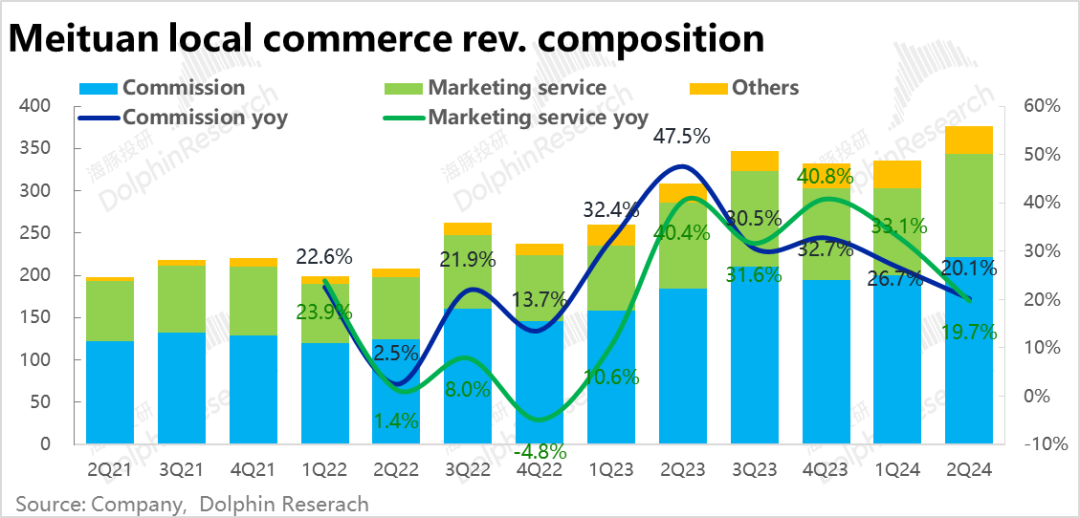

2. Strong growth in store visits, signaling a formal rapprochement with Douyin? Commission and advertising revenue, which better reflect the performance of store visit services, grew by 19.7% and 20.1% year-over-year, respectively. Compared to market expectations (with limited sample sizes and thus limited reference value), these revenue streams did not significantly outperform. However, what is the actual situation?

On the one hand, these revenue streams include slower-growing home delivery services (with an order growth rate of just 14.2%). Additionally, Meituan disclosed that the order growth rate for store visit services reached 60% this quarter. Even considering the impact of declining average prices, the actual GTV growth rate is likely to be higher than the guided range of 35% to 40%. Dolphin IQ believes that the revenue growth rate for store visit services can be confirmed to be higher than the guided 20% (potentially close to 30%), contributing significantly to the revenue beat this quarter.

Furthermore, considering the notable weakening in macroeconomic consumption conditions in the second quarter, with catering consumption growth slipping from 11% in the previous quarter to just 5%, and the cumulative growth rate of service retail sales declining from 10% at the end of March to 7.5% at the end of June, Meituan's ability to deliver slightly better-than-expected growth in store visit services amidst adverse industry trends indicates a potential easing of competition between Meituan and Douyin in this segment. A likely scenario is that both companies have shifted their focus to monetization.

