ToB Or ToC, large models don't do 'multiple-choice questions'?

![]() 09/03 2024

09/03 2024

![]() 434

434

Source | BohuFN

Author | Kaikai

On the commercialization path of AI large models, 'ToB or ToC' has always been a dilemma. However, there is a consensus within the AI industry that startups are more likely to find opportunities on the C-end, while internet giants can gain scale advantages through the B-end.

But currently, this consensus may be broken. The Dark Side of the Moon, which has been regarded as a 'To C advocate,' recently announced the launch of enterprise-level APIs, and the storage cost for the context cache Cache of the Kimi open platform will be reduced by 50%, accelerating its efforts in the B-end market.

Coincidentally, the progenitor of large models, OpenAI, also announced recently that it will allow enterprises to customize its flagship AI model GPT-4o using their own data, meaning that enterprises can now customize and optimize AI models with stronger performance.

From the 'Hundred Models War' to the 'Battle of Applications,' large models have reached a critical stage of commercialization. It is not only necessary to consider whether the product stands out, but also to comprehensively consider issues such as cost, application, and monetization. Every company is seeking its own answer. For them, 'ToB or ToC' may not be a multiple-choice question, but a required question.

01 Monetization: The Obstacle for C-end Large Models

Before Kimi began focusing on the B-end, it had tested a C-end tipping model in May this year, where users could purchase gifts ranging from 5.20 yuan to 399 yuan to obtain different priority usage times during peak hours.

Regarding the launch of the tipping function, The Dark Side of the Moon once stated that the service was in the testing phase, and the company remained open-minded about exploring commercialization models.

From this perspective, Kimi's tipping model seems more like a test of users' willingness to pay rather than a pursuit of profit, given that most of Kimi's user base is converted from platforms like Douyin and Bilibili, exploring the attitudes of young people is essential for the company.

However, this does not mean that Kimi plans to continue 'powering with love' indefinitely, as the 'burn rate' for large model startups is extremely fast. Firstly, large models need to invest significant marketing costs to enter the C-end market.

Since this year's Spring Festival, large model companies have embarked on marketing battles. The most common online advertising model is CPA, where the large model company pays advertising fees once a user triggers an ad by browsing the website and completes registration or downloads the app.

However, the currently available platforms are primarily Bilibili, Douyin, and other platforms focused on young users, while there are many large model enterprises that need to invest in advertising. The bidding model of CPA has also indirectly pushed up advertising costs.

According to industry insiders, the average CPA quote on Bilibili was generally below 10 yuan per person at the beginning of 2023, but the current CPA cost for The Dark Side of the Moon on Bilibili may have reached as high as 30 yuan.

According to Sina Technology's estimates, the company has invested over 30 million yuan in advertising since February this year. The effect of advertising was significant, with Kimi's page views once increasing by more than four times, but the excessive marketing costs ultimately burned investors' money.

The second cost is training. OpenAI initially planned to spend around $800 million on training costs this year, but as OpenAI accelerates the training of its latest flagship model, training costs may double again.

Dario, CEO of OpenAI's top competitor Anthropic, also stated that the current AI model training costs being developed by the company are as high as $1 billion, but these costs could rise to $10 billion or even $100 billion by 2027.

Finally, there are computing costs. The computing costs of large models will continue to rise as the user base grows. Guosheng Securities once estimated that to build a large model comparable to ChatGPT, an investment of 1 billion yuan would be required, assuming a price of 100,000 yuan per A100 chip.

As costs continue to rise, the 'AI Five Dragons' that have received successive new financing may not be short of money, but they cannot indefinitely ignore commercialization and monetization, let alone other large model companies without excess funds.

However, monetizing in the C-end market is not easy. Firstly, most general-purpose large models, such as ERNIE Bot and ChatGPT, are currently free, and cultivating users' paid habits will require a long period. Homogeneous AI applications are also far from being a rigid demand.

Secondly, the revenue model for large models in the C-end market is relatively limited. Apart from subscription fees, other charging models still face significant challenges. For example, relying on advertising for revenue generation may affect user experience and raise privacy concerns. Previously, WPS Office's charging for AI features caused an uproar due to its 'Russian doll' pricing structure.

Thirdly, C-end consumers recognize products more based on the brand, which is why The Dark Side of the Moon spends a lot of money on advertising. In this context, if Alibaba or Tencent heavily invest in a particular AI application, other startups may struggle to compete.

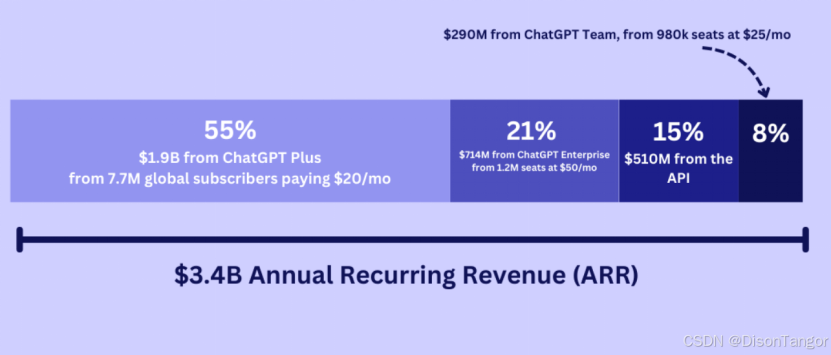

Even for OpenAI, its C-end market revenue has reached $1.9 billion, primarily from 7.7 million global subscribers paying $20 per month for ChatGPT Plus, but this is still far from sufficient to cover the costs of building and running the model.

