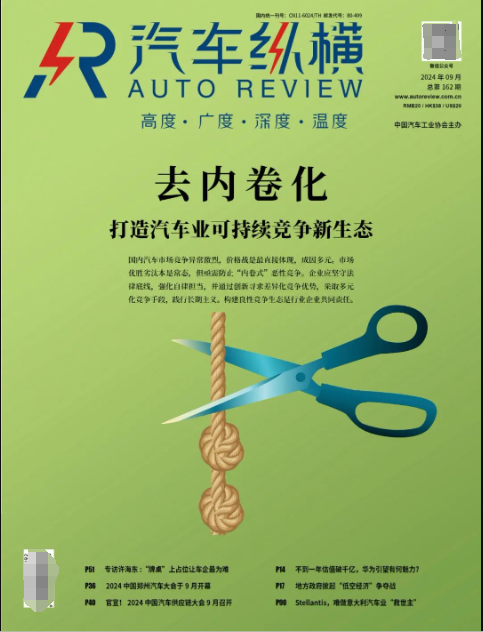

"Involution approaching a critical point, it's time to 'stop'" | Cover Story: De-involutionizing - Forging a New Sustainable Competitive Ecosystem in the Automotive Industry (Part I)

![]() 09/04 2024

09/04 2024

![]() 619

619

Editor's Note

The domestic automotive market is fiercely competitive, with price wars being the most direct manifestation. The causes are multifaceted. While market competition and survival of the fittest are natural, there is an urgent need to prevent malicious "involutionary" competition. Companies must adhere to legal boundaries, strengthen self-discipline, seek differentiated competitive advantages through innovation, adopt diversified competition strategies, and embrace long-termism. Building a healthy competitive ecosystem is a shared responsibility among industry players.

Focusing on the impact of "involutionary" competition on the automotive industry, Auto Review presents this special "Cover Story" series. This series comprises five articles, with the first being released today. Stay tuned.

Market economies thrive on competition, which breeds champions. However, current involutionary trends constitute an unhealthy development. It is the shared responsibility of the automotive industry to address this issue and foster a healthy, orderly, and sustainable market environment.

In terms of the current level of involution, if the Chinese automotive industry claims to be second in involution, no other country dares to claim first. As Li Shufu, Chairman of Geely Holding Group, stated, China leads the world in automotive industry involution. The topic of involution is a hot issue in the automotive sector.

Involution is increasingly externalized, potentially evolving into malicious competition. It occurs between auto companies of the same type and those of different natures, as well as between similar products, including both new energy vehicles and fuel vehicles. This has caused immense suffering within the industry, particularly with escalating price wars. Behind these price wars lie cost battles, profit wars, market share wars, and even battles for the survival of companies.

Many industry players are forced into this inescapable "prisoner's dilemma." Consequently, recent industry voices have been calling for an end to price wars and a return to healthy competition. On July 30, 2024, the Political Bureau of the CPC Central Committee made a definitive statement: strengthen industry self-discipline to prevent "involutionary" malicious competition; reinforce the market's survival of the fittest mechanism and ensure smooth exit channels for backward and inefficient capacity. This marks the first time the state has expressed a clear stance on involution.

Currently, the cascading impact of involution on the automotive industry is approaching a critical point. Breaking the cycle of involutionary malicious competition and restoring healthy and orderly competition in the automotive market is an urgent task for achieving high-quality development in the automotive industry. Returning to our roots, adhering to innovation-driven long-termism, and fostering a new sustainable competitive ecosystem grounded in law and self-discipline are the keys to unlocking the involution conundrum and the shared new mission of automotive industry enterprises.

"Involution" Sparks Divergent Views

There are diverse voices and perspectives within the industry regarding involution.

In July 2024, during the 2024 China Automotive Forum, the China Association of Automobile Manufacturers (CAAM) convened a symposium on involution, with key industry players actively participating. At the forum, Fu Bingfeng, Executive Vice President and Secretary-General of CAAM, noted that domestic automotive market demand growth is sluggish, intensifying industry competition and placing considerable pressure on the overall operation of the sector. This intensified involution is detrimental to the healthy development of the automotive industry, and the market needs to return to normal competitive order. Xin Guobin, Vice Minister of Industry and Information Technology, also expressed concern about insufficient domestic automotive consumption demand, fierce market competition, and the emergence of some disorderly competition phenomena, leading to declining profits or even losses for many enterprises and an increase in inter-enterprise arrears, which impact and disrupt the stability of the industrial chain and supply chain.

Meanwhile, at the theme forum of the 2024 China Automotive Forum, "Building Chinese Automotive Brands in the Era of Globalization," speakers engaged in heated discussions and even debates on the topic of involution. Yang Xueliang, Senior Vice President of Geely Holding Group, viewed involution negatively, describing it as a synonym for unhealthy competition that disrupts competitive order, represents low-level competition, and fosters growth without quality or staying power. In contrast, Li Yunfei, General Manager of BYD Brand and Public Relations, argued that Chinese automobiles are becoming stronger through involution, including in technology, products, and services. Over the past four years, Chinese mainstream automotive brands have increased their R&D investment 2.5 times compared to four years ago, and recent products have significantly improved compared to those from three to five years ago, both in comparison to themselves and to foreign-invested and joint venture peers.

Broadly speaking, the automotive industry can be divided into two camps: those opposed to involution and those who support it. Opponents include representatives such as Zeng Qinghong, Chairman of GAC Group; Li Shufu, Chairman of Geely Holding Group; Wei Jianjun, Chairman of Great Wall Motor; and Fu Yuwu, Honorary Chairman of the China Society of Automotive Engineers.

Zeng Qinghong believes that we should adopt a broader perspective and long-term strategy rather than engage in involution through price wars, which may boost sales but erode profits. The goal of enterprises is to make profits, contribute to the country and society, and stabilize and expand employment. The automotive industry cannot survive through involution, and zero-sum games must be rejected.

Li Shufu argues that any healthy industrial development must demonstrate good economic returns in terms of input-output ratios. Endless involution and simplistic price wars lead to cutting corners, counterfeiting, and unregulated competition, which is detrimental to sustainable and high-quality development in the automotive industry. Unregulated competition must be opposed.

Wei Jianjun urges Chinese auto companies to self-reflect, adhere to ethical boundaries, and prevent "involutionary" malicious competition. Companies that cannot generate profits will not last long. He opposes operating at a loss and advocates for "quality market share." He even suggests conducting an audit of the automotive industry to identify problematic players and uphold competitive order.

Market economies thrive on competition, which fosters champions. However, Fu Yuwu believes that involution has become a frightening phenomenon. If left unchecked, it could distort the industry's values and undermine its rule of law environment. He emphasizes avoiding price wars, which are both unaffordable and unwinnable, and respecting the market.

Supporters of involution, including Zhu Huarong, Chairman of Changan Automobile, and Wang Chuanfu, Chairman and CEO of BYD, view it optimistically as a natural process of survival of the fittest and the pursuit of excellence.

Zhu Huarong sees involution as a normal process where good money drives out bad, and the best way for the industry to quickly return to healthy competition. It signifies the pursuit of excellence, elevates Chinese brands to new heights, maximizes user benefits, and genuinely creates value for customers. He stresses the importance of user-centricity and honesty in brand and product promotion to avoid eroding societal and consumer trust in the industry.

Wang Chuanfu embraces involution as competition, urging entrepreneurs to engage in it and compete globally, upholding Chinese brands and striving for world dominance.

However, supporters of involution do not condone malicious competition; they also advocate for normal, healthy market competition. In their view, price wars are a market economy phenomenon but should not sacrifice value.

On August 21, 2024, during a dialogue with Fu Yuwu, Yin Tongyue, Chairman of Chery Holding Group, stated that price wars are the lowest form of competition. Instead, enterprises should focus on technological innovation, brand upgrading, globalization, and differentiated development. With a vast domestic market of 30 million vehicles, China has ample room for development. Brands can expand multidimensionally upwards and sideways but should avoid downward trends.

In essence, both supporters and opponents of involution share the core idea of promoting healthy and orderly competition.

Involution Plunges the Industry into a Dilemma

It is undeniable that involution has plunged the entire automotive industry into a state of anxiety, potentially exceeding common perceptions.

Involution manifests in various forms, including price, cost, channel, technology, configuration, traffic, public opinion, and leadership, encompassing nearly all core elements. Price wars are the most direct manifestation, involving both direct and indirect price reductions. Xu Haidong, Deputy Chief Engineer of CAAM, warned in an exclusive interview with Auto Review that automakers should not rely solely on pricing strategies, as this could lead to malicious competition detrimental to industry development.

Price wars have persisted for nearly a decade. Amid ample production capacity, supply-demand imbalances, and product homogenization, price wars frequently erupt. A brief overview of price wars in the domestic automotive market reveals that from 2000 to 2010, there were few price wars, with promotions primarily occurring at specific times. From 2010 to 2015, as product offerings diversified and market competition intensified, price wars escalated. After 2015, the rise of the SUV market further intensified competition. While the domestic market was still dominated by joint ventures, various brands engaged in varying degrees of price wars to capture market share. Today, as the domestic automotive market transitions from growth to maturity, and domestic brands rise, price wars have spread across the entire market, affecting both domestic and foreign brands, as well as new and used vehicle markets.

