Once abandoned by the 'Apple supply chain', now Huawei's new favorite: In-depth analysis of OFILM's optical legend.

![]() 09/06 2024

09/06 2024

![]() 629

629

Recently, OFILM released its performance report for the first half of 2024: The company achieved operating revenue of 9.536 billion yuan in the first half of the year, a year-on-year increase of 51.02%; net profit attributable to shareholders of listed companies was 39.1445 million yuan, turning losses into profits year-on-year; basic earnings per share were 0.012 yuan.

The reason for the turnaround and profit-making, OFILM explained in its announcement: On the one hand, the company's business order volume in the first half of the year increased compared to the same period last year, and the growth in operating revenue drove a year-on-year increase in net profit; on the other hand, the company insists on guiding technological industrialization and upgrading through independent innovation, continuously investing in research and development, strengthening internal management, steadily improving product quality, continuously achieving breakthroughs in key technologies and product applications, and realizing rapid year-on-year growth in revenue from high value-added products, thereby enhancing profitability.

Back in the day, OFILM was a hot commodity in the capital market, basking in glory, and had big names like Huawei and Apple as its guests. Being able to enter the 'Apple supply chain' and win the favor of Huawei is no easy feat for just any company.

But life is always full of variables. After 'breaking up' with Apple, it was once ridiculed as 'OFILoss,' losing billions over three consecutive years. However, it managed to climb out of the mire and stage a remarkable comeback.

After bidding farewell to the 'Apple supply chain,' why did OFILM, a leading optical enterprise, 'lose everything'? And what did it rely on to remain invincible? Today, let's delve into the inspiring story of OFILM's rebound from the depths.

01

Rising Star of the 'Apple Supply Chain'

OFILM, formerly a Sino-foreign joint venture, was established in March 2001, originally positioned to engage in the research and development, production, and sales of precision thin-film components for optical fiber communications. In its first two years, like many start-ups, it stumbled forward without significant business success. By September 2004, the original shareholders, perhaps discouraged, began to withdraw, leaving OFILM at a crossroads.

At this point, Cai Rongjun and Cai Gaoxiao, two brothers, invested 4.39 million yuan to buy the struggling OFILM. This marked a new chapter in OFILM's story. After enduring the toughest times, OFILM carved out a niche in the competitive field of infrared cut-off filters, not only establishing a foothold but also capturing 30% of the global market share, successfully listing on the capital market in 2010.

Cai Rongjun's vision, however, extended far beyond this. From touch screens to camera modules and fingerprint recognition, each transformation precisely tapped into the pulse of the times. In 2008, OFILM ventured into the touchscreen sector; in 2012, it entered the camera module market; and in 2014, it made a significant investment to build Asia's largest fingerprint recognition module factory.

Under his leadership, OFILM underwent four remarkable transformations, solidifying its position in the optical field step by step.

Fast forward to 2016, when OFILM accomplished a feat that garnered industry-wide attention – acquiring Guangzhou Delta, a company specializing in micro-camera modules and optical lenses. This move not only propelled OFILM into the 'Apple supply chain,' making it a key supplier to Apple in China, but also saw its market value soar to 70 billion yuan within a year, closing in on the optical industry's 'elder brother,' Sunny Optical.

In 2018, Apple contributed 8.3 billion yuan in revenue to OFILM. In 2019 and 2020, this figure grew to 11.7 billion and 14.5 billion yuan, respectively. During this period, OFILM was a 'star enterprise' in the industry. Senior optical professionals in frontline sales shook their heads when mentioning it: 'Back then, when bidding for orders, everyone trembled at the mere mention of OFILM because there was no chance of winning.'

At that time, OFILM was not only a core player in the mobile phone supply chain but also boasted heavyweight clients like Huawei and Apple. In 2019, OFILM's top three customers were Huawei, Apple, and Xiaomi, accounting for 31.16%, 22.51%, and 19% of sales, respectively.

