Xiaopeng MONA - Smart Cabin, Intelligent Driving, and Product Business Background

![]() 08/30 2024

08/30 2024

![]() 578

578

Xiaopeng has really shaken things up by pricing its MONA at 119,800 yuan, effectively launching the first salvo in the new forces' price reduction strategy.

When it comes to Xiaopeng, we immediately think of its intelligence. Therefore, this article will analyze Xiaopeng's smart cabin and intelligent driving capabilities under the banner of technological equality, drawing on information from the product launch. However, before delving into these topics, let's first understand the product's business background through relevant information.

Xiaopeng Mona's Past and Present - Didi's Da Vinci, Xiaopeng's Technology + Art

Smart Cabin = Voice, Music, Navigation

Intelligent Driving = Two Electronic and Electrical Architectures + High and Low Configurations

Vehicle and Other Aspects, Xiaopeng's Persistent Weaknesses

I hope this provides you with some information and inspiration. Finally, feel free to leave your comments and share your thoughts on Xiaopeng MONA. Will consumers embrace its technology-driven approach to equality? Could MONA become Xiaopeng's first high-volume model?

Xiaopeng Mona's Past and Present - Didi's Da Vinci, Xiaopeng's Technology + Art

Starting in 2021, Didi secretly launched its in-house automotive project code-named "Da Vinci" with a team size peaking at 1,700 people. The first model was an A-class pure electric vehicle targeting the mass consumer market with a price tag of around 150,000 yuan.

Meanwhile, Xiaopeng, as a new force in the industry, has faced persistent sales pressure and desperately needed a high-volume model to boost overall sales. However, its highly anticipated P-series and G-series models failed to meet expectations.

Around 2023, Didi faced various risks and decided to refocus on its core business of mobility services, leading to the cancellation of the "Da Vinci" vehicle project.

This led to a natural collaboration between Xiaopeng and Didi, giving birth to the precursor of the MONA product.

On August 28, 2023, Xiaopeng announced that it had signed a share purchase agreement with Didi and its subsidiaries, agreeing to a conditional maximum consideration of approximately HK$5.835 billion. The acquisition was completed through the issuance of additional shares, with a maximum of 91.13 million shares issued, representing approximately 5% of the enlarged share capital.

During the initial closing, Xiaopeng issued consideration shares to Didi, representing 3.25% of the total share capital post-transaction, to acquire assets and R&D capabilities related to Didi's smart electric vehicle project.

Post-transaction, Didi became a strategic shareholder of Xiaopeng.

As a result, the model originally developed by Didi evolved into the current MONA, primarily targeting individual consumers (2C) while also catering to the business-to-business (2B) A-class segment.

Xiaopeng believes that A-class vehicles must be produced on a large scale to achieve cost competitiveness. Positioned as a fusion of technology and art, MONA emphasizes both design and technological intelligence.

Xiaopeng's strategic collaboration with Didi progressed through four closing stages:

The initial closing involved Xiaopeng issuing 58.16 million Class A ordinary shares to Didi, representing approximately 3.25% of Xiaopeng's share capital, as previously mentioned.

SOP closing, most recently, involved Xiaopeng issuing 4.64 million Class A ordinary shares to Didi as SOP consideration shares, accounting for approximately 0.24% of the company's issued and outstanding share capital post-SOP share issuance.

Future stages include:

The first performance milestone closing, set for 13 months after the first qualified new vehicle delivery to customers, requires cumulative deliveries of 100,000 vehicles by October 2025, at which point Didi will receive new shares.

The second performance milestone closing, set for 12 months after the expiration of the first performance period, requires cumulative deliveries of an additional 100,000 vehicles by October 2026.

Therefore, in terms of sales, MONA aims to generate buzz for Xiaopeng while leveraging Didi's user base, both C-end and B-end, to ensure sales volumes.

This outlines MONA's business background, and subsequently, its technical framework and supply chain differ from Xiaopeng's existing ones.