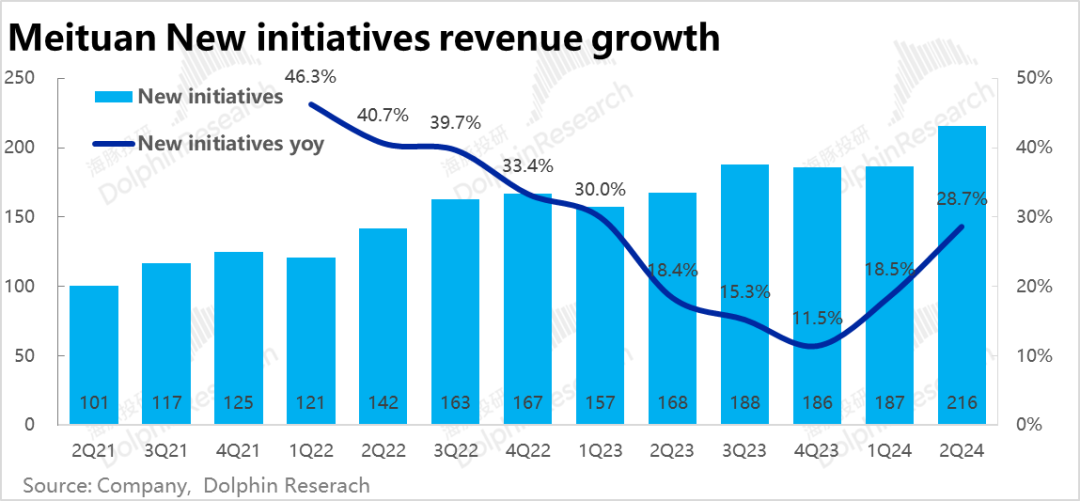

3. Accelerated growth in innovative businesses: Innovative businesses, centered on Meituan Select (community group buying) and Elephant Supermarket (self-operated dark stores), generated revenue of RMB 21.6 billion this quarter, representing a growth rate of nearly 29%, exceeding market expectations by approximately RMB 1.1 billion and significantly contributing to the revenue beat. Based on detailed revenue expectations, Dolphin IQ believes that the robust growth was likely driven primarily by the self-operated Elephant Supermarket, with the full recognition of revenue from self-operated businesses further amplifying revenue figures.

