OPPO falls back to "Others" and still needs to help itself.

![]() 09/06 2024

09/06 2024

![]() 534

534

The sanctions against Huawei serve as a stark reminder that self-developed chips remain a crucial moat for the sustained development of smartphones.

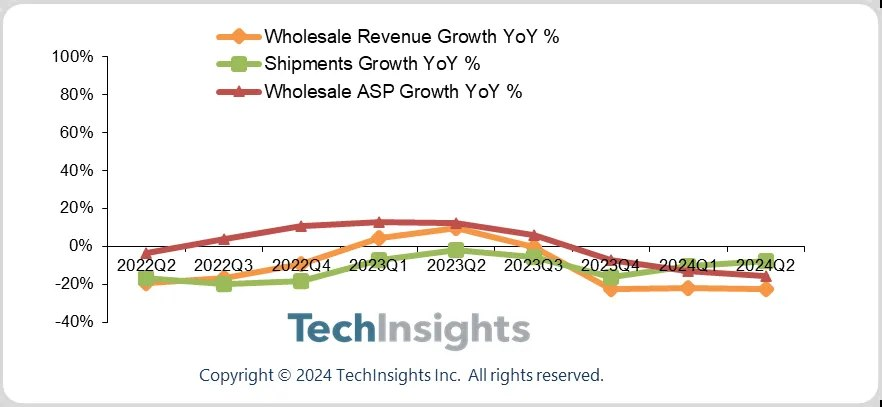

Amid economic pressures and sluggish consumption, the domestic and international smartphone markets have endured a prolonged downturn. However, as the industry navigates through these challenging waters, the smartphone market has regained its growth trajectory, ushering in a new phase of recovery and revitalization.

Recently, Xiaomi Group, which has always been in the spotlight, delivered its best quarterly report in history. Apart from its automotive business recording a high gross margin of 15.4%, Xiaomi's smartphone business also excelled in the second quarter.

In the second quarter of 2024, Xiaomi's smartphone revenue reached 46.5 billion yuan, representing a year-on-year growth of 27.1%. Globally, Xiaomi shipped 42.2 million units, marking a 28.1% increase from the previous year.

According to Canalys data, Xiaomi ranked third in global smartphone shipments during the second quarter, with a market share of 14.6%. Among the top five brands, Xiaomi recorded the fastest year-on-year growth in shipments.

TechInsights' second-quarter 2024 global smartphone shipment report revealed that Samsung topped the list with nearly 19% of shipments, followed by Apple with a 15% market share. Xiaomi, vivo, and Transsion ranked among the top five, while OPPO (including OnePlus) fell out of the top five, relegated to the "others" category.

As a leading domestic smartphone manufacturer, OPPO's sales performance in the second quarter was somewhat disappointing. Data showed that OPPO and its subsidiary brand OnePlus shipped a combined total of 25 million units globally in the second quarter, a year-on-year decline of 8%, making it the only brand among the top ten to experience a decline. Specifically, OPPO's shipments decreased by 5% year-on-year, while OnePlus's shipments declined by a more significant 22%.

The smartphone market has witnessed a resurgence, with domestic smartphone brands regaining their dominance over Apple and Samsung in terms of shipments. Among Huawei, Xiaomi, OPPO, and vivo, only OPPO lags behind.

Since the chip monopoly incident, Huawei has made a strong comeback, while Xiaomi has garnered significant attention with its new energy vehicle, the Su7, under the leadership of "Leibusi". Vivo, which shares the same origins as OPPO, even topped the domestic sales rankings in the second quarter. In contrast, OPPO, once a dominant player, has gradually lost its voice.

01 Abandoning Self-Developed Chips and XR

In 2019, Huawei was added to the U.S. Entity List, followed by stringent chip sanctions imposed by the U.S. government. These sanctions severely impacted Huawei's smartphone business, which plummeted. According to Omdia data, Huawei's smartphone shipments dropped from 190 million units in 2020 to 35 million units in 2021, a year-on-year decline of 81.6%. This figure further declined to 28 million units in 2022.

As one giant falls, many others rise. The decline of the former king of domestic smartphones paved the way for new leaders to emerge. With Qualcomm chip supplies available during the period when Huawei's chip supply was disrupted, vivo and OPPO entered a period of rapid growth. In 2021, OPPO topped the shipment rankings with 64.4 million units sold, marking a 34.3% year-on-year increase.

However, OPPO's ascendancy proved to be fleeting. After being surpassed by vivo in 2022, OPPO's market share continued to decline, failing to reclaim the top spot.

OPPO's decline may be related to its frequent strategic adjustments in recent years.

In 2019, OPPO announced the establishment of its chip company, ZEKU, with a focus on providing hardware and software support for high-end flagship smartphones. In 2021, OPPO officially unveiled its first self-developed 6nm image-specific NPU (Neural Processing Unit) chip, the MariSilicon X.

At the time, OPPO's CEO, Chen Mingyong, a disciple of Duan Yongping, stated that the MariSilicon X was just a small step in OPPO's self-developed chip journey. He emphasized that OPPO would continue to invest resources and use a team of thousands to steadfastly work on self-developed chips.

In 2022, OPPO released its second self-developed chip, the MariSilicon Y, a Bluetooth audio SoC chip.

Despite previous ambitious statements, OPPO suddenly announced in May 2023 that it would cease chip development and shut down its ZEKU business, laying off nearly 3,000 employees related to the project. Market speculation suggests that this decision may be related to the exorbitant costs associated with chip development. It is rumored that OPPO spent up to 100 million yuan on a single tape-out test for its chips, and the expenses related to its R&D team were also considerable.

The combination of these massive expenses and declining smartphone sales in the smart device market led to the collapse of OPPO's chip development efforts.

Earlier this year, it was reported that OPPO had ceased its exploration of XR projects since 2019. XR refers to the combination of VR (Virtual Reality), AR (Augmented Reality), and MR (Mixed Reality).

In response, OPPO stated that it would continue pre-research in AR, emphasizing that AI is a strategic technology leading the future. OPPO Research Institute will intensify its efforts in breakthroughs and new opportunities in cutting-edge core technologies such as AI, AR, and 5G/6G. OPPO has once again shifted its focus, this time aiming at AI.

Opinions on OPPO's two decisions to abandon projects have been mixed. Some view them as wise moves to protect the company and cut losses in a timely manner, while others criticize OPPO's internal management as chaotic, accusing it of chasing fads and wasting significant funds by abandoning projects halfway through.

02 Betting on AI and Foldable Phones

At the beginning of this year, OPPO's CEO Chen Yongming designated 2024 as the first year of AI phones in an internal letter. On February 20th, the company held an AI strategy conference, announcing its "1+N" agent ecosystem strategy, which includes the OPPO AI Super Agent and the AI Pro Agent development platform.

In fact, since the emergence of generative AI applications like ChatGPT, smartphone manufacturers have already sensed the business opportunities and begun to lay out their strategies in the AI large model race. Domestic and international smartphone manufacturers such as Huawei, vivo, Xiaomi, Honor, Samsung, and Apple have all made moves in this arena.

At its developer conference in 2023, vivo unveiled its self-developed general-purpose large model matrix, Lanxin, which comprises five models with parameter volumes ranging from 1 billion to 175 billion (Lanxin 1B, Lanxin 7B, Lanxin 70B, Lanxin 130B, and Lanxin 175B).

Recently, Xiaomi Group President Lu Bingwei shared on social media that Xiaomi's upcoming Pengpai OS 2.0 will focus on AI technology and be reconstructed with AI large models. Earlier rumors suggested that the Xiaomi 15 series would be the first to ship with Pengpai OS 2.0.

Huawei also launched its Pangu Large Model 5.0 this year, and the Huawei Mate 60 series now features the company's self-developed Pangu Large Model.

OPPO released its self-trained personalized large model and agent, AndesGPT, at the end of 2023. Earlier this year, OPPO's flagship Find X7 series became the first to integrate AndesGPT.

In August of this year, OPPO's Chief Product Officer Liu Zuohu announced that OPPO's international models would integrate Google's AI large model, Gemini.

As competition intensifies in the smartphone market, foldable phones have emerged as a new direction for manufacturers to differentiate themselves. Since Samsung released its first foldable phone, the Galaxy Fold, in 2019, the form factor of smartphones has evolved rapidly, from small vertical folds to large horizontal folds and even tri-folds.

OPPO launched its first foldable product, the Find N series, in 2021. From August to October last year, the company Intensively launched OPPO Find N3 Flip, OPPO Find N3, and the limited edition OPPO Find N3. Among them, the OPPO Find N3 Flip is a compact and portable small foldable phone.

According to IDC data, Huawei dominated the Chinese foldable phone market in the second quarter of 2024 with a 41.7% market share. Vivo and Honor followed closely, while OPPO ranked fourth.

In terms of foldable form factors, the growth of small folds has been sluggish, while the prices of large folds have gradually decreased. Tri-folds have become the new battlefield for competition among leading manufacturers.

On August 25th, a blogger revealed that Xiaomi had started testing its tri-fold phone. Earlier this year, Huawei's Yu Chengdong was spotted holding a new tri-fold phone on a flight. Honor has also stated that it is ready to mass-produce tri-fold phones.

Whether it's AI large models on the software side or foldable phones on the hardware side, OPPO is actively making moves. However, compared to its competitors, OPPO lacks both a first-mover advantage and significant differentiation. With products largely homogenized, consumers' choice ultimately comes down to product quality and brand tone. Therefore, to achieve growth, OPPO needs to continue to delve deeper into differentiation.

03 Pursuing High-End in Overseas Markets

When OPPO was first established, its winning formula lay in marketing and offline channel advantages. However, in today's market, high-end technology and brand equity have become the primary factors in capturing consumer mindshare. In this regard, overseas markets seem to be a better fit for OPPO.

To date, OPPO's business has expanded to over 60 countries and regions worldwide, with more than 400,000 sales outlets.

Compared to developed markets like Europe and the United States, Southeast Asia has always been a gold mine for Chinese businesses looking to expand overseas. OPPO entered the Southeast Asian market in 2009 and quickly rose to the top by establishing factories, conducting aggressive marketing campaigns, and positioning itself as a mid-to-low-end brand.

After securing a substantial market share, OPPO began to focus on the high-end market. In 2023, amid the homogenization of the straight-screen phone market, OPPO introduced its "All in Foldable" strategy in overseas markets, exporting its small foldable phone, the OPPO Find N2 Flip.

Data shows that in the second quarter of 2023, the OPPO Find N2 Flip achieved over 50% market share in Indonesia, Malaysia, Thailand, and Singapore, with a staggering 81% share in Malaysia alone.

According to the latest Canalys research data, OPPO (excluding OnePlus) regained its second-place position in the Southeast Asian market in the second quarter of 2024, shipping 4.2 million units and capturing a 17% market share.

The small foldable phone has played a crucial role in maintaining OPPO's leading position in the Southeast Asian market. However, rumors have circulated this year that OPPO may discontinue its small foldable product line and instead focus on mass-producing more foldable concept phones. While the sluggish growth of small foldables, due to their inferior battery life and performance compared to straight-screen and large foldable phones, may justify this decision, it remains uncertain whether other foldable models can replicate the success of OPPO's small foldables overseas.

Apart from OPPO, Chinese brands like Xiaomi, Huawei, and vivo have also achieved impressive results in emerging overseas markets. However, in the international market as a whole, Samsung and Apple remain synonymous with high-end brands. After establishing a foothold in the mid-to-low-end market, how Chinese smartphone manufacturers can bridge the gap in brand recognition in the high-end market is a challenge they must address.

Returning to the core issue, faced with fierce domestic and international competition, OPPO must come up with more innovative strategies to reverse its declining fortunes.

OPPO's Liu Zuohu once said, "Competition always exists, and the only way to navigate through cycles is to make good products." To enhance its core competitiveness, OPPO may need to revisit self-developed chips, which it had previously abandoned, as a strategy for the next cycle.

On the same day that OPPO launched the Find N3 Flip, Huawei unveiled the Mate 60 series, stealing the spotlight. Equipped with the Kirin 9000S processor, this series marks Huawei's return to using its flagship Kirin chip three years after being blocked by the United States. The launch of this model holds historical significance for Chinese smartphone manufacturers seeking to break free from American restrictions. By gradually shaking off the shadow of sanctions through self-developed chips, Huawei may soon reclaim its position as the leading domestic brand.

Self-developed chips undoubtedly come at a hefty cost, necessitating OPPO to boost sales and accumulate capital. There is room for maneuver in both AI large models and foldable phones. In the long run, the sanctions against Huawei serve as a stark reminder that self-developed chips remain a crucial moat for the sustained development of smartphones. To reverse its decline and maintain its leading position, OPPO must help itself.