How long can XD.com's fiery success continue?

![]() 09/02 2024

09/02 2024

![]() 621

621

On August 30th, Beijing time, XD.com (2400.HK) released its half-year results for 2024. Market expectations were not low, given the positive earnings preview earlier in the month.

In reality, both game and TapTap advertising revenues fell slightly short of expectations. However, higher profitability from self-developed games and stricter cost controls on R&D personnel offset the significant increase in marketing expenses due to the pre-marketing of "Sword of Lily" launched globally in August, ultimately resulting in a more impressive profit performance for XD.com.

Specifically:

1. "Muffin" Takes Over from "Sausage Party"

Game revenues grew 29% YoY to RMB 1.49 billion in the first half, exceeding the preview but falling short of market expectations. The YoY growth was primarily driven by "Let's Go Muffin," launched at the beginning of the year, and "Sword of Lily," launched at the end of last year. Meanwhile, the pillar game "Sausage Party" continued to decline. The top five games are now "Let's Go Muffin" > "Sausage Party" > "Sword of Lily" > "Torchlight: Infinite" > "Ragnarok M."

"Let's Go Muffin," which was launched in Hong Kong, Macau, and Taiwan before mainland China in January, unexpectedly became a hit. By "unexpected," it doesn't mean the game wasn't well-received; rather, its success surpassed expectations. Developed by the RO team, "Muffin" built upon previous successes ("Ragnarok Online" and "Eternal Ulala") in terms of gameplay style and genre. As an idle game incorporating MMO elements, market expectations for its revenue streams were not low.

However, "Muffin's" popularity exceeded expectations, dropping out of the top 10 on Hong Kong's iOS bestseller list only in July and currently maintaining a top 20 position. In mainland China, where competition was fierce, the game dropped out of the top 10 over the summer after two months of launch in May. Nonetheless, the large mainland market suggests potential revenues of nearly RMB 1 billion in the first three months based on Seven-Mac data and an assumed Android/iOS ratio of 2:1, exceeding previous expectations.

2. TapTap User Growth with Controlled Commercialization

TapTap's domestic MAU increased to 43.24 million in the first half of 2024, up 27% YoY and a net increase of 5.59 million QoQ. This growth was fueled by industry-wide supply increases and TapTap's product cycle, with standout performances from its launched games (self-developed/exclusive hits remaining the primary driver of traffic).