Smart Cabin = Voice, Music, Navigation

Xiaopeng MONA M03's cabin features a dashboard-free design, reminiscent of Tesla's minimalist aesthetic while saving costs. It boasts a 15.6-inch central touchscreen, powered by a Qualcomm Snapdragon 8155 chip and 16GB of RAM, forming the backbone of Xiaopeng MONA's smart cabin.

Xiaopeng has identified three high-frequency cabin applications through user data collected from its existing vehicles: voice control, music, and navigation. According to Xiaopeng's data, these three applications have a weekly penetration rate exceeding 99.2%.

While Xiaopeng claims that these functions are less utilized in traditional gasoline-powered vehicles, this is more likely a reflection of the limitations of that era rather than an inherent disinterest.

Xiaopeng MONA's cabin highlights are built around these three high-frequency applications:

Four-zone voice assistant: Xiaopeng emphasizes hands-free operation, with the four-zone system accurately recognizing driver, front passenger, and rear passengers. Coupled with local and cloud-based AI algorithms, the voice assistant delivers an exceptional experience. While Xiaopeng excels in this area, differentiating through voice technology remains challenging due to the advanced state of China's smart voice software supply chain.

Music-synced cabin: Equipped with 18 speakers and a 7.1.4 channel audio system, MONA delivers an immersive sound experience. The "7" represents the main audio channels (left, right, surround, and center), the "1" stands for the subwoofer, and the final "4" signifies height or sky channels. MONA adopts acoustic tuning from Precision Acoustics, acquired by AAC Technologies.

Immersive navigation map: Featuring lane-level 3D rendering, Xiaopeng's customized version of Gaode Maps enhances the in-car navigation experience through streamlined input and smooth interaction. Gaode Maps' deep integration with Xiaopeng, facilitated by Alibaba's investment in the latter, underscores the strong supplier-customer relationship.

These three cabin highlights are core competencies of internet and IT companies, leveraging their strengths in technology, software, and supply chains.

As for the amusing yet somewhat frivolous "wooden fish" feature mentioned at the launch, it seems more of a gimmick than a practical addition, perhaps echoing the storytelling style popularized by some tech leaders.

Intelligent Driving = Two Electronic and Electrical Architectures + High and Low Configurations

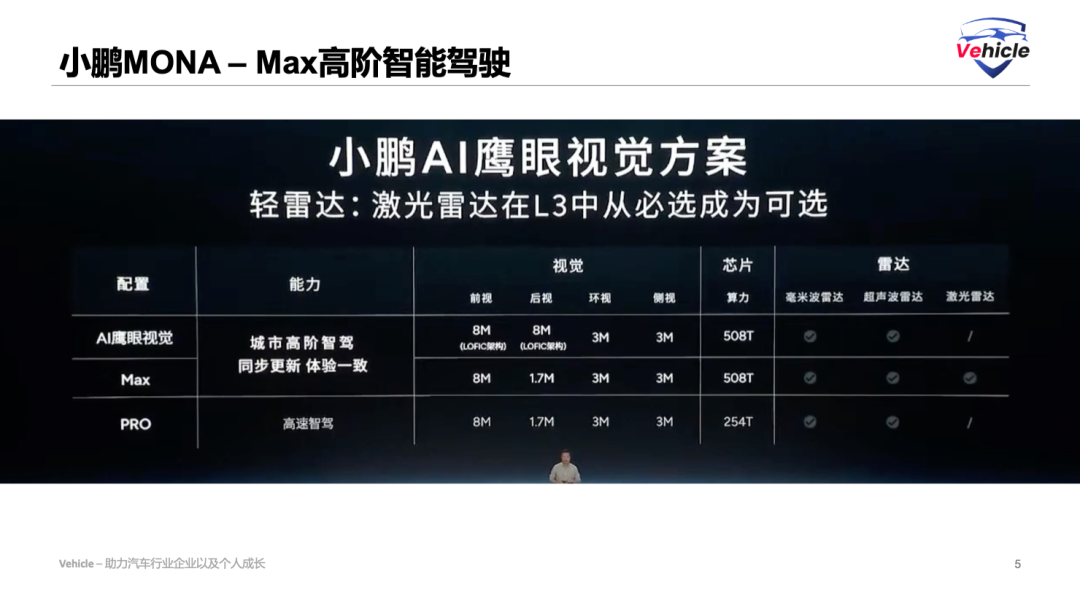

Xiaopeng MONA M03 offers two intelligent driving options: Basic and Max versions. The MONA launch highlighted that these versions utilize distinct electronic and electrical architectures. The Max version, leveraging Xiaopeng's proprietary architecture, is scheduled for delivery in early 2025.

