Yonyou Network's crisis and opportunities in its half-year report

![]() 09/06 2024

09/06 2024

![]() 480

480

Author: Poetry and Starry Sky

ID: SingingUnderStars

It is reported that estimated data show that OpenAI, a leader in generative AI, may incur a total operating cost of $8.5 billion this year. Among them, the costs of inference and training are as high as $4 billion and $3 billion, respectively. OpenAI's annual revenue is estimated to be between $3.5 billion and $4.5 billion, significantly lower than its operating costs.

According to my calculations, this revenue scale implies that there are almost no other profit models besides charging membership fees to individual users.

I thought American AI had already figured out a viable business model! Why aren't there any high-profit To B applications? The reason is simple: the open-source large models have swallowed up that potential revenue.

For example, several AI projects I'm currently responsible for all use open-source large models. We originally used ChatGLM but have now switched to qwen.

Many people praise ChatGPT for being much better than domestic AI, capable of responding to absurd remarks and identifying logical traps...

However, the true application of large B-end AI models is not about chatting with fools. It's often used for tasks like:

Summarizing sales figures for the entire insurance industry this month; answering customer operational queries from a knowledge base; checking whether OCR-recognized invoice headers are reasonable and automatically correcting any inaccuracies.

This is also why Apple developed its own AI large model instead of relying solely on ChatGPT.

If OpenAI fails to deliver a game-changing B-end application in the short term (which seems unlikely), its valuation collapse may be imminent.

When industry leaders struggle to find a profitable model, the anxiety across the entire sector is palpable.

01

Yonyou Network Reports Half-Year Loss

Yonyou Network has released its half-year performance forecast, projecting a net loss of 750 million to 884 million yuan for the first half of the year.

According to the announcement, the loss is primarily attributed to three factors: 1) the company's business operations exhibit seasonal characteristics, with the first-half revenue accounting for a lower proportion of annual revenue than first-half costs; 2) the amortization of intangible assets arising from R&D investments has increased by approximately 150 million yuan year-on-year; 3) the change in fair value of other non-current financial assets has decreased by approximately 50 million yuan year-on-year.

As AI gained momentum, Yonyou quickly entered the field and became one of the early adopters of AI large models in the industry.

However, the reality is harsh: despite significant investments in R&D and computing resources, the results have been underwhelming.

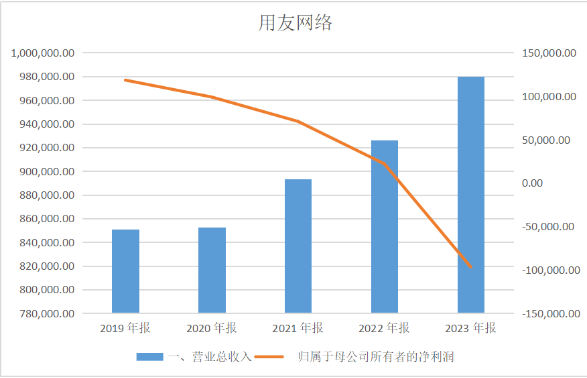

Data Source: Tonghuashun iFind, Chart: Poetry and Starry Sky

In fact, the company's poor performance is not a recent phenomenon.

The company's net profit has continued to decline in recent years. In 2023, the company achieved revenue of 9.796 billion yuan, a year-on-year increase of 5.8%; net profit attributable to shareholders was -967 million yuan; and net profit after deducting non-recurring gains and losses was -1.104 billion yuan.

It is evident that there has been no significant improvement in operating conditions in 2024.

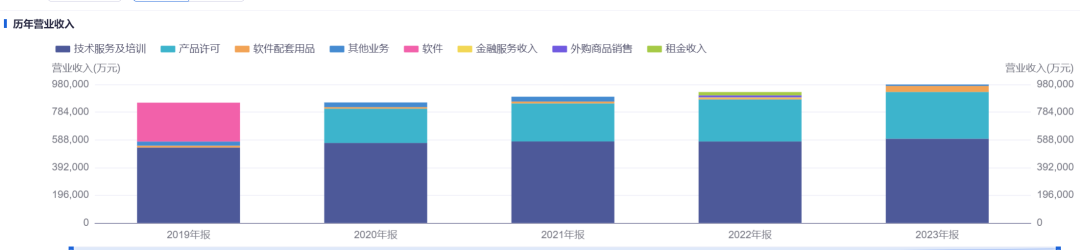

Data Source: Tonghuashun iFind

Examining the company's business segments, the primary cause of the loss lies in the rapid decline in gross margins for core businesses.

