NVIDIA: AI Faith Collapsing, Will Its Secret Sauce Become Poison?

![]() 08/29 2024

08/29 2024

![]() 659

659

NVIDIA (NVDA.O) released its fiscal second-quarter 2025 earnings (ending July 2024) after market close on August 29, Beijing time:

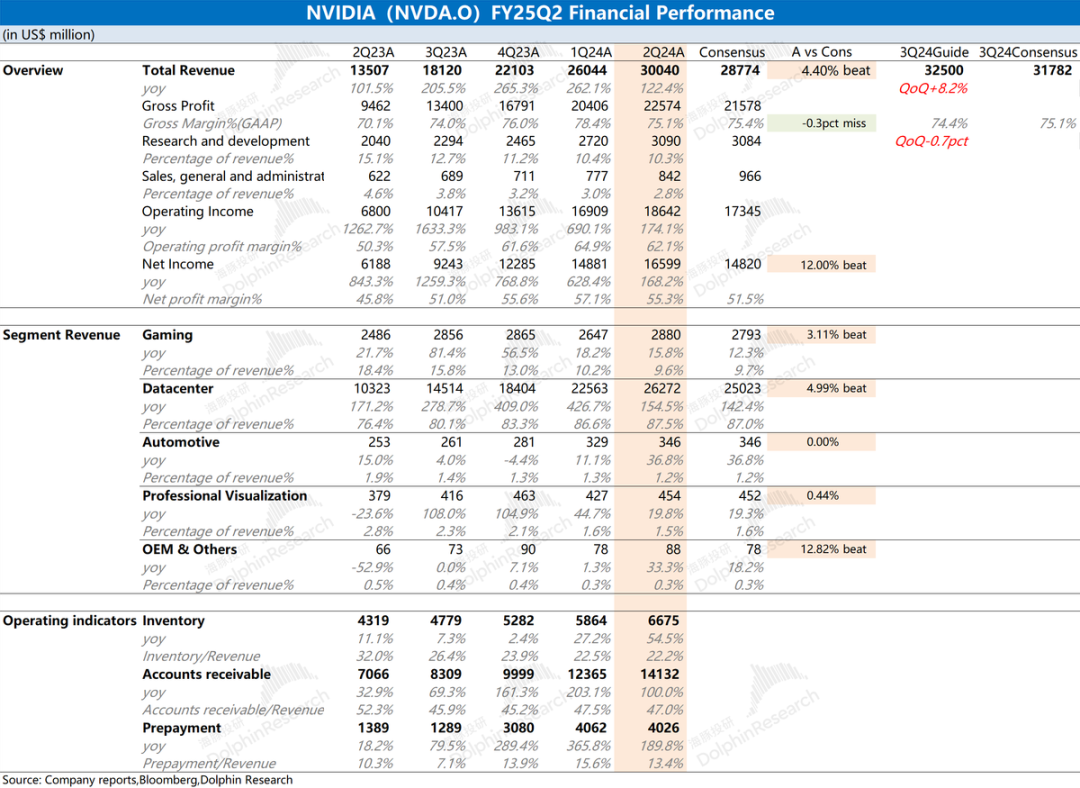

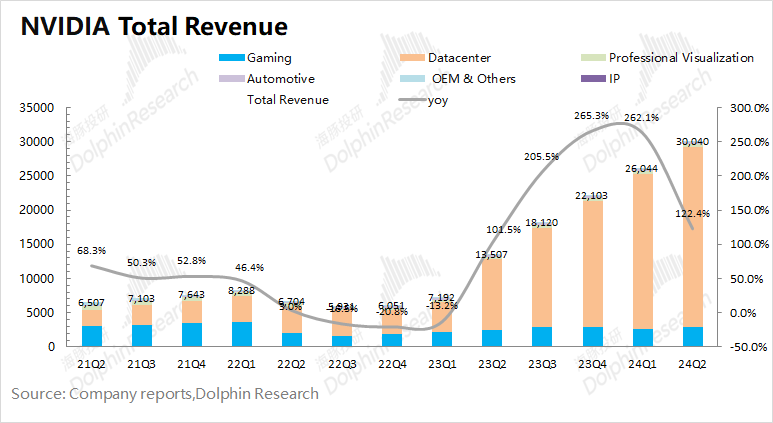

1. Overall performance: Revenue growth slows, gross margin declines. This quarter, NVIDIA generated revenue of $30.04 billion, up 122.4% YoY, slightly above market expectations ($28.8 billion). Gross margin (GAAP) was 75.1%, lower than market expectations (75.4%) due to negative impacts like material inventory build-up. Net income was $16.6 billion, up 168% YoY, setting a new profit high but with decelerating growth.

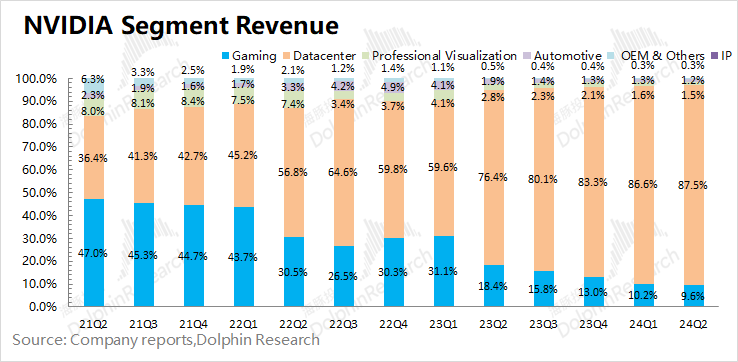

2. Core business performance: Datacenter is the primary driver. Datacenter revenue accounted for 87.5% of total revenue, making it the company's core business.