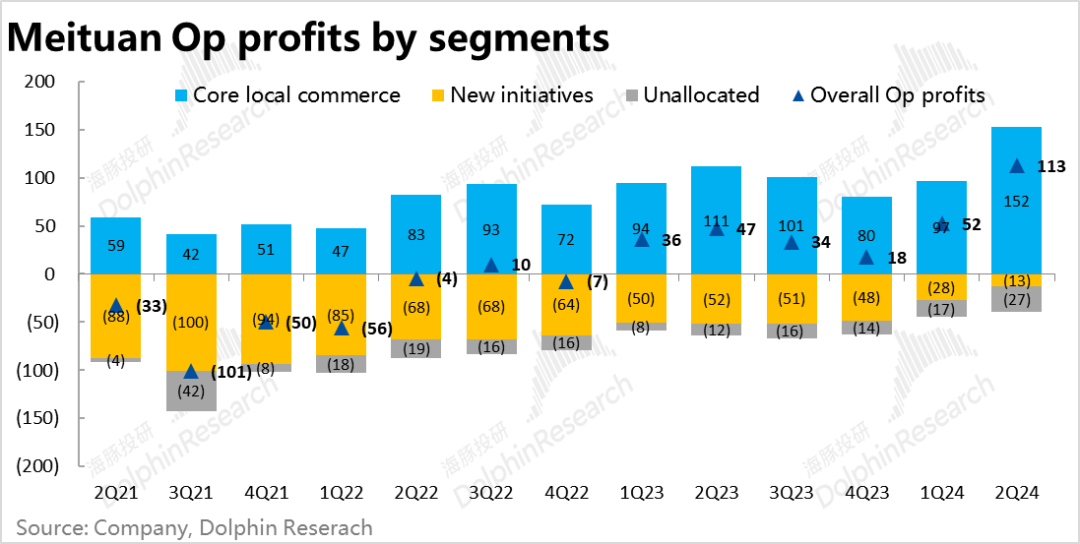

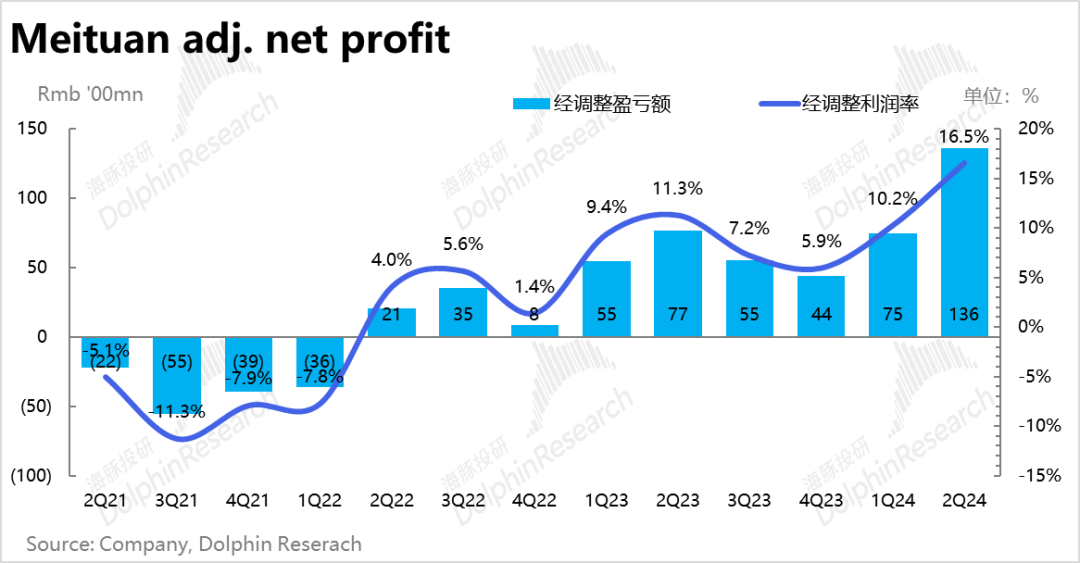

4. Loss reduction in new businesses and profit growth in core businesses: On the profitability front, while new businesses exceeded revenue expectations, their losses narrowed significantly quarter-over-quarter to just RMB 1.3 billion, notably less than the expected RMB 2.1 billion. At this pace, the annual loss for new businesses is likely to be significantly less than the guided figure of approximately RMB 10 billion.

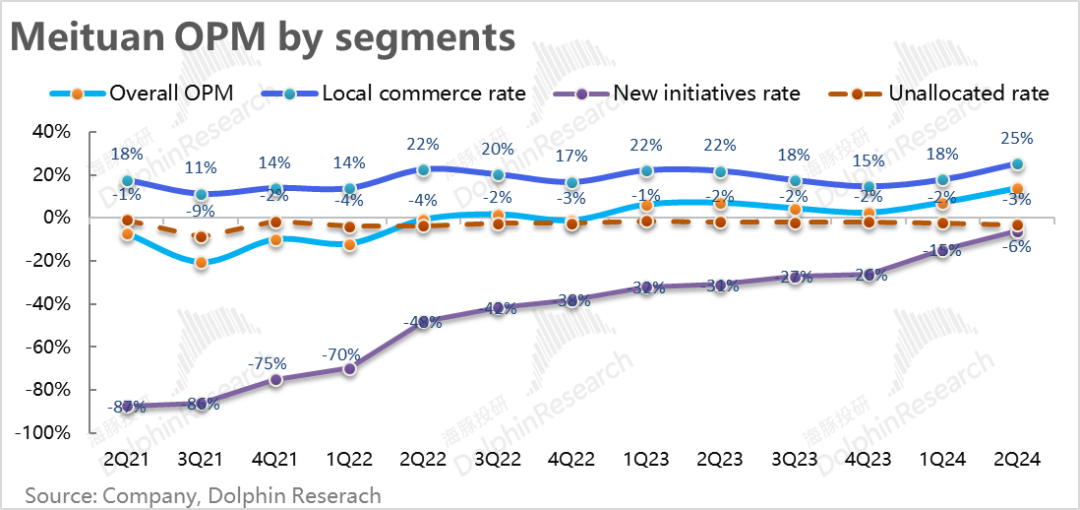

Beyond loss reduction in innovative businesses, the profit release from the core local commerce segment was also significantly better than expected, totaling RMB 15.2 billion, far exceeding the expected RMB 12.3 billion. The operating profit margin reached 25.1%, an increase of approximately 3.3 percentage points year-over-year, setting a new record high. Considering the previously mentioned revenue beat in store visit services and the stabilization of average delivery revenue per order, Dolphin IQ believes that improved unit economics in food delivery (narrower decline in average check size and maintained low delivery costs), coupled with reduced competition in store visit services, contributed to the notable improvement in profit levels for local commerce. The specific extent of profit margin improvements in each business segment will be discussed in subsequent management interactions.

