Your "Garbage Time", My "Bonus Time"

![]() 09/03 2024

09/03 2024

![]() 641

641

Introduction

The bonus time for new forces is budding.

"Garbage Time in History" is a concept that has become popular across the internet this year, eye-catching and ambivalent, stuck at the right moment like "digging and digging" last year. When it comes to the recent Beijing Auto Show, some people were discussing whether the joint ventures of Chinese automakers have entered "garbage time".

So, naturally, at this Chengdu Auto Show, we couldn't avoid talking about "garbage time." Essentially, as a term from basketball, "garbage time" refers to when the score difference between the two teams is so significant that both sides substitute their main players and simply wait out the remaining time. In the context of history and culture, this becomes "Garbage Time in History."

However, the Yin-Yang philosophy of the I Ching teaches us that "what is poison to one may be honey to another." If there is garbage time, there must also be "bonus time in history." Everything reaches its peak and declines, but there are always opportunities for renewal and revitalization.

From the perspective of the automotive industry, this Chengdu Auto Show has a hint of "garbage time" for many brands, with a strong "chicken rib" effect. Joint ventures like Nissan and Kia didn't even attend, while there were many more foreign bloggers covering the event. Tesla was also absent, presumably due to disdain.

However, amidst the chaos, we can discern that the new forces (in general) are stirring, vying for their "bonus time." This paradox is quite intriguing.

Joint Ventures vs. Domestic Brands

Visually, the media day of the Chengdu Auto Show was relatively quiet despite the sweltering weather. Apart from the usual array of advertisements, only Cadillac and BYD stood out, and media attendance was noticeably lower on the first day. However, car buyers flooded in on the second day, with halls 4, 9, 10, and 11 packed with people.

The quietness reflects the end of the bonus period for many traditional brands, the so-called old forces, whose easy money-making days are over. As the saying goes, "Once a person rides a wave of success for too long, a single ripple can destroy their life."

So, facing "garbage time" and the cutthroat competition in the automotive industry, how can one navigate through the fog, smoothly transition through "garbage time," and find "bonus time"?

In this regard, German automakers have begun their "counterattack." BMW showcased its largest-ever participation at the show, though the all-new BMW X3 on display, set to launch in January next year, is still a gasoline-powered model. Nevertheless, this didn't deter a Sichuan University professor who accompanied me from finding it appealing after seeing the JiYue models, remarking, "I still have some reservations about electric cars."

To put it another way, Chery, recently ranked among the world's top 500 companies and the second-largest domestic automaker, recently launched the Tiggo 8L, which is also gasoline-powered. Despite the hype surrounding new energy vehicles, traditional automakers remain committed to retaining their market share in gasoline engines, complemented by hybrids, accounting for 76% of the total.

Regardless of the timing, the main theme of auto shows remains price wars. And it must be said that joint ventures are just as competitive as domestic brands when it comes to discounting.

Volkswagen, for instance, was vigorously promoting its intelligent cockpit and autonomous driving capabilities, aiming to seize the initiative in the wave of intelligentization. However, the announcement of the starting price of the all-new Tharu XR at just 79,900 yuan surprised everyone, with many people joking about "thanking BYD" for the move.

Not only SAIC Volkswagen but also Beijing Hyundai, with its Santa Fe featuring a 2.0t+8AT powertrain and HTRC intelligent all-wheel drive, has a starting price of just 185,800 yuan.

Domestic brands are no exception. Hongqi introduced the HS7 plug-in hybrid version priced from 315,800 yuan, with discounts close to 55,000 yuan. ARCFOX is offering limited-time discounts of up to 31,888 yuan on select models. The starting price of the JiYue 07 is 215,900 yuan, roughly the same as Xiaomi's low-end SU7 with only 54TOPS of computing power. The wave of low prices in the industry shows no signs of abating.

Although my voice may be small, I must appeal that such price wars cannot become the norm. Ultimately, such cutthroat competition leads to corners being cut, harming consumers' fundamental interests and failing to guarantee the reasonable profits of suppliers and dealers. In the end, it's the consumers who foot the bill.

Therefore, perhaps the first problem that needs to be addressed is to stop the annual price reductions imposed on suppliers. (That's a tangent; let's get back on track.)

