Inheriting Apple's "squeezing toothpaste" strategy, GoPro's new product completely loses the battle for sports cameras

![]() 09/06 2024

09/06 2024

![]() 434

434

On September 5th, renowned sports camera brand GoPro unveiled its latest flagship sports camera, the Hero 13 Black (hereinafter referred to as GoPro 13), priced at the familiar RMB 3,298. As a former GoPro 8 user, I feel a mix of emotions when seeing the new GoPro 13. After all, years have passed, and it seems GoPro has hit the pause button. Neither its appearance, specifications, nor price impress me.

(Image source: GoPro's official JD.com flagship store)

Perhaps the once dominant GoPro in the sports camera market can no longer stir up much commotion.

Is GoPro standing still?

Let's start with specifications. The GoPro 13 is equipped with a 1/1.9-inch sensor, capable of capturing up to 27 megapixel photos, 5.3K video at 60fps, 4K video at 120fps, and 2.7K video at 240fps. If I remember correctly, this setup has been used since the GoPro 11. While there might be some sensor upgrades, improvements in image quality, resolution, and video recording are minimal.

(Image source: GoPro official)

In contrast, domestic brands DJI and Insta360 released their Action 4 and Ace Pro last year, both equipped with a larger 1/1.3-inch sensor. While limited to 4K resolution, their overall performance surpasses GoPro's.

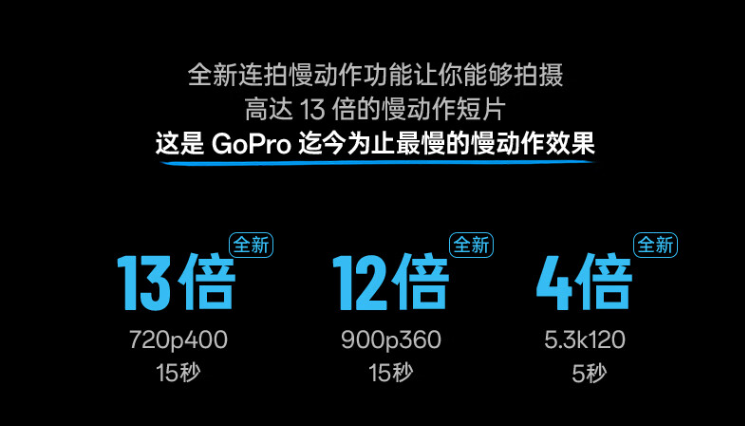

In terms of features, the GoPro 13 introduces a Super Burst Slow Motion mode, capable of recording 720P video at 400fps, 900p at 360fps, and 5.3K at 120fps, according to official data.

(Image source: GoPro official)

Other specifications include a 1900mAh battery, promising up to 150 minutes of battery life for 1080p30fps recording, 90 minutes for 4K30fps or 5.3K30fps. It also features enhanced HyperSmooth 6.0 stabilization for 360° horizon leveling.

GoPro also launched a new lens kit, including ultra-wide, macro, cinema, and ND filters, automatically adjusting to optimal settings. Interestingly, GoPro adopted a magnetic mount similar to DJI's design.

(Image source: GoPro official)

Based on the official specifications, GoPro appears less competitive than DJI and Insta360, let alone in localization efforts.

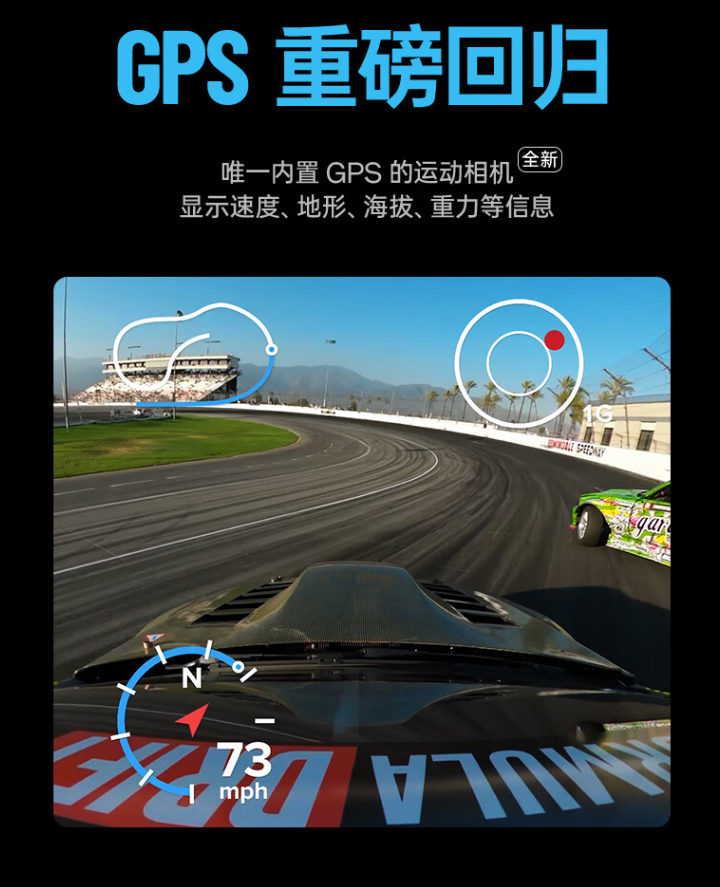

However, GoPro isn't without its strengths. As the only sports camera with a built-in GPS system, it displays speed, terrain, altitude, and gravity details. Competitors require additional accessories for similar features, adding cost and compromising portability.

(Image source: GoPro official)

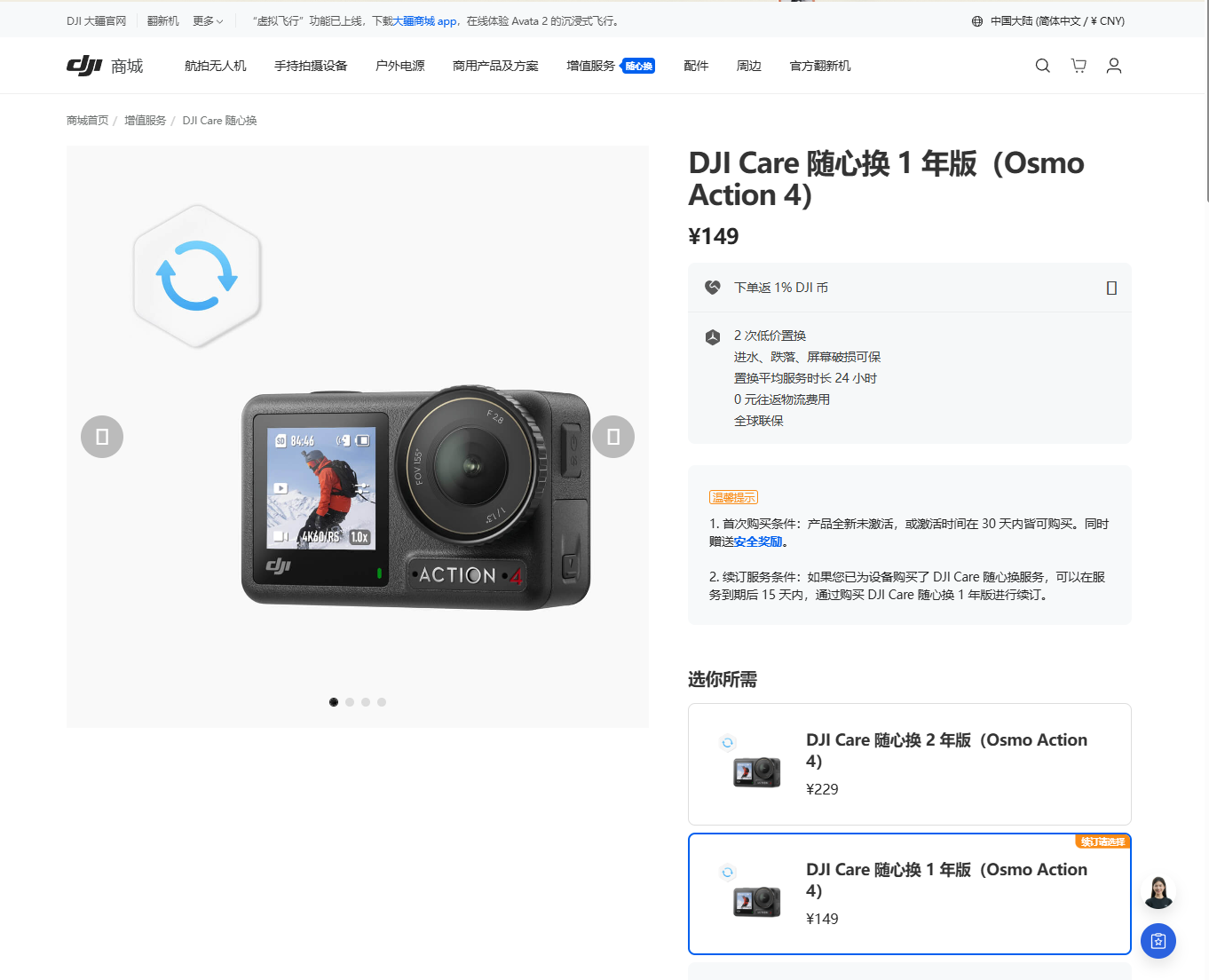

Despite decent specs, the GoPro 13's RMB 3,298 price tag fails to ignite interest. For example, the DJI Action 4 costs only RMB 1,998 on JD.com, with the All-in-One Bundle and two years of Care Refresh for RMB 2,927. The price gap is hard to justify for casual users, given GoPro's focus on extreme sports recording and GPS features.

Sports Cameras: GoPro Is No Longer the Only Option

According to GoPro's Q2 2024 earnings report, revenue declined 13.8% YoY, with net income plunging nearly 300%. GoPro's failure lies in its limited product line. Despite attempts with drones and panoramic cameras, GoPro's flagship remains the Hero Black series.

(Image source: GoPro official)

The core issue isn't pricing but stagnant product development. The GoPro 13's sensor is nearly identical to the 11th generation, with minimal image quality improvements. Key upgrades include better slow-motion recording and software stabilization.

(Image source: Insta360 official)

In contrast, DJI and Insta360 understand consumer needs. The DJI Action 4 boasts top hardware and a user-friendly app for quick editing. Insta360's thumb-sized Go3 enables discreet recording, while its Insta360 ONE R offers 360° views for diverse scenarios.

(Image source: DJI official)

DJI and Insta360 will soon release flagship sports cameras, likely improving battery life and image quality. Notably, the Insta360 Ace Pro 2 is rumored to include dual AI chips for intelligent features like auto-tracking and one-click editing.

Ignoring pricing, domestic brands surpass GoPro in specifications. Consumers face a choice: affordable domestic cameras or pricier, well-known GoPros. The decision isn't difficult.

Beyond products, GoPro faces a critical weakness in China: after-sales service, a common issue for international brands. While GoPro's service is adequate, the process is cumbersome (involving contacting retailers, finding official support, and writing emails). Repairs often take half a month.

DJI and Insta360 better meet Chinese consumer expectations. DJI's Care Refresh service offers replacements for damaged products, reducing waiting times. Users pay only for the replacement, a fast, convenient, and cost-effective solution that resonates with consumers.

(Image source: DJI official)

Like Apple, GoPro remains an industry leader but struggles with innovation, facing criticism. DJI and Insta360 capitalize on GoPro's weaknesses, attracting users with niche advantages. GoPro's market share continues to shrink.

Final Thoughts

Based on my understanding of the sports camera market, most consumers hesitate to spend thousands on a camera. Many buy out of curiosity, losing interest quickly. With prices higher than DJI and Insta360, GoPro's performance in China deteriorates.

Despite expanding into smart helmets and reviving drones, GoPro must innovate to remain relevant. If it fails, it risks becoming a legend of the past in the sports camera market.

Source: Leitech