That Sharp, which is engaged in home appliances, is also going to make electric cars

![]() 09/09 2024

09/09 2024

![]() 499

499

Japanese-style refrigerator, color TV and large sofa

Author | Wang Lei, Liu Yajie

In 2024, another company announced its intention to cross over into automobile manufacturing.

It's Sharp, from Japan.

Once a dominant player in the global TV LCD panel market, Sharp's Japanese factory has now ceased full-scale production of LCD panels for TVs and made a significant strategic shift -

It will officially enter the pure electric vehicle business, with plans to launch vehicles in a few years.

Sharp is also considering partnering with its parent company, Foxconn, to develop its own pure electric vehicles. A concept electric vehicle named LDK+ will be exhibited at the "Tech-Day" technology exhibition on September 17.

This concept car will integrate AI and IoT technologies to showcase cutting-edge AIoT applications, and it also incorporates designs for solar cells and energy storage batteries.

It seems that after struggling in its traditional business, Sharp is also looking to create new revenue pillars.

01 "Father of LCD" Crosses Over into Automobile Manufacturing

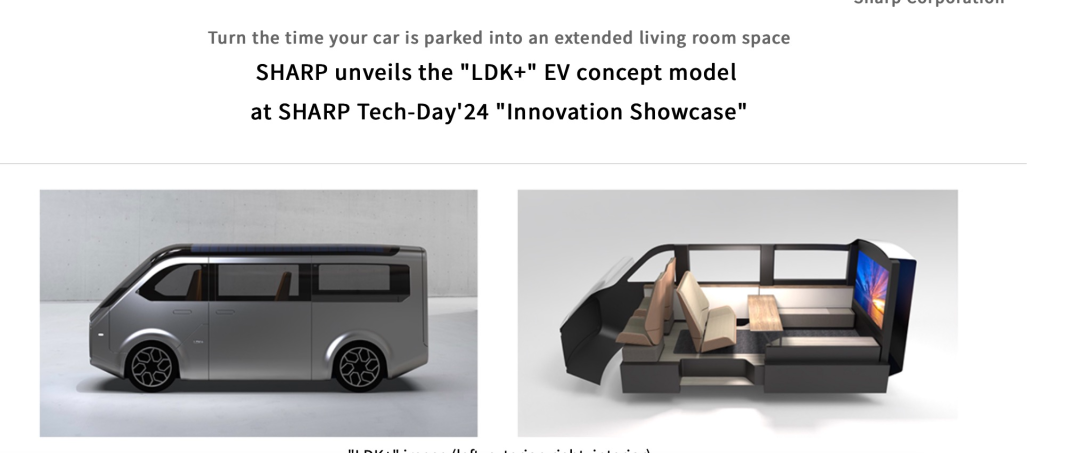

According to official sources, Sharp will unveil a prototype electric vehicle, the Sharp LDK+ van-type electric concept car, on the 17th of this month.

Built on Foxconn's MIH EV open platform and co-developed with Folofly Corporation, the vehicle will feature Sharp's proprietary AI technology, CE-LLM, and AIoT smart internet technology.

From the official images, the LDK+ concept electric vehicle has a boxy shape, reminiscent of a mini-bus.

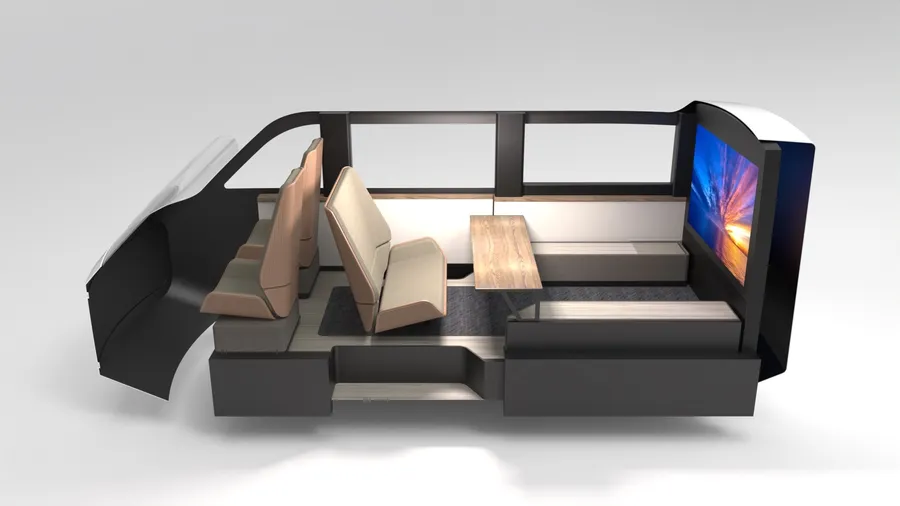

Sharp's Senior Executive Director Mototaka Taneya said that the company views electric vehicles as mobile rooms, and the design goal of LDK+ is to create value for users even when the vehicle is stationary.

Inside the vehicle, there are rotating rear seats and a 65-inch large display screen. When the doors are closed, the LCD shutters on the side windows also close.

Moreover, based on the big data accumulated by Sharp's AI from household appliances in daily life, the vehicle's AI system can automatically adjust the air conditioning and brightness according to the owner's preferences.

As an "extension of the living room," LDK+ can also connect to the home. When there is a prolonged power outage, the electricity stored in the battery can be converted into household electricity. Its AI system will also manage energy usage between the home and electric vehicle, allowing the vehicle to "create value even when not in motion."