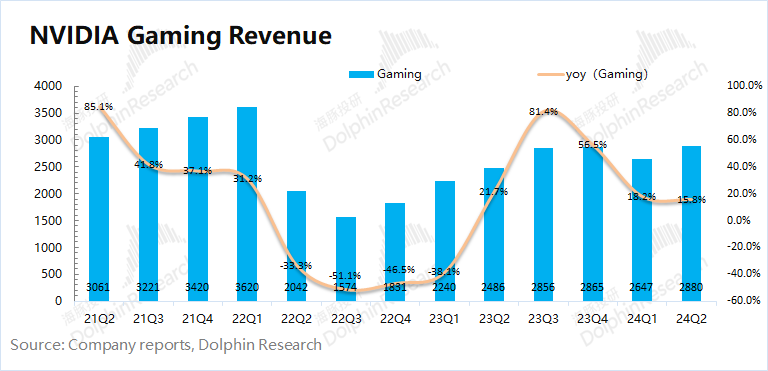

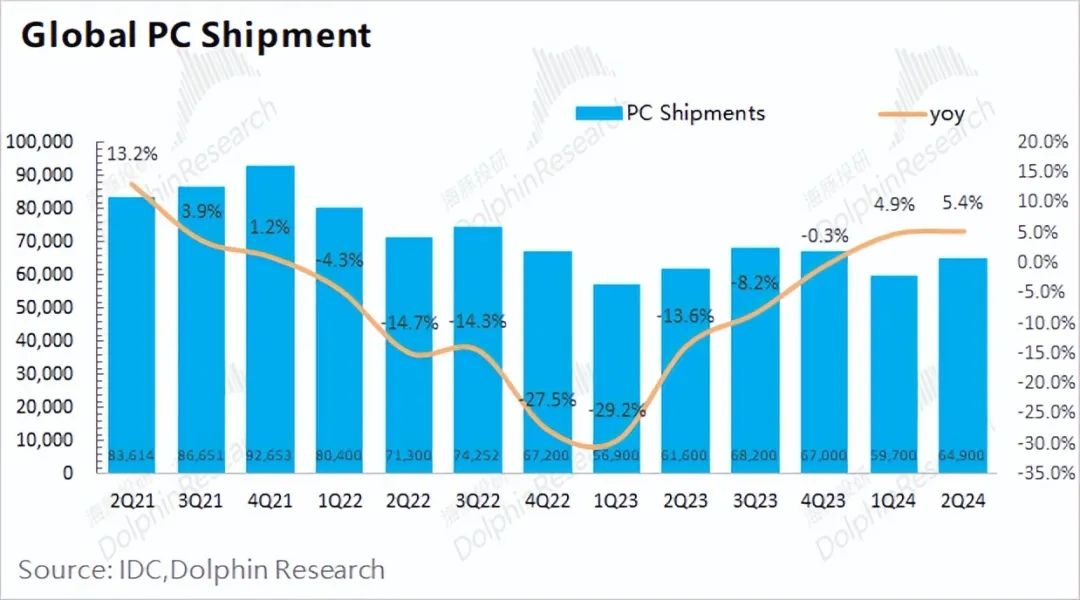

1) Gaming revenue grew 15.8% YoY, continuing its recovery. Dolphin Insights believes this growth was fueled by the PC industry's recovery and increased GPU market share. Global PC shipments rebounded to 64.9 million units this quarter, showing signs of improvement.

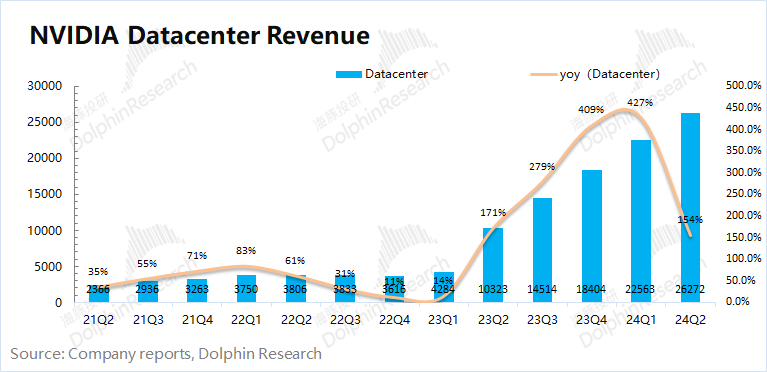

2) Datacenter revenue surged 155% YoY, driven by demand for large language models, recommendation engines, and generative AI. Growth benefited from increased capital expenditures by cloud service providers, but revenue growth started to slow this quarter.

3. Key financial metrics: Expense ratio remains low. NVIDIA's operating expense ratio fell further to 13.1% this quarter, as revenue growth offset expense increases. Inventory levels are still historically low, indicating strong product demand.

4. Next-quarter guidance: NVIDIA expects Q3 FY2025 revenue of $32.5 billion (plus or minus 2%), up 79.4% YoY, slightly above market expectations ($31.8 billion). Gross margin is projected at 74.4% (plus or minus 0.5%), below market expectations (75.1%).

Dolphin Insights' Overall View:

NVIDIA's Q2 FY2025 results were decent, with both revenue and profit exceeding expectations. However, the next-quarter guidance did not significantly surpass market expectations. While revenue was slightly above forecasts, gross margin continued to decline, notably below market projections. Gross margin will remain under pressure in H2 due to negative impacts like material inventory build-up.