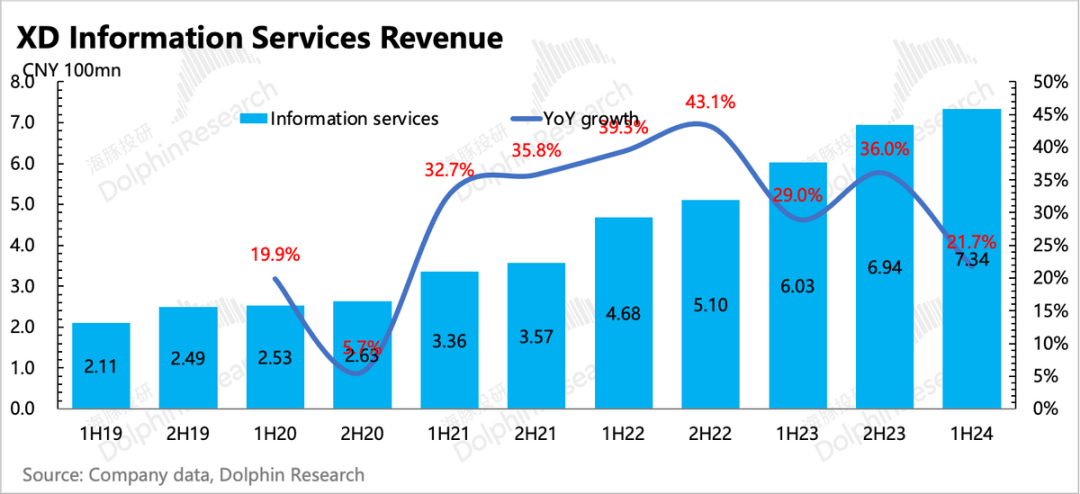

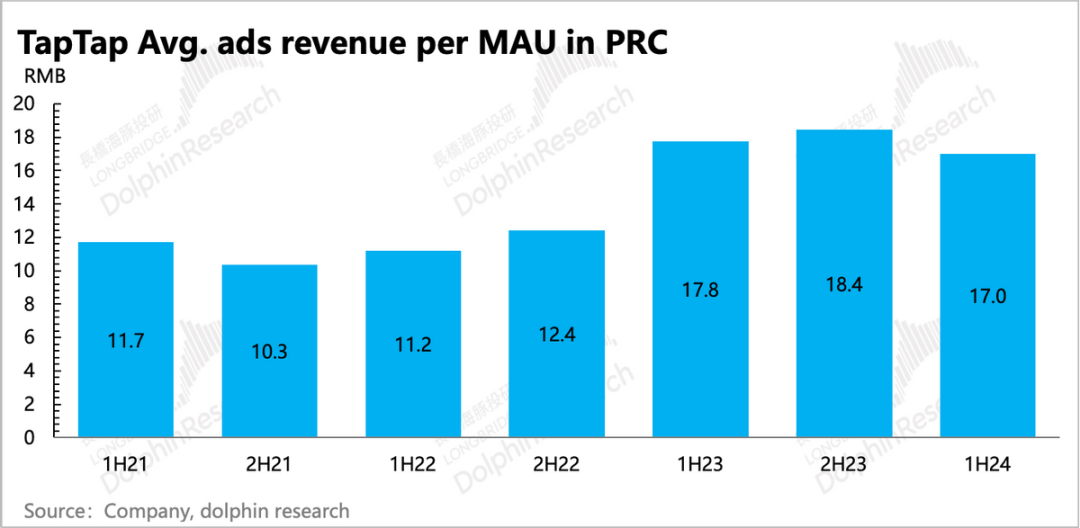

However, XD.com indicated that to ensure user experience, it exercised restraint in advertising during the first half. As a result, TapTap's information service revenue reached RMB 734 million, up 22% YoY, but the monetization value per user declined YoY.

TapTap's growing user influence will attract more advertising and exclusive/primary distribution of high-quality games (e.g., "Happy Fishing Master," "Echoes of the Soul," "Sword and Fairy 3" in the first half). TapTap adheres to a zero-commission policy, contrasting sharply with Tencent's recent challenge to Android channels, highlighting developers' long-standing grievances with traditional channels.

XD.com's controlled advertising load rate in the first half underscores TapTap's supply-demand position in the industry chain, suggesting strong performance during the summer game frenzy in the second half.

3. High Self-Developed Game Margins + Stricter Staff Reduction = Exceeding Profit Expectations

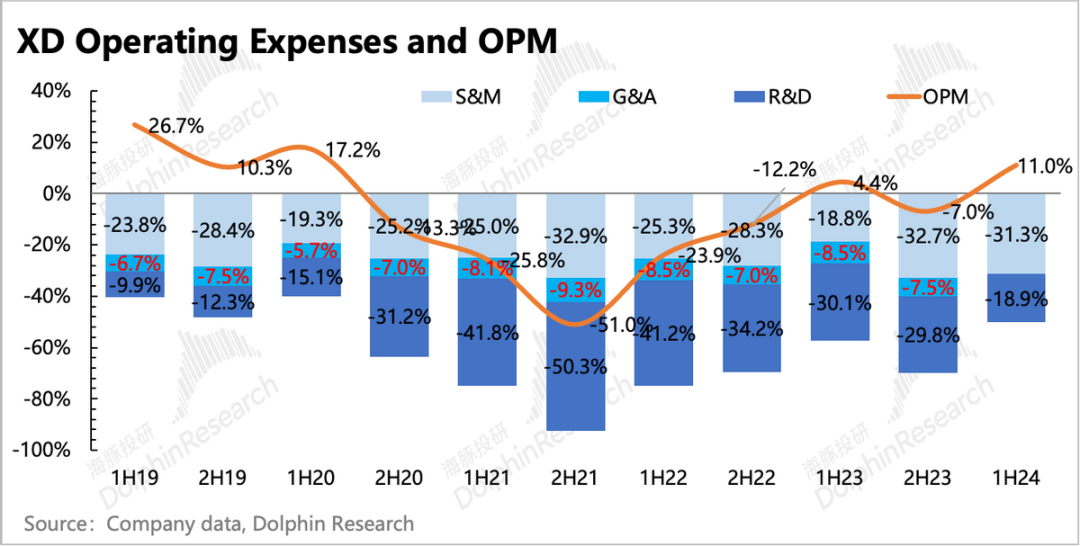

While third-party high-frequency data previews revenues, expenses and profit performance are the primary focus of the interim report, providing incremental information on "business operational efficiency." More self-developed games mean less external revenue sharing, and higher advertising conversion efficiency translates to more revenue per server cost. These factors will drive XD.com's overall gross margin to 67% in the second half, a new record high.

