Spending 5 billion yuan on advertising in three years, Jihong shares' cross-border move attracts the attention of Shenzhen Stock Exchange

![]() 09/06 2024

09/06 2024

![]() 530

530

With this attack on the Hong Kong stock market, Jihong shares aims to raise funds to expand into new overseas markets, enhance R&D capabilities, and improve technical infrastructure, in order to secure a larger market share.

As of the close on September 5, Jihong shares were trading at 10.26 yuan per share, with a total market value of 3.949 billion yuan.

01

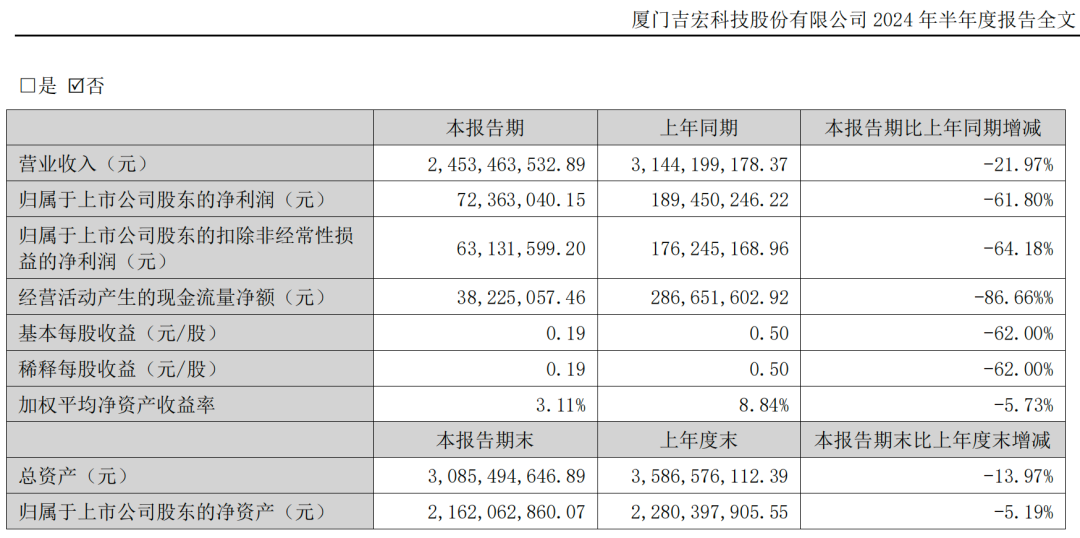

Net profit in the first half of the year declined by 60% year-on-year

Jihong shares' business primarily consists of two segments: cross-border social e-commerce (hereinafter referred to as "e-commerce business") and paper FMCG packaging (hereinafter referred to as "packaging business"). The e-commerce business covers Japan, South Korea, Thailand, Italy, Germany, the United States, among others, while the packaging business serves clients such as Yili, Luckin Coffee, and McDonald's.

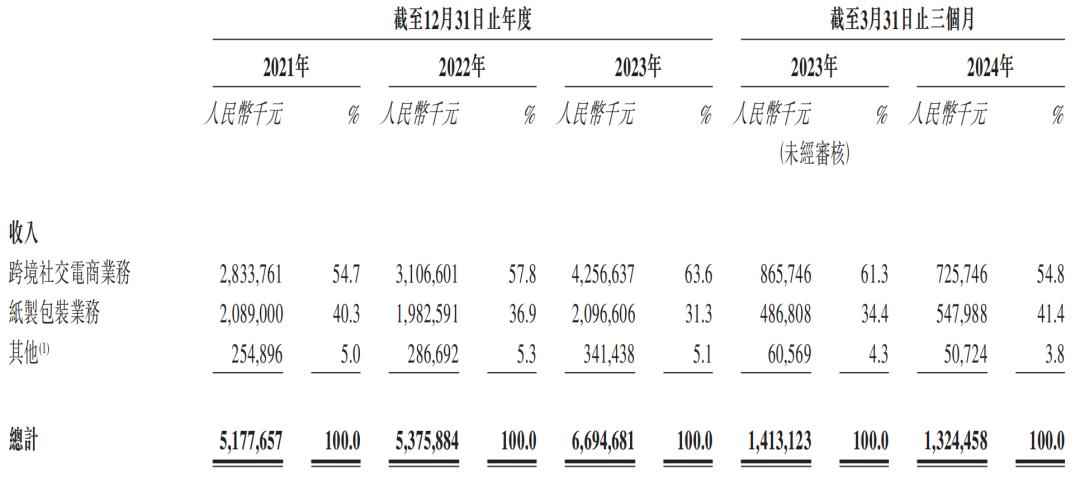

From 2021 to 2023, Jihong shares achieved operating revenues of 5.18 billion yuan, 5.38 billion yuan, and 6.69 billion yuan, respectively, with corresponding net profits of 209 million yuan, 172 million yuan, and 332 million yuan. While operating revenues grew steadily, net profits fluctuated.