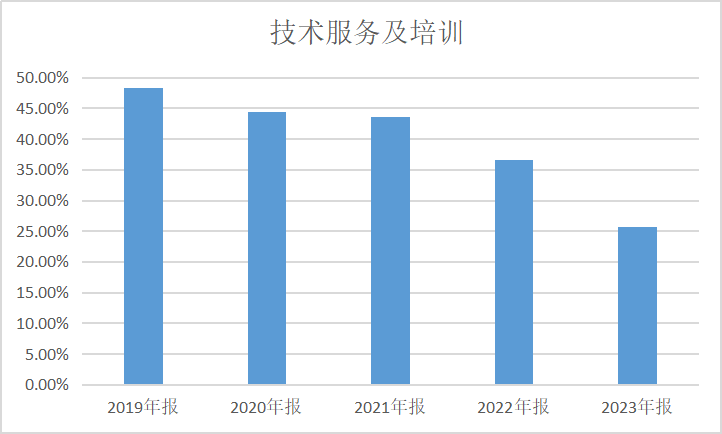

Taking the "Technical Services and Training" segment, which accounts for over 60% of revenue, as an example, the gross margin has plummeted from nearly 50% to 25% over the past five years, almost halving.

Data Source: Tonghuashun iFind, Chart: Poetry and Starry Sky

This reflects intense competition in the industry and indicates a lack of sufficient customer stickiness for the company's products.

According to the company's annual report, in 2023, the company embarked on its largest-ever business organization model upgrade. Large enterprise customer business shifted from a regionally focused organizational model to an industry-focused one, while mid-sized enterprise customer business continued to operate regionally but with a unified, vertical organizational structure nationwide.

By the end of the year, the business organization model upgrade had been completed, and the company had overcome the phased impact on its business and performance.

The company believes that its business is gradually entering a period of sound growth, although performance remains uninspiring.

02

Cash Flow Crisis

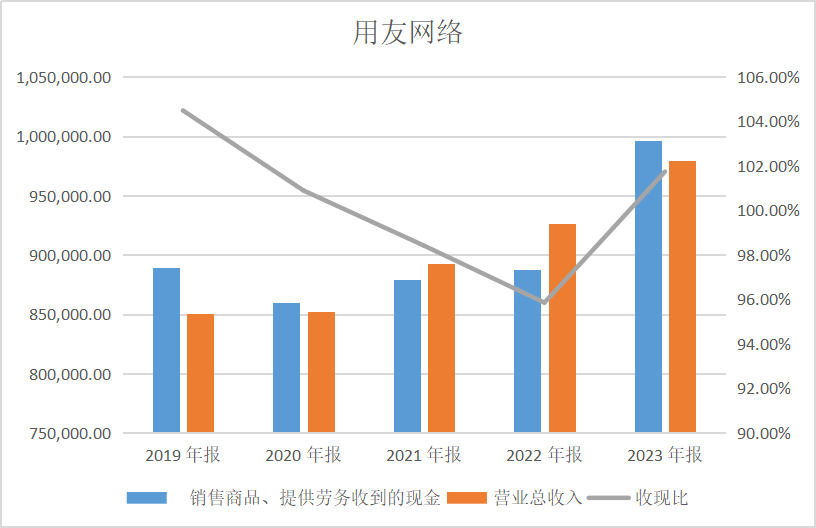

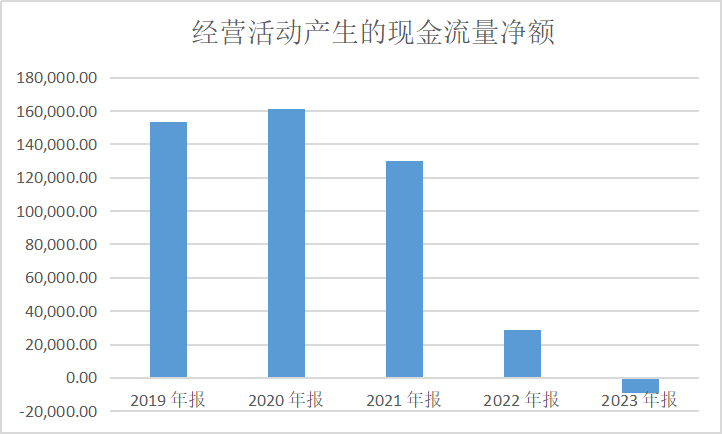

Comparing the company's revenue and operating cash inflows over the years reveals a gradual deterioration in operating cash flows.