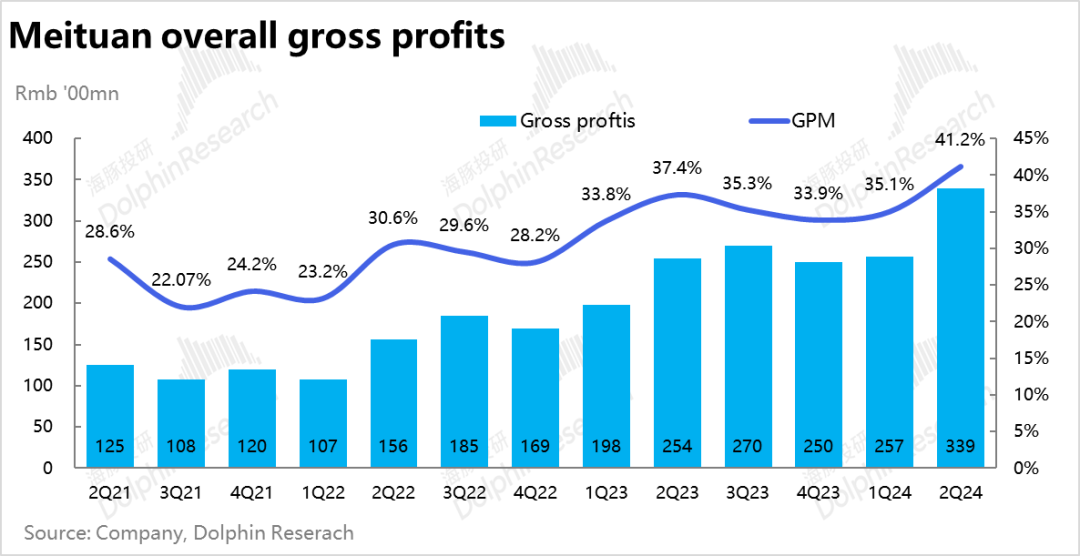

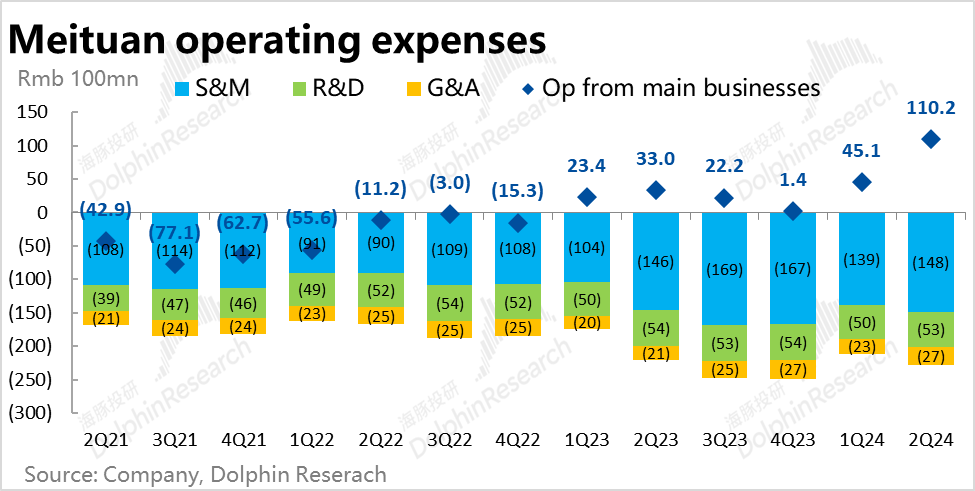

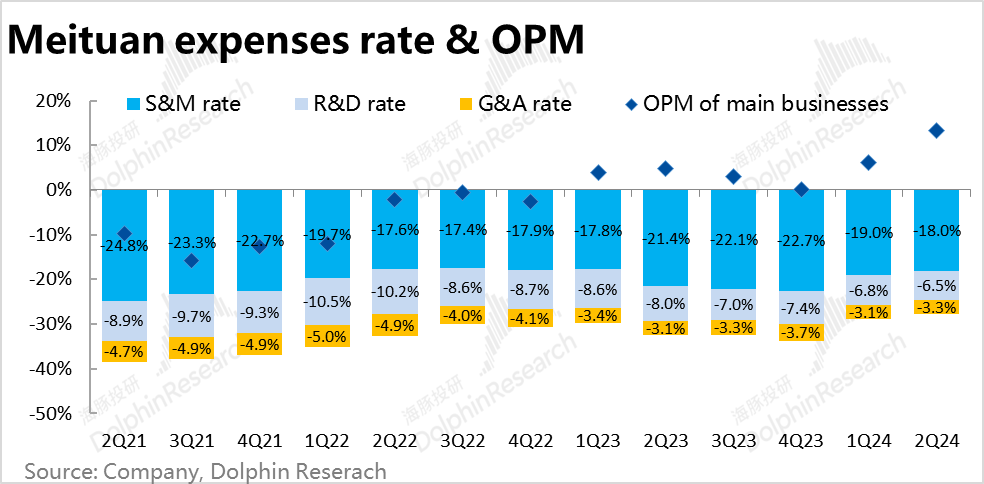

5. From a cost and expense perspective, the gross margin for this quarter reached 41.2%, an increase of 3.8 percentage points year-over-year. It is evident that the profit release was not solely driven by cost control but rather by genuine improvements in competitive dynamics and efficiency. In terms of expenses, the combined three operating expenses increased by 3% year-over-year, significantly lower than the revenue growth rate, indicating the company's cautious approach to expense investment, which also contributed to the profit release. Ultimately, thanks to the unexpected revenue growth and notable profit margin improvement, Meituan achieved an operating profit of RMB 11.3 billion this quarter, significantly exceeding the expected RMB 8.7 billion, resulting in a double beat on both the revenue and profit fronts.

Dolphin IQ Perspective:

In the context of nearly universal turbulence among e-commerce companies earlier and moderately strong domestic entertainment consumption reflected in Huazhu and Ctrip's results, Meituan's ability to deliver notable revenue and profit beats against the tide is undoubtedly commendable.

Beyond the financial figures, Dolphin IQ believes that several genuine trends in business changes have emerged:

1) Home delivery services (primarily food delivery, with some room for growth in instant shopping) are increasingly maturing, with limited overall growth and a largely stable industry landscape, making it difficult to significantly increase market share. Meituan may actively or passively de-emphasize growth. However, the current environment creates an advantage of abundant labor supply, allowing Meituan, as the dominant player, to squeeze out additional profits from food delivery unit economics through adjustments to delivery fees, commissions, or food delivery personnel incentives. Nevertheless, such improvements, absent significant technological breakthroughs (e.g., robot delivery), are unlikely to be sustainable in the long run. After squeezing out remaining profit margins, this segment should be viewed as gradually maturing.