XD.com has also actively pursued cost reduction and efficiency enhancement over the past year. Research and development layoffs, cost optimizations in servers, usage rights, intangible assets, and property/plant contributed significantly to the decline in R&D expenses. Notably, marketing expenses doubled YoY, outpacing revenue growth, suggesting low monetization efficiency. However, this includes the pre-marketing expenses for "Sword of Lily's" global launch in August, resulting in artificially high figures. As revenues from game launches are confirmed in the second half, marketing expense ratios will gradually return to normal levels.

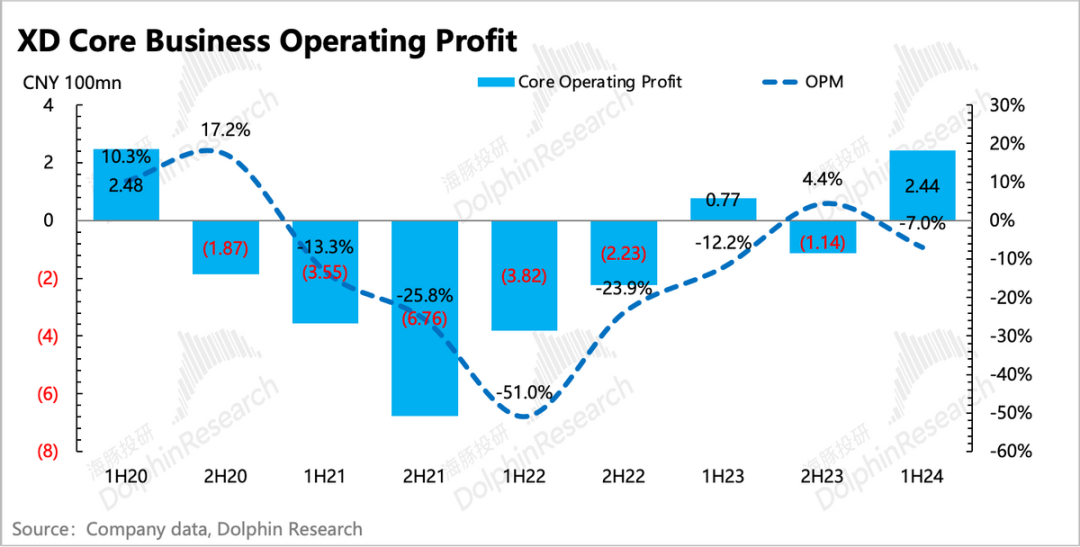

Ultimately, the core primary business operating profit reached RMB 244 million, with a profit margin of 12.2%, up 5ppt and 20ppt YoY and QoQ, respectively.

4. Performance Indicators vs. Market Expectations

Dolphin Insights

This year marks a significant product year for XD.com, but market expectations are already priced into the stock due to the relative transparency of game revenue data. While TapTap generates revenue through advertising, its traffic is heavily dependent on its product cycle and performance, particularly in the current stage. TapTap's reliance on XD.com's internal games may gradually diminish as user penetration reaches a critical mass.

The primary driver of valuation changes remains the future pipeline's performance (the following estimates are Dolphin's rough calculations for cautious reference):

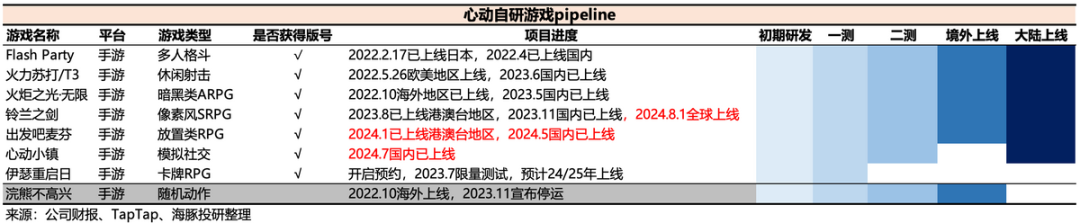

1) In the short term, game revenues in the second half are expected to remain strong, but market expectations are high. Key incremental contributors include "XD Town" (open beta in July), mainland China's "Let's Go Muffin" (open beta in May), and "Sword of Lily's" global launch (August). While "Let's Go Muffin" and "XD Town" will drive near-term growth, "XD Town's" long-term potential is greater due to its high DAU and ability to boost TapTap user engagement.

TapTap's MAU hit a record high of 43.24 million in the first half and is expected to continue breaking records in the second half. Despite deliberate commercialization efforts in the first half, Dolphin expects TapTap to perform well during the summer game frenzy.

2) In the medium term, XD.com's pipeline may weaken after this product cycle. Most upcoming launches are international versions of games released this year, such as "Let's Go Muffin" in Japan and South Korea and "XD Town's" global launch. XD.com mentioned three games under development, including "Ether Reboot," but Dolphin has less clarity on its performance compared to "XD Town" and remains cautious. Insights from the earnings call management team will be valuable.

Given uncertainty over XD.com's 2025 outlook, Dolphin remains neutral on its current valuation of HK$9.5 billion, implying a 2024 P/E ratio of 14x. More concrete information on the three in-development games from the earnings call will be crucial.

Detailed Financial Report Commentary

I. TapTap: User Growth with Controlled Commercialization

TapTap's domestic MAU reached 43.24 million in the first half, up 27% YoY and a net increase of 5.59 million QoQ. This growth was fueled by industry-wide supply increases and TapTap's product cycle, with standout game performances driving traffic. While "Let's Go Muffin" performed well in Hong Kong, Macau, and Taiwan, its distribution may not have relied solely on TapTap, resulting in a 29% YoY decline in international TapTap MAU due to "Sausage Party's" weakness. However, user activity increased compared to the second half of last year without "Let's Go Muffin."

XD.com attributed user churn primarily to India and deliberate cost-cutting measures affecting overseas TapTap MAU. "XD Town" may offer hope for reviving TapTap's overseas growth; otherwise, its international expansion may stall temporarily.

Despite TapTap's traffic growth, not all was reflected in monetization. XD.com exercised restraint in advertising to ensure user experience. As a result, TapTap's information service revenue reached RMB 734 million, up 22% YoY, but monetization per user declined YoY.

TapTap's growing influence will attract more advertising and exclusive/primary distribution of high-quality games (e.g., "Happy Fishing Master," "Echoes of the Soul," "Sword and Fairy 3" in the first half). TapTap's zero-commission policy contrasts with traditional channels, highlighted by Tencent's recent challenge to Android channels. XD.com's controlled advertising load rate in the first half underscores TapTap's supply-demand position, suggesting strong second-half performance during the summer game frenzy.

II. Games: Enjoying the New Product Cycle, "Muffin" Takes Over from "Sausage Party"

Game revenues grew 29% YoY to RMB 1.49 billion in the first half, exceeding the preview but falling short of market expectations. Growth was primarily driven by "Let's Go Muffin" (launched at the beginning of the year) and "Sword of Lily" (launched at the end of last year), while "Sausage Party" continued to decline. The top five games are now "Let's Go Muffin" > "Sausage Party" > "Sword of Lily" > "Torchlight: Infinite" > "Ragnarok M."

"Let's Go Muffin," launched in Hong Kong, Macau, and Taiwan before mainland China in January, unexpectedly became a hit. Its success wasn't surprising given its RO team's background and previous successes ("Ragnarok Online" and "Eternal Ulala"). As an idle game incorporating MMO elements, market expectations for its revenue streams were not low. However, "Muffin's" popularity exceeded expectations, dropping out of Hong Kong's iOS bestseller list only in July and maintaining a top 20 position. In mainland China, despite fierce competition, the game's estimated three-month revenues could reach nearly RMB 1 billion, exceeding previous expectations.

User and ARPPU data highlight "Let's Go Muffin's" strong monetization, with overall game ARPPU growing 68% YoY in the first half.

