OPPO falls behind, AI hard to save

![]() 08/29 2024

08/29 2024

![]() 628

628

OPPO once fell from first to sixth, suffering a "Waterloo" as the industry recovers! Betting on AI technology, OPPO desires to regain its glory, but the reality is grim. Without proactive responses, AI may not help OPPO return to the top, and its future path is full of uncertainties.

In the past two years, the mobile phone industry has embarked on a new cycle of upgrades, and the entire market has begun to recover, with shipments of various manufacturers experiencing qualitative growth. However, OPPO, which has long been a market leader, is far from happy.

According to data from multiple authoritative research institutions both domestically and internationally, OPPO's market share and shipments have declined significantly both domestically and internationally, failing to benefit from this round of industry growth.

In fact, OPPO's struggles extend beyond market competition. The company's internal business layout has also been mired in frustrating situations. Whether it's the heavily promoted chips, the subsequent XR products, or foldable phones, these high-tech businesses have either been completely halted or temporarily shelved, reflecting the company's indecisiveness in strategic planning.

OPPO is fully committed to entering the AI field, seeking to leverage this revolutionary technology to rebuild its competitiveness in the mobile phone industry. However, under the triple pressures of the market environment, competitors, and internal challenges, OPPO faces formidable challenges in regaining its former glory.

Part.1

Massive sales decline, "leader" status at risk

In terms of sales alone, the signs of OPPO's decline were already evident.

According to IDC reports, OPPO's global mobile phone shipments in 2023 were 103.1 million units, with a market share of 8.8%, a year-on-year decrease of 9.9%, ranking fourth globally. However, in terms of quarters, OPPO fell out of the top five in both the second and fourth quarters.

In fact, the market share gap between the fourth, fifth, and sixth places in the global market is not significant. However, starting from the fourth quarter of last year, OPPO experienced declines in both shipments and market share.

According to a report published by market research firm TechInsights, Samsung topped the list with nearly 19% of shipments in the second quarter of 2024, followed by Apple with 15% market share. Xiaomi, vivo, and Transsion followed, with OPPO (including OnePlus) ranking behind them.

Among these mobile phone manufacturers, OPPO was the only one with declining shipments. According to TechInsights, OPPO and OnePlus combined shipped 25 million mobile phones globally, down 8% year-on-year, making OPPO the only brand among the top ten in the second quarter to experience an annual decline. This also marked the 11th consecutive quarter of annual decline for OPPO.

Even domestically, OPPO's performance was lackluster.

According to IDC's quarterly tracking report on China's smartphone market, OPPO held a steady first place in China's mobile phone market with a 19.6% market share in the first quarter of 2023. However, it slipped to 17.7% in the second quarter, 16.2% in the third quarter, and rebounded slightly to 16.7% in the fourth quarter. But as of 2024, OPPO's decline became more apparent.

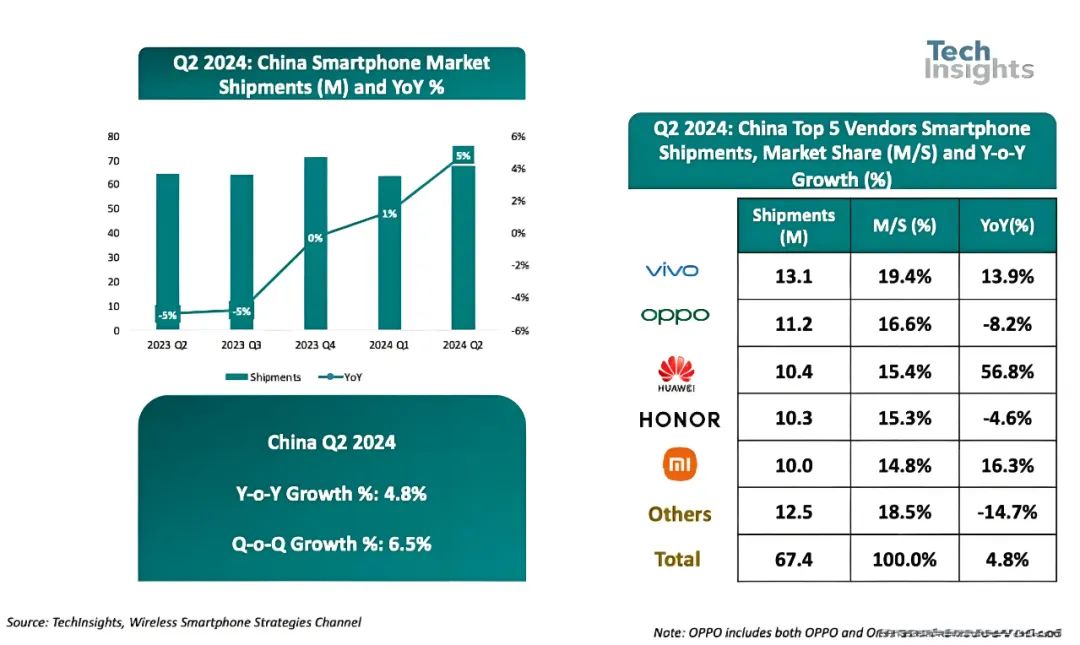

According to TechInsights, China's smartphone shipments grew by 5% year-on-year in the second quarter of 2024, with vivo leading the market with 19% of shipments, followed by OPPO (including OnePlus), Huawei, Honor, and Xiaomi.

However, a key point is that OPPO's shipments in the second quarter were 11.2 million units, down 8% year-on-year, marking the fourth consecutive quarter of negative growth. And TechInsights' statistics are based on shipments. If sales figures were used instead, OPPO's domestic market ranking would have declined even further.

