Huawei plans to enhance its extended-range models, aiming to surpass plug-in hybrids next year

![]() 09/03 2024

09/03 2024

![]() 581

581

Charging is too slow, and using fuel is too expensive. From this perspective, it seems reasonable to describe extended-range electric vehicles (EREVs) as outdated technology. However, this situation may change starting next year. GAC Group recently disclosed its new vehicle plans for next year, including EREVs and plug-in hybrids (PHEVs) in collaboration with Huawei that support 4C supercharging speeds. Additionally, AVIATA recently announced that its EREV technology will also support 4C charging speeds by next year. Starting next year, both PHEVs and EREVs may simultaneously offer fast charging speeds comparable to battery electric vehicles (BEVs) and lower fuel consumption in depleted battery conditions.

The smaller the battery, the harder it is to fully charge in 15 minutes

While BEVs are embracing 800V high-voltage platforms and fast-charging powers exceeding 500kW, PHEVs and EREVs seem to have hit a technical wall. Whether it's Li Auto, which has long focused on EREVs, Huawei, a late entrant, or BYD's PHEV technology, 100kW charging power is essentially the ceiling for civilian use. Consequently, while BEVs boast about 4C and 5C fast charging, PHEVs and EREVs remain stuck at around half an hour for a full charge.

From a user's perspective, PHEVs and EREVs have smaller battery capacities, often half that of BEVs. Yet, their charging speeds are not faster but slower. This is due to insufficient technology. While this criticism holds some truth, the fundamental reason for limiting fast charging in PHEVs and EREVs is their small battery capacities.

To improve charging speed, one can either increase voltage or current. Most new energy vehicles opt for the former, giving rise to the concept of 800V high voltage. Tesla, on the other hand, insists on enhancing current. However, neither approach is straightforward for PHEVs and EREVs with limited battery capacities.

First, achieving high voltage requires series-connecting enough battery modules, preferably high-voltage ternary lithium-ion modules. However, many cost-effective PHEVs and EREVs use lithium iron phosphate batteries, and even Huawei, which uses ternary lithium-ion batteries, struggles to match BEVs' voltage levels with around 40kWh capacities. BEVs typically have battery capacities of 70-100kWh.

Therefore, in PHEVs and EREVs, larger battery capacities directly correlate with faster charging speeds. For instance, the AITO M9 with a 52kWh battery can fast charge to 80% in the same time as the 42kWh version. The NIO U8, with over 49kWh, can charge from 30% to 80% in as little as 18 minutes.

But we're talking about achieving 4C fast charging, i.e., a full charge in 15 minutes. AVIATA has previously shown that it can reduce charging time from 30% to 80% to just 10 minutes. Pushing voltage with specialized modules isn't cost-effective. Instead, enhancing the battery's ability to handle high currents and increasing overall battery capacity are practical solutions to boost charging speed while keeping costs under control.

AVIATA's 4C supercharging battery pack, for example, has a capacity of 52.4kWh. Technically and economically, the need for ternary lithium-ion batteries in PHEVs and EREVs further diminishes with larger battery packs. The core challenge in matching BEVs' charging times lies in enhancing the reactivity of lithium iron phosphate batteries, which companies like CATL and Geely have already addressed with products like the Shenxing and Shendun batteries.

Upgrading cathode activity, refining electrolyte formulations, optimizing separator permeability, and increasing anode embedding space are key upgrades for 800V high-voltage lithium iron phosphate batteries in BEVs. Importantly, these upgrades have withstood market tests in high-voltage, high-current mass production applications.

For PHEVs and EREVs, the challenge is that these larger batteries are best suited for B-segment and above vehicles, preferably SUVs. Restricting battery pack sizes to fit B-segment and smaller cars using ternary lithium-ion batteries may not be cost-effective due to limited marginal benefits and higher price sensitivity in these segments.

In summary, next year's PHEV and EREV models will significantly upgrade their fast-charging capabilities, rivaling first-tier BEVs. Larger battery capacities may also enhance their pure electric range or reduce prices for high-end models that already use larger batteries.

Will EREVs be more economical on the highway with fuel than charging?