In recent years, price wars have become more pronounced and intense. In January 2023, Tesla initiated price cuts, followed by BYD and other automakers. Later, luxury brands such as Mercedes-Benz, BMW, and Audi also joined in. Both profitable and loss-making automakers have been inadvertently drawn into this price melee. According to the China Passenger Car Association, 136 models have been discounted in the first five months of 2024 alone, exceeding 90% of the total number of discounted models in 2023 and the total number of discounted models in 2022. Currently, involution is pushing competitors into a corner.

Another notable aspect of involution is the "competition for leadership." Several prominent automotive leaders have entered the livestreaming arena to attract traffic. In addition to early internet celebrities like Yu Chengdong, Chairman of Huawei's Intelligent Automotive Solutions BU; Lei Jun, Founder of Xiaomi Technology; Li Bin, Chairman of NIO; and Robin Li, Chairman and CEO of Baidu, Zhu Huarong, Yin Tongyue, Wei Jianjun, Li Shufu, and Zhang Yong, Co-founder of NIO EV, have also joined the livestreaming trend. Yin Tongyue humorously remarked, "It even forced this 60-year-old man out of retirement."

The involution dilemma manifests in multiple ways.

Primary Manifestation 1: Declining Profitability in the Automotive Industry: This is a cause for concern within the industry.

According to the National Bureau of Statistics, from January to June 2024, the automotive industry generated a revenue of 4,767.2 billion yuan, up 5.1% year-on-year; operating costs amounted to 4,173.0 billion yuan, up 5.3%; profits totaled 237.7 billion yuan, up 10.7%; and the profit margin was 5.0%, still lower than the average downstream industrial enterprise profit margin of 6.4%.

Professor Liu Rui from the School of Applied Economics, Renmin University of China, stated that in 2023, the average net profit margin of the automotive industry was only 5%. Among domestic automakers with higher net profit margins, NIO, BYD, Great Wall Motor, and Geely recorded 10%, 5%, 4%, and 3%, respectively, while other automakers fared worse or even recorded negative margins. Most automakers have already reduced their product prices to the lowest possible levels.

Data shows that in fiscal year 2023, Tesla, Mercedes-Benz, and Toyota generated revenues and net profits of $96.77 billion, €153.218 billion, ¥45.09 trillion, and $14.997 billion, €14.531 billion, ¥4.94 trillion, respectively. Meanwhile, domestic automakers BYD and SAIC Motor recorded revenues and net profits of 602.3 billion yuan, 744.704 billion yuan, and 30.041 billion yuan, 14.106 billion yuan, respectively. Clearly, domestic brands must compete fiercely for both sales and profits.

Notably, automobile consumption has experienced negative growth. According to the National Bureau of Statistics, in July 2024, total retail sales of consumer goods amounted to 3,775.7 billion yuan, up 2.7% year-on-year. Among them, automobile consumption totaled 379.8 billion yuan, down 4.9%, while retail sales of consumer goods excluding automobiles were 3,395.9 billion yuan, up 3.6%. From January to July 2024, total retail sales of consumer goods reached 27,372.6 billion yuan, up 3.5% year-on-year. Automobile consumption totaled 2,673.6 billion yuan, down 1.7%, while retail sales of consumer goods excluding automobiles were 24,699.0 billion yuan, up 4.0%.

Primary Manifestation 2: Involution Harms Industry Chain Enterprises: As Lu Fang, CEO of Voyah Auto, noted, "Endless price wars can harm upstream and downstream enterprises." Upstream suppliers face issues such as declining supply prices and delayed payments, while downstream dealers grapple with inventory pressures, declining sales, and negative price spreads.

According to data released by the China Automobile Dealers Association, the comprehensive inventory coefficient of auto dealers in July 2024 was 1.5, up 7.1% month-on-month and down 11.8% year-on-year. In 2023, 43.5% of auto dealers incurred losses, 18.8% broke even, and 37.6% recorded profits. In the first half of 2024, over half of dealers incurred losses. Comparatively, in 2018, 33.6% of dealers recorded profits, followed by 29.7% in 2019, 39.4% in 2020, and 53.8% in 2021. Clearly, auto dealers are facing unprecedented operational pressures. Over 8,000 dealers have exited the market in the past four years, with even some leading dealers facing crises.

Moreover, many automakers have failed to achieve the desired sales volumes despite price reductions. According to the "2024 China Auto Dealer Development Report" released by the China Automobile Dealers Association, the increase in sales volumes among the top 100 dealers did not translate into expanded revenue scales. In 2023, their total revenue was 1,931.7 billion yuan, roughly the same as in 2022. Gross margins on new and used vehicles declined to varying degrees.

