Li Bin's new perspective on oil-powered vehicles: a vicious cycle has begun, and the penetration rate of new energy vehicles will reach 80% within two years

![]() 09/06 2024

09/06 2024

![]() 525

525

Acceleration of new energy vehicles replacing oil-powered vehicles

”

Author: Wang Lei, Liu Yajie

Editor: Qin Zhangyong

The last one to submit their homework isn't necessarily the worst student.

As the last automaker among NIO, Xpeng, and Li Auto to release its second-quarter financial report, NIO has delivered a number of positive news.

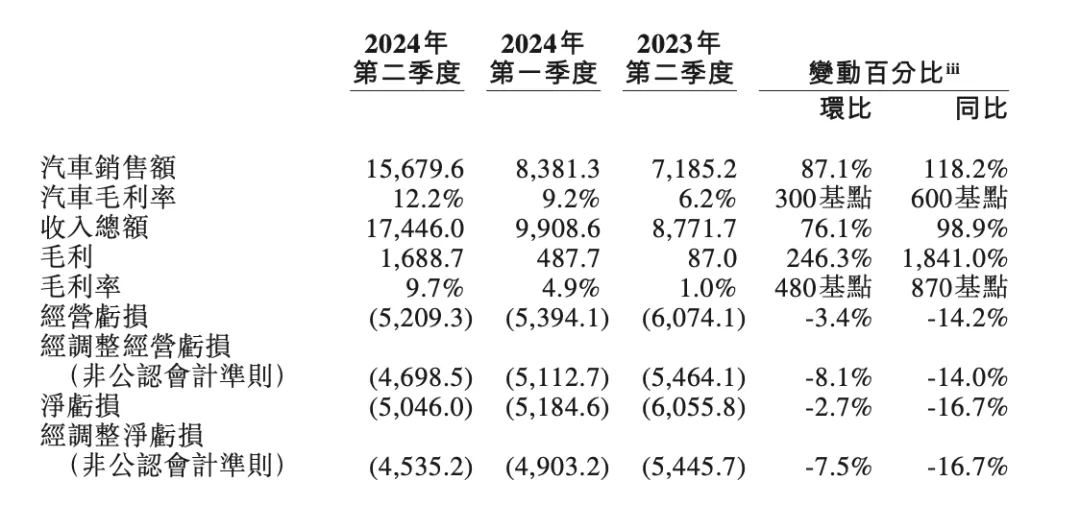

For instance, the company achieved a quarterly revenue of 17.45 billion yuan, setting a new record for a single quarter, with 57,373 vehicles delivered, also a new high. NIO's profitability has also improved significantly, with gross margin reaching 1.689 billion yuan in the same period, an increase of 1841% year-on-year, and a vehicle gross margin of 12.2%, up 6 percentage points from the previous year.

Although still incurring losses, the company's various metrics have shown significant improvement. Following the release of the second-quarter financial report, NIO's share price surged by over 14% overnight.

More importantly, this momentum is likely to continue. During the conference call, Li Bin announced that the Leda L60 would officially launch on September 19th.

As the cheapest battery swap model within NIO's current lineup, the Leda L60 is highly anticipated. Li Bin stated that sufficient preparations have been made in terms of supply chain and production capacity to ensure timely delivery.

Looking ahead to the market, Li Bin is eager and optimistic about the new energy vehicle market. In his view, oil-powered vehicles have entered a vicious cycle in China, and the penetration rate of new energy vehicles will exceed 80% within 2 to 3 years.

"From a long-term perspective, with the launch of new products and updates to existing ones, NIO is expected to achieve a monthly sales volume of 30,000 to 40,000 vehicles in China and meet its operating target of a 25% gross margin."

01 Oil-powered vehicles in a vicious cycle, new energy vehicle penetration rate of 80%

With positive financial metrics, Li Bin seemed relieved and shared numerous insights and new vehicle information during the Q2 earnings call.

He also rarely analyzed the prospects of the current oil-powered vehicle and new energy vehicle markets, marking the first time he has publicly expressed his views on oil-powered vehicles since apologizing last year for his critical remarks about them.

