"Kingdee in the South, Yonyou in the North", the latter doesn't have much time left

![]() 08/29 2024

08/29 2024

![]() 458

458

The domestic SaaS industry is undergoing a transformation, and industry fluctuations have led to some unusual phenomena.

For example, there have been recent voices suggesting that "in the next 10 years, Kingdee has a high potential to surpass Yonyou." It is well known that in the domestic SaaS software industry, "Kingdee dominates the south, while Yonyou rules the north," with their headquarters located in two major cities at opposite ends of the country, forming a north-south confrontation.

However, much like the saying "Northern Joe Feng, Southern Murong," despite their geographical locations, their strengths are not entirely equal.

The reason why there are voices suggesting that Kingdee might surpass Yonyou lies in Yonyou's organizational transformation over the past year, coupled with its multi-billion R&D investment, which has led to a period of transition that impacted its 2023 performance. This has narrowed the gap between Yonyou and the second tier of companies in the industry in the first half of this year, leading to some voices even directly predicting that Kingdee may overtake Yonyou.

Below, let's delve deeper into the intricacies of enterprise services.

1. Nearly double the revenue gap, not in the same tier

Indeed, if Kingdee wants to surpass Yonyou, the first half of this year was the opportunity, and almost the only one.

Let's take a look at Yonyou's data for the first half of this year.

According to financial reports, Yonyou achieved a total operating revenue of 3.81 billion yuan in the first half of this year, an increase of 12.9% year-on-year, maintaining steady growth. Among them, cloud service revenue reached 2.85 billion yuan, an increase of 21.3% year-on-year, accounting for 74.8% of total operating revenue, with a continuously increasing share.

The reason why there are claims that Kingdee surpassed Yonyou is that Kingdee's 2.87 billion yuan in revenue in the first half of this year appears to be very close to Yonyou's. Some argue that Yonyou's loss of 794 million yuan in the first half of the year is close to last year's full-year loss, suggesting a decline in Yonyou's performance.

In fact, let's return to the topic and discuss the intricacies of the industry.

Firstly, Yonyou's revenue in 2023 was 9.8 billion yuan, approaching 10 billion, while Kingdee's revenue was 5.68 billion yuan. Yonyou's revenue is almost double that of Kingdee. If Yonyou is considered the leader in domestic SaaS, the first tier, then it may be the only one in that tier, while Kingdee might fall into the second tier.

Furthermore, to understand why the revenue gap between the two companies in the first half of the year seems small, let's look at their third and fourth-quarter performance.

Yonyou's revenue for Q1-Q2 2023 was 3.37 billion yuan, while Q3-Q4 revenue was 6.43 billion yuan. Therefore, for Yonyou, the latter half of the year, specifically Q3-Q4, accounts for the bulk of its revenue.

In contrast, Kingdee's first-half revenue in 2023 was 2.57 billion yuan, with Q3-Q4 revenue of 3.11 billion yuan, resulting in a relatively even annual revenue distribution.

This explains why the revenue gap between the two companies in the first half of 2024 seems small; the main action takes place in the latter half of the year.

By now, it should be clear why Yonyou's first-half loss is close to last year's full-year loss. In fact, Yonyou's net profit attributable to shareholders of listed companies in the first half of this year was a loss of 790 million yuan, compared to a loss of 940 million yuan in the same period last year, narrowing the loss by 150 million yuan.

A narrowing loss is a positive trend. Meanwhile, insiders have also noticed some "clues." Yonyou's revenue from central state-owned enterprises accounts for a high proportion of its total revenue. In the first half of the year, large enterprise customer business revenue reached 2.39 billion yuan, accounting for over 60% of total revenue, suggesting more revenue in the latter half of the year and an overall healthier revenue situation.

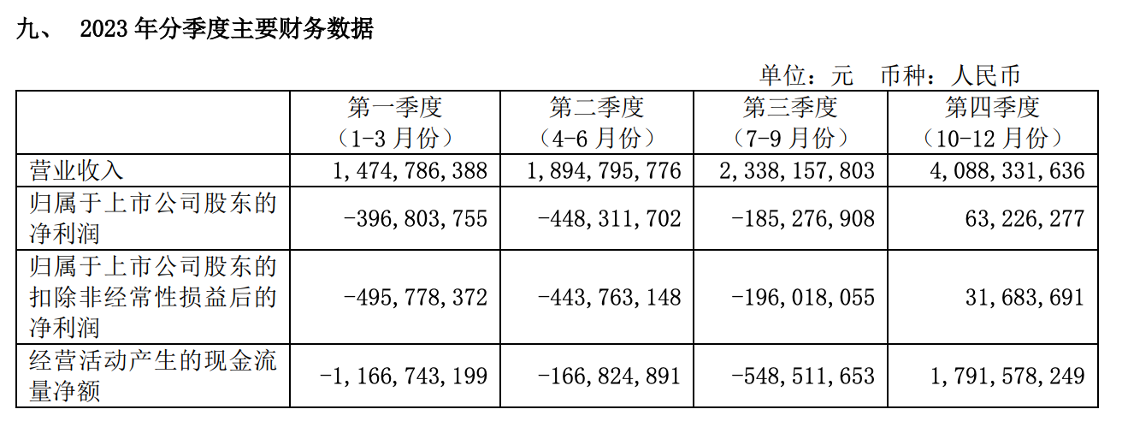

Taking 2023 as an example, revenue for Q1-Q2 was 1.47 billion yuan and 1.89 billion yuan, respectively, while Q3-Q4 revenue was 2.34 billion yuan and 4.09 billion yuan. For Yonyou, the latter half of the year, specifically Q3-Q4, accounts for the bulk of its revenue.