Based on speculation,

The Max version's hardware and electronic-electrical architecture are likely similar to those of Xiaopeng's other models like G6 and G9, offering comparable functionalities and highlights.

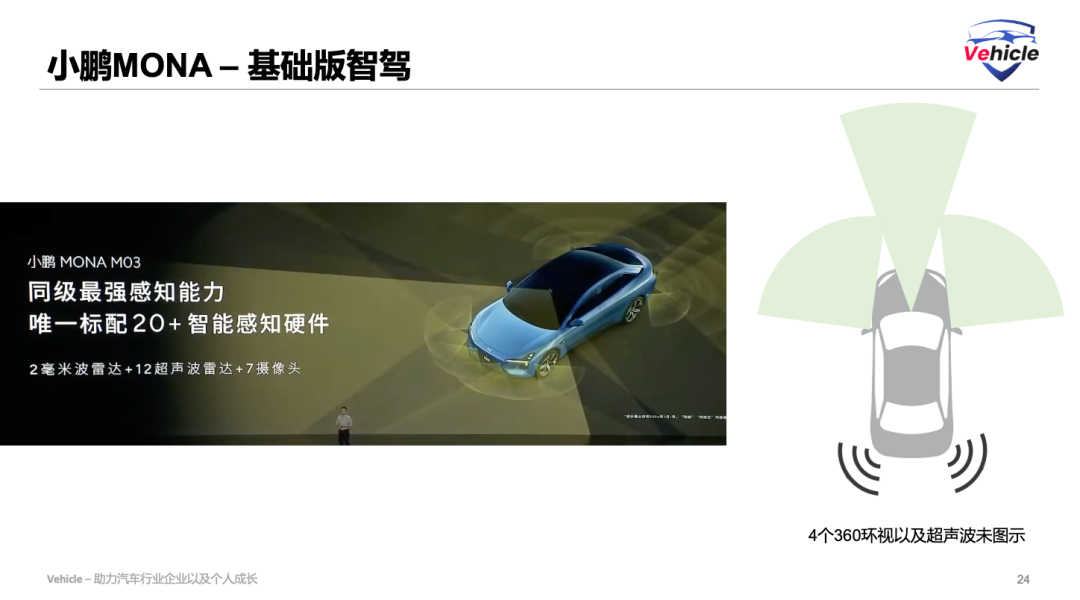

The Basic version provides standard L2 capabilities, likely utilizing the electronic-electrical architecture and supply chain from Didi's Da Vinci project. It features 2 mmWave radars, 12 ultrasonic radars, 7 cameras, and a Mobileye EyeQ4 chip for ADAS functions.

According to launch images, the Basic version employs a front long-range camera, two forward-facing side cameras, four surround-view cameras, and two short-range mmWave radars at the rear.

This configuration offers a cost-effective L2 solution, omitting expensive long-range mmWave radars in favor of pure vision-based AEB and ACC/LCC, while utilizing inexpensive short-range corner radars for BSD/LCA/DOW/RCTA/RCW active safety features. The estimated BOM cost for this setup is around 1,500 yuan.

The Basic version's intelligent driving and active safety software algorithms are likely sourced from Mobileye, while parking functions may utilize Xiaopeng's parking algorithms running on the Qualcomm Snapdragon 8155 cabin chip.

The Max version, offering L2++ advanced intelligent driving capabilities, employs Xiaopeng's existing solutions, as detailed in previous articles like "Vision Reigns Supreme - Xiaopeng and Tesla's Autonomous Driving Solutions."