02

The Darkest Hour for the Abandoned Child of the 'Apple Supply Chain'

However, OFILM's journey was not without its setbacks.

In 2020, the U.S. Department of Commerce blacklisted 11 Chinese companies, including OFILM, under the pretext of 'human rights abuses,' casting a shadow over OFILM's development.

The real storm erupted in 2021, when Apple, to protect itself, accelerated its 'de-China' efforts, ruthlessly excluding 33 Chinese supply chain enterprises, including OFILM. Meanwhile, Huawei's mobile phone business plummeted due to U.S. sanctions. OFILM seemed to lose its two pillars overnight, with a sharp decline in performance that almost pushed it to the brink. At that time, OFILM's net profit plummeted by 90%, as if it would disappear into the market's tumultuous waves at any moment.

After losing Apple as a major customer, the consumer electronics industry faced a severe winter, and OFILM disposed of significant assets from 2021 to 2023. On the one hand, it divested its customized Apple assets and sold them to Wintek, booking substantial asset impairment losses; on the other hand, it also booked significant inventory write-downs.

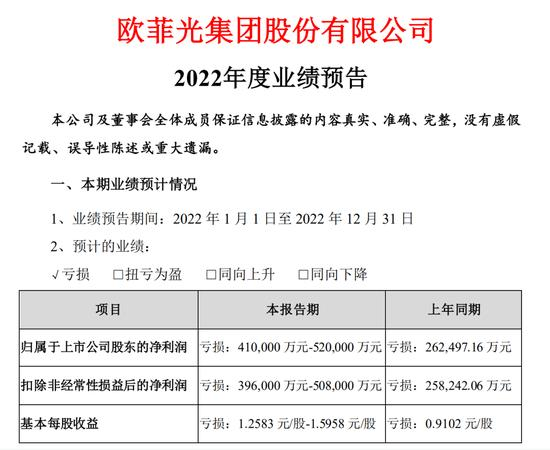

As a result, the years from 2020 to 2022 were undoubtedly the darkest moments for OFILM. In 2020, the company lost 1.945 billion yuan. In 2021, OFILM's revenue plunged by another 52.75%, with a net profit loss of 2.625 billion yuan, a year-on-year decline of 34.99%. In 2022, the company's performance continued to decline, with revenue down 35.09% year-on-year and a net profit loss of 5.182 billion yuan, a year-on-year decline of 97.43%.

From 2020 to 2022, OFILM lost nearly 10 billion yuan in total, earning it the nickname 'OFILoss.'

After losing its status in the 'Apple supply chain,' OFILM's share price, revenue, and profits collapsed comprehensively. The Shenzhen Stock Exchange even issued a letter of concern to OFILM, requiring the company to supplement its disclosure of the timing of the termination of procurement relationships with specific foreign customers and to verify the timeliness of information disclosure related to order changes.

However, OFILM did not give up. Like Huawei, OFILM sounded the clarion call for counterattack. Entering 2023, OFILM set two clear goals: reduce costs and improve efficiency, and achieve profitability. Although it has not completely shaken off the shadow of losses, the company's operations have gradually returned to normal.

As OFILM CEO Cai Rongjun said, 'We must stubbornly survive.'

03

Becoming Huawei's 'New Favorite' and Returning with Strength

In 2023, OFILM finally turned the corner.

Huawei launched the Mate60 series, which also shone a spotlight on OFILM as the primary supplier of camera modules, fingerprint modules, and other critical components for this popular model. OFILM virtually monopolized the manufacture of these essential components.

Market research firm TechInsights offered an optimistic forecast, predicting that the Mate60 series would ship 5 to 6 million units over its lifecycle, representing a significant revenue stream for OFILM. In the stock market, the popularity of the Mate60 series lifted A-share companies associated with Huawei, with OFILM leading the pack, securing six consecutive trading days of limit-up gains, with a peak increase of nearly double.