Furthermore, Yonyou and Kingdee's revenue structures differ. Yonyou's cloud services account for 75% of its total revenue, while software accounts for 25%. Based on these figures, Yonyou's cloud service revenue exceeds Kingdee's total first-half revenue.

2. Fierce competition for large customers, but the outcome is clear

If we ask what the most direct impact of domestic SaaS in the past two years has been, it would be the substitution of domestic products for foreign ones. In this substitution, SaaS companies must compete fiercely for large customers and enterprises.

The number and quality of large customer services sometimes speak volumes in the enterprise service sector.

When comparing Yonyou and Kingdee, we find that there is still a significant gap in scale.

Firstly, there are differences in revenue proportions from small, medium, and large enterprises.

Yonyou's revenue from large customers and government accounts for 72% of its total revenue, while Kingdee's accounts for only 28%. For small and medium-sized enterprises, Yonyou's revenue accounts for 28%, while Kingdee's accounts for 69% of its total revenue.

In the first half of this year, Kingdee Cloud StarOcean did achieve some success with large customers. Financial reports show that the combined cloud service revenue of Kingdee Cloud Sky and Kingdee Cloud StarOcean reached 546 million yuan, an increase of 38.9% year-on-year. However, in reality, we understand that early-stage enterprises or products tend to have an advantage in growth rate, but their scale, at less than 600 million yuan, is still relatively small.

In the past six months, Yonyou has made new breakthroughs with very large enterprises, signing new contracts with large state-owned enterprises and industry leaders, including CITIC Group, China Huadian, China Mobile, Dongfeng Motor, ZTO Express, Aimu Group, Chengde Lulu, and Aiyan Group, among others, totaling 40 contracts. Data shows that Yonyou is the vendor that has replaced the most international ERP systems in China.

Clearly, in terms of large customers, Yonyou maintains a leading position.

In fact, data shows that the industry positions of the two companies are inherently different.

According to Yonyou's financial report, IDC data indicates that Yonyou continues to lead the Chinese enterprise cloud service market, ranking first in market share for Chinese aPaaS and Chinese enterprise application SaaS, and has consistently ranked first in market share for super-large and large enterprise application SaaS in China for multiple years.

In contrast, Kingdee's financial report highlights its strengths in the growth enterprise application software market and small and medium-sized market segments.

Large customers are the commanding heights of competition in the enterprise service market, and the different strategies of the two companies reflect their varying degrees of determination to win this commanding height.

3. Barriers built by billions of R&D investment

In its interim report, several key metrics from Yonyou are worth noting.

Firstly, Yonyou's gross margin was 52.5% in the first half of the year, with a single-quarter gross margin of 54.0% in the second quarter, indicating a continuous improvement. This suggests that Yonyou's basic product refinement is complete, and the product is entering a later stage of returns.

Simply put, enterprise service products have a certain marginal effect. Heavy investment in the early stages can lead to better customer-centric products. Only after the product is refined will the marginal benefits of product revenue begin to emerge.

In terms of renewal rates, YonBIP revenue increased by 42.1% year-on-year during the reporting period, with a renewal rate of 101.1%; YonSuite revenue increased by 116.1% year-on-year, with a continuously improved renewal rate of 92.4%.

The most direct manifestation is that Yonyou's product reputation has spread to the industry. In the first half of this year, 81,800 new cloud service paying customers were added, compared to 59,500 last year. The surge in new customers indicates that Yonyou's industrialization strategy has won market recognition. Furthermore, a new batch of benchmark enterprises, such as central state-owned enterprises, were signed in the first half of this year, laying a solid foundation for future replication and promotion.

Since its establishment 36 years ago, Yonyou has accumulated a strong brand presence and has the capability to serve very large customers in terms of technology and products, making it more suitable for the information security and service guarantees required by large enterprises. This is almost a unique capability and barrier in the industry.

According to rough estimates, Yonyou has invested over 10 billion yuan in the past few years, with R&D investment accounting for 32.8% of revenue in 2023. In August this year, Yonyou BIP and YonGPT, the enterprise service large model, underwent another upgrade, putting them at the forefront among similar vendors.

Yonyou has created a product system that can "accompany a company's growth with one system," meaning that as a company grows from a growth enterprise to a large or giant enterprise, Yonyou can ensure that the company's applications, experience, and data remain unchanged, enabling seamless switching of enterprise applications and ensuring business continuity and stability. This is something that Kingdee's product system does not possess.

Most importantly, the ability to serve large customers does not happen overnight. We can see that Yonyou's confidence stems from accompanying customers in their growth over 36 years, during which it has accumulated rich industry know-how and leading practices. This is why Yonyou can continuously gain customer trust and create a series of benchmark users.

Currently, Yonyou has established group-level enterprise software cooperation with 74 central enterprises and has created a large number of benchmark industry customers represented by long industrial chains, laying a solid foundation for gaining more market recognition and trust.

Of course, in the era of digital intelligence, if Yonyou wants to win more market recognition, it must continue to iterate and refine its products.

Summary

With the arrival of a new SaaS cycle, the future structure of the SaaS industry over the next decade is beginning to take shape. Companies that understand customers, invest heavily in R&D, refine products, and deepen industry expertise will be the direct beneficiaries of this trend.

Polarization will become more apparent, and the market doesn't leave much time for latecomers.