For the struggling Japanese and Korean automakers, "garbage time" is undoubtedly difficult. As the popular internet celebrity "Xiaosuannai" quipped, some companies are already "lagging behind" in terms of branding. Regardless of technology, getting the naming right is crucial. The message is clear: efforts must be made to narrow the gap.

Under the principle of "the winner takes all," struggling is a necessary "last stand," whether it's effective or not. Apart from launching new models like the all-new fifth-generation Santa Fe and IONIQ5, Beijing Hyundai also featured a group of fit male models at its booth for the first time, deviating from the usual female models and energetic girl groups. While it may not have made much difference, it at least added some excitement.

Moving on to its luxury brand Genesis, when I asked a sales consultant about any new changes or policies since the arrival of CEO Zhu Jiang, she shook her head. This only made me more curious about what new moves they might be "holding back."

For joint ventures facing "garbage time," it's "bonus time" for domestic "new forces" like BYD. At this auto show, BYD had its own pavilion, and Hall 9 was packed with visitors. With brand booths for BYD's Look up , Tengshi , and Fang Chengbao , along with a central technology exhibition area showcasing technologies like Yun Nian -P, the e-platform 3.0 EVO, and the fifth-generation DM technology, not to mention various experience zones in the plaza area, the scale was unprecedented.

From BYD's performance, we can deeply understand Charlie Munger's concepts of "scale advantage" and "social proof" from "Poor Charlie's Almanack." Here, we can also sense that each of our life trajectories bears the profound imprint of the times, including cyclical patterns in industries and individuals.

Just like the famous "soul-searching" question, for these old forces, figuring out how to survive is top priority. As the market changes, so must our mindset. As Tao Yuanming wrote in his "Return to the Native Land": "I have come to realize that there is no use lamenting over the past; what is important is to seize the future. I am not far gone astray; I now see the right path and regret my past errors."

Judging from the performances of various participants at the Chengdu Auto Show, perhaps the solution lies in "looking inward." This doesn't mean escaping but rather deeply reflecting and catching up. Being "user-centric" isn't just talk; it must be put into practice.

Coincidentally, in Hall 14, I saw Cadillac's booth facing that of Lixiang. The confrontation between the old and new forces was clear, with the gray-clad Cadillac team facing the vibrant green-clad Lixiang team. Similarly, in Hall 4, Mercedes-Benz's booth was across from Huawei's HarmonyOS Intelligent Driving Solution booth. Whether it's garbage time or bonus time, old forces or new forces, gray or green, "looking inward" provides ready examples.

Technological Bonus

Looking at the current automotive industry landscape through the lens of the auto show, companies, employees, and technologies are experiencing vastly different realities. While successful companies are soaring, struggling ones are floundering, much like Evergrande. Recruiters and layoff victims represent the two extremes of the industry's fortunes.

From a technological perspective, it's time for the new forces to unleash their "bonus time" potential. What's particularly unsettling for the old forces is that while the use of ChatGPT for human-machine interaction in cockpits was only discussed last year, this year, we're already seeing "end-to-end" large AI models being integrated into autonomous driving systems.

As four-wheel-hub-motor-powered "tank turns" revolutionize the off-road driving experience, vehicles capable of traveling over 2,000 kilometers on a single tank of fuel are hitting the market.

Behind the waves of technological innovation and iteration that seem calm on the surface of the Chengdu Auto Show lies a profound transformation in China's automotive industry. Many are anxious about how to navigate this storm. At least from this Chengdu Auto Show, we hope to glean some insights.

