August New Energy Car Companies: Frequent Launches, Embracing Huawei, and Fiercely Competing for Sales

![]() 09/04 2024

09/04 2024

![]() 491

491

Data Analysis of New Energy & Auto

Only those who survive have the qualification to become mainstream players.

Total words: 5007

Estimated reading time: 25 minutes

At the launch event of MONA M03, He Xiaopeng once again sparked anxiety with his prediction that “only seven mainstream automakers will remain in the next decade.”

August marks the disclosure period for semi-annual reports, where financial performance, in addition to sales figures, becomes the focus of public attention.

Xiaomi disclosed its automotive business performance, with each vehicle incurring a loss of RMB 60,000, which trended on social media. At the end of the month, facing rumors of “NIO declaring bankruptcy,” NIO directly announced that it had filed a police report. The rumors targeted NIO because from 2018 to 2023, NIO incurred staggering losses of RMB 72.9 billion.

While continuously vying for sales, automakers also prioritize operational sustainability. Only those who survive have the opportunity to consider becoming mainstream players.

Vol.1: Sales Continue to Climb

Policies continue to fuel the new energy vehicle market.

On August 16, seven departments including the Ministry of Commerce issued the “Notice on Further Promoting the Trade-in of Old Vehicles for New Ones.” The subsidy standard for individual consumers who scrap eligible old vehicles and purchase new ones was increased from RMB 10,000 to RMB 20,000 for new energy passenger vehicles.

Officials stated that the promotion of low-carbon transportation tools aims to make new energy vehicles the mainstream by 2035.

Incentives have driven a continuous increase in overall sales for new energy automakers.

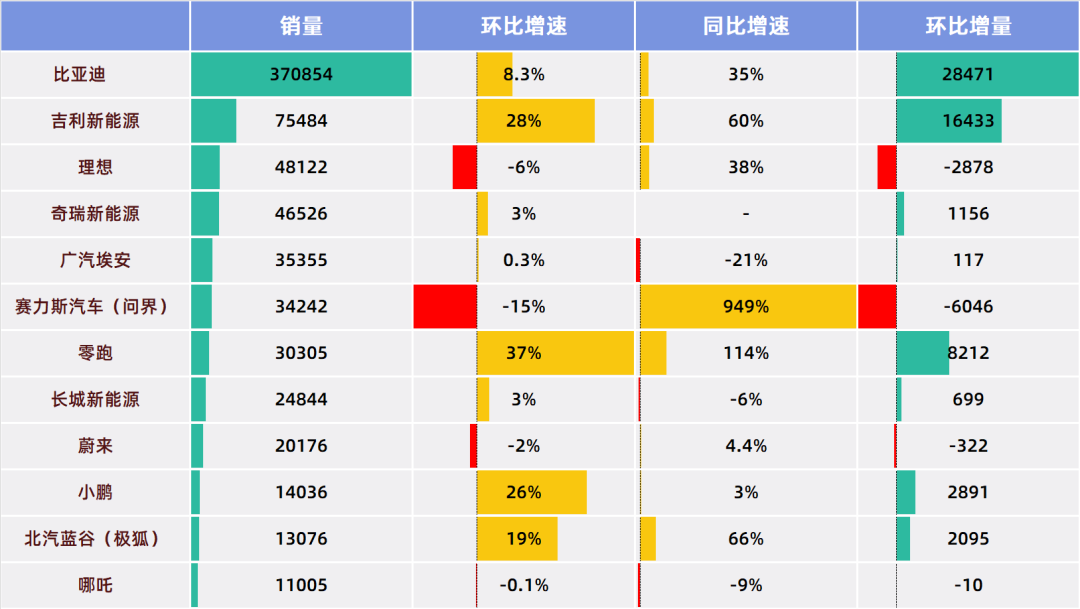

After a relatively subdued July, automaker sales rebounded in August. To date, 12 automakers and 22 brands have announced their sales figures. Among automakers, only Aion, Nezha, and Great Wall experienced year-on-year sales declines. On a month-on-month basis, only four automakers saw declines, including Lixiang, which set a new monthly sales record last month. Among the 22 brands, 15 experienced month-on-month growth.

The average sales of the 22 brands were 31,030 units, an increase of 2,206 units from July. The median was 16,026 units, an increase of 2,626 units from July. Overall, August's sales performance was significantly better than July's.

Compared to July, the threshold for automakers has risen further. Facing fiercer competition, manufacturers will not stop intensifying internal competition. At the end of July, many automakers expressed opposition to the weekly new energy sales rankings, but this did not prevent Lixiang from releasing its weekly sales rankings. This market is like sailing against the current. Taking Nezha Automobile as an example, as Nezha has stagnated over the past three months, it has dropped from second-to-last to last among the 12 manufacturers.

If only seven automakers can become mainstream players, then current monthly sales of at least 30,000 units are necessary to even discuss this possibility. This is under the premise that automakers like Xiaomi, SAIC Motor, and Dongfeng Motor have not yet disclosed their specific monthly sales data.

Whether to intensify competition or not is not a choice for companies to make. When announcing the launch of the new Wenjie M7 Pro, Yu Chengdong stated that the vehicle incurs a loss of nearly RMB 30,000 per unit sold. Even for the high-end Wenjie, which positions itself as such, the situation is like this. Imagine how other automakers fare.

Having sales may mean incurring losses, but without sales, there is not even an opportunity to achieve economies of scale and reduce costs.

Vol.2: Half of Annual Targets Expected to Be Met

The market remains open, and users' acceptance of brands is not low. New brands have the potential for significant sales growth.

In August, BYD, Geely, Chery, and Leapmotor all achieved record-high sales. Specifically, in addition to dominant brands like BYD continuing their strong performance, many originally less prominent brands also made breakthroughs.

Leapmotor, originally in the second tier of new forces, experienced a surge in sales to over 30,000 units this month, setting a new record.

Geely Galaxy launched its fourth model this month. Although the Galaxy brand was not originally a major contributor to Geely's sales, its strong market performance this month made it Geely's top-selling brand, pushing Geely's new energy vehicle sales to a record high.

Chang'an Automobile's Deep Blue brand struggled to surpass 20,000 sales for a long time, but in August, it reached a new milestone with 20,131 units sold.

It can be seen that the new energy vehicle market is still far from a settled landscape, and many automakers still have opportunities to break through.

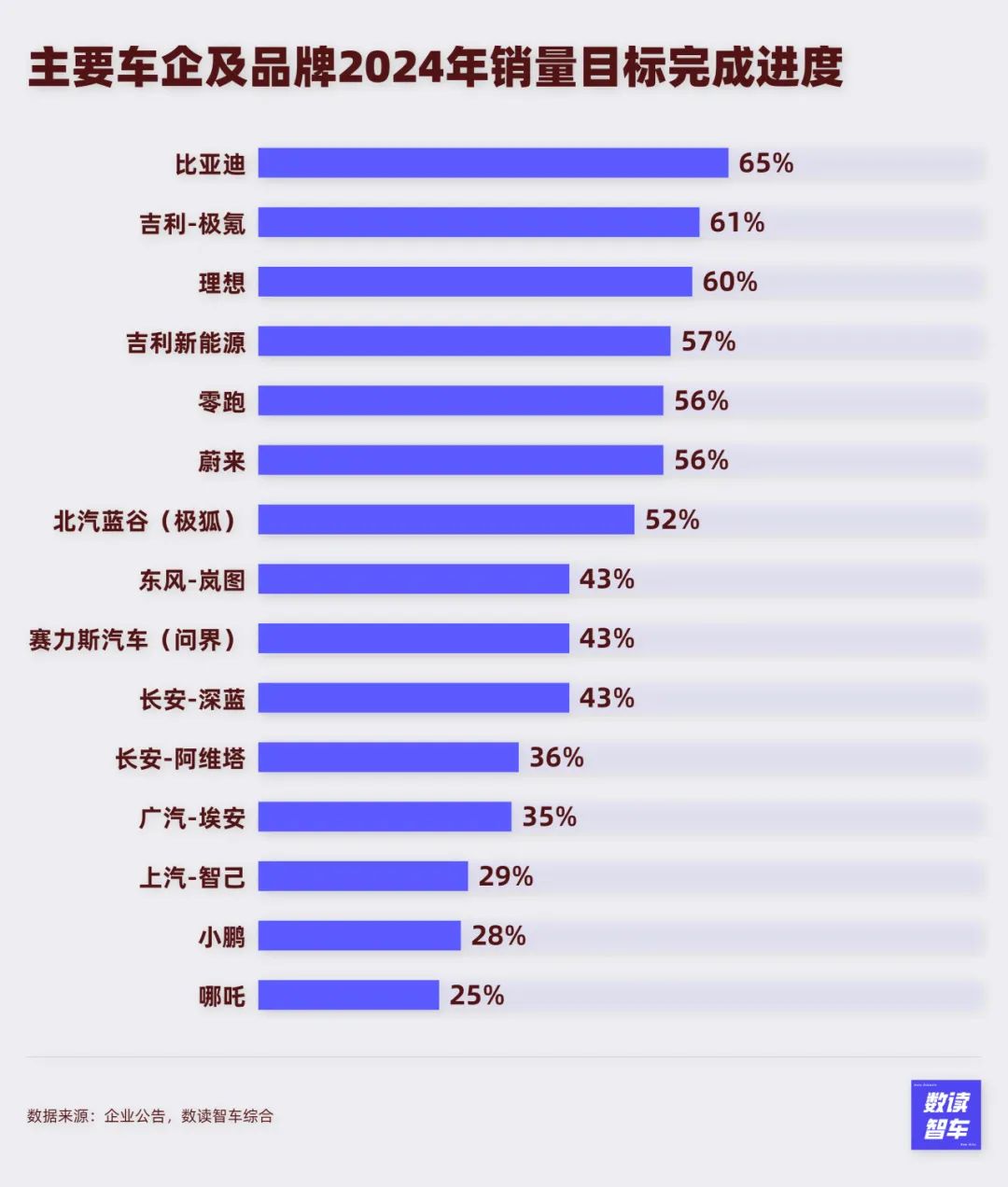

With the release of August sales figures, two-thirds of 2024 have passed. Based on the targets set by automakers, the progress of seven automakers or brands is currently relatively optimistic.

Among them, BYD has already achieved 65% of its annual target, while Zeekr has completed 61%. After adjusting its target, Lixiang has achieved 60%. If everything goes well, these three companies are almost certain to meet their annual targets.

In addition, Geely's new energy vehicle sales have reached 57% of the target, while NIO and Leapmotor have both achieved 56%, and BAIC BluePark has completed 52%. These four companies also have a high probability of meeting their set targets.

However, IM Motor, Xiaopeng, and Nezha are currently progressing slowly, with less than 30% of their targets achieved, making it extremely challenging for them to meet their goals.

Vol.3: Intensive Launch of New Vehicles

The Chengdu Auto Show opened at the end of August, which is one of the important battlegrounds for automakers every year. Many automakers scheduled their new product launches for August.

On August 3, Geely Galaxy launched its fourth model, the all-electric compact SUV Galaxy E5, which may be a key driver of the Galaxy series' sales growth.

On August 5, Chery's Starway brand launched the 2025 mid-to-large SUV Lanyue. During this month, Chery also Multiple models have been released intensively ,including the mid-size SUV Ruihu 8 L and the 2025 Starway Xingji Yuan ES. The intensive model launches also contributed to a new high in Chery's new energy vehicle deliveries.

On August 6, Beijing Automotive Group and Huawei jointly launched the flagship mid-to-large sedan Enjoy S9. The two models are priced between RMB 399,800 and RMB 449,800. Within 72 hours of their launch, more than 4,800 large orders were placed, and currently, over 8,000 large orders have been received. Such performance is remarkable in the high-price segment.

On August 9, Dongfeng Motor's Yipai eπ007 extended-range version was launched. In addition, the annual new model of Hoval's MPV model Mondrian was also released.

On August 13, pre-sales for the Nezha S shooting brake version began, with a starting price of RMB 175,900 for the extended-range version.

On the same day, the 2025 Zeekr 001 and Zeekr 007 were simultaneously launched. Additionally, Zeekr unveiled the all-electric large five-seater SUV Zeekr 7X, which comes standard with an 800V high-voltage platform and has a starting price of RMB 239,900. Notably, the new Zeekr 001 and 007 were launched less than six months and eight months, respectively, after the 2024 models. Many owners felt that “new cars becoming old in half a year” violated their rights, leading to incidents of blocking delivery centers. While the incident has since subsided, its impact on Zeekr remains to be assessed.

As a leader in new energy automakers, BYD's Yangwang U9 began deliveries this month. BYD also launched the 2025 Song PLUS EV, BYD Dolphin, and Dolphin 07 DM-i.

On August 26, the new Wenjie M7 Pro was officially launched with a starting price of RMB 249,800.

Changan AVATR's third model, the AVATR 07, began pre-sales. During the Chengdu Auto Show, Deep Blue's S05 and L07 made their debuts.

Additionally, Great Wall Motor's WEY brand launched a new model of the Lanshan Intelligent Driving Edition, and Jishiqi's Jishiqi 01 Standard Range Edition was also launched this month.

With the launch of a large number of new vehicles, automakers are well-prepared for the second half of the year. Following past trends, the next four months are crucial for sales sprints.

Vol.4: Surging Enthusiasm for Overseas Expansion

Sales growth cannot solely rely on the domestic market; automakers' ambitions for overseas markets are evident.

BYD expressed optimism about the Vietnamese electric vehicle market, stating that its development has just begun and has enormous potential.

GAC Aion's sub-brand Hyperion changed its English name to “HYPTEC” and introduced a new brand color. Analysts believe this move aims to expand into international markets.

SAIC Motor's MG Motor announced plans to establish a Latin American hub in Mexico, including an auto plant and a research and development center. The person in charge stated that this plan would not only enable local production but also explore the Latin American market.

Furthermore, Xiaomi Group's President Lu Weibing stated that Xiaomi Automobile is studying entry into Europe. Zeekr Intelligent Technology's Vice President Chen Yu revealed that Zeekr plans to enter the Japanese market in 2025.

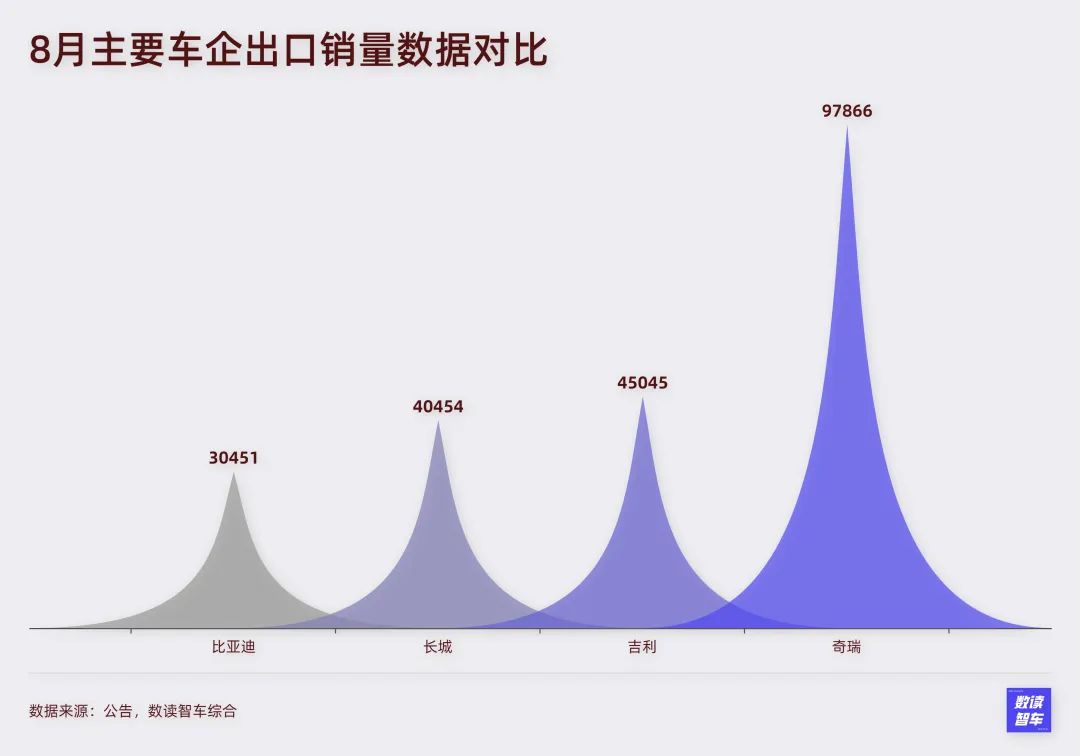

Of course, overseas expansion is not a simple task at present. Even for a strong player like BYD, which achieved record-high sales, its exports in August were only 30,451 units, still falling short of previous peaks.

In contrast, Great Wall Motor, Geely, and Chery performed actively, with exports reaching new highs. Great Wall Motor exported 40,454 units, Geely exported 45,045 units, and Chery's exports were even more impressive at 97,866 units in August. However, unlike BYD, these three automakers export both new energy and traditional vehicles.

Vol.5: Competing for Huawei's Intelligent Automotive BU

In addition to overseas expansion, timely addressing shortcomings is also an option for automakers.

In the past two months, “Shenzhen Yinwang” has become a buzzword in the automotive industry. This company is a new entity established by Huawei's Intelligent Automotive BU in January this year. With Beijing Automotive Group, Chery, JAC Motor, and Huawei's Intelligent Automotive BU forming in-depth partnerships and announcing their collaborations, outsiders believe that Shenzhen Yinwang could evolve into an intelligent automotive alliance formed by multiple automakers.

According to Huawei's disclosed data, Shenzhen Yinwang's operating revenue from 2022 to the first half of this year was RMB 2.098 billion, RMB 4.7 billion, and RMB 10.435 billion, respectively. The gross profit margins of its main business were 17.73%, 32.13%, and 55.36%, respectively. Its net profit attributable to shareholders was -RMB 7.587 billion, -RMB 5.597 billion, and RMB 2.231 billion, respectively. The estimated net profit attributable to shareholders for 2024 is RMB 3.351 billion, demonstrating strong performance.

Against this backdrop, Shenzhen Yinwang has become a target for automakers to compete for.

On August 19, Changan Automobile announced that AVATR Technology planned to acquire a 10% stake in Shenzhen Yinwang held by Huawei for RMB 11.5 billion. This may not be the end, as AVATR Technology may continue to increase its stake. It is rumored that “AVATR may further increase its stake in Shenzhen Yinwang to 20%.”

After AVATR, Seres, the first automaker to choose the Smart Selection model, also opted to invest. On August 25, Seres announced its intention to acquire a 10% stake in Shenzhen Yinwang for RMB 11.5 billion.

Furthermore, the latest news indicates that Huawei is currently in negotiations with partners such as Beijing Automotive Group BluePark and JAC Motor regarding related cooperations. Of course, for an extended period, Shenzhen Yinwang will continue to be led and managed by Huawei.

Automakers have been embracing Huawei since the beginning of the year. By leveraging Huawei's intelligent driving system, automakers can quickly address their shortcomings. Now, through equity investments, automakers have further strengthened their ties with Huawei, effectively enhancing the stability of their cooperation and mitigating risks.

NIO, Xpeng, and Leapmotor: Focusing on Boosting Sales

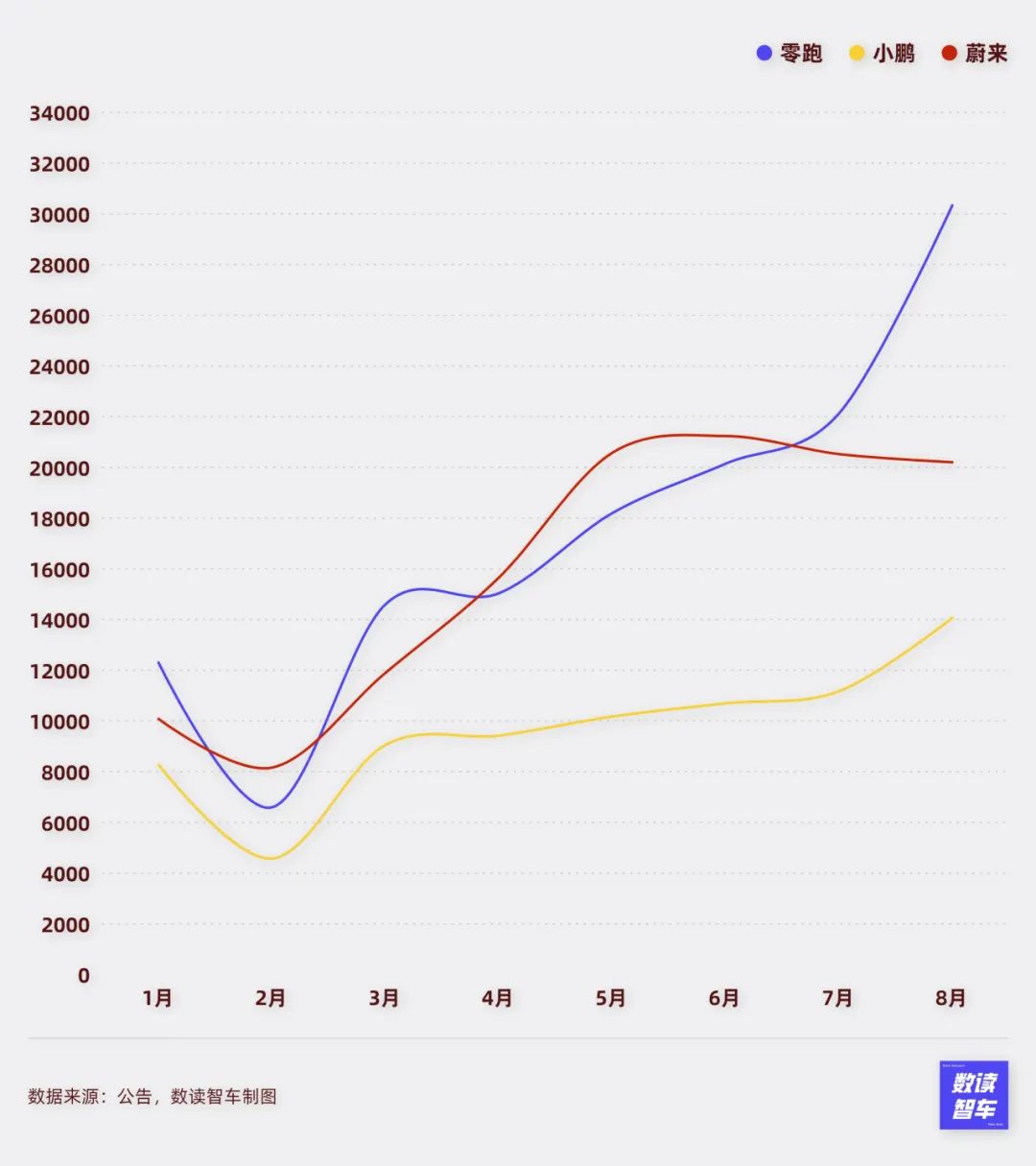

Since last year, NIO, Xpeng, and Lixiang have undergone notable differentiation, with Lixiang leading the way, which continues to be the case this month. Starting from the second quarter of this year, NIO and Leapmotor gradually moved into the second tier, while Xpeng and Nezha's sales have remained sluggish.

Leapmotor is the best-performing automaker in the second tier. August marked the first full delivery month for C16, achieving over 8,000 deliveries, a remarkable performance. This boosted Leapmotor to a record-high sales figure of 30,305 units, surpassing the 30,000 threshold for the first time.

Leapmotor does not have a large portfolio of models, but its strength lies in low-cost extended-range vehicles and a steady development strategy with strong product capabilities. Leapmotor has steadily increased its sales, which is a very positive performance. However, Leapmotor does not have many cards to play, as its starting prices have always been below RMB 200,000, making it challenging to extend into higher price segments.

NIO's sales growth began in April and stabilized at over 20,000 units per month. Notably, in May this year, NIO's sub-brand Ledo was officially launched, with the first model, the Ledo L60, set to begin deliveries in September. This means that NIO has already stabilized at 20,000 units per month before the delivery of its low-cost models. The foundational capability built by battery swapping is a crucial factor.

Currently, Ledo has opened over 100 stores covering 55 cities nationwide, and NIO's sales are highly likely to reach a new level.

Xpeng Motors' sales growth has been slower than NIO's, and it has yet to surpass 15,000 units this year. However, Xpeng Motors has also introduced its low-cost models to the market. On August 27, Xpeng's MONA M03 was unveiled, and nationwide deliveries officially began at the Chengdu Auto Show on August 30.

MONA is Xpeng Motors' volume model, priced from RMB 119,800, offering high-level intelligent driving features for models priced below RMB 200,000. It aims to capture the market with low prices and high specifications. The MONA M03's launch performance was impressive, with over 30,000 large orders placed within 48 hours of its launch and a peak daily customer traffic of over 1,300, making it a phenomenal product in the RMB 100,000 price segment. Compared to Ledo, which still prices its models above RMB 200,000, MONA has priced its models below this threshold. Xpeng's upcoming sales performance is worth anticipating.

Undoubtedly, NIO and Xpeng both have the opportunity to achieve extremely impressive sales levels in the next four months. However, whether it's Leapmotor, NIO, or Xpeng, while striving to boost sales at this stage, the issue of operational pressure will be unavoidable. None of these three automakers are profitable in the foreseeable future. In the first half of the year, Xpeng suffered a loss of 2.65 billion yuan, Leapmotor lost 2.2 billion yuan, and NIO is highly unlikely to be profitable either, facing significant operational pressure.

Li Auto vs. HarmonyOS: Undecided Contest, Long-Term Coexistence

HarmonyOS has occupied the niche of intelligent driving, while Li Auto's 'home' ecosystem is also unbreakable. Both companies have shown strength in high-end models. Early this year, HarmonyOS briefly surpassed Li Auto, but now the gap between the two is widening. This month, HarmonyOS sold 33,699 units across its entire lineup, while Li Auto sold 48,122 units, surpassing the sales of Xpeng by a significant margin.

Currently, the Wenjie, Zhijie, Xiangjie, and Zunjie series have been finalized. Although Wenjie's performance in August was not particularly impressive, both the M9 and M7 models sold over 10,000 units each, demonstrating Huawei's strong appeal in the high-end market. This is a testament to the brand's power, product competitiveness, and technological prowess. In August, the new Wenjie M7 Pro was launched, with over 6,000 orders received within 48 hours of its release, promising a bright sales outlook.

The Xiangjie S9, a collaboration between Huawei and Beijing Automotive Group, received 8,000 orders within 20 days of its launch and began partial deliveries in August.

The Zhijie R7, a pure electric SUV jointly developed by Huawei and Chery, has also been unveiled, with an expected price range of 300,000 to 400,000 yuan.

In addition, the fourth member of the series, "Aojie," will be launched in the fourth quarter. Aojie has three large vehicles under development, covering sedans, SUVs, and MPVs. The launch of its first vehicle is expected in Q4 2024.

In terms of price segments, the "Four Jie" series are direct competitors with BBA, Li Auto, and others. Li Auto stated at its earnings call that "HarmonyOS Intelligent Drive is our strongest competitor in the market, and we will coexist healthily in the long term."

HarmonyOS and Li Auto will be compared for a long time to come.

Great Wall Motor: Uncertain Times

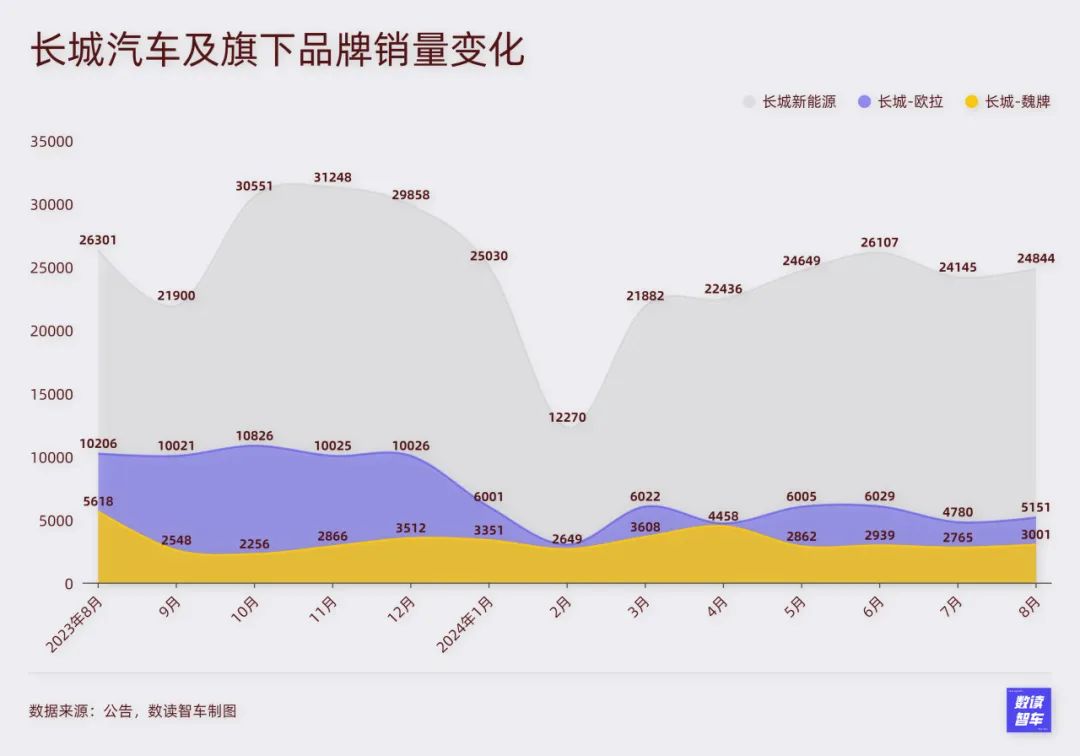

In terms of sales, Great Wall Motor's predicament is already apparent.

Since the beginning of the year, Great Wall Motor's new energy vehicle sales have consistently failed to exceed 30,000 units, essentially stagnating. In August, Great Wall Motor sold 24,844 new energy vehicles, which, while not terrible, still showed a year-on-year decline.

A more significant issue for Great Wall Motor is the lack of a flagship brand in the new energy segment. Its Ora brand delivered 5,151 units this month, failing to surpass 7,000 units in any month this year. WEY performed even worse, selling just 3,001 units in August, remaining lukewarm.

To compound matters, Great Wall Motor was blacklisted by China Southern Power Grid in August and received a regulatory letter from the Shanghai Stock Exchange. On August 14, China Southern Power Grid issued a supplier disciplinary notice stating that Great Wall Motor Co., Ltd. had been listed as a "non-bidding" supplier due to "major dishonest behavior by the supplier with adverse impact," with a disciplinary period of 24 months. It's been a double whammy for Great Wall Motor, which is currently undervalued.

At this stage, with obstacles in its new energy layout, Great Wall Motor eagerly awaits Wei Jianjun to turn the tide.

Beijing Automotive Group: Making a Big Push

Similar to Chery's collaboration with Huawei in previous months, Beijing Automotive Group is now eager to get in on the action.

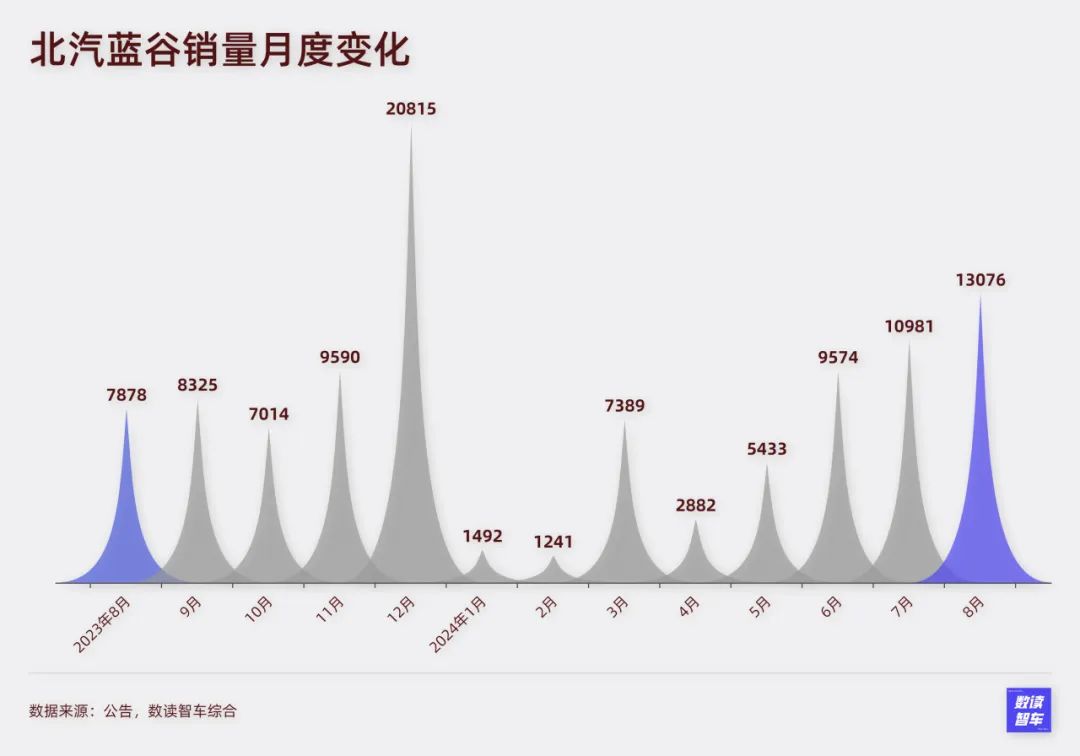

In August, Beijing Automotive BluePark sold 13,076 units, which, while seemingly modest, marked the company's first consecutive month of deliveries exceeding 10,000 units in a long time.

Beijing Automotive Group made numerous new vehicle launches this month. On August 1, ARCFOX added an entry-level model, the Alpha S5 560 Pro, to the Alpha S5 lineup, with a guide price of 160,800 yuan. This move aims to lower the entry barrier for the entire lineup and enhance its market competitiveness. Additionally, the Xiangjie S9 was launched.

After a prolonged downturn, Beijing Automotive Group has started making intense moves, and its sales are likely to see a new uptick. It also has the potential to become an important disruptor in the future.

In August, domestic new energy automakers embarked on a new round of product launches, intensifying model introductions and strengthening collaborations to address shortcomings, preparing for the sales sprint in the coming months. While the "internal competition" among automakers will not last forever, in the challenging environment, such choices are difficult to reverse in the short term.