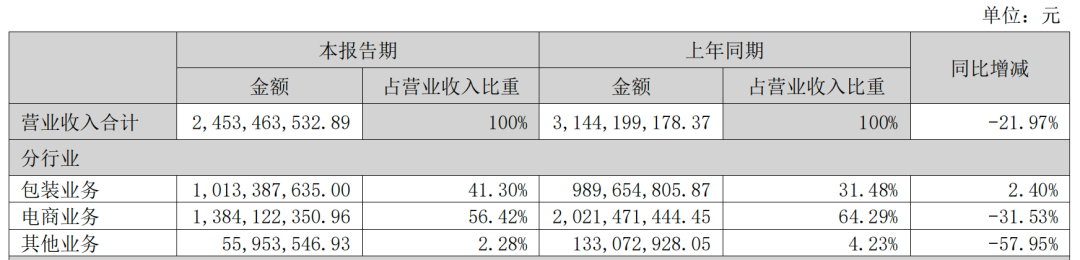

Looking at the business segments individually, the e-commerce business showed significant revenue growth, with increases of 9.6% and 37.0% year-on-year in 2022 and 2023, respectively. The packaging business maintained relatively stable revenue growth, with increases of 5.8% and 12.6% over the same periods. However, the gap in contribution to overall performance between the two businesses has widened Expanding year by year . In 2023, over 60% of Jihong shares' revenue came from its cross-border social e-commerce business.

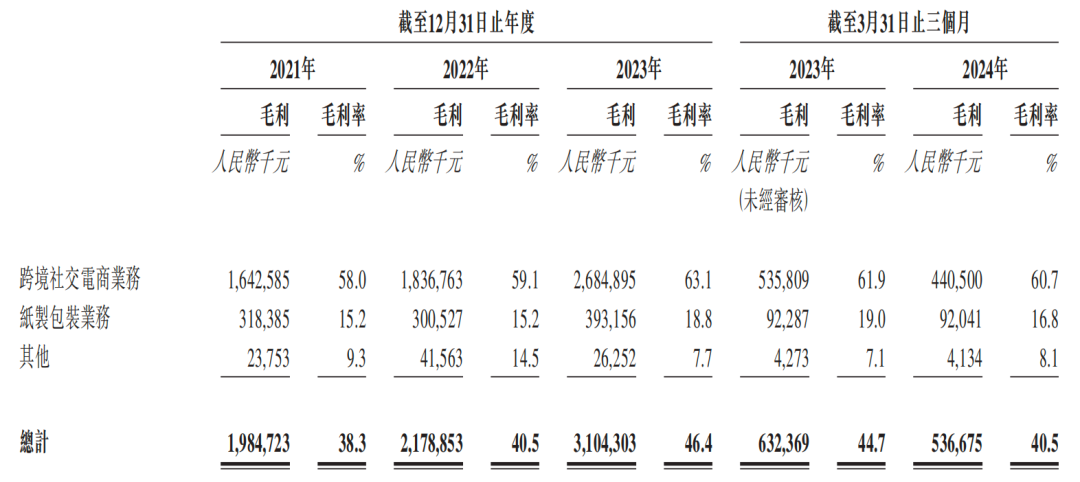

In terms of gross margin performance, the e-commerce business also outperformed. From 2021 to 2023, it recorded gross margins of 1.643 billion yuan, 1.837 billion yuan, and 2.685 billion yuan, maintaining high gross margins of 58.0%, 59.1%, and 63.1%, respectively. In contrast, the packaging business had lower gross margins of 15.2%, 15.2%, and 18.8% over the same periods, contributing gross margins of 318 million yuan, 301 million yuan, and 393 million yuan, respectively.

According to Frost & Sullivan, in terms of revenue generated from social media e-commerce operations in Asia in 2023, Jihong shares ranked second among China's B2C export e-commerce companies, with a market share of 2.3%. Additionally, as a leading paper FMCG packaging company in mainland China, Jihong shares ranked first in terms of revenue among paper FMCG sales packaging companies in mainland China in 2023, with a market share of 1.2%.