2) Store visit services, which resumed growth last quarter but remained under profit pressure due to competition, likely announced a return to an operating profit margin of approximately 35%, similar to earlier levels. Combined with market research, this reflects a truce between Meituan and Douyin as both shift their focus from pursuing scale (i.e., GTV) to prioritizing profitability. While we cannot definitively state that this signals a permanent ceasefire in store visit services, it justifies raising profit expectations for this segment in the short to medium term.

3) Finally, the unexpected revenue growth and loss reduction in new businesses to some extent dispelled earlier market rumors that Douyin's reinvigorated investment in community group buying could hinder Meituan's progress in loss reduction for new businesses. Of course, based on Pinduoduo's previous earnings communication, the possibility of increased investment and renewed competition from Pinduoduo cannot be ruled out. Nevertheless, this quarter's results demonstrate Meituan's strong ability to control and optimize losses in new businesses without external pressure. In summary, Meituan's three major business segments are, to varying degrees, enjoying a sweet spot of marginal improvement in the medium term.

Detailed Financial Report Commentary Follows

I. Steady Growth in Home Delivery Services: Approaching Maturity?

Primarily reflected in delivery business data for home delivery services (food delivery and instant shopping), the total number of orders in the second quarter was approximately 6.2 billion, representing a year-over-year increase of 14.2%, narrowly meeting company guidance and market expectations. This initially suggests that, given the high base from last year, home delivery services did not perform exceptionally well this quarter.

In terms of revenue, Meituan's year-over-year growth rate in delivery revenue was 13%, slightly lower than the order growth rate but with a significantly narrowed gap of just 1.2 percentage points. The year-over-year decline in average delivery revenue per order, calculated simply as delivery revenue divided by the number of orders, also narrowed to 1 percentage point (note: this figure is influenced by different recognition standards for delivery revenue across different business models). The stabilization of average delivery revenue per order can be attributed to several factors: 1) reduced delivery fee discounts and subsidies, 2) a weaker dilution effect from the expansion of low-priced meal deals, and 3) an increase in the proportion of instant shopping or Meituan's self-operated delivery services.

