Persist in launching the "tariff war", who caused the demand for electrification in Europe to collapse

![]() 09/02 2024

09/02 2024

![]() 444

444

This EU tariff adjustment will also catalyze the positive transformation of the auto companies' overseas expansion model, and the construction of overseas factories is expected to accelerate, and the trend of local factory construction is inevitable.

On August 20th local time, the European Commission issued a draft final ruling on anti-subsidy investigations into electric vehicles from China, adjusting the initial tax rates: imposing an anti-subsidy tax of 17% on BYD, 19.3% on Geely, 36.3% on SAIC Motor, 21.3% on other cooperative companies, and 36.3% on all other non-cooperative companies.

The EU claims that these tariffs may be aimed at protecting the local automotive industry in Europe, but this action has instead led to a further increase in the cost of electric vehicles for European consumers, further cooling the European electric vehicle market.

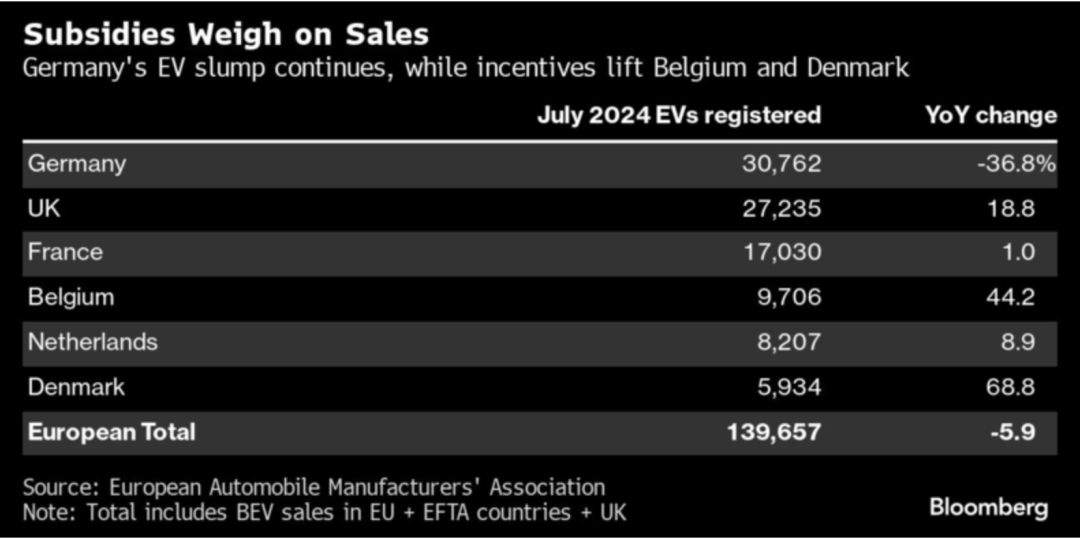

Data shows that the number of new car registrations in Europe in July increased by only 0.2% year-on-year. The four major markets in the region performed differently: Italy (+4.7%) and Spain (+3.4%) both recorded small increases, while France (-2.3%) and Germany (-2.1%) saw declines.

In fact, electric vehicle sales in Europe have been declining for several consecutive months. Due to the continued decline in demand for electric vehicles, local auto companies have reduced their electric vehicle production plans and slowed down plans to launch the fuel vehicle market.

For example, German automaker Volkswagen is currently considering closing its Audi electric vehicle factory near Brussels and is seeking further cost reductions. In addition, Stellantis NV, Europe's second-largest manufacturer, saw its net profit almost halved in the first half of this year, and its CEO warned about the company's underperforming brand lines.

Mercedes-Benz Group lowered its profit margin expectations for this year and canceled its medium-term target for electric vehicle sales, saying the transition from fuel vehicles will take longer than expected.

Analysts such as Gillian Davies of Bloomberg Intelligence said in a report: "Due to the lack of incentives and the low interest of consumers in pure electric vehicles except for the first batch of users, the registration growth of pure electric vehicles (in Europe) may continue to slow down."

"Internal strife intensifies"

According to the German newspaper "Handelsblatt" website on August 23, the German government and the European Commission continued to argue over the imposition of punitive tariffs on Chinese electric vehicles. After the latest adjustment to the taxation regulations in Brussels, a German government representative said that if European automakers happen to pay the highest tariffs, it would be an "interesting way to promote industry development."

Another government representative emphasized that changing the EU Commission's tariffs remains a goal of the German government. In other words, it is to reduce related tariffs. German automakers Volkswagen, BMW, and Mercedes-Benz hope to raise objections again at next week's EU Commission hearing.

Due to the adjustment of electric vehicle tariff levels, German manufacturers should pay at least a 21.3% anti-subsidy tax when exporting their products from China to the EU. On the other hand, Chinese competitors BYD and Geely only need to pay special tariffs of 17.0% and 19.3%, respectively, while American automaker Tesla only needs to pay a 9% punitive tariff.

This has caused outrage in the German automotive industry.

According to reports, Hildegard Müller, President of the German Association of the Automotive Industry, said this week that this contradicts the European Commission's goal of strengthening the competitiveness of European enterprises. The German government said that in the competition with Chinese automakers, the tariffs set by the European Commission are now weakening its own automakers instead of strengthening them.