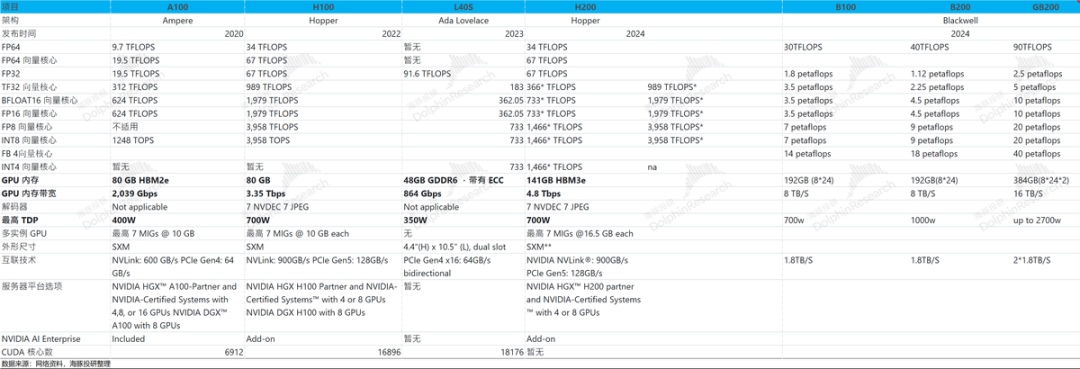

Regarding Blackwell, production design started in Q2, but NVIDIA aims to redesign some photomasks to enhance stability. Mass production is expected in Q4.

Considering cloud service providers' increasing capital expenditures, NVIDIA's datacenter and AI businesses are expected to continue growing. Popular games like Black Myth: Wukong may boost gaming revenue. Revenue growth is likely to persist, but gross margin risks further decline.

Investment-wise, while NVIDIA's growth persists, the pace has slowed. The stock already reflects high market expectations. The decelerating growth and Blackwell redesign may shake market confidence. Based on NVIDIA's performance and market conditions, Dolphin Insights estimates a PE ratio of around 45x for FY2025. Further operational adjustments could pressure the stock.

Detailed Analysis Follows

I. Core Performance Metrics: Slowing Revenue Growth, Declining Gross Margin

1.1 Revenue:

NVIDIA generated $30.04 billion in revenue in Q2 FY2025, up 122.4% YoY, exceeding market expectations ($28.8 billion). Revenue growth was fueled by datacenter and gaming businesses.

For Q3 FY2025, NVIDIA expects revenue of $32.5 billion (plus or minus 2%), up 79.4% YoY, slightly above market expectations ($31.8 billion). Growth will mainly come from the datacenter business. Blackwell's mass production in Q4 could add incremental revenue.

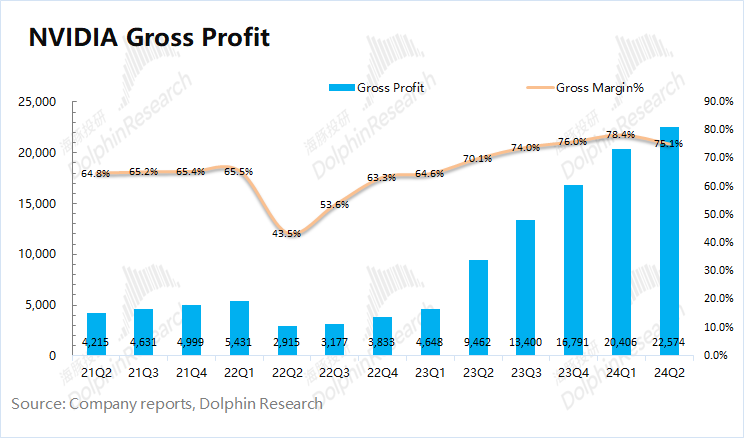

1.2 Gross Margin (GAAP):

NVIDIA's Q2 FY2025 gross margin (GAAP) was 75.1%, below market expectations (75.4%). Gross margin was impacted by low-volume Blackwell material inventory build-up.

The datacenter business's strong growth has lifted gross margin. AI products have higher gross margins, and market demand outstrips supply, raising prices. Sustaining high gross margins will require market validation.

NVIDIA expects a Q3 FY2025 gross margin of 74.4% (plus or minus 0.5%), below market projections (75.1%). Driven by AI demand, gross margin has risen from 65% to over 70%. However, gross margin will remain under pressure due to factors like material costs.