Furthermore, the stabilization of average delivery revenue per order, coupled with likely low delivery costs due to abundant labor supply, indicates potential improvement in Meituan's unit economics for delivery services.

II. Strong Growth in Store Visit Services: Formal Truce with Douyin?

Focusing on commission and advertising revenue, which better reflect the performance of store visit services, these revenue streams grew by 19.7% and 20.1% year-over-year, respectively, ending the previous trend of advertisement growth significantly outpacing commission growth. So, how do these revenue growth rates compare?

Based on Meituan's previous guidance, the expected revenue growth rate for store visit services was approximately slightly above 20%, while market expectations (with limited sample sizes) suggest actual performance was marginally below expectations. At first glance, this does not seem particularly impressive.

However, considering that these revenue streams also include the drag from slower-growing home delivery services (with an order growth rate of just 14.2%) and that Meituan disclosed an order growth rate of 60% for store visit services, the ultimate GTV growth rate is likely to exceed the expected range of 35% to 40%, despite the impact of declining average prices. Therefore, the revenue growth rate for store visit services is higher than guidance.

Furthermore, considering the notable weakening in macroeconomic consumption conditions in the second quarter, with catering consumption growth slipping from 11% in the previous quarter to just 5% and the cumulative growth rate of service retail sales declining from 10% at the end of March to 7.5% at the end of June, Meituan's ability to deliver slightly better-than-expected growth in store visit services amidst adverse industry trends clearly indicates a potential easing of competition between Meituan and Douyin in this segment. A likely scenario is that both companies have shifted their focus to monetization rather than market share grab.

III. Revenue Beat for Innovative Businesses

Beyond the core home delivery and store visit services, innovative businesses centered on Meituan Select (community group buying), Elephant Supermarket (self-operated dark stores), as well as bike-sharing and ride-hailing, generated revenue of RMB 21.6 billion this quarter, representing a growth rate of nearly 29%, exceeding market expectations by approximately RMB 1.1 billion and significantly contributing to the revenue beat.

Based on detailed revenue expectations, Dolphin IQ believes that the robust growth was primarily driven by the self-operated Elephant Supermarket, with the full recognition of revenue from self-operated businesses further amplifying revenue figures.

IV. Loss Reduction in New Businesses and Profit Growth in Core Businesses: A Winning Combination

On the profitability front, while new businesses exceeded revenue expectations, their losses narrowed significantly quarter-over-quarter to just RMB 1.3 billion, notably less than the expected RMB 2.1 billion. At this pace, the annual loss for new businesses is likely to be significantly less than the guided figure of approximately RMB 10 billion.

Beyond loss reduction in innovative businesses, the profit release from the core local commerce segment was also significantly better than expected, totaling RMB 15.2 billion, far exceeding the expected RMB 12.3 billion. The operating profit margin for local commerce reached 25.1%, an increase of approximately 3.3 percentage points year-over-year, setting a new record high.

Considering the previously mentioned revenue beat in store visit services and the stabilization of average delivery revenue per order, Dolphin IQ believes that improved unit economics in food delivery (narrower decline in average check size and maintained low delivery costs), coupled with reduced competition in store visit services, contributed to the notable improvement in profit levels, exceeding expectations. The specific extent of profit margin improvements in each segment and the actual improvement rates will be discussed in subsequent management interactions.

From a cost and expense perspective, Meituan's gross profit reached RMB 33.9 billion in this quarter, with a gross margin of 41.2%, an increase of 3.8 percentage points year-over-year. This demonstrates that the profit release was not solely driven by cost control but rather by genuine improvements in competitive dynamics and efficiency.

In terms of expenses, marketing expenses increased slightly by 2% year-over-year, while research and development expenses continued to narrow on a year-over-year basis. Administrative expenses increased notably by 26% year-over-year, likely due to the expansion into overseas markets. Overall, the combined three operating expenses increased by 3% year-over-year, significantly lower than revenue growth, indicating the company's cautious approach to expense investment, which also contributed to the profit release.

Ultimately, thanks primarily to unexpected revenue growth and notable profit margin improvement, Meituan achieved an operating profit of RMB 11.3 billion this quarter, significantly exceeding the expected RMB 8.7 billion, resulting in a double beat on both the revenue and profit fronts.

- END -

// Reprint authorization

This article is an original article of Dolphin Investment Research. If you need to reprint it, please obtain authorization.