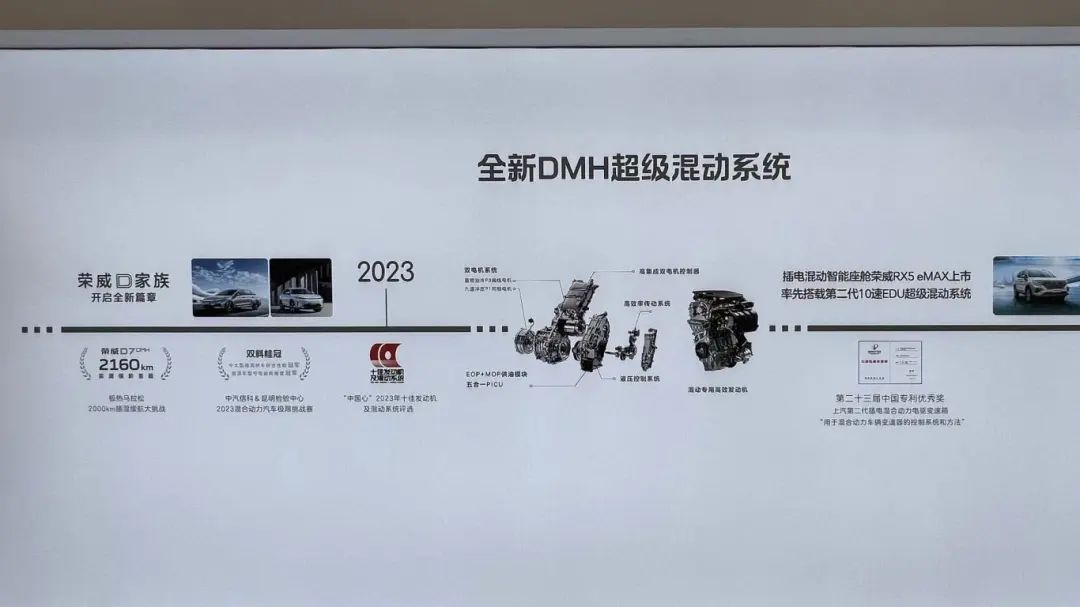

No one wants to exit the stage quietly. For example, Roewe showcased its four-stage technological achievement—the all-new DMH super hybrid system—which was unseen at previous auto shows. The imminent competition is forcing traditional automakers to catch up, with products like Dongfeng's Lingxi L significantly improved from previous generations.

As we enter the second half of the electrification and intelligentization era, intelligent driving and AI are gradually becoming mainstream for automakers. Technologies like end-to-end systems, AI large model integration, and pure vision-based routes will be the core of the future automotive industry.

We can see that Huawei's influence in the automotive market is growing. Apart from showcasing its HarmonyOS Intelligent Driving Solution booth, which occupied nearly half of the exhibition hall and sold cars directly, Huawei is also seeing an expansion of its shareholder base for its Huawei Inside program, now valued at 115 billion yuan.

The first generation of new forces like NIO, XPeng, and Li Auto, enjoying their "bonus time," are focused on selling cars. The second wave of new forces like AVITR, JiYue, and HOYON, eager to escape "garbage time," are unveiling new models to capture market share. JiYue's Xia Yiping even teared up during an interview, becoming a small internet sensation.

XPeng prominently displayed five MONA M03 models at its booth. With over 30,000 pre-orders within 48 hours of its August 27 launch, XPeng found some solace amidst its struggle to reach monthly sales of 20,000 units. Meanwhile, Li Auto announced the update of its end-to-end and VLM vision-language model-based intelligent driving technology, launching a recruitment campaign for 10,000 people to experience its "parking space to parking space" autonomous driving feature.

At Geely's booth, I spoke with an engineer explaining the GEA global intelligent new energy architecture. Derived from the HAO architecture, this platform offers remarkable flexibility. Compared to GM's Ultium platform, it has pre-planned battery packs with ample redundancy. Moreover, the chassis is designed with sufficient hard points for cross-platform manufacturing, setting a good foundation for redundancy. Based on this architecture, the inaugural product, the Geely Yinhe E5, is said to have received 60,000 orders.

Of course, this chassis also reflects advancements in smart manufacturing that aren't immediately apparent at auto shows. Technologies like flexible manufacturing and digital twins under Industry 4.0 will undoubtedly bring about more changes from "manufacturing" to "smart manufacturing." Just as those unfamiliar with computers were left behind by the digital age, "smart manufacturing" will also weed out automakers that fail to keep pace.

The rapid development of domestic brands in intelligence is also making more and more foreign automakers realize the cost-effectiveness of establishing software R&D capabilities in China. In line with local government guidance, many newly established R&D centers are emerging, many of which are tasked with providing solutions globally, marking a shift from "In China for China" to "In China for Global."

As a car sales-focused event, the Chengdu Auto Show didn't feature as many new product and technology launches as the Beijing or Shanghai Auto Shows, instead focusing more on the southwestern market. As a beacon for the second half of the year, the intense competition between "garbage time" and "bonus time" is evident. However, as someone who enjoys writing in-depth analysis, I must confess that I'm hesitant to attend next year's show.