1.3 Operating Metrics

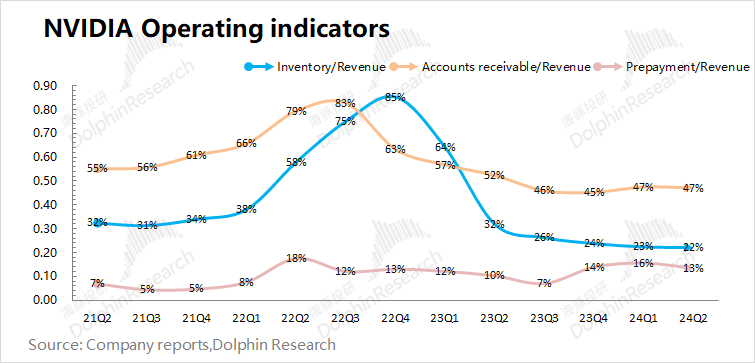

1) Inventory-to-Revenue Ratio: 22% this quarter, down 1pct MoM. Despite inventory rising to $6.7 billion, the ratio remains historically low compared to high revenue growth. Supply still lags demand, supporting high gross margins.

2) Accounts Receivable-to-Revenue Ratio: 47% this quarter, stable. The low ratio indicates good collection performance.

II. Core Business Performance: Datacenter as the Primary Driver

Driven by AI demand, NVIDIA's datacenter revenue share expanded to 87.5% in Q2 FY2025, squeezing gaming's share below 10%. The datacenter business significantly impacts NVIDIA's performance.

2.1 Datacenter Business:

NVIDIA's datacenter revenue was $26.3 billion in Q2 FY2025, up 154% YoY, a new high fueled by demand for the Hopper GPU computing platform for large language models, recommendation engines, and generative AI applications.

By segment: Computing revenue was $22.6 billion, up 162% YoY; Networking revenue was $3.7 billion, up 114% YoY, driven by AI revenue from InfiniBand and Ethernet.

Cloud service providers account for about 45% of datacenter revenue. Their capital expenditures directly impact NVIDIA's datacenter business. Meta, Google, Microsoft, and Amazon's combined capital expenditures reached $58.3 billion this quarter, up 70% YoY, with Microsoft's QoQ growth exceeding 30%. These increases support NVIDIA's datacenter growth.

Based on NVIDIA's Q3 FY2025 revenue guidance of $32.5 billion, Dolphin Insights believes growth will mainly come from the datacenter business, with cloud providers' annual capital expenditure plans revised upwards this quarter. Blackwell shipments in Q4 could add incremental revenue.

Blackwell Progress: NVIDIA delivered Blackwell architecture samples to customers in Q2. Mass production is expected to start in Q4 and continue into FY2026, with Q4 Blackwell revenue projected in the billions.

2.2 Gaming Business:

NVIDIA's gaming revenue was $2.88 billion in Q2 FY2025, up 15.8% YoY, driven by GeForce RTX 40 series GPU and gaming console SOC sales. Gaming GPU recovery outpaced the overall PC market, with NVIDIA regaining GPU market share.

The PC market's overall shipment recovery also contributed to gaming revenue growth. According to IDC, global PC shipments reached 64.9 million units in Q2 2024, up 5.4% YoY. With the PC market improving, NVIDIA's gaming business benefited.