Faced with the various dilemmas caused by involution, its systemic damage is gradually becoming apparent. Consequently, there are growing calls from industry insiders, and many enterprises are actively responding. A notable example is the decision by Mercedes-Benz, BMW, Audi, and others to withdraw from price wars, setting a positive precedent for ending the escalating trend.

Amid the transition to electrification and intelligence, and facing industry involution, many joint ventures have experienced declining profits or even incurred net losses in recent years. Consequently, some foreign and joint venture brands are under immense pressure in the Chinese market. For instance, BMW delivered 1.0965 million vehicles globally in the first half of 2024, up 2.3% year-on-year, but sales in China declined 4.2% year-on-year to 375,900 units. Foreign and joint venture brands have also been forced to engage in involution and price wars. Since July 2024, Mercedes-Benz, BMW, Audi, and others have adjusted their market strategies, helping restore confidence and stability in sales channels. As Gao Xiang, President and CEO of BMW Group Region China, stated, they aim to achieve a healthy and sustainable development for dealers by setting reasonable sales targets and pacing, ultimately striking a balance between sales quality and pricing strategies.

Upholding Both Law and Self-Discipline

Undoubtedly, involution has profoundly impacted the entire automotive industry. To maintain market competition order, adhering to laws and self-discipline are shared responsibilities of industry enterprises.

From a legal perspective, China has formulated relevant laws and regulations to address disruptive and malicious competition.

On July 30, 2024, the Political Bureau of the CPC Central Committee Meeting stated that it would further foster a first-class market-oriented, legalized, and internationalized business environment. The Regulation on the Review of Fair Competition also came into effect on August 1. Its purpose is to promote fair market competition, optimize the business environment, and establish a unified national market. China's Price Law and Anti-Unfair Competition Law also regulate market competition behaviors, including pricing. For instance, the Price Law emphasizes state support for fair, open, and legitimate market competition, safeguarding normal price order; operators should reduce production and operation costs, provide consumers with reasonably priced goods and services, and earn legitimate profits through market competition; operators must not engage in improper pricing practices such as excluding competitors, monopolizing the market, or dumping below cost.

On August 16, Zhou Zhigao, Director of the Competition Coordination Department of the State Administration for Market Regulation, publicly stated that fair competition is the core of a market economy and a crucial safeguard for promoting high-quality development. To regulate market competition and maintain a fair market order, guidelines such as the Guidelines for Anti-monopoly Compliance by Operators and the Guidelines for Anti-monopoly Compliance in Concentrations of Operators have been issued. A national standard, the Code for Compliance Management of Fair Competition by Operators, is also under development to actively promote a multi-stakeholder co-governance structure featuring proactive corporate compliance, effective government guidance, and broad societal support.

Wang Qing, Deputy Director of the Market Research Institute of the Development Research Center of the State Council, believes that while price wars have their merits, with moderate price competition contributing to cost reduction and technological progress, the current intense automotive price competition in China has gone too far, disrupting normal pricing order. Addressing the chaos in the current automotive market, he suggests that government departments could formulate reasonable competition rules without compromising industrial and consumer interests, encourage fair competition, crack down on unfair competition, regulate and manage unfair competition beyond pricing, and establish an investigation trigger mechanism for unfair competition through low-price sales, allowing injured enterprises to lodge complaints through this mechanism.

From a self-regulatory perspective, industry players should actively engage rather than follow the crowd. Maintaining healthy and orderly competition in the industry is a shared responsibility among enterprises.

At the 2024 China Automotive Forum, Yang Xueliang emphasized the importance of self-discipline beyond legal reliance. "All our activities must adhere to the legal high line and moral bottom line. Regardless of the extent or severity of internal competition, or the prevalence of online rumors and bullying, we must uphold our principles and strive to escape this vicious cycle as soon as possible," he said, adding that they would avoid simplistic price wars and instead focus on technological, quality, service, brand, and ethical battles while adhering to global compliance in operations.

From a future development perspective, fostering new productive forces is a crucial driver for the development of China's automotive industry and the lifeblood of automotive enterprises. Electrification, intelligence, and digital intelligence are emerging as new productive forces for automotive enterprises.

In summary, to overcome the challenges of internal competition, automotive enterprises must abide by laws, exercise self-discipline, and be driven by innovation. They should adhere to legal and compliant competition, allowing good money to drive out bad, and firmly practice long-termism. By winning in technological and value battles, the automotive industry can ultimately escape the vicious cycle of internal competition and embark on a path of healthy competition. The tipping point of internal competition is approaching, and it's time for automotive enterprises to 'call it quits.'

Note: This article was first published in the 'Cover Story' section of the September 2024 issue of 'Automotive Horizons' magazine. Stay tuned for more.

Image: From the internet

Article: Automotive Horizons

Typesetting: Automotive Horizons