Foreign media cited OpenAI's unpublished internal financial data, stating that OpenAI will face losses of up to $5 billion this year. Annual revenue is estimated to be between $3.5 billion and $4.5 billion, but operating costs may reach $8.5 billion, including $4 billion in inference costs.

OpenAI provides a free version of ChatGPT for C-end users, increasing inference costs without generating any additional revenue, which contributes to its financial struggles.

02 Betting on the B-end as the Ultimate Destination for C-end Models?

In simple terms, for large models to develop rapidly in the C-end market, they must achieve better comprehensive capabilities and user experience, and adopt a low-cost or free usage model to better attract users.

This model requires continuous 'burning' of funds, forcing top large model players to turn their attention to the B-end market. Taking Baidu as an example, it recently released its second-quarter 2024 financial report, where Baidu Intelligent Cloud revenue reached 5.1 billion yuan, a year-on-year increase of 14%, and continued to achieve profitability, with AI contributing an increasing share of revenue from 6.9% in the previous quarter to 9%.

However, from Baidu's 2023 annual report, although Baidu's advertising system reconstructed with the ERNIE large model achieved hundreds of millions of yuan in incremental revenue, its online marketing revenue still declined compared to the previous two quarters, indicating that the activity and monetization rates of large models in the C-end market did not meet expectations.

Therefore, there are differing opinions among industry leaders on whether large models should focus on ToB or ToC. Wang Xiaochuan, CEO of Baichuan Intelligence, has explicitly stated that To C is ten times larger than To B, and that large companies will all compete in To B, with Baichuan Intelligence committed to differentiation.

Zhu Xiaohu, of Jinsha River Ventures, believes that in China, the To B business model is far more suitable than the To C model for large models.

While there are differing views, large model companies are not overly concerned about whether to focus on To C or To B. They are not just 'all-in' on one or the other but rather mutually empower each other.

Zhang Yaqin, Dean of the Institute for Artificial Intelligence, Tsinghua University, once stated that at the application and service level, the To B cycle is relatively long, while To C application products can be rapidly launched, which is consistent with the development path of mobile internet.

Therefore, most large model startups adopt a parallel strategy of To B and To C. Even Baichuan Intelligence, which openly states, 'We focus on the C-end,' has also launched an API interface business.

This 'C+B' business model is currently the mainstream commercial model for large model companies. For example, OpenAI charges membership fees for ChatGPT on the C-end and API invocation fees for large models on the B-end through 'public cloud + API.'

Apart from monetization through charging, large model enterprises also enhance their existing mature businesses through AI. For example, Alibaba's Quark browser recently launched a PC version, upgrading a series of 'all-scenario AI' functions such as AI search and AI writing, further increasing customer attractiveness and stickiness. SenseTime, which has primarily focused on the B-end, also introduced its AIGC product 'Miaohua Qupai' capable of generating creative photos to the C-end market this year.

Therefore, in choosing the commercialization path for large models, simultaneously betting on ToC and ToB not only compensates for the uncertainty of the C-end with the stable income of the B-end but also mutually empowers both businesses at the technical and branding levels in the longer term.

On the one hand, large model companies can continuously collect user feedback and accumulate model application practices through C-end products, ultimately feeding back to the large model for iterative upgrades. It is difficult to form a closed loop of user feedback if only external APIs are opened.

On the other hand, as Kai-Fu Lee, CEO of Sinovation Ventures, said, there are more opportunities in the short term for To C in China, where C-end products are more likely to explode and gain a reputation, and their traffic and momentum can also benefit B-end businesses.

Finally, large model companies that 'focus on the C-end' are also actively introducing APIs to reduce costs, even continuously lowering invocation costs, hoping that developers can develop useful AI applications on their ecosystems.

Just as in the early days of the internet industry, when the degree of differentiation between products was not significant, the competition was about who could build the first successful ecosystem. Only with the participation of more creators can there be opportunities to develop useful AI applications.

Therefore, the current debate about whether ToC or ToB is better is not very meaningful, as the main contradiction in the large model industry is not just financial pressure but the need for more people to apply and create an ecosystem. Neither the B-end nor the C-end market alone can easily achieve this goal.

According to the Cyberspace Administration of China, as of August, there are over 190 generative AI service large models registered and available in China. However, Kai-Fu Lee once predicted that when the large model competition nears its conclusion, only around 30 large model companies may survive.

Currently, no large model company is recognized as the 'leader,' including internet giants, which may not necessarily have an advantage. For startups, regardless of the path chosen, they must compete fiercely for branding, products, and ecosystems, or they will have fewer opportunities in the future.