However, due to a decrease in e-commerce business revenue, Jihong shares' performance declined in the first half of 2024. From January to June of this year, the company achieved operating revenue of 2.453 billion yuan, a year-on-year decrease of 21.97%; net profit attributable to shareholders was 72.363 million yuan, a year-on-year decrease of 61.80%; and net profit after deducting non-recurring gains and losses was 63.1316 million yuan, a year-on-year decrease of 64.18%. Notably, e-commerce business revenue declined significantly by 31.53% year-on-year to 1.384 billion yuan, while gross margin decreased by 3.97% year-on-year.

Jihong shares stated that in the first half of this year, its cross-border social e-commerce business experienced declines in both revenue and profit due to multiple factors such as fluctuations in the exchange rates between the Japanese yen and South Korean won against the Chinese yuan, intensified market competition, and more. Although the packaging business increased slightly by 2.4% year-on-year, influenced by domestic and international macroeconomic factors, downstream customer sales growth slowed, packaging demand weakened, and product sales prices decreased along with declines in raw material prices.

02

Advertising costs exceeded 5 billion yuan in three years

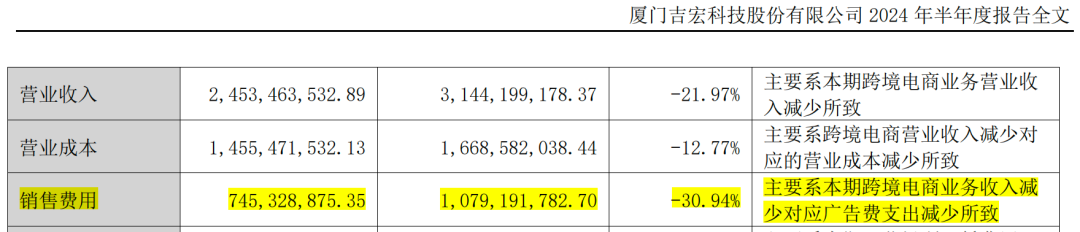

Rui Finance and Economics' "Pre-IPO Review" notes that as e-commerce business revenue decreased, Jihong shares' selling expenses also declined significantly in the first half of this year, down 30.94% year-on-year, with a difference of less than one percentage point compared to the decline in e-commerce business revenue.

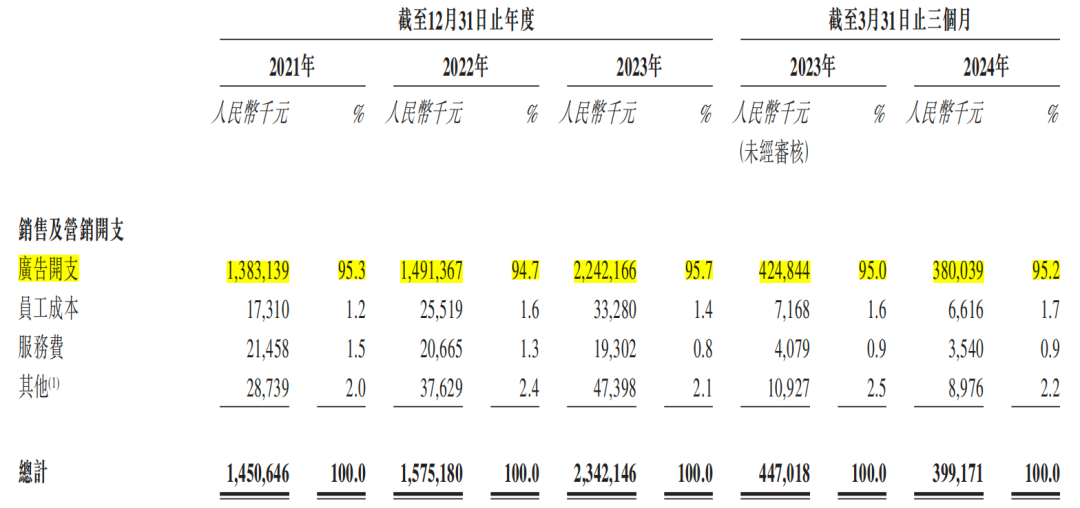

Simultaneously, out of Jihong shares' 745 million yuan in selling expenses in the first half of this year, advertising expenses amounted to 706 million yuan, accounting for nearly 95% of the total. Compensation, service fees, business promotion expenses, fixed asset depreciation, and business entertainment expenses combined accounted for just over 5% of the total. This perhaps indicates that Jihong shares' e-commerce business relies heavily on marketing support to generate revenue.