Looking ahead, game revenues are poised for peak growth in the second half. In addition to new games launched in the first half (reflected in doubled deferred revenues), key incremental contributors include "XD Town" (open beta in July), mainland China's "Let's Go Muffin" (open beta in May), and "Sword of Lily's" global launch (August).

a. New games, particularly "XD Town" and "Let's Go Muffin," will drive significant incremental revenues. Based on current revenue trends, Dolphin estimates full-year revenues of RMB 500 million for "XD Town," RMB 1.2 billion for "Let's Go Muffin," and RMB 300 million for "Sword of Lily's" overseas launch, totaling RMB 2 billion. Assuming 90% revenue recognition, this translates to RMB 1.8 billion in second-half revenues.

b. For established games, assuming a 10% YoY decline (based on Seven-Mac data and recent slowdown in "Sausage Party's" revenues), and a 10% QoQ decline for "Let's Go Muffin" in Hong Kong, Macau, and Taiwan, Dolphin estimates non-new game revenues of RMB 1.3 billion in the second half.

c. Combined, new and established games are expected to generate RMB 3.1 billion in second-half revenues, up nearly 90% YoY, confirming 2024 as a standout year for XD.com. However, future growth may face challenges given the current pipeline. XD.com disclosed three games under development, including "Ether Reboot," but further details may emerge during the earnings call.

In summary, R&D speed and efficiency remain uncontrollable factors for XD.com, underscoring the importance of focusing on short-term investment opportunities tied to product cycles for small and medium-sized game companies, according to Dolphin Insights.

III. Self-developed high gross margin + stricter headcount reduction = exceeding profit expectations

In the first half of the year, XD.com easily achieved a net profit of 251 million yuan under strong monetization, falling within the expected profit range. Excluding gains and losses from financial management and changes in the value of financial assets, the core operating profit was 244 million yuan, with a profit margin of 12%.

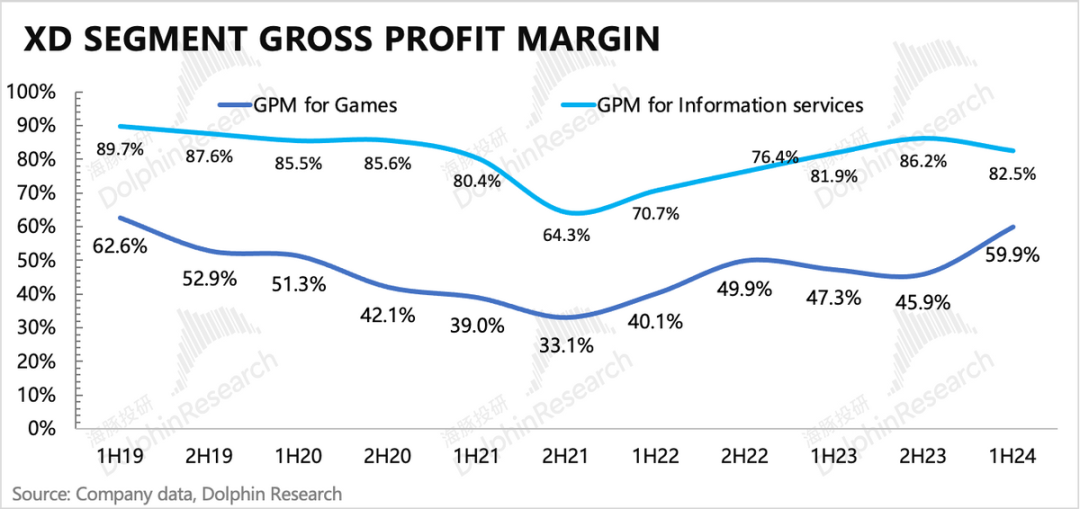

More self-developed games mean less external revenue sharing. Higher ad conversion efficiency means more revenue can be generated per unit server cost. These two factors are the core drivers of the company's overall gross margin increasing to 67% in the second half of the year, once again breaking historical highs.

Specifically, the game gross margin has reached 60%, comparable to leading game companies; while the gross margin of TapTap ads has declined sequentially, mainly due to the company's proactive restraint in ad placements and reduction of ad load rates to ensure a relatively good user experience for new users when they first arrive on the platform.

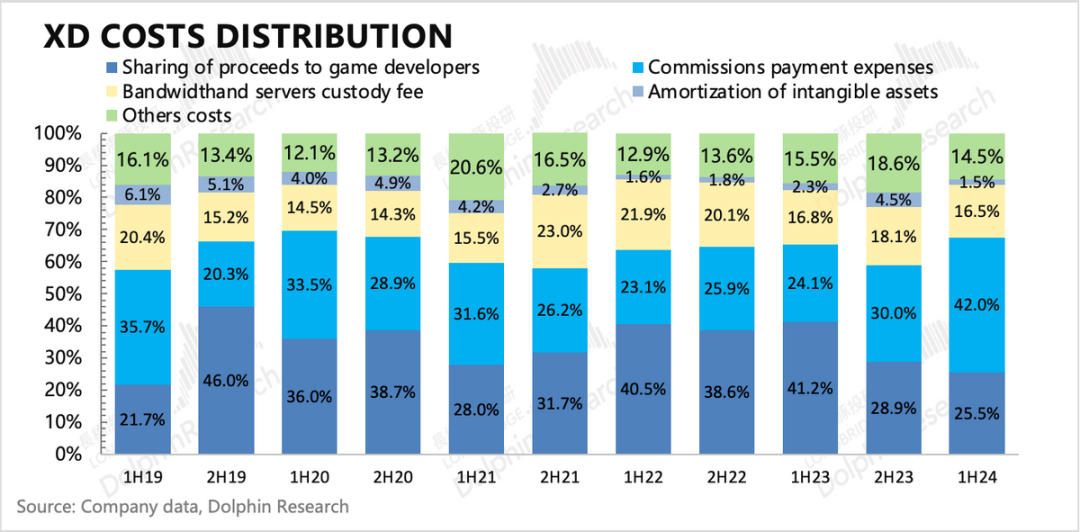

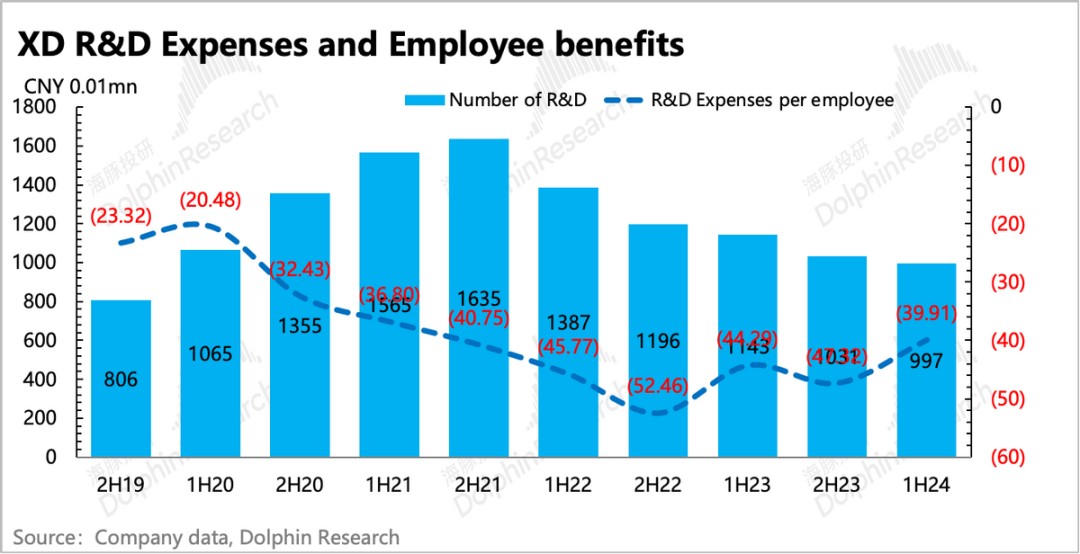

Of course, the company has also been actively working on cost reduction and efficiency improvement over the past year. From the breakdown of expenses, R&D layoffs, cost optimization of servers/licenses/intangible assets, and property and plant costs are the main factors leading to the decrease in R&D expenses.

It is worth mentioning that marketing expenses doubled in the first half of the year, outpacing revenue growth, suggesting seemingly inefficient monetization. However, this was partially due to the aggressive marketing campaign for "Sword of Lily" launched globally in August of the second half of the year, leading to inflated marketing expenses. As revenue from the game is recognized in the second half of the year, the marketing expense ratio will gradually return to normal levels seen in previous years.