2.3 Automotive Business:

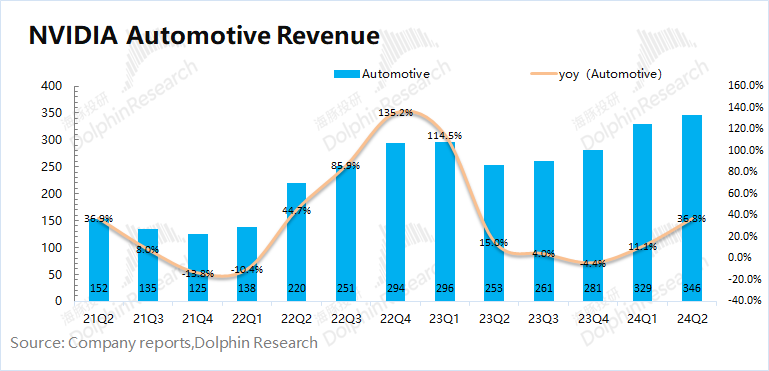

NVIDIA's automotive revenue was $346 million in Q2 FY2025, up 36.8% YoY, driven by AI Cockpit solutions and autonomous driving platforms. While revenue grew, the automotive business's share remains small (less than 2%). NVIDIA's performance is still primarily driven by datacenter and gaming.

III. Key Financial Metrics: Falling Expense Ratio

3.1 Operating Margin

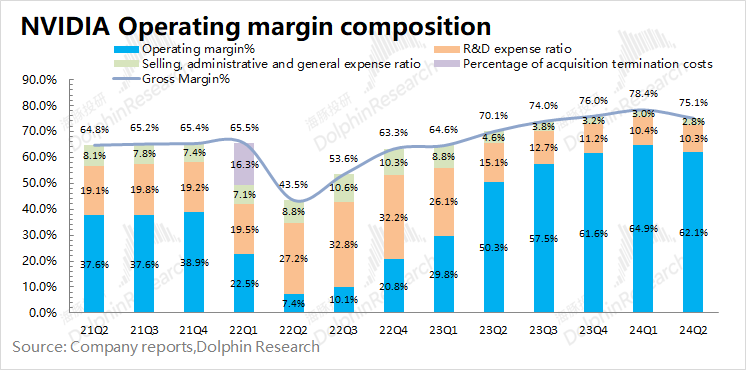

NVIDIA's Q2 FY2025 operating margin was 62.1%, down due to lower gross margin. Operating margin changes reflect: "Operating Margin = Gross Margin - R&D Expense Ratio - Selling, General, and Administrative Expense Ratio"

1) Gross Margin: 75.1% this quarter, down 3.3pct MoM, impacted by material inventory build-up.

2) R&D Expense Ratio: 10.3% this quarter, down 0.1pct MoM. Absolute R&D spending increased, but the ratio fell due to revenue growth.

3) Selling, General, and Administrative Expense Ratio: 2.8% this quarter, down 0.2pct MoM. Absolute expenses rose, but the ratio remains low.

NVIDIA's Q3 FY2025 operating expense guidance increased to $4.3 billion, but the expense ratio is expected to fall further to around 13.2% due to revenue growth.

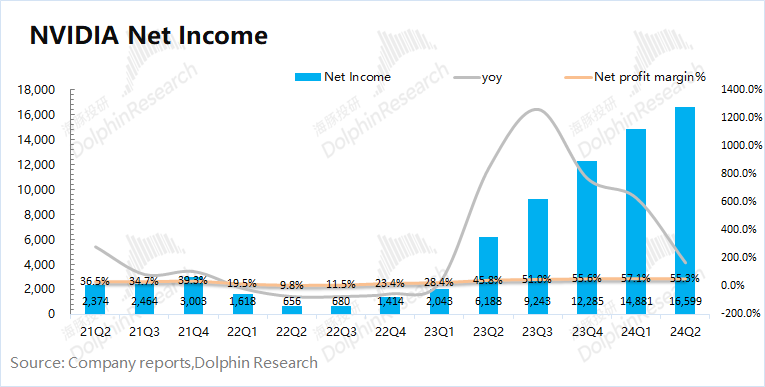

3.2 Net Income (GAAP) Margin

NVIDIA's Q2 FY2025 net income was $16.6 billion, up significantly YoY. Net margin was 55.3%, down QoQ. While revenue and expense ratios improved, gross margin fell more, dragging down net margin.