OpenAI, Awaiting the Next 'Sugar Daddy'

![]() 09/04 2024

09/04 2024

![]() 1524

1524

Author | Sun Pengyue

Editor | Da Feng

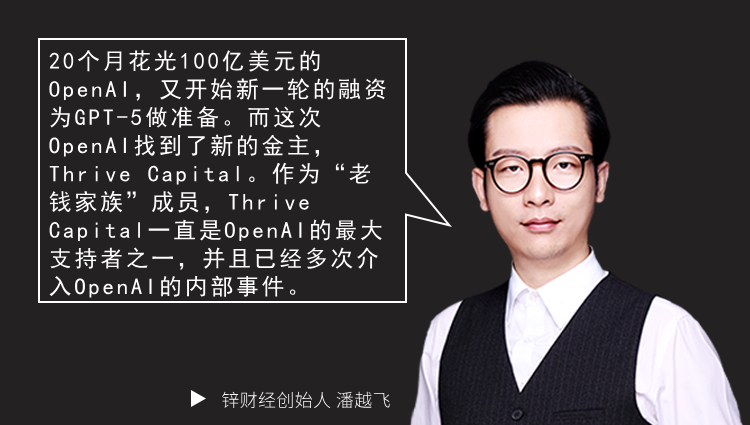

Having burned through $10 billion, OpenAI is embarking on another funding round!

On August 30th, CNBC and The Wall Street Journal reported that OpenAI is planning a new multi-billion dollar funding round, led by Thrive Capital with a $1 billion investment, pushing OpenAI's valuation above $100 billion.

The new round of betting has already begun. In addition to Thrive Capital, Microsoft, NVIDIA, and Apple are also showing interest.

Burning through $10 Billion in Less Than Two Years

It cannot be denied that OpenAI is burning through money at an astonishing rate.

OpenAI's last funding round was in January 2023, with Microsoft investing approximately $10 billion, making it the largest funding round in the AI space to date.

From January 2023 to September 2024, OpenAI used $10 billion to achieve a valuation of over $100 billion and surpassed 200 million ChatGPT users (as of mid-2024).

Over the past decade, OpenAI has undergone seven funding rounds, raising over $20 billion, making it a veritable "gold-guzzler."

In 2015, newly established OpenAI garnered support from capital titans, including current world's richest man, Elon Musk.

In June 2015, Musk led a $1 billion funding round for OpenAI, joined by investors like Peter Thiel, Reid Hoffman, jessica Livingston, Infosys, Amazon Web Services, YC Research, and Sam Altman.

Despite a promising start, OpenAI faced development bottlenecks from 2015 to 2018. Being a non-profit organization clashed with Musk's vision for commercialization, leading to their separation in February 2018.

Elon Musk and Sam Altman

Before 2019, OpenAI was cautious about funding. However, with Musk's departure and the critical transition from GPT-2 to GPT-3, OpenAI became more open to funding.

In 2019, OpenAI secured three funding rounds, led by Khosla Ventures, Reid Hoffman Foundation, Matthew Brown, and Microsoft, with Microsoft investing $1 billion in July 2019.

To secure funding for GPT's development, OpenAI transformed from a non-profit to a for-profit entity, OpenAI LP, with a profit cap. This new structure attracted significant investor interest.

In January 2021, OpenAI received investments from Tiger Global Management, Bedrock Capital, and Andreessen Horowitz, though the specific amounts remain undisclosed.

Microsoft invested $2 billion and $10 billion in 2021 and January 2023, respectively. In April 2023, OpenAI secured an additional $300 million from Sequoia Capital and Thrive Capital.

With nearly $20 billion in funding, OpenAI developed ChatGPT 4.0, ushering in a new era of AI.

Who is OpenAI and ChatGPT's greatest contributor? It's not CEO Sam Altman, but Microsoft.

Sam Altman and Satya Nadella

In the past five years, Microsoft has invested $12 billion in OpenAI through three funding rounds. Over 80% of OpenAI's funding comes from Microsoft.

Microsoft has provided more than just capital. OpenAI's technology runs on Microsoft Azure, and Microsoft has built a computing center to support OpenAI's large models.