Online traffic is the cornerstone for cross-border e-commerce sellers to acquire potential customers and seize sales opportunities. Greater online traffic translates to a wider audience and more potential customers, thereby increasing the likelihood of sales and potential revenue.

Online traffic can be classified into three types based on its source: organic traffic, platform traffic, and social media traffic. As part of its e-commerce business, Jihong shares advertises and promotes products on social media platforms through digital marketing service providers, such as Meta (including Facebook and Instagram), TikTok, Google (including YouTube), Line, Snapchat, and X (formerly Twitter).

Extending the timeline, from 2021 to 2023, Jihong shares' e-commerce business generated revenues of 2.834 billion yuan, 3.107 billion yuan, and 4.257 billion yuan, respectively. During the same periods, sales and marketing expenses amounted to 1.451 billion yuan, 1.575 billion yuan, and 2.342 billion yuan, respectively, of which advertising expenses accounted for 1.383 billion yuan, 1.491 billion yuan, and 2.242 billion yuan, respectively. These advertising expenses comprised 95.3%, 94.7%, and 95.7% of total sales and marketing expenses over the same periods, totaling 5.116 billion yuan and concentrated on a limited number of social media platforms.

Jihong shares stated that its ability to respond promptly to consumer preferences may affect the effectiveness of its advertising expenses in the cross-border social e-commerce business, which in turn may impact its ability to attract and retain corporate customers, as well as its business profitability, potentially affecting its overall business, financial position, and operating performance. In the foreseeable future, social media platforms will remain the primary channel for its marketing and promotion efforts.

03

Shareholders cash in 1.1 billion yuan

However, cross-border e-commerce was not Jihong shares' original business; rather, it emerged as a result of expanding its business scope amidst the internet wave.

Founded in 2003, Jihong shares initially focused on providing one-stop paper packaging products and services to FMCG enterprise customers, specializing in marketing strategies, product design, process design, technical planning, transportation, and logistics.

Relying on Yili Group's contribution of over 65% of its main business revenue from 2013 to 2016, Jihong shares successfully listed on the Shenzhen Stock Exchange in 2016.

But Jihong shares' ambitions did not stop there. In 2017, seizing the cross-border e-commerce opportunities brought about by the development of mobile internet, Jihong shares expanded its business into cross-border social e-commerce, achieving revenue of over 200 million yuan that year, which became its primary source of income.

In 2018, Jihong shares built on its momentum and added targeted advertising to its e-commerce business, resulting in a 461.94% year-on-year increase in internet business revenue, which included both targeted marketing and cross-border e-commerce, to 1.209 billion yuan.

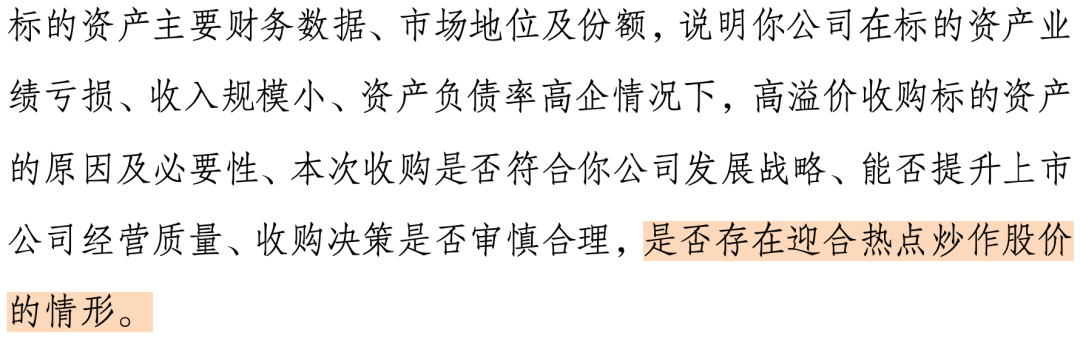

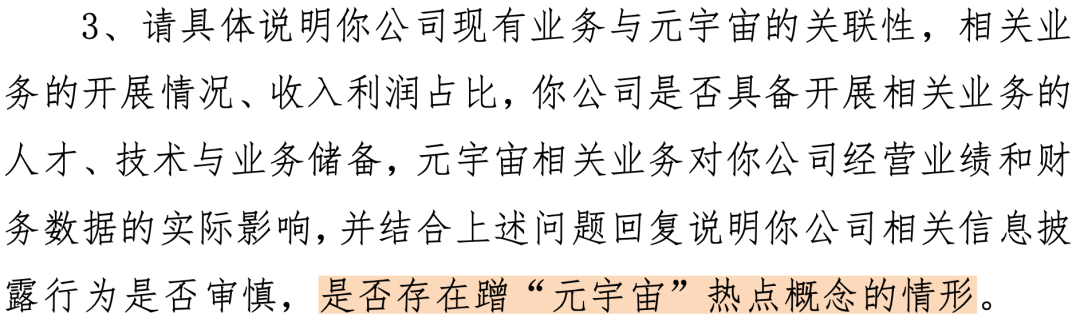

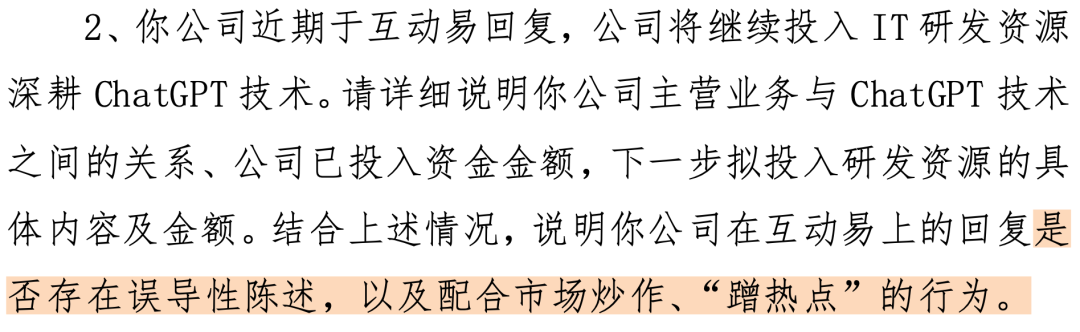

Subsequently, Jihong shares ventured into cross-industry moves. It entered the blockchain technology application field, acquired Gujiao Winery, invested in e-cigarette industry-related companies, and participated in the establishment of equity investment funds to invest in early- to mid-stage companies related to the metaverse industry chain that were not yet publicly listed. Unfortunately, the results were not ideal, prompting the Shenzhen Stock Exchange to issue several letters of concern inquiring whether these moves amounted to catering to market speculation, riding the "metaverse" trend, or "trend-chasing."

Meanwhile, Jihong shares' share price experienced significant fluctuations in 2019 and 2020. In 2020, benefiting from the explosive growth of the cross-border e-commerce business amid the pandemic, Jihong shares' performance rose against the trend, and its share price soared accordingly, with its total market value once exceeding 18 billion yuan in August 2020.

However, it is noteworthy that during the surge in share price, Jihong shares' founders and major shareholders conducted large-scale share reductions, cashing in substantial funds, totaling 1.125 billion yuan in cash-ins over a year.

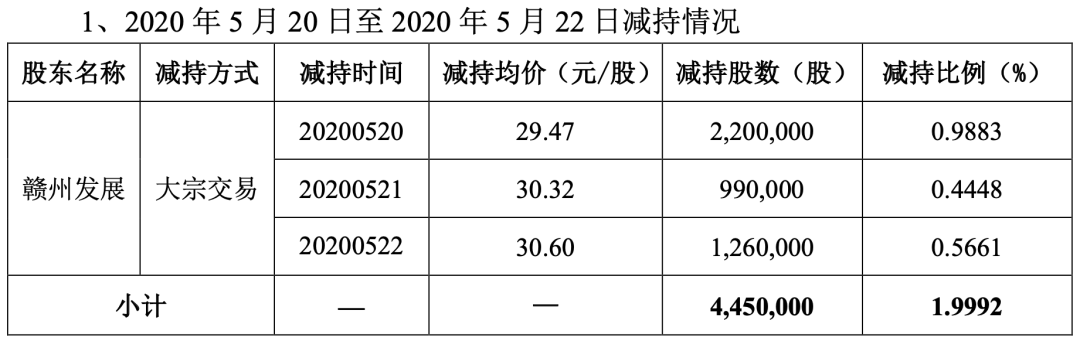

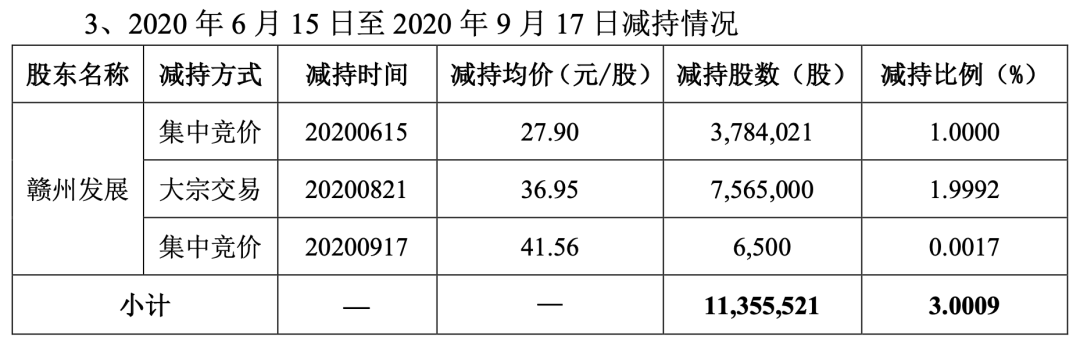

Between May 20 and December 14, 2020, Ganzhou Development, which held a 9.75% stake, reduced its holdings by 19.583 million shares through block trades and concentrated bidding, lowering its stake to 3.75%. The reduction in holdings occurred within a price range of 27.5 yuan to 44.19 yuan per share, resulting in a total cash-in of nearly 666 million yuan.

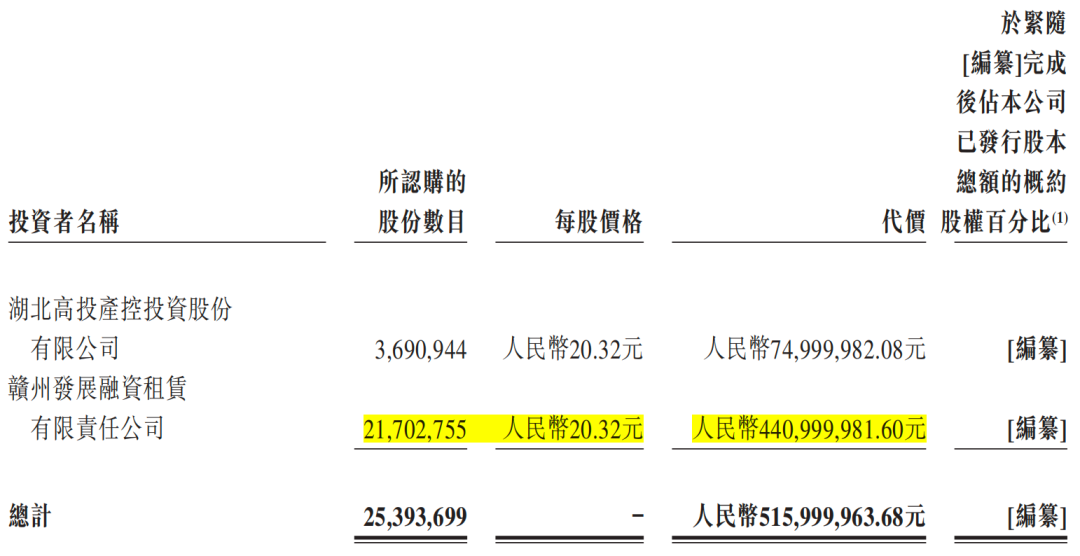

Ganzhou Development's reduced shares originated from non-publicly issued shares subscribed in 2019 (including shares obtained through the company's equity distribution). At that time, it subscribed to 21.7028 million shares at a cost of approximately 441 million yuan, making it one of the top ten shareholders. It began frequently reducing its holdings after the lifting of restrictions on May 14, 2020.

On September 4, 2020, Jihong shares announced that its controlling shareholder and actual controller Zhuang Hao, along with concerted action partners Zhuang Shu and Tibet Yongyue, intended to reduce their combined shareholdings by up to 22.7045 million shares, accounting for 6% of the company's share capital, through block trades or concentrated bidding. The reason for the reduction was to incentivize core team members and meet the personal financial needs of some shareholders.

Ultimately, within the reduction period, Zhuang Hao and Zhuang Shu transferred a total of 14.1321 million shares to the core team through block trades, representing a 3.73% stake, for a total cash-in of 459 million yuan.