Continuing the previous discussion, with battery capacities exceeding 50kWh, even the AITO M7's AWD version can achieve over 200km of pure electric range under WLTC conditions. With 4C fast charging, it can replenish approximately 120km of range in 15 minutes, ample for urban and suburban driving but insufficient for highway travel. To address EREVs' highway energy consumption, internal combustion engines (ICEs) are necessary.

Unlike PHEVs, which have direct drive assistance on highways, EREVs' ICEs solely function as generators. While sacrificing ICE-driven efficiency, this allows for more extreme ICE development.

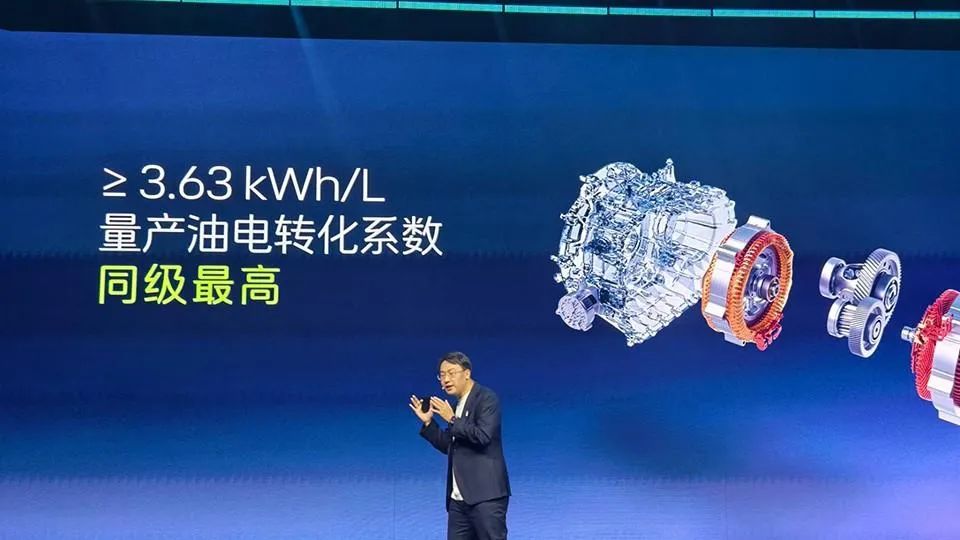

Take AVIATA's EREV, equipped with Changan's 1.5T JL469ZQ1 engine (also used in the SL03 G318). Its 1.45 bore-to-stroke ratio is unconventional for conventional ICEs but optimizes power generation in EREVs. This engine achieves a power generation efficiency of 3.63kWh/L, exceeding the current benchmark of 3.3kWh/L for EREVs.

Carmakers without direct drive technology can optimize ICEs more aggressively than those also producing conventional vehicles. For example, Chery's fifth-generation engine, designed for both PHEVs and EREVs, has a more conventional bore-to-stroke ratio of around 1.27, while the current AITO 1.5T engine has a ratio of approximately 1.2. The AVIATA and SL03's range-extender ICEs have a compression ratio of just 16, indicating room for further optimization.

ICEs must consider ignition reliability beyond driving performance. The example ICEs manage knock control and are compatible with 92-octane fuel, uncommon in high-compression EREV range extenders that typically require 95-octane. Achieving low-octane compatibility requires precise fuel injection and tumble flow design.

Ignition is crucial. Uneven ignition causes vibrations and incomplete combustion, leading to carbon deposits. Changan enhances tumble flow and ignition energy for reliable ignition, while Chery introduces pre-combustion chambers to ignite leaner fuel-air mixtures efficiently and uniformly.

AVIATA 11's EREV, powered by the new engine, achieves a fuel consumption of 6.2L/100km in depleted battery mode. For reference, the AITO M7 consumes 6.85L/100km, despite the AVIATA having a 31kW higher motor power and weighing just 70kg more. If the M7 achieved similar fuel economy with 92-octane fuel, highway fuel costs could drop below 0.5 yuan/km, cheaper than electricity at highway charging stations (assuming 1.5-3 yuan/kWh and the M7's 23kWh/100km consumption). (Theoretical calculations for reference only)

These technological advancements indicate significant improvements in PHEV and EREV battery and ICE technologies. These cumulative changes are poised to explode in next year's new models, offering faster charging and more economical fuel consumption. Even for EREVs alone, next year may finally shed the label of 'outdated technology.'