Before 2020, the cash received from the sale of goods and provision of services exceeded operating revenue, but this trend reversed in 2021 and 2022.

The cash receipt ratio is a good indicator of a listed company's profit quality.

The cash receipt ratio refers to the ratio of cash received from the sale of goods and provision of services to operating revenue. It reflects how much of each RMB 1 of main business revenue is actually received in cash.

Generally speaking, this ratio reflects the actual sales revenue from a cash inflow perspective, excluding the risk posed by accounts receivable to the company. If the ratio is greater than 1, it indicates that not only has all current revenue been received in cash, but also some previous accounts receivable have been collected, suggesting good profit quality. Conversely, if the ratio is less than 1, it suggests that some current revenue has not been collected in cash, and profit quality is not optimistic.

Data Source: Tonghuashun iFind, Chart: Poetry and Starry Sky

Especially in 2022, the company's operating cash inflows declined significantly.

From Yonyou's business model perspective, full payment is often not received immediately after a business transaction. The down payment might only be half or even one-third, with the remaining balance paid after the software has been operational for some time.

The deterioration in cash flows indicates that the company's customer payment situation has worsened, potentially leading to bad debt risks.

While the cash receipt ratio improved in 2023, the company's net operating cash flow turned negative.

Data Source: Tonghuashun iFind, Chart: Poetry and Starry Sky

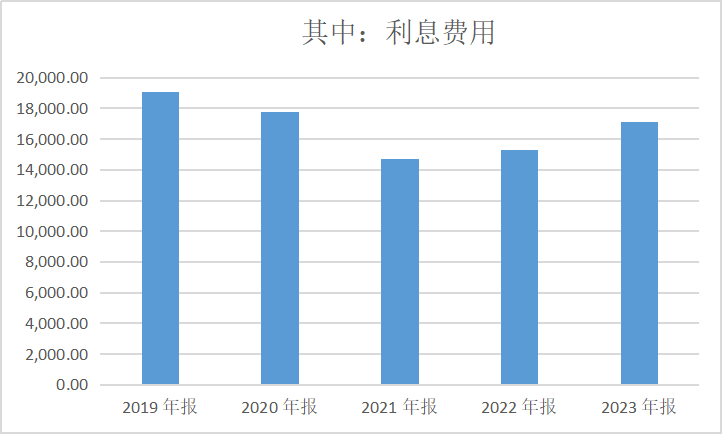

Meanwhile, the company borrowed heavily, with interest expenses reaching 170 million yuan in 2023, an increase from the previous year, becoming a significant factor affecting profits.

Data Source: Tonghuashun iFind, Chart: Poetry and Starry Sky

How desperate is the company for cash? Yonyou Network led the establishment of Zhongguancun Bank, along with OriginWater, Oriental Landscape, and Enlight Media.

03

A Bright Future Amid Challenging Paths

With the advancement of information technology innovation, imported ERP systems like SAP and Oracle will be phased out from state-owned enterprises and central enterprises. For Yonyou Network, a leading domestic ERP giant, this presents a significant opportunity.

According to forecasts by Zhiyan Consulting and Qianzhan Industry Research Institute, China's ERP market is projected to grow at a CAGR of 10.8% from 2022 to 2027.

With the adoption of cloud-based systems and the empowerment of AI technology, the ERP market is expected to expand further. In this process, the company, leveraging its industry-leading position in product technology maturity, AI large model empowerment, and information technology innovation ecosystem construction, is well-positioned to seize this opportunity.

Especially in serving large customers, the company has accumulated rich experience, which will become a significant advantage in the wave of localization and digital-intelligent transformation. Amid the trend of domestic software replacing overseas vendors, the company is poised to gain a higher market share leveraging its technical advantages and market experience.

However, turning this historical opportunity into tangible profits remains a long and arduous journey.

- END -

Disclaimer: This article is based on publicly available information disclosed by listed companies in accordance with legal requirements (including but not limited to interim announcements, periodic reports, and official interactive platforms). Poetry and Starry Sky strives for fairness in the content and viewpoints presented but cannot guarantee their accuracy, completeness, or timeliness. The information or opinions expressed herein do not constitute investment advice, and Poetry and Starry Sky assumes no responsibility for any actions taken based on this article.

Copyright Notice: The content of this article is originally created by Poetry and Starry Sky and may not be reproduced without authorization.