In 2023, OFILM's performance also flourished. Annual revenue reached 16.8 billion yuan, a year-on-year increase of 3.72%. More importantly, the company achieved its first profit in four years, with a net profit attributable to shareholders of 77 million yuan, undoubtedly the best reward for OFILM's perseverance and hard work.

In 2023, Xiaomi CEO Lei Jun revealed that Xiaomi plans to achieve a total output value of 200 billion yuan over the next decade and collaborate with renowned suppliers to promote the upgrading and development of domestic supply chains. Among them were domestic supply chain partners, including OFILM, marking not only Xiaomi's vision but also new opportunities for supply chain enterprises like OFILM.

The rise of domestic mobile phone giants like Huawei, Xiaomi, OPPO, and VIVO has also provided a vast stage for OFILM to thrive in the fiercely competitive market.

04

Diversified Self-Rescue, Aiming at VR/AR

However, the battle rages on, and OFILM has been actively pursuing self-rescue in recent years. Instead of relying solely on consumer electronics, it has embraced diversification, venturing into optics fields such as robotics, smart homes, and smart cars, striving for steady progress through a multi-legged strategy.

As the VR/AR market boomed, and industry leaders like GoerTek and Sunny Optical achieved growth through VR/AR businesses, OFILM could not remain indifferent. After all, GoerTek mentioned VR/AR 33 times in its 2021 annual report, and Sunny Optical even pushed VR/AR product revenue into the top three on its revenue list. Faced with such an alluring prospect, OFILM could not sit idly by.

In April 2022, OFILM officially announced significant changes, integrating its IoT Ecosystem Business Unit, covering smart locks, IP cameras, robots, and related products; and consolidating its Metaverse Business Unit, responsible for optical lenses, imaging modules, optical engine modules, and complete machine assembly and manufacturing in the VR/AR field. This was a relatively rare business structural adjustment since OFILM's listing in 2010.

From OFILM's strategic adjustments, it is evident that it is integrating resources while mapping out a business blueprint for the metaverse. It hopes to find a new path to revive its sluggish stock price and somewhat embarrassing financial data in recent years. After all, in the limitless field of VR/AR, no one wants to miss the next trend.

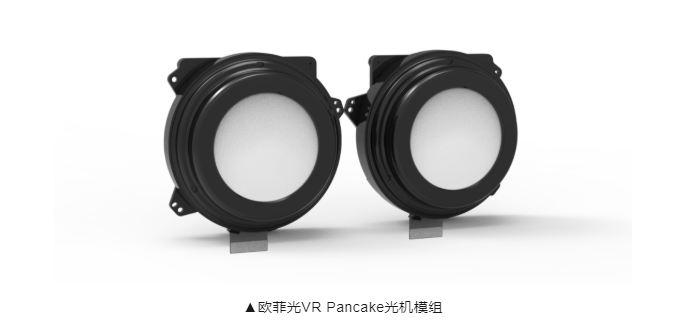

In September 2022, OFILM successfully developed a new generation of VR Pancake optical engine modules. Featuring a folded optical path with a 3P lens design and curved film technology, these modules offer advantages such as short total lens length, myopia adjustment, no change in field of view (FOV) during diopter adjustment, low dispersion, and high pixels per degree (PPD), significantly reducing the weight and size of VR headsets.

Looking back over the past few years, OFILM's layout in the VR/AR field has been impressive.

Since 2016, OFILM has invested in multiple VR/AR innovators, such as 3Glasses and U.S. AR company ODG, and actively participated in the establishment of the Nanchang Virtual Reality Research Institute. These investments have not only enriched OFILM's experience and resources in the VR/AR field but also laid a solid foundation for its subsequent development.

05

Conclusion

With the clarion call for counterattack sounding, OFILM has not only been reborn but also stands at the forefront of the industry with a brand-new attitude.

However, the story is far from over, and the journey ahead holds even more promise for OFILM.

Written by Vivi

(Images not specifically marked in the article are sourced from the internet)