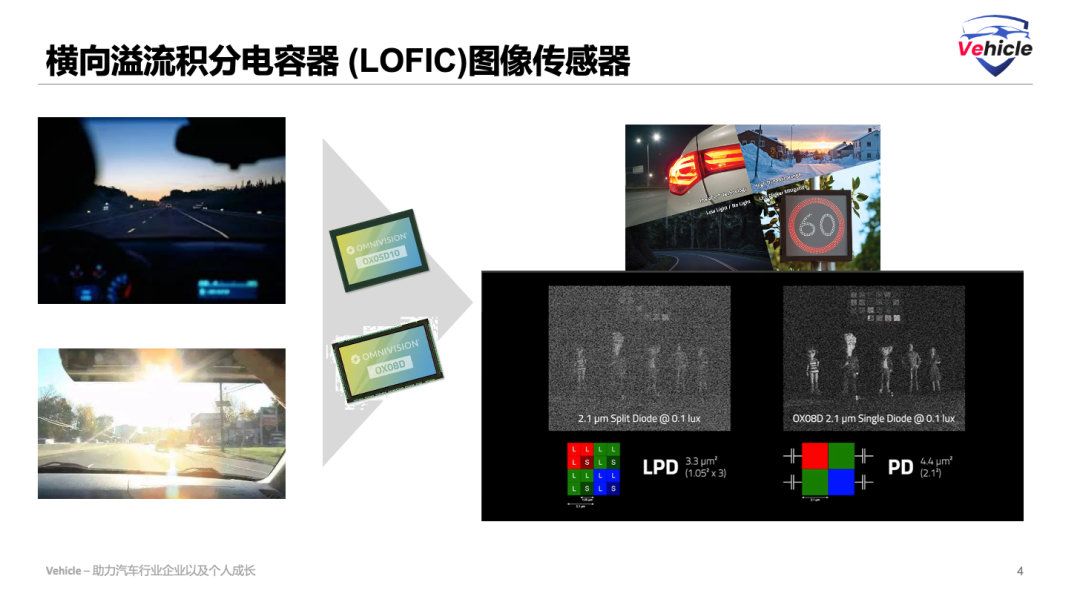

However, at its 10th-anniversary launch, Xiaopeng unveiled its next-generation AI Eagle Eye vision solution, featuring LOFIC (Lateral Overflow Integration Capacitor) image sensors for low-noise, high-sensitivity, large full-well capacity, and linear response under single exposure.

These cameras leverage LOFIC's unique capabilities to improve HDR imaging in dynamic lighting conditions, ensuring stability and reliability of visual information. Xiaopeng's branding as "Eagle Eye" primarily serves as an advertisement for OmniVision's LOFIC sensors, likely spurring further adoption and promotion in China's intelligent driving industry.

Vehicle and Other Aspects, Xiaopeng's Persistent Weaknesses

Xiaopeng MONA M03 is available in two-wheel drive configurations with two power options: a high-end model with a 160kW front motor delivering a 0-100km/h acceleration of 7.4 seconds, and a low-end model with a 140kW motor achieving around 8 seconds.

Battery capacity and range: The two models offer 51.8kWh and 62.2kWh batteries, corresponding to CLTC ranges of 515km and 620km, respectively. Xiaopeng touts MONA's energy efficiency, likely due to its lighter weight resulting from a smaller battery pack, reducing overall energy consumption compared to heavier models.

Xiaopeng's chassis and electric drive systems have always been areas for improvement, and significant advancements may not be immediately evident. Therefore, take these claims with a grain of salt, but feel free to share your thoughts or seek Jack's expert opinion if you're surprised by any developments.

Having reviewed Xiaopeng MONA's specifications, we can roughly estimate its BOM cost:

The lion's share comes from the battery, which, based on current LFP battery prices (around 300 yuan per kWh), translates to approximately 15,000 to 20,000 yuan for the battery pack. Adding the costs of sheet metal, interior and exterior trim, electric components, and electronic-electrical systems, the total BOM cost is likely around 60,000 yuan.

Do you think MONA is priced appropriately or too expensive? Will it achieve monthly sales of over 10,000 units? Share your thoughts in the comments below.

*Unauthorized reproduction and excerpt are strictly prohibited - Reference Materials: