Idealism and destiny are inevitable

![]() 09/05 2024

09/05 2024

![]() 612

612

Editor | Ji Ran

Lixiang Auto has experienced both joys and sorrows recently.

In terms of overall sales, Lixiang's momentum remains strong. In the second quarter of this year, Lixiang delivered 108,600 vehicles, an increase of 25.5% year-on-year. For the entire first half of the year, deliveries reached 188,900 vehicles, up 35.8% year-on-year, maintaining its top position among new energy vehicle startups. However, despite the sales increase, Lixiang's profitability has declined. On August 28, Lixiang released its second-quarter financial report for 2024, reporting revenue of 31.7 billion yuan, a year-on-year increase of 10.6%. Nevertheless, net profit was 1.5 billion yuan, a decrease of 44.9% year-on-year, nearly halved. Capital markets are clearly dissatisfied with these results. On the day following the financial report's release, Lixiang's share price fell by 9%. It's worth noting that Lixiang only recently emerged as the first new energy vehicle startup to turn a profit last year, and this year's significant fluctuation in net profit has understandably raised doubts among investors.

In fact, the primary reason for Lixiang's declining profitability in the second quarter lies in the company's conservative strategic approach following the failure of its MAGA project in the first quarter. To boost sales, Lixiang resorted to offering low-priced products and discounts in the second quarter, which negatively impacted its overall gross margin and profits. In my view, a more significant concern for Lixiang lies in the aggressiveness and ambition behind the MAGA failure, rather than just the decline in profits. Amidst fierce competition and relentless pressure from rivals, Lixiang must address this underlying issue to avoid further difficulties in the future.

Insight into the Essence of 'Increased Sales, Decreased Profits'

If we examine Lixiang's biggest challenge in the first half of this year, it undoubtedly lies in the MEGA project. Even the reasons for increased sales and decreased profits in the second quarter can be traced back to MEGA. On March 1st of this year, Lixiang unveiled its first pure electric MPV model, the MEGA. At the time, Li Xiang proudly stated, "MEGA will be Lixiang Auto's next blockbuster product, ranking first in sales among vehicles priced above 500,000 yuan." However, reality proved harsher than expectations. Upon its launch, the MEGA faced a deluge of criticism over its appearance, significantly impacting its sales. In March, MEGA sold 3,229 units, but sales plummeted to 1,145 units in April. Under pressure, Lixiang reduced the price by 30,000 yuan, yet sales in May remained dismal at 614 units, and only 654 units were sold in July, marking an 80% decline from its first-month sales. More concerningly, the MEGA's struggles have also impacted L-Series sales. Li Xiang, Lixiang's founder, previously acknowledged that the disruption caused by the MEGA has significantly reduced the time and effort invested by the sales team in serving L-Series customers, to the extent that the flagship L8 model has even lost its prominent display position in stores.

Behind the MEGA's failure lies Lixiang's aggressiveness and ambition. For a brand-new model like MEGA, which had yet to be validated by the market, Lixiang needed to go through the initial stage of commercial validation. However, Lixiang mistakenly treated MEGA as if it were already in the rapid growth phase, leading to strategic missteps. This exposed Lixiang's extreme desire for sales and its aggressive approach after achieving a leading position. Another indicator of Lixiang's ambition and expansion is its weekly release of new energy vehicle sales rankings, despite strong opposition from peers like NIO and XPeng. Despite this opposition, Lixiang continues to publish these rankings each week due to its top position. Having tasted the bitter consequences of aggressiveness, Lixiang has become more conservative, acknowledging that "destiny is inevitable." In the second quarter of this year, Lixiang refocused on its L-Series models. For instance, it removed the MEGA from its most prominent display positions in stores and replaced it with L-Series models. In this process, Lixiang found a lifeline for sales: the L6.

Image source: Lixiang Auto official website

On April 18th of this year, Lixiang launched the L6, a mid-to-large SUV with a starting price of 249,800 yuan, making it Lixiang's first model priced below 300,000 yuan. It has gradually become Lixiang's primary sales driver, with 23,864 units sold in June, ranking first in monthly SUV sales and contributing nearly half of Lixiang's monthly sales. Alongside the launch of low-priced models, Lixiang has also intensified price reductions across its entire lineup. In April, Lixiang reduced prices across its entire model range by 18,000 to 20,000 yuan for the L7, L8, and L9. The combination of low-priced models and across-the-board price reductions directly impacted Lixiang's gross margin, subsequently dragging down net profits.

In the second quarter of this year, Lixiang's vehicle gross margin was 18.7%, compared to 21% in the second quarter of 2023 and 19.3% in the first quarter of 2024. This gross margin is already below the "healthy threshold" of 20% set by Li Xiang. Citi released a research report stating that due to slowing sales of BEV (battery electric vehicle) models and unfavorable supply-demand dynamics, it has downgraded Lixiang Auto's gross margin outlook for the next two years and expects a valuation downgrade risk in 2025. Despite rising sales, Lixiang's management has consistently expressed a conservative outlook for annual sales. Initially, Li Xiang announced in February that the company would increase its 2024 sales target to 800,000 units. However, Lixiang's management lowered the target to 560,000 to 640,000 units in March. During the second-quarter earnings call, management further reduced the target to 500,000 units, 300,000 units lower than the initial target set at the beginning of the year.

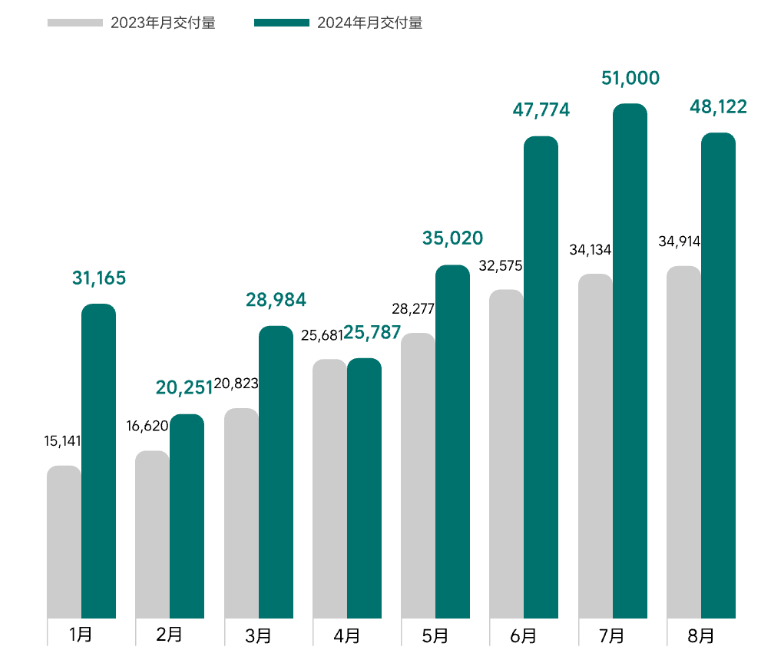

Lixiang Auto's deliveries since the beginning of the year

The primary reason for this conservative sales outlook is the lack of new model launches in the second half of the year, making it challenging to achieve the annual target of 500,000 to 600,000 units.

In fact, this year was originally poised to be a banner year for Lixiang in terms of product launches. However, due to the MEGA failure, Lixiang's management has become more cautious, postponing the launch of its upcoming pure electric SUV from the second half of the year to the first half of next year. Nevertheless, as Lixiang adopts a conservative approach to new model launches, its competitors have launched fierce attacks.

No New Models, But Fierce Competition from Rivals

During the second-quarter earnings call this year, Li Xiang identified HarmonyOS Intelligent Driving as Lixiang's strongest competitor. In fact, Lixiang and AITO have formed a tight competitive dynamic. In the first three months of this year, AITO surpassed Lixiang in monthly sales, while Lixiang regained the upper hand in the subsequent three months. The two companies are now in a stalemate. In China's new energy vehicle sales rankings in August, Lixiang ranked second, closely followed by AITO in third place. Specifically, Lixiang sold 48,122 units, a year-on-year increase of 37.8% but a month-on-month decrease of 5.6%. Its cumulative annual sales reached 231,879 units, up 30.02% year-on-year. AITO sold 31,216 units, a staggering year-on-year increase of 868.8% but a month-on-month decrease of 24.8%. Its cumulative annual sales reached 248,137 units, up 708.3% year-on-year. In terms of specific models, Lixiang's L7, L8, and L9 are priced between 300,000 and 500,000 yuan, while AITO's M7 and M9 are highly competitive in terms of pricing, functionality, space, and configuration. In fact, AITO has frequently gained the upper hand in its competition with Lixiang. When the AITO M7 was launched in 2022, it was widely recognized for its similarity to the Lixiang ONE in terms of model and pricing.

Backed by Huawei, the AITO M7 entered the market with great momentum, temporarily overshadowing the Lixiang ONE. Li Xiang admitted in a lengthy Weibo post, "The launch and operation of the AITO M7 in the third quarter of 2022 directly crippled the Lixiang ONE. I've never encountered such a formidable rival before, and for a long time, we were powerless to respond." Recently, AITO has once again launched an attack on Lixiang. On August 26th, the AITO M7 Pro, which fully competes with the Lixiang L6, was officially unveiled, with a starting price of 249,800 yuan, identical to the L6. Yu Chengdong, CEO of AITO, announced at the launch event, "We will become the best SUV in the 250,000 yuan price range." Although this claim is less ambitious than the "best SUV under 5 million yuan" slogan used during the initial M7 launch, it still intensifies competition in the 250,000 to 300,000 yuan automotive market. During the event, Yu Chengdong specifically compared the M7 Pro with the Lixiang L7 and L6 in terms of space, intelligent driving, and other indicators, subtly declaring, "We will surpass our outstanding peers."

The rivalry between Lixiang and AITO is palpable. Compared to Lixiang, AITO's primary advantages lie in its intelligent experience and Huawei branding. While the previous-generation M7 also had a starting price of 249,800 yuan, it did not come equipped with Huawei's intelligent driving system. In contrast, all four variants of the new M7 are equipped with Huawei's HUAWEI ADS Basic Edition, supporting NCA intelligent driving assistance, AEB active safety, and intelligent parking assistance. The unchanged price combined with upgraded features and Huawei branding will undoubtedly attract a large number of consumers. Facing AITO's relentless pursuit, Lixiang has also intensified its efforts in intelligent driving. According to its financial report, Lixiang's R&D expenses in the second quarter of this year reached 3 billion yuan, accounting for 10% of its total revenue. These expenses are primarily focused on the development of core technologies such as intelligent driving, intelligent space, and intelligent electrification.

According to Tianyancha App, Lixiang Auto established an industrial intelligence company in Jiangsu Province in August this year, with a business scope encompassing basic software development for artificial intelligence, computer system services, industrial robot manufacturing, and intelligent robot sales.

Clearly, Lixiang is preparing to strengthen its technological moat and engage in a protracted battle with AITO. At the same time, Lixiang is pinning its hopes on the pure electric vehicles to be launched next year.

From Extended-Range to Pure Electric: A New Adventure?

During the second-quarter earnings call this year, Li Xiang stated, "We hope to enter the first tier of high-end pure electric vehicles within approximately two years." Although the launch of Lixiang's new pure electric SUV has been postponed to the first half of next year, Li Xiang remains confident about the future. However, having learned from the lessons of the MEGA failure, Lixiang is now more cautious. Li Xiang specifically emphasized that the new pure electric SUV must address two key issues: the product's styling and design, and the ability to provide over 2,000 supercharging stations to customers upon delivery. Having learned from past mistakes, Lixiang is now extremely cautious about the styling of its new models. Nevertheless, as Lixiang looks forward to its new models next year, it must also maintain a close watch on its existing stronghold. With a growing number of competitors entering this space, Lixiang's top position could be threatened if it fails to develop an appropriate strategy.

Extended-range SUVs can be considered Lixiang's stronghold. Lixiang's previous success primarily stemmed from its early entry into the mid-to-large SUV market, avoiding the fiercely competitive compact and mid-size segments. The mid-to-large SUV market was once dominated by BBA (BMW, Benz, and Audi), but their relatively high prices deterred many potential customers. By offering the L7, L8, and L9 at half the price of BBA models, Lixiang successfully captured a large number of SUV enthusiasts who couldn't afford the higher prices. Today, Lixiang's extended-range SUV brand recognition is deeply ingrained, and it is strongly associated with family use scenarios. This is the foundation of its success and its primary advantage.

However, the mid-to-large SUV market has limited growth potential, and competition is intensifying. It's time for Lixiang to further enhance its differentiating advantages. This year has seen the launch of several extended-range SUVs, including the Nezha L, ZERO1 C10, and SL03 G318. On August 30th, Avatr launched its third model, the Avatr 07, an extended-range SUV that targets the Lixiang L6 and AITO M7. Some media outlets have reported that its price may start at just over 200,000 yuan. Zeekr has explicitly stated that it will launch a large SUV supporting both extended-range and plug-in hybrid modes next year, and media reports suggest that Xiaomi's third planned vehicle will be an extended-range SUV targeting family use, scheduled for launch in 2026.

The influx of players into the extended-range SUV segment is a testament to its significant potential. According to data from the China Passenger Car Association, SUVs accounted for 47.8% of the market share in 2023, surpassing sedans for the first time with a 0.7% advantage. In the first seven months of this year, sales growth rates for pure electric and hybrid vehicles differed significantly, at 10.1% and 84.5%, respectively. Additionally, extended-range vehicles are more readily accepted by high-end consumers, accounting for 42% of the high-end vehicle market. Many pure electric vehicle manufacturers are now vigorously entering the extended-range SUV segment, aiming to capture a share of the market that was once Lixiang's domain. At this juncture, is Lixiang's full-fledged entry into the pure electric vehicle segment a risky move? The answer remains uncertain until the performance of its pure electric models next year becomes evident. After all, the MEGA failure has raised doubts about Lixiang's strategy in the pure electric vehicle space. Ultimately, Lixiang must remain humble, using a more rational and cautious approach to navigate the increasingly competitive and differentiated new energy vehicle market.