It is worth mentioning that concurrent with the major shareholders' reductions, Jihong shares simultaneously advanced its share repurchase plan, which was launched in December 2019. By the expiration of the repurchase plan on December 2, 2020, Jihong shares had repurchased 4.0365 million shares through its dedicated share repurchase securities account, using concentrated bidding transactions, for a total repurchase amount of 120 million yuan (excluding transaction fees), representing 1.07% of the total share capital at the time.

In addition, Ganzhou's concerted action partner Ganzhou Jinkong, which has been promoting Ganzhou's development, reduced its holding by a total of 5 million shares through block trades on June 28, 2021, and December 3, 2021, with a reduction ratio of 1.29%; then reduced its holding by 7.56 million shares through block trades on December 22, 2022, with a reduction ratio of 1.998%; after the change, the shareholding ratio was 5.66%.

From June 14 to November 24, 2023, Ganzhou Development reduced its holding by 520,000 shares at a price of 22.59 yuan per share. Currently, Ganzhou Development holds 2.18% of Jihong shares.

04

The shareholding ratio of the actual controller's family is less than 1/3

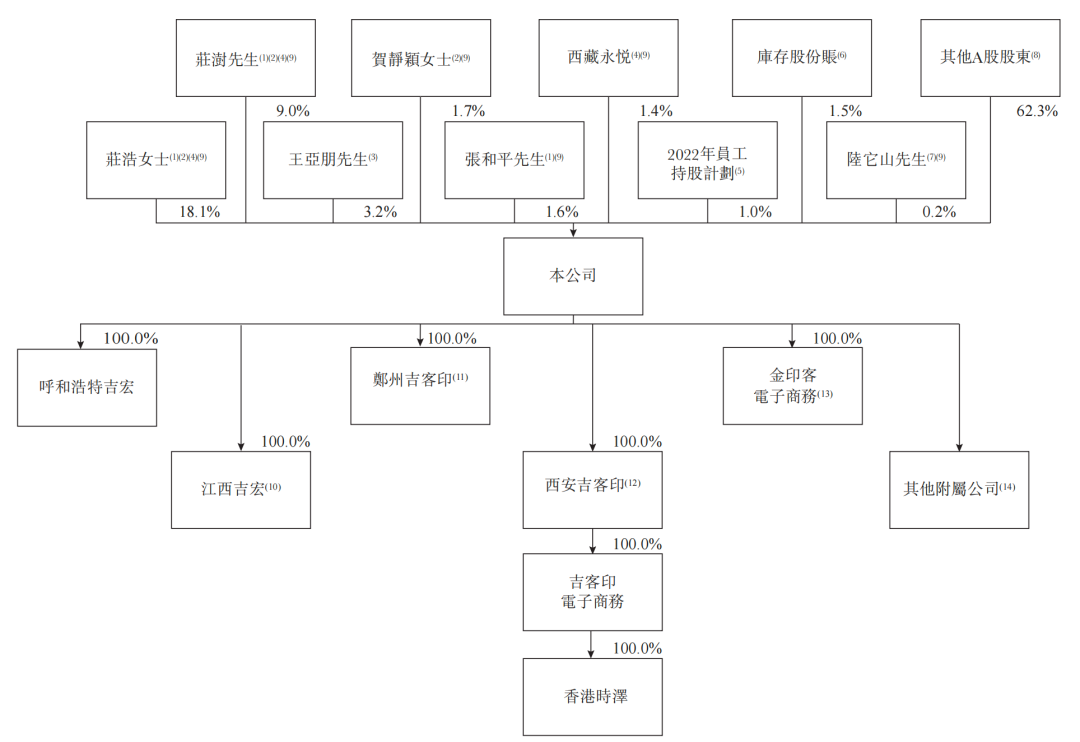

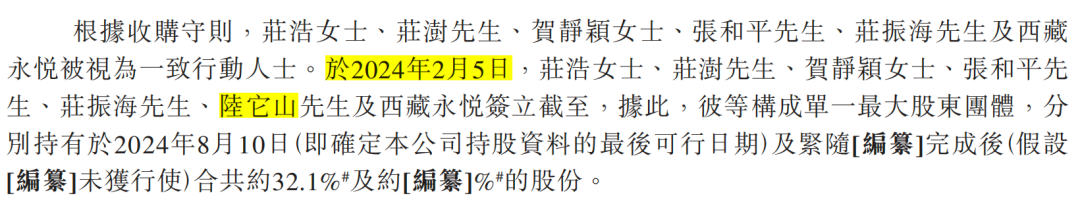

At the time of submission, Jihong was jointly controlled by Zhuang Hao, Zhuang Shu, He Jingying, Zhang Heping, Zhuang Zhenhai, Lu Tashan, and Tibet Yongyue as concerted action persons. As of August 10, 2024, the aforementioned shareholders collectively held 32.1% of the shares.

Among them, the founder Zhuang Hao holds 18.1% of the shares directly and concurrently serves as Executive Director and General Manager; Zhuang Shu is Zhuang Hao's brother, holding 9.0% of the shares personally; Zhuang Zhenhai is the father of the two, but does not directly hold Jihong shares; Zhang Heping is Zhuang Hao's spouse and concurrently serves as Executive Director, holding 1.6% of the shares; He Jingying is Zhuang Shu's spouse and serves as Executive Director, holding 1.7% of the shares.

Established in 2010, Tibet Yongyue is primarily engaged in providing business management and consulting services. Zhuang Zhenhai holds a 71.4% equity interest in Tibet Yongyue, which in turn holds a 1.4% stake in Jihong.

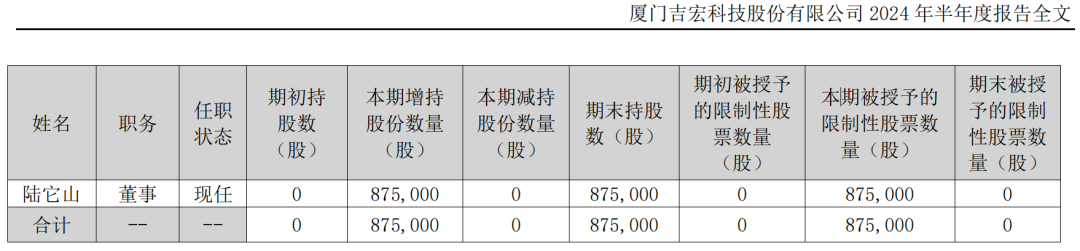

Rui Finance's "Pre-IPO Review" notes that Lu Tashan only became a shareholder of Jihong this year and was identified as a concerted action person on February 5. Currently, he directly holds 0.2% of the shares, which were granted to him.

As of June 30, 2024, Jihong had a total of 37,242 shareholders, a decrease of 998 from the end of the first quarter, with the top ten shareholders holding a combined 44.73% of the shares.

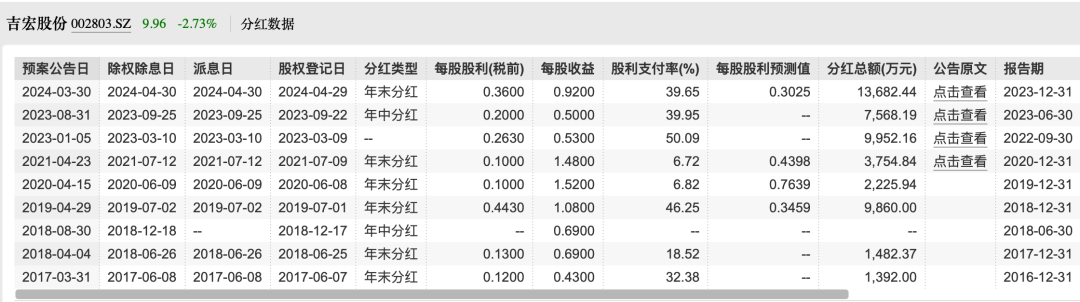

According to Wind data, since its listing in 2016, Jihong has accumulated a total net profit of 2.05 billion yuan, with a total of 8 dividend distributions totaling 499 million yuan. In the past three years, the cumulative cash dividends (including buybacks) amounted to 322 million yuan.

Attachment: List of Intermediaries Involved in Jihong's IPO Concerted Sponsors: China International Capital Corporation Hong Kong Securities Limited | China Merchants Bank International Capital Limited Legal Advisors: DeTong International LLP | Robertsons LLP | Kangda Law Firm | Jun He Law Offices | Lee and Li, Attorneys-at-Law | Dentons Rodyk & Davidson LLP | Al Tamimi & Company | Shin & Kim LLC | Anderson Mori & Tomotsune | SyCip Salazar Hernandez & Gatmaitan | Christopher & Lee Ong | Weerawong, Chinnavat & Partners Ltd.

Auditors and Reporting Accountants: Ernst & Young

Compliance Advisor: Fosun Henry Capital Limited

Industry Advisor: Insight Consulting Group

Tax Advisor: Ernst & Young (China) Enterprise Advisory Co., Ltd.