Sharp's concept of electric vehicles is quite reasonable, echoing the current domestic trend of bringing "sofas, refrigerators, and large TVs" into cars.

In fact, as early as 2019, Sharp ventured into the automotive sector when Toyota and Sharp announced their collaboration on a photovoltaic cell project. Since 2020, they have been testing vehicles equipped with photovoltaic cells on urban roads and highways, with the photovoltaic cells produced and installed by Sharp.

Regarding its entry into the electric vehicle market, Sharp said this strategic move will rely on its parent company Foxconn's electric vehicle platform for development, followed by sales.

In this context, it is more accurate to say that Foxconn wants to continue its pursuit of electric vehicle manufacturing rather than Sharp alone.

Back to their last collaboration 11 years ago, Sharp and Foxconn decided to form an alliance in the smartphone business, jointly developing and selling smartphones under the Sharp brand in mainland China. However, the partnership eventually failed due to fierce competition and other factors. At the time, it was rumored that Foxconn's smartphone business had already shifted away from Sharp to partner with local Chinese mobile phone manufacturers like Xiaomi.

In April 2016, Sharp was acquired by Taiwan's Foxconn Group, becoming a subsidiary. At the time, Foxconn invested 288.8 billion yen (approximately 19.35 billion yuan) to acquire a 66% stake in Sharp through the purchase of ordinary shares and special shares.

Beyond their close relationship, they also share similar views. Previously, the chairman of Foxconn affirmed that electric vehicles are the future direction of development.

He stated that Foxconn will continue to expand its customer base, seeking partnerships with existing and new automotive manufacturers, and assisting them in mass production and scale expansion. By 2025, Foxconn aims for a 5% market share, with a production target of 500,000 to 750,000 vehicles, and expects over half of its revenue to come from original equipment manufacturing (OEM) of electric vehicles.

02 How Many People Will Buy It?

"All under heaven are driven by profit, all come and go for it."

Sharp's entry into the electric vehicle market is no exception to this rule.

Founded in 1912, Sharp is a century-old home appliance giant, specializing in televisions, washing machines, refrigerators, and other household appliances. It once dominated the global TV LCD panel market.

However, due to intense price competition with Chinese manufacturers and the shift of Korean competitors towards high-definition OLED panels, Sharp, as the only Japanese manufacturer of TV LCD panels, had to announce the complete cessation of TV LCD panel production at its Sakai factory in late August, marking the end of TV panel production in Japan.

Sharp's financial performance has also been unimpressive. In the second quarter of this year, Sharp's revenue was 531.9 billion yen (approximately 26.47 billion yuan), a 1.7% decrease from the same period last year. Its consolidated operating profit was a loss of 5.8 billion yen (approximately 288 million yuan), compared to a loss of 7 billion yen in the same period in 2023. Its consolidated gross profit was a loss of 10.1 billion yen (approximately 503 million yuan), and its consolidated net profit was a loss of 1.2 billion yen.

Since the beginning of 2024, sales of joint venture TVs in China have continued to decline. The four major joint venture TV brands - Sony, Samsung, Sharp, and Philips - sold less than 100,000 units in August, and their cumulative sales from January to August totaled only 700,000 units, a year-on-year decline of 20%.

Moreover, with its parent company Foxconn's intention to enter the electric vehicle market, the pure electric new energy vehicle sector, which is generally not favored by Western countries, has become a lifesaver for this giant company in urgent need of transformation.

Of course, there are precedents for traditional home appliance companies to cross over into automobile manufacturing, such as Skyworth.

As early as 2017, when new energy vehicle startups were just emerging in China, Skyworth began preparing for automobile manufacturing. Skyworth Automobile's predecessor, Tianmei Automobile, signed a contract for a 300,000-capacity new energy passenger vehicle production base in 2018, and Skyworth Automobile was officially established in 2021.

However, since its establishment, Skyworth Automobile has remained on the fringes of the new energy vehicle industry.

In 2021, Skyworth Automobile sold only 4,088 vehicles, rising to 21,900 in 2022, but falling to 18,600 in 2023. In the 2023 wholesale sales ranking of new energy passenger vehicles, Skyworth Automobile ranked 24th out of 25 brands, second from the bottom. Since the beginning of this year, Skyworth Automobile has not disclosed its sales figures.

However, Skyworth has not fully invested in complete vehicle manufacturing. While Skyworth Automobile inherits the brand name of Skyworth Group, it is owned by Kaiwo Group, which has no affiliation with Skyworth Group, except that both companies were founded by Huang Hongsheng.

Moreover, Kaiwo Group is a commercial vehicle company. In other words, although it is called Skyworth Automobile, it is actually a case of "commercial-to-passenger" transition, with its revenue base still relying on home appliances.

In fact, the home appliance industry does have advantages in crossing over into automobile manufacturing. These home appliance giants have significant advantages in terms of technology and R&D capabilities, especially in the research and manufacture of core components such as motors and compressors.

For example, the thermal management system in new energy vehicles is critical. It directly affects the operating temperature of the battery and motor control system, and its efficiency and control effect can impact the final driving range and overall vehicle safety.

Components such as electric compressors and electronic expansion valves, which are core parts of the thermal management system in new energy vehicles, are often upgraded or modified versions of components used in home appliances like air conditioners. There is a high degree of overlap with the core technologies of