According to Li Bin, the penetration rate of domestic new energy vehicles has already exceeded 50%, and both pure electric and plug-in hybrid vehicles are accelerating the replacement of oil-powered vehicles. Within two years, the penetration rate of new energy vehicles in China is expected to exceed 80%.

"This growth will be very rapid. Just look at Norway, where the penetration rate quickly reached 80% after breaking the 50% mark. I believe that within two years at most, the penetration rate of new energy vehicles in China will exceed 80%. I am very confident about this," said Li Bin.

Regarding the future market trend, Li Bin believes that the growth rate of the automotive market has already slowed down this year. "The passenger vehicle market only grew by 3.6% in the first half of this year, and maintaining the current scale with some decline would be normal," he said.

Li Bin also commented on oil-powered vehicles, stating that they have entered a vicious cycle.

"They can only maintain market share by lowering prices, but price reductions harm dealers' profitability, damage brands, and lower the residual value of used cars," he explained.

Moreover, the market share of pure oil-powered vehicles in China is declining rapidly, with Japanese automakers like Honda, Toyota, and Nissan encountering similar issues as Hyundai-Kia and Ford did in China over the past few years.

"In the coming years, joint venture automakers' pure oil-powered vehicles will face significant challenges, and their market share will be ceded to new energy vehicles, leading to a rapid expansion of the new energy vehicle market," Li Bin predicted.

02 Leda targeting monthly sales of 30,000; Firefly going global

It is evident that Li Bin is eager to showcase China's new energy vehicle reversal and disruption, and NIO is poised to make its move starting in the third quarter.

During the earnings call, Li Bin announced that the Leda brand's first model, the L60, targeted at the mainstream family market, would officially launch on September 19th and commence deliveries at the end of September, marking the beginning of NIO's dual-brand era.

Li Bin is confident about the future market performance of the L60.

He stated that current orders far exceed expectations, and the Leda L60 is priced 30,000 yuan cheaper than Tesla's Model Y. Moreover, NIO has reserved some pricing flexibility to adapt to future market conditions.

Currently, the pre-sale price of the Leda L60 starts at 219,900 yuan, but according to Li Bin, the official price is likely to be lower than this figure.

However, Li Bin emphasized that NIO would strive to balance vehicle profitability and price points for the Leda L60, avoiding overly aggressive pricing strategies.

Regarding sales, Li Bin maintained a realistic expectation for the Leda L60, acknowledging that the entire supply chain and production capacity would undergo a ramp-up process. This year, NIO aims to prepare for monthly deliveries of 10,000 Leda L60s, with the goal of achieving monthly deliveries of 20,000 next year.

"We will gradually increase production and aim to achieve monthly deliveries of 30,000 eventually. We are confident in achieving this goal," he said.

Apart from the NIO and Leda brands, Li Bin also shared updates on the third brand, Firefly, during the call.

NIO's third brand, Firefly, is scheduled to debut in the first half of next year, with the first product expected to be delivered earlier in the same period. "The price might not be higher than a MINI, but the product will definitely be better," Li Bin said, indicating that by 2025, NIO will have three brands in its portfolio.

Li Bin explained that with battery buyouts, the three brands could cover a price range from 140,000 to 800,000 yuan, while with battery-as-a-service (Baas), they could cover a market from 100,000 to 700,000 yuan, directly competing with oil-powered vehicles.

Based on these statements, it can be inferred that the starting price of NIO's Firefly should be around 140,000 yuan, and with Baas, the entry-level price could be around 100,000 yuan.

Unlike the other two brands, Firefly will undertake NIO's global expansion plans.

"Starting next year, we will have products like Firefly that are more suitable for global markets. Therefore, with Leda and Firefly, our global expansion plans will be even more aggressive," Li Bin said.

While casting a wide net with its products, NIO is also preparing for a sprint in the coming years. Li Bin revealed that the F2 factory is already producing the L60 in double shifts, and the F3 factory, with an annual capacity of 600,000 units, will be completed and put into operation in the third quarter of next year. By then, at least three factories will be operating simultaneously, with total capacity reaching the million-unit level.

03 Third-quarter deliveries to exceed 61,000 at the minimum

Finally, let's take a look at NIO's financial performance.