German Chancellor Olaf Scholz has been skeptical of Brussels' tariff plan from the start, fearing that German automakers will face a competitive disadvantage and trade conflicts with China will escalate.

In addition, some European automakers have very negative sentiments towards the "tariff stick."

Swedish electric vehicle manufacturer Polestar said on August 29 that the EU and the United States' imposition of import tariffs on Chinese-made electric vehicles will harm local European companies.

According to Reuters, Polestar CFO Ansgar told analysts on a conference call that he attended a meeting with the European Commission that day to discuss electric vehicle tariff issues. He believes that the European Commission cannot protect European industry by imposing tariffs, as this will harm companies that invest in technology and create jobs in Europe.

According to Reuters, as of August, several main electric vehicles of Polestar were produced by Chinese factories, and under the latest EU tariff plan, Polestar's products will be subject to a 19.3% tariff.

According to another report on the Spanish website "El Pais" on August 23, European automakers have had a tough time in the stock market lately. Since Brussels announced the imposition of tariffs on Chinese electric vehicles on the grounds of "unfair advantage", the cumulative decline in some stocks in the industry has reached 26%.

"Breakthrough" EU high tariff restrictions

Affected by the EU tariff increase and changes in electric vehicle subsidies, it has caused a huge impact on Chinese automakers.

From the perspective of export regions, Europe is the second-largest new energy vehicle market globally after China and the largest importer of electric vehicles from China. According to data from China Customs, China exported 1.55 million electric vehicles in 2023, with 40% going to Europe.

However, since the EU implemented temporary tariffs, the market share of Chinese automakers has been declining. In the first half of this year, China's total exports of pure electric vehicles to the 27 EU countries were about 220,000, a decrease of about 15% from the same period last year.

According to research firm JATO Dynamics, MG registrations in Europe fell 38% year-on-year in July, and even more sharply from June, by 60%.

Ahead of the tariff deadline, SAIC Motor supplied more than 13,000 MG electric vehicles to European dealers in June.

Data from Dataforce shows that the number of electric vehicles registered in Europe by Chinese automakers in July totaled less than 14,000, down from more than 23,000 in June, a year-on-year decrease of 9.7%.

However, according to JATO, although BYD, China's largest automaker, saw a 5.5% month-on-month decline in European sales, its market share in Europe doubled year-on-year in July this year.

At the same time, investment institutions and industry insiders agree that this EU tariff adjustment will also catalyze the positive transformation of automakers' overseas expansion model, and the construction of overseas factories is expected to accelerate, and the trend of local factory construction is inevitable.

BYD is currently building factories in Hungary and Turkey, Chery has established a joint venture to produce passenger cars in Spain by acquiring and transforming existing Nissan factories, and SAIC Motor is also considering building its first electric vehicle factory in Europe in Spain...

China's new auto forces are not to be outdone.

According to a Bloomberg report on the 26th, XPeng CEO He Xiaopeng said in an interview at the company's Guangzhou headquarters that the company is selecting a site for its European factory and plans to build a large data center, "which will not be affected by tariff hikes." He also believes that XPeng's advantages in artificial intelligence and intelligent assisted driving systems will help it enter the European market.

He Xiaopeng said that building a factory in Europe is part of future localized production plans, and the current site selection work is still in its early stages. He revealed that XPeng hopes to establish production capacity in areas with "relatively low labor risks." He also said that due to the critical role of efficient software collection in the intelligent driving functions of automobiles, it also plans to build a large data center in Europe.

"Although some profits from European countries will decrease after the tariff increase, XPeng's global expansion plans will not be affected by the tariff hike."

And the most obvious effect of Chinese automakers building factories overseas is that it accelerates the overseas expansion of the supporting automotive industry chain. Before that, a number of Chinese battery companies such as CATL, GuoXuan High-tech, China Aviation Lithium Battery, and Hive Energy were striving for the European market and have won orders from many multinational automakers, accelerating overseas layout.

Once these factories are operational, they will be able to avoid the impact of the new tariff policy.

Obviously, with the further deepening of the local presence of vehicle companies, the synergistic effect of this industrial chain will become more prominent, but industrial chain cooperation does not mean "forming cliques".

Cui Dongshu, Secretary-General of the China Passenger Car Association, emphasized in an interview that in fact, the internal connection between Chinese automakers and overseas markets has long existed, but it is still necessary to develop low-key and establish relatively moderate relations in overseas markets to avoid risks. "Create more benefits for the locals and reduce some frictions." Cui Dongshu believes that maintaining such an investment and factory construction logic can achieve better localization development.

In general, Europe and the United States have successively erected high tariff barriers against Chinese electric vehicles and other products, reflecting the West's intractable trade protectionist "complex" and an increasing tendency to politicize economic and trade issues in an attempt to weaken China's export competitiveness. However, this approach is bound to result in a lose-lose situation, disrupting normal economic and trade exchanges and destabilizing the global production and supply chain, ultimately making consumers pay for unnecessary price hikes.

Note: Some images are sourced from the internet, please contact us for removal if there is any infringement.