Microsoft has also integrated OpenAI into its Windows ecosystem, including Bing search, Microsoft 365, GitHub, and marketing software.

Microsoft is not only OpenAI's largest investor but also its most loyal user.

However, as the largest investor, Microsoft is neither leading nor participating in OpenAI's new funding round, raising questions.

OpenAI's 'New Sugar Daddy'

Thrive Capital leads OpenAI's current funding round, positioning itself as OpenAI's new primary investor.

Founded by Joshua Kushner, a millennial investor and member of an influential American family, Thrive Capital is known for its successful investment in Instagram, yielding a 100% return when Facebook acquired Instagram for $1 billion in 2012.

Joshua Kushner is close to Sam Altman and has long been an advocate for investing in OpenAI.

In 2023, Thrive Capital led OpenAI's funding round, joined by Sequoia Capital, a16z, and K2. Thrive Capital invested nearly $130 million, valuing OpenAI at $27 billion at the time.

Thrive Capital has also been deeply involved in OpenAI's internal affairs.

When Sam Altman faced internal strife and was fired by the board in late 2023, Joshua Kushner was his biggest supporter, playing a crucial role in his reinstatement within five days.

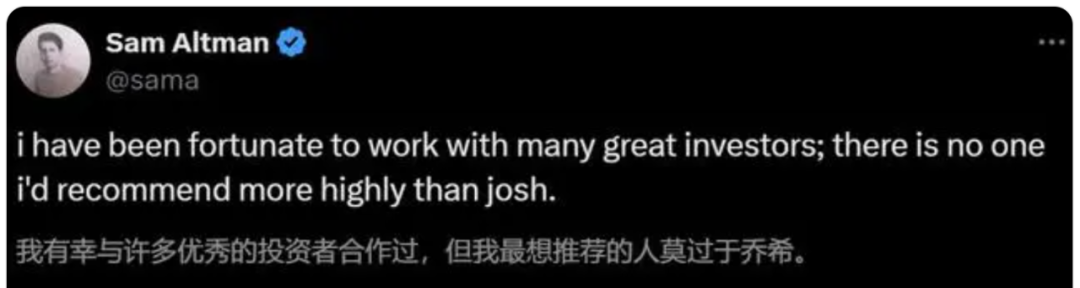

Sam Altman trusts Joshua Kushner and Thrive Capital deeply, even praising them on social media: "I've had the pleasure of working with many excellent investors, but Josh (Joshua Kushner) is at the top of my list."

To increase returns, Joshua Kushner has worked diligently to elevate OpenAI's valuation.

In April, Thrive Capital facilitated a stock sale for former OpenAI employees, raising OpenAI's valuation from $27 billion to $86 billion.

For OpenAI's current funding round, Thrive Capital has valued OpenAI at $100 billion and even circulated rumors of a $125 billion valuation on Wall Street.

It's fair to say that every major investor in OpenAI, aside from Musk, has been beneficial.

Will OpenAI Pursue an IPO?

Despite multiple investors, ChatGPT continues to be a cash-intensive endeavor.

When Microsoft invested $10 billion, it was believed to sustain OpenAI for 2-3 years. However, within 20 months, OpenAI has run out of funds in an increasingly competitive AI landscape.

OpenAI is currently developing GPT-5, which will be even more costly than GPT-4 and GPT-4o.

While funding addresses immediate needs, it is not a long-term solution. An IPO seems the best path to secure more capital.

In June, US media reported that Sam Altman informed some shareholders that OpenAI was considering transforming its governance structure into a for-profit entity, outside the control of its non-profit board.

As a for-profit entity, OpenAI could leverage its over $100 billion valuation to pursue an IPO.

This isn't just speculation. In June, OpenAI hired Sarah Friar, a seasoned finance expert who led two successful IPOs (Square and Nextdoor), as its CFO.

Sarah Friar's appointment is a significant boost to OpenAI's IPO preparations, given her expertise in auditing, financial forecasting, and governance structure changes.

Against this backdrop, OpenAI's current funding round may very well be its last before an IPO.