03 ToB: The Battle in the Age of Customization

It is evident that the B-end is an indispensable part of the commercialization loop for large model companies, but it is not easy to succeed in the B-end market.

Firstly, there is the relentless price war in the B-end market. In May this year, ByteDance officially launched its Doubao large model, with the pricing of its main model in the enterprise market set at 0.0008 yuan per thousand tokens, over 90% cheaper than the industry average, driving domestic large model token prices from 'cents per token' to 'fractions of a cent per token,' shocking the industry and prompting many competitors to follow suit with price cuts.

Indeed, most large model companies believe that the industry should avoid price wars, but when push comes to shove, not cutting prices means losing market share to competitors. Even though Baidu's Robin Li once called on entrepreneurs to compete in AI applications rather than prices, after ByteDance and Ali Cloud significantly reduced their prices, Baidu's two main large models quickly announced that they would be completely free.

Industry insiders believe that there are not many enterprises willing to pay for software, and the profit margins for large models in the B-end are rapidly shrinking. Last year's large model projects that could sell for tens of millions of yuan may only sell for 1 million yuan this year, with too many open-source large models available on the market and fierce competition.

Secondly, B-end and G-end businesses are sometimes 'hard nuts to crack.' On the one hand, each B-end customization case is unique, and non-standardized customization services mean higher costs, especially for complex scenarios and late digital transformation environments where issues like data security and information silos are not easy to overcome.

On the other hand, the sales cycle and accounts receivable period for B-end and G-end businesses are often longer, requiring companies to demonstrate more patience and sustained efforts. Recently, Liu Qingfeng, Chairman of iFLYTEK, stated that the company would proactively slow down or even abandon some G-end businesses due to concerns about the payment cycle.

Thirdly, for vertical industries such as finance, healthcare, and law, there is a high demand for the involvement of large models, and reserving high-quality talent in related fields is also a significant cost.

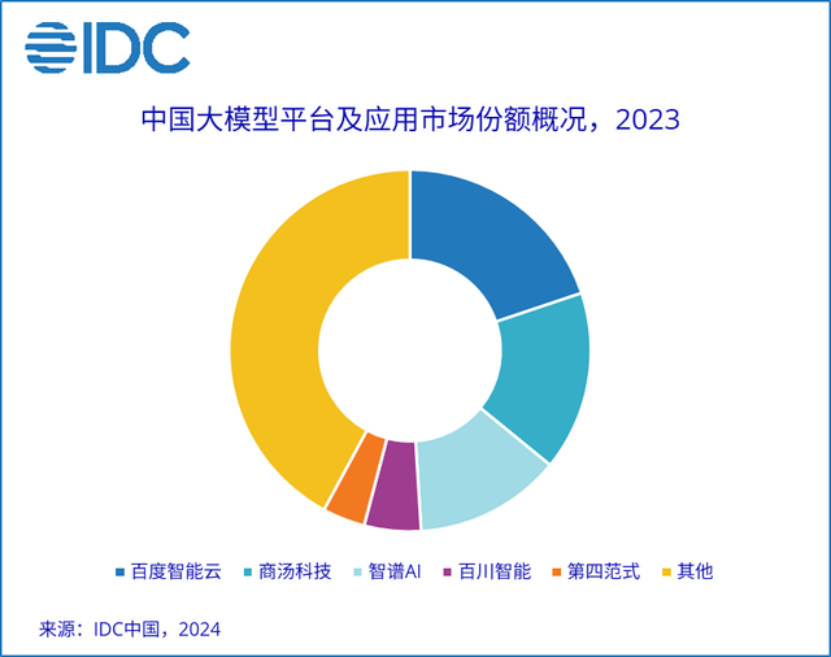

Finally, even if large model startups overcome these challenges, enterprises developing base models often prefer established cloud vendors. Data shows that in the 2023 large model market, Baidu Intelligent Cloud, SenseTime, and Zhipu AI ranked top in market share, accounting for half of the market combined.

However, this does not mean that startups cannot break through. Data shows that the adoption rate of generative AI by enterprises in China reached 15% in 2023, with a market size of 14.4 trillion yuan, a figure expected to continue to increase.

In the second half of the B-end market for large models, the focus may need to shift from an enterprise perspective to an industry perspective, rooting in various aspects such as office work, production, education, and manufacturing, and becoming a driving force for new enterprise growth, which is key to enterprises embracing this new technology.

Some enterprise representatives believe that they are not concerned with how flashy large models are but rather how much money they can save their businesses. What they truly need are complete business solutions based on overall technological advancements.

As the large model industry continues to develop, the question of finding a sustainable business model amid user growth and model capability advancements will continue to plague every large model enterprise, but the answers may vary among different companies.

This means that in the large model industry, there is no one-size-fits-all model. Whether ToB or ToC, they are merely paths for large models to the future. What truly determines the future of enterprises is their ability to bring more innovative AI applications and services to customers through the service process.

If only 30 large models ultimately survive, the ones that do will not necessarily be the most well-known but rather the most practical.

* The cover image and accompanying images belong to their respective copyright owners. If the copyright owner believes that their work is not suitable for public browsing or should not be used free of charge, please contact us promptly, and we will promptly make corrections.