In the second quarter of this year, NIO generated revenue of 17.45 billion yuan, an increase of 98.9% year-on-year and 76.1% quarter-on-quarter, setting a new record. Sales of other products (excluding vehicles) amounted to 1.7663 billion yuan, an increase of 11.3% year-on-year.

For the first half of the year, NIO's total revenue was 27.355 billion yuan, an increase of 40.66% year-on-year. In the second quarter, NIO incurred a net loss of 5.046 billion yuan, a narrowing of 16.7% year-on-year, bringing the first-half net loss to 10.231 billion yuan.

Currently, NIO, Xpeng, and Li Auto have all released their second-quarter financial reports, allowing for a brief comparison of their respective operating conditions.

In the first half of this year, Xpeng generated revenue of 14.66 billion yuan, an increase of 61.20% year-on-year, with a net loss of 2.65 billion yuan, narrower than the same period last year. Li Auto topped the list with revenue of 54.57 billion yuan and a net profit of 1.69 billion yuan.

During the same period, NIO delivered 87,400 new vehicles, generating vehicle sales of 15.68 billion yuan. Xpeng delivered 52,000 vehicles and generated vehicle sales of 6.82 billion yuan, while Li Auto delivered 189,000 vehicles and generated vehicle sales of 30.3 billion yuan.

NIO's gross margin was impressive, with a quarterly gross margin of 1.689 billion yuan, an increase of 1841% year-on-year and 246.3% quarter-on-quarter, resulting in a gross margin of 9.7%. Specifically, NIO's vehicle gross margin reached 12.2%, up 6 percentage points year-on-year and 3 percentage points quarter-on-quarter.

Xpeng's second-quarter gross margin was 14%, compared to -3.9% in the same period last year. Among them, the automotive gross margin was 6.4%, while Li Auto's automotive gross margin for the second quarter reached 18.7%.

R&D investment is also a crucial indicator. In the first half of the year, Li Auto's R&D expenses increased by over 40% year-on-year, while NIO's R&D expenses decreased by over 5% year-on-year. However, NIO's cumulative R&D investment of 6.083 billion yuan in the first half of the year remained the highest among "NIO, Xpeng, and Li Auto."

In the second quarter of this year, NIO's R&D expenses amounted to 3.22 billion yuan, a decrease of 3.8% year-on-year and an increase of 12.4% quarter-on-quarter. In comparison, Li Auto's R&D expenses were 3 billion yuan, and Xpeng's were 1.47 billion yuan, less than half of NIO's.

Furthermore, due to increased personnel costs in sales functions and heightened sales and marketing activities, NIO's selling, general, and administrative expenses rose to 3.7575 billion yuan in the second quarter, an increase of 31.5% year-on-year and 25.4% quarter-on-quarter.

Second-quarter selling expenses also reached 15.7573 billion yuan, up 81.4% year-on-year and 67.3% quarter-on-quarter.

For the third quarter, NIO provided its strongest-ever quarterly delivery and revenue guidance, projecting deliveries of 61,000 to 63,000 vehicles, an increase of 10% to 13.7% year-on-year. Revenue guidance stands at 19.11 billion to 19.67 billion yuan, an increase of 0.2% to 3.2% year-on-year.

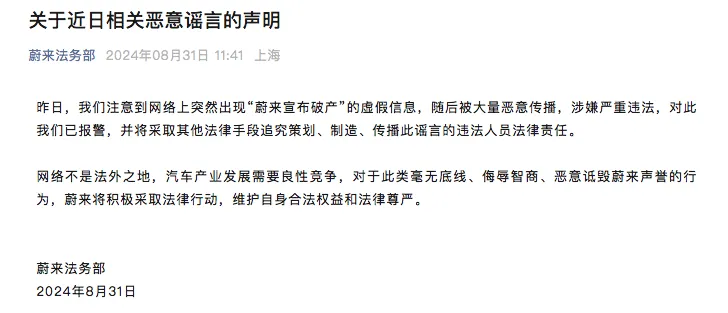

Interestingly, just a few days ago, rumors circulated that NIO had announced its bankruptcy. However, the financial report clearly debunks these rumors, as NIO still has 41.6 billion yuan in cash and cash equivalents on its balance sheet.

The latest news is that the person responsible for spreading the rumors has been apprehended.