According to Counterpoint data, China's smartphone sales grew by 6% year-on-year in the second quarter of 2024, with vivo, Apple, Huawei, and Xiaomi ranking in the top four market shares. OPPO's market share was only 14.6%, falling from first to sixth place in just one year.

It is worth mentioning that the global smartphone shipment trend has maintained a recovery trend for three consecutive quarters. In this context, OPPO's market share is being increasingly squeezed, and the company is gradually being marginalized.

Part.2

Held hostage by dealers, strategic indecisiveness

Despite the continuous decline in market share, OPPO has never been a company that wants to give up.

In addition to its long-term focus on imaging, OPPO made a commitment to self-develop chips in 2019, initiated channel reforms in 2020, and later invested heavily in XR and IoT. OPPO is eager to make changes.

However, the results have often been disappointing. After four years of chip development, OPPO announced the closure of ZEKU and the dissolution of its R&D team in 2023, bringing an end to its chip-making journey.

OPPO's strategic approach to IoT was merely to proceed with the development of related hardware products without targeted strategic deployment, resulting in missed opportunities for IoT development. Today, IoT business has faded from OPPO's core focus, with personnel optimization and bonus cuts in the IoT business group, and rumors of layoffs in the TV business line.

From an internal perspective, OPPO's failed business reforms are also related to its strong-willed dealers.

Strong channel ties are essential to OPPO's survival. Dealers are a core component of OPPO and hold significant shares in the company, giving them considerable influence. This means that dealers have a high degree of influence in setting company strategies and product decisions, serving as both judges and contestants.

As the mobile phone supply chain becomes more transparent, OPPO faces an internal contradiction: if it does not elevate its brand and move towards high-end models, it will be caught between two fronts. However, dealers prioritize profit, preferring to sell the most profitable models. Consequently, investments in R&D can affect short-term profits, which dealers often lack patience for.

As a result, reforms that have been invested in for a long time but do not generate profits often do not last long within OPPO. The sudden dissolution of ZEKU and the gradual decline of IoT are examples of this. For OPPO, cutting its self-developed chip business means losing a growth point in its high-end product market. If mid-to-high-end products and IoT products perform poorly, dealer profits will shrink, and the main company will need to subsidize them due to strong dependencies, thereby reducing funding for new product R&D.

Dealers who do not see product improvements or increased SKUs tend to blame reform failures, which, in turn, require dealer support. This creates a negative feedback loop. Behind the strategic indecisiveness, OPPO misses critical windows of opportunity.

Regarding this, an industry insider said, "The ups and downs of many of OPPO's businesses reflect its aggressive strategic decisions, giving the impression of using a business logic approach. If something is profitable, they do it; if not, they cut it."

Frankly, OPPO's product capabilities and commitment are commendable across imaging, chips, TVs, headphones, and other IoT products. However, when the main company wants to push a business, it first needs to figure out how to avoid losses, often requiring consultations with major agents for their opinions. Without market momentum to sell new products, new businesses struggle to gain traction.

However, a long drought has finally brought relief. As the biggest change in the past five to ten years, AI phones will usher in a new replacement cycle, spurring industry reshuffling. OPPO has halted traditional smartphone projects and embraced the ALL in AI slogan, aiming to reclaim its industry leadership.

Part.3

Seeking solutions in AI, a long road to breakthrough

Compared to phones from three or four years ago, there has been no significant improvement in performance across major brands. No matter how much manufacturers boast, there are no secrets in technology innovation, so everyone is on the same level.

Most people replace their phones not because they seek better products but because their old phones can no longer handle increasingly bloated apps. Except for Apple, user loyalty to other phone brands is low, leading to endless internal competition within the industry. Choosing a phone becomes simple: among similar parameters, the cheaper option wins.

Thus, the integration of AI and phones has become the industry's breakthrough. Companies are actively preparing for this. The same is true for OPPO, which has focused more on AI phones than previous projects, deeply integrating internal resources to tackle the market.

From a market perspective, AI phone penetration is expected to challenge the critical 10% threshold from the second half of this year to the first half of next year. If the hypothesis of interactive innovation is validated, AI phone penetration is projected to reach 50% within three years.

On paper, it seems that all mainstream phone manufacturers will actively embrace this change, starting from the same starting line. Each brand has launched its own edge AI model with comparable parameters and supporting operating systems. A commonality is that all Android manufacturers focus on enabling capabilities.

Taking the OPPO Find X7 series as an example, it was launched with AI call summaries, image erasure, and a new AI assistant as key selling points. OPPO described it as "tasting AI," but most consumers prioritize phone heating and battery life when making purchases. Essentially, current AI is not very appealing.

Additionally, the popularization and application of AI technology require a mature ecosystem as support. While OPPO has invested heavily in AI technology, its ecosystem development lags behind. Compared to companies with robust ecosystems like Apple, Xiaomi, and Huawei, OPPO's AI services and applications lag in user experience and market influence. This ecosystem weakness makes OPPO's AI advantages less pronounced, making it difficult to form strong market competitiveness in a short time.

For OPPO to achieve rapid breakthroughs in AI, it needs to create a landmark event similar to the "iPhone moment" to differentiate itself from competitors. However, the reality is that neither the market nor competitors will give OPPO the time and opportunity to do so.

In the fiercely competitive market environment, every phone manufacturer is actively deploying AI technology to seize market opportunities. For OPPO to stand out, it must not only make technical breakthroughs but also innovate in market strategies and user experiences.

The global smartphone market is slightly recovering, but competition remains fierce! Excess capacity and differentiation challenges trap all phone manufacturers. As an industry "lifesaver," AI phones will undoubtedly bring significant traffic to manufacturers. However, considering the complexity of the market environment and OPPO's difficult situation, its path to regaining popularity is bound to be thorny, with an uncertain outlook.