China Unicom lags behind in performance: R&D investment falls short of peers

![]() 09/03 2024

09/03 2024

![]() 462

462

Recently, China Unicom (600050.SH), one of the three major domestic telecom operators, released its financial results for the first half of 2024, showcasing a double-digit growth in both revenue and profit.

Stockstar notes that the interim report still reveals several issues. On the one hand, traditional business revenues, represented by broadband, mobile data services, and voice calls, have begun to decline. On the other hand, the growth of emerging businesses such as cloud computing and big data has slowed across the board.

Moreover, among the three major telecom operators, China Unicom ranks last in both revenue scale and profitability, trailing behind China Mobile and China Telecom. This phenomenon is attributed to China Unicom's lagging base station construction, lack of distinctive services, and insufficient R&D investment, which collectively contribute to the company's disadvantaged position in both traditional and new businesses.

01. Some traditional businesses facing decline

Public information indicates that China Unicom's revenue primarily comes from providing telecom services such as voice, data access, value-added telecom services, and internet applications, as well as selling or bundling communication products, including terminals.

In the first half of 2024, China Unicom achieved revenue of RMB 197.3 billion, up 2.9% year-on-year, with net profit attributable to shareholders amounting to RMB 6.039 billion, a 10.93% increase year-on-year.

According to data from the Ministry of Industry and Information Technology, the telecommunications industry operated relatively steadily in the first half of 2024, with cumulative telecom business revenue reaching RMB 894.1 billion, up 3% year-on-year. In other words, while China Unicom's revenue increased, its growth rate was lower than the industry average.

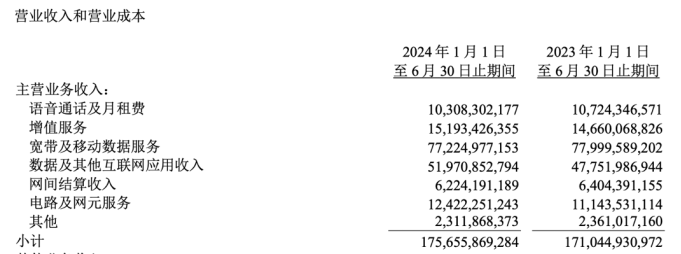

From a segment perspective, China Unicom's service revenue amounted to RMB 175.7 billion in the first half of this year, up 2.7% year-on-year, which represents a slowdown compared to the 6.25% growth rate in the same period last year. Notably, the company's flagship broadband and mobile data services saw a decline in revenue, with a total of RMB 77.225 billion, down 0.99% year-on-year. Simultaneously, voice calls, monthly rental fees, and inter-network settlement income also declined, by 3.88% and 2.81%, respectively.

As China Unicom's second growth engine, the Digital Intelligence and Network Services (DINS) business encompasses six major segments: Unicom Cloud, data centers, digital science integration, data services, digital intelligence applications, and cybersecurity.

In the first half of this year, the company's overall DINS business revenue reached RMB 43.5 billion, up 6.6% year-on-year. Stockstar notes that the growth rates of the company's cloud services, big data business, and cybersecurity business have all slowed down.

Specifically, in the first half of this year, Unicom Cloud revenue amounted to RMB 31.7 billion, up 24.3% year-on-year, a decrease of 11.7 percentage points from the 36% growth rate in the same period last year. The big data business generated revenue of RMB 3.2 billion in the first half of the year, up 8.6% year-on-year, a significant slowdown from the 54% growth rate in the same period last year. Cybersecurity business revenue reached RMB 1.4 billion in the first half of the year, up 58.2% year-on-year, a sharp decline from the triple-digit growth rate (178%) in the same period last year.

Furthermore, as China Unicom accelerates the development momentum of its DINS business, the long implementation cycles and complex acceptance processes of DINS projects, compared to traditional connected communication services, have led to an increase in accounts receivable. As of the end of June 2024, the company's accounts receivable amounted to RMB 60.056 billion, up 50.2% from the beginning of the year and 20.86% year-on-year.

The slow pace of payment collection has led to a year-on-year decline in net operating cash inflows. In the first half of this year, China Unicom's net cash flow from operating activities amounted to RMB 30.138 billion, down 23.2% year-on-year.

02. Lagging behind in user scale

As one of the three major telecom operators, China Unicom lags behind the other two operators in both revenue scale and profitability.

In the first half of this year, China Mobile and China Telecom generated revenues of RMB 546.7 billion and RMB 266 billion, respectively, both exceeding China Unicom's RMB 197.3 billion. In terms of profitability, China Mobile and China Telecom's net profit attributable to shareholders amounted to RMB 80.2 billion and RMB 21.8 billion, respectively, both higher than China Unicom's RMB 6.039 billion.

Firstly, the communications business serves as the foundation for the three major telecom operators. In the first half of this year, China Mobile's communications business revenue amounted to RMB 463.6 billion, while China Telecom's telecommunications service revenue reached RMB 246.2 billion, both exceeding China Unicom's RMB 175.7 billion.

This phenomenon is attributed to China Unicom's relatively lagging base station construction and lack of distinctive services. The number of base stations directly affects the scope and density of network coverage. In the first half of this year, China Mobile accumulated over 2.29 million 5G base stations, with 351,000 newly constructed.

China Unicom, in collaboration with China Telecom, has jointly built a high-quality network featuring high, medium, and low-frequency coordination and 5G/4G integration. During the reporting period, more than 100,000 additional 5G mid- and high-frequency base stations were jointly built and shared, bringing the total number of jointly built and shared 5G base stations to 1.31 million.

Apart from insufficient network coverage, industry insiders point out that China Unicom is notably lacking in distinctive services and differentiated competition. Compared to China Mobile and China Telecom, China Unicom fails to adequately showcase unique services, resulting in a lack of sufficient competitive differentiation. This makes it difficult for users to clearly distinguish China Unicom from the other two operators when making their choice.

These factors have contributed to China Unicom's disadvantaged position in terms of mobile user scale. In the first half of this year, China Unicom had a total of 340 million users, including 276 million 5G package users, significantly trailing behind China Mobile's 1 billion mobile users and 514 million 5G network users, as well as China Telecom's 417 million mobile users and 337 million 5G package users.

Secondly, building upon their traditional businesses, the three major telecom operators are vigorously expanding into emerging businesses represented by cloud computing and big data technologies.

Stockstar notes that China Unicom also lags behind in terms of revenue scale and growth rate for its new businesses. In the first half of this year, China Mobile's digital transformation revenue amounted to RMB 147.1 billion, up 11% year-on-year, while China Telecom's industrial digitalization revenue reached RMB 73.7 billion, up 7.2% year-on-year, both exceeding China Unicom's new business revenue (RMB 43.5 billion) and growth rate (6.6%).

Among them, cloud service revenue serves as the core driver of growth for the second curve business of the three major operators. In the first half of this year, China Mobile's mobile cloud revenue amounted to RMB 50.4 billion, China Telecom's Tianyi Cloud revenue reached RMB 55.2 billion, while China Unicom's Unicom Cloud revenue stood at RMB 31.7 billion, ranking last.

China Unicom's slow development in new businesses is related to its insufficient R&D investment. Stockstar notes that in the first half of this year, China Unicom's R&D expenses amounted to RMB 2.994 billion, accounting for 1.52% of revenue, while China Telecom's R&D expenses reached RMB 4.659 billion, or 1.75% of revenue, and China Mobile's R&D expenses totaled RMB 11.971 billion, or 2.19% of revenue. China Unicom's R&D investment falls short of that of the other two operators. (This article is originally published by Stockstar, Author | Li Ruohan)

- End -