"The rise of Chinese automobiles" does not require hype, but a return to essential needs

![]() 09/04 2024

09/04 2024

![]() 433

433

Introduction

Introduction

No matter how intense the electric vehicle transformation is, the true rise of Chinese automobiles cannot rely solely on one-sided development. Both independent innovation and open cooperation are essential.

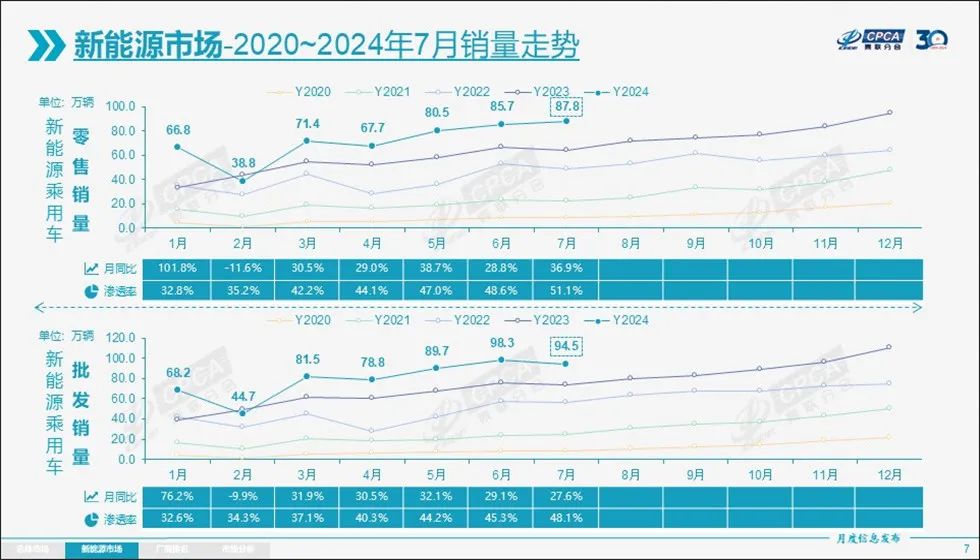

In July, when 878,000 new energy vehicles were sold in the entire Chinese market, a year-on-year increase of 36.9%, many people may mistakenly believe that given China's urgent demand for industrial transformation and the superior understanding of electric vehicles among Chinese consumers compared to other countries, a new business model is gradually taking shape in China, and the energy transition in the automotive market will soon be completed.

However, the reality is that according to data from the China Passenger Car Association, the market share of traditional internal combustion engine vehicles (including HEVs) in China was still 48.95% in July, and the sales growth of pure electric vehicles has been flattening since the beginning of 2024. Therefore, regardless of how far beyond expectations the development of new energy vehicles may be, every Chinese automaker must be clear that pure electric vehicles and traditional gasoline vehicles are not simply succedaneum , but coexist and complement each other.

In other words, the future of the Chinese automotive market will not rely on the overly biased approach of "putting all eggs in one basket." As long as consumer demand remains diverse, a development model with multiple energy technologies coexisting will continue to drive balanced industry growth for a long time to come.

Technological iteration requires foresight and a pragmatic approach

Currently, the 2024 Chengdu Auto Show is in full swing. Unlike previous years, when pure electric vehicles were highly touted, an increasing number of hybrid vehicles are emerging, and even brands like AVATR, ZEEKR, and GAC AION, which previously focused on pure electric technology, have announced plans to introduce new energy products with engines.

Signs in the consumer market also indicate that even though discussions surrounding pure electric vehicles dominate the internet, a vast majority of consumers do not limit their choices to a single vehicle type when selecting a car.

From the perspective of Chinese consumers' vehicle usage scenarios, there are still many people who will continue to choose gasoline or hybrid vehicles due to factors such as infrastructure, weather conditions, and convenience of use in low-tier inland cities, northern regions with significant seasonal temperature differences, or long-distance travel routes with challenging terrain. Furthermore, the cost of purchasing gasoline vehicles is currently at an all-time low, with top-of-the-line Fit models available for as little as 80,000 yuan and popular joint-venture B-segment sedans like the Accord and Camry available for around 150,000 yuan, making them attractive options for many consumers.

In the international market, even though China's auto exports have repeatedly hit record highs, with passenger vehicle exports reaching 399,000 units in July, a year-on-year increase of 22.4%, the exports of traditional fuel vehicles and plug-in hybrid vehicles still amounted to 366,000 and 27,000 units, respectively, representing year-on-year growths of 25.7% and 190%.

It can also be said that to capture the global automotive consumer market, it is necessary to adhere to a multi-energy development strategy.

As early as two years ago, Li Shufu, Chairman of Geely Automobile, stated, "Coal-fired power generation accounts for about 70% of China's current power generation mix. Therefore, continuous exploration of multiple sustainable energy technology pathways is a major breakthrough for Geely to accelerate the transformation of the automotive industry and contribute to carbon neutrality goals."

This year, Zeng Qinghong, Chairman of GAC Group, also expressed the importance of respecting consumers' diverse needs and suggested that the entire industry should balance the development pace of new energy and gasoline vehicles.

The rational voices from within the industry serve as a reminder that if gasoline vehicles maintain their dominant position in specific segments and niche markets for an extended period, it is crucial for the entire industry to promptly address consumers' genuine and diverse needs by adopting a multi-energy development approach.

Therefore, given the diversity of consumer demands and the automotive market, no one should adopt a one-size-fits-all approach centered solely on "full electrification." To avoid constant anxiety about one's own development and even survival, it is necessary to return to the essential needs of the consumer market, embrace a comprehensive layout, and simultaneously advance along all technological pathways to navigate the complex and ever-changing industry dynamics.

Over the past two decades, mainstream Chinese automakers such as GAC Group, Geely Group, and Chery have consistently pursued a multi-energy layout and explored multiple powertrain routes, maintaining their own planning and pace amidst the electric vehicle wave. This strategic resilience has become a solid foundation for their future aspirations.

Data shows that the sales proportion of new energy and energy-efficient vehicles at GAC Group has continued to increase, reaching 40.63% in the first half of 2024, providing a solid foundation for steady sales growth in the future. Recently, Feng Xingya, General Manager of GAC Group, also stated that GAC Group will focus resources on creating star products across various routes, including EV, PHEV, REV, HEV, and fuel cell vehicles. 2025 will be a big year for GAC Group's self-owned brand plug-in vehicles, with the launch of multiple PHEV and REEV models. Multiple analyses suggest that the multi-energy product structure is becoming one of GAC Group's core advantages in facing fierce competition in the future.

Independent Innovation + Win-Win Cooperation: The Key to the True Rise of Chinese Automobiles

Indeed, regardless of how deeply the Chinese automotive market transforms, the essential diversity of the market cannot be erased in the short term, and a multi-energy structure layout remains crucial for corporate survival. To effectively layout a multi-energy structure, it is essential to uphold independent innovation while recognizing the importance of win-win cooperation. As Zeng Qinghong, General Manager of GAC Group, noted at an industry forum, increasingly powerful and confident Chinese brands will enter a new stage of open cooperation with foreign brands: the next generation of Chinese automobiles will embark on a new journey of "simultaneous strength in gasoline and electric powertrains, advancing along multiple paths," leading to comprehensive growth, global development, and entering a new era centered on users and value orientation.

It is undeniable that Chinese automakers have demonstrated significant advantages in electrification and intelligence and are gradually gaining market influence. In the first half of 2024, the market share of self-owned brands exceeded 60%. Behind this achievement lies the continuous improvement in independent innovation capabilities among self-owned brands. For instance, under the guidance of "Technology GAC," GAC Group has invested over RMB 50 billion in independent R&D and filed over 19,000 patent applications, with invention patents accounting for over 42.1% of the total. Particularly in intelligence, GAC Group has mastered L2 to L4 technology R&D and application capabilities. Geely Automobile is also actively implementing the "Smart Geely 2025" strategy, building a strong technological moat through continuous investment and breakthroughs in core technologies such as intelligent driving, smart cockpits, chip R&D, and battery, motor, and electronic control systems. Notably, these experienced Chinese automakers are gradually breaking free from their reliance on joint ventures and achieving technology reverse exports to joint ventures, setting an example for the self-empowerment of Chinese automobiles, after decades of "market-for-technology" joint venture cooperation.

At the same time, it cannot be denied that joint venture brands, especially Japanese brands, still possess significant technical advantages in hybrid vehicles, and their technological layouts in areas such as fuel cells also contribute to the diversification of Chinese automobiles. Furthermore, the "competition on the same stage" among various brands better satisfies users' diverse needs with differentiated values, as there is still considerable demand for hybrid vehicles among consumers.

As a result, automakers that truly understand the market dynamics are reducing user costs through price reductions while introducing more intelligent hybrid vehicles to meet consumers' demands for technological intelligence. This strategy is gaining market recognition. Data shows that in the first half of 2024, sales of new energy and energy-efficient vehicles at GAC Toyota increased by 12.6% year-on-year, with the sales proportion rising to 46.1%. Meanwhile, GAC Honda's energy-efficient vehicle sales have surpassed 500,000 units. These facts demonstrate that consumers are still willing to pay for practical products.

It is evident that only through independent innovation and win-win cooperation can Chinese automobiles advance towards broader horizons and achieve both "upward mobility" and "going global."

Therefore, looking back at the consistent advocacy of automakers' leaders like Li Shufu and Zeng Qinghong, the underlying message is undoubtedly clear. The automotive landscape is evolving towards a new stage of diversified coexistence. The diversity and differentiation in national energy structures determine that the transition of automotive power sources is a gradual, long-term process. Chinese automakers should not overlook any significant technological direction in their development. Moreover, the Chinese automotive market has always been one where diverse needs flourish. Only by truly returning to consumers' essential needs can we consistently provide products that cater to their demands and ultimately propel the true rise of Chinese automobiles.

It is worth mentioning that the topic of "evaluation methods and indicators for passenger vehicle fuel consumption" has recently sparked heated discussions. Some argue that this is an attempt to tighten constraints on specific vehicle types, mistakenly suggesting that the era of gasoline vehicles is coming to an end. In reality, this standard aims to reduce the average fuel consumption of automakers across their entire vehicle lineups, not just individual models. Automakers can develop new energy vehicles or purchase credits to meet the standard. So, once again, the era of multi-energy products will persist for an extended period.