Ma Yun's Most Reluctant A-share Company

![]() 08/29 2024

08/29 2024

![]() 586

586

Author: Poetry and Starry Sky

ID: SingingUnderStars

In 2014, Ma Yun spent 3.3 billion yuan acquiring a 20.62% stake in the A-share listed company Hengsheng Electronics, becoming the company's actual controller.

Hengsheng Electronics is a To B enterprise, with financial institutions as its primary B-end customers. According to incomplete statistics, the company has a significant market share in the financial industry, including 125 securities clients (47%), 102 public funds (85%), 132 insurance companies (89%), 241 banks (75%), 63 trusts (85%), and 126 futures companies (30%).

Therefore, Ma Yun's actual control of Hengsheng Electronics caused a stir in the financial industry at the time.

Many people believed that Ma Yun coveted the industry's big data. However, Poetry and Starry Sky believes this was Alibaba's move to complete its financial ecosystem.

Since the Alipay era, Alibaba has been interacting with banks, even bypassing UnionPay to establish interconnections with each bank (later absorbed by the Network Payment and Clearing Association), and further connecting with securities companies during the Yu'ebao era.

As Alibaba's business expanded, so did Ma Yun's ambitions. He aimed to build infrastructure for the financial industry and integrate Alibaba (Ant Group) into this vast sector.

Of course, everyone knows the outcome.

In January 2023, equity changes occurred at Ant Group, with Ma Yun stepping down as the actual controller. Ant Group became an enterprise without an actual controller, and so did Hengsheng Electronics.

Nonetheless, Ma Yun still wields influence over Ant Group and, consequently, Hengsheng Electronics.

01

Sudden Drop in Performance

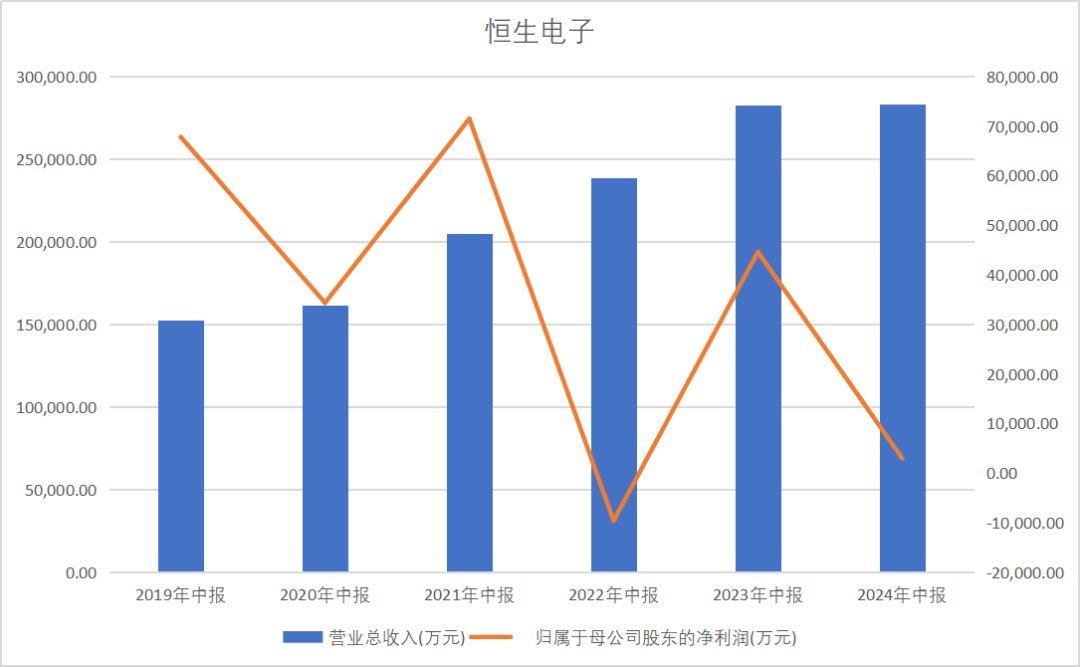

The mid-year report revealed that Hengsheng Electronics' revenue for the first half of 2024 was approximately 2.836 billion yuan, a 0.32% YoY increase. Net profit attributable to shareholders of listed companies was about 29.89 million yuan, a 93.30% YoY decrease. Non-recurring profit and loss-adjusted net profit attributable to shareholders of listed companies was approximately 136 million yuan, a 48.81% YoY decrease.

Data Source: iFind; Chart: Poetry and Starry Sky

This is a disappointing performance.

As an infrastructure enterprise in the financial industry, Hengsheng Electronics has been affected by the shrinking financial sector over the past two years.

The company stated in its mid-year report that the deep-seated contradictions accumulated in the capital market over a long period are still being addressed, and risks that emerged earlier have not been fully resolved. This means that the development of the capital market may still undergo significant transitions, and current challenges and pressures continue to mount.

Financial institutions' technology investments are influenced by both revenue performance and the proportion of technology investments in revenue. Due to overall pressure on the securities and fund industries' revenues, along with increasing regulatory and compliance requirements, new business needs are still emerging among financial institutions. As a result, information technology budgets have decreased significantly or even negatively.

Additionally, the company's non-recurring profit and loss were approximately -106 million yuan, primarily due to a significant YoY decrease in the fair value change gains of financial assets held by the company.

It's important to note that this is not unique to Hengsheng Electronics. Over the past two years, similar situations have arisen among B-end and G-end customers, leading to tighter budgets not only for information technology but also for non-essential expenses like advertising, significantly impacting the IT and advertising industries.

This is partly because industries have discovered that they can survive with defensive strategies, avoiding unnecessary technology upgrades and advertising expenses.

This has resulted in sluggish B-end consumption, affecting the development of small and medium-sized enterprises that rely on it.

The government has recognized this issue, first proposing equipment upgrades and subsequently introducing policies to promote cultural communication.

For the financial industry, equipment upgrades are closely tied to Alibaba: cloud migration (Alibaba Cloud) and software iterations (Hengsheng Electronics).

02

Financial Information Technology Innovation

Poetry and Starry Sky has advocated for information technology innovation for several years, and it is now gaining momentum.

You may not use information technology innovation computers, but you cannot ignore this sector.

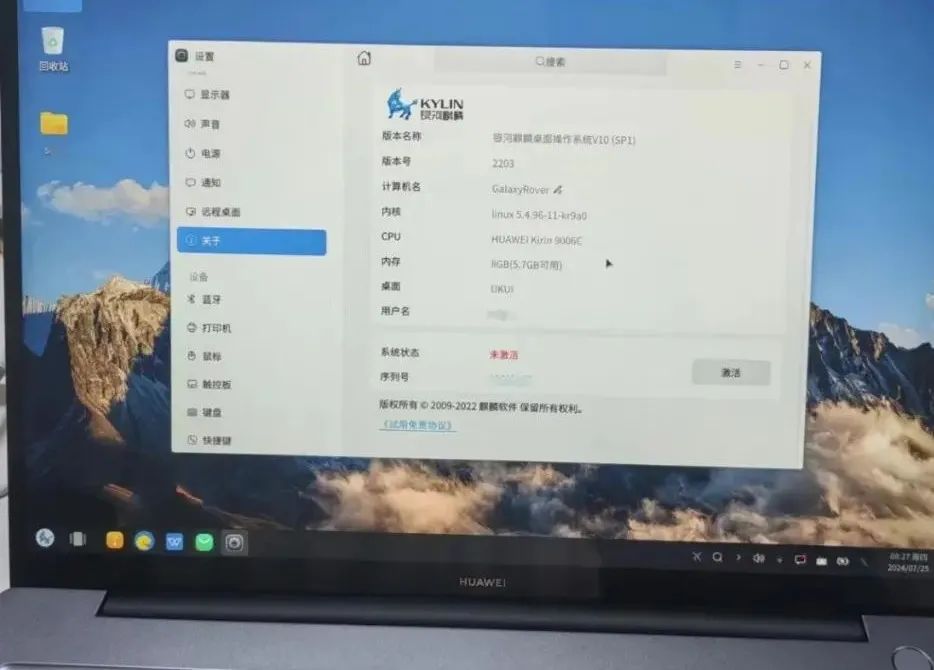

In fact, Poetry and Starry Sky is already using an information technology innovation laptop:

We've even seen a Linux version of Tonghuashun in the app store.

While it may have shortcomings, it's sufficient for daily office applications and runs smoothly.

Apart from defense, the financial sector has the greatest need for information technology innovation.

Autonomous and controllable systems are crucial in the financial industry, as demonstrated by Russia's exclusion from SWIFT.

Among financial service providers, Hengsheng Electronics, backed by Alibaba, offers comprehensive information technology innovation solutions. Alibaba Cloud boasts ARM+Kylin architecture, OceanBase domestic database, and domestic development tools.

Currently, Hengsheng Electronics boasts "full-stack in-house research and development," a remarkable capability previously claimed only by Huawei.

The company states that it has been preparing for information technology innovation since 2019. Early progress was limited due to immature underlying hardware and middleware, coupled with the financial industry's pursuit of zero-error, high-reliability operating environments. After extensive preparations, 100% of Hengsheng's products are now compatible with information technology innovation.

On August 21, Hengsheng Electronics announced new progress in its information technology innovation service brand, Hengsheng Xingchen, with the successful delivery of the core operating system for its enhanced transaction server, based on the Kylin Advanced Server Operating System V10SP3 Transaction Enhanced Edition, jointly developed with Kylin Software. This operating system targets core transaction areas in the securities, insurance, fund, and futures industries.

If early information technology innovation efforts focused on process optimization, they have now entered a stage of substantial progress.

03

Operational Risks

The company's primary operational risk stems from the financial industry's shift to a defensive strategy.

Poetry and Starry Sky believes that tightening the financial industry's belt is essential for the vibrant development of small and medium-sized enterprises.

The current development situation reflects this trend.

This also implies that Hengsheng Electronics' major clients may no longer spend lavishly, opting instead for austerity and cutting unnecessary expenses. The days of the company effortlessly amassing profits are gone.

The company's gross margin exceeds 70%, with some businesses, like wealth technology services, approaching 80%. This is not typical for the IT industry but a result of the financial industry's generous spending.

By contrast, other IT peers often struggle with gross margins of 30%-50%.

- END -

Disclaimer: This article is based on the public company attributes of listed companies and an analysis of information disclosed by listed companies in accordance with legal requirements (including but not limited to interim announcements, periodic reports, and official interaction platforms). Poetry and Starry Sky strives for fairness in the content and opinions presented but does not guarantee their accuracy, completeness, or timeliness. The information or opinions expressed herein do not constitute investment advice, and Poetry and Starry Sky assumes no responsibility for any actions taken based on this article.

Copyright Notice: The content of this article is original to Poetry and Starry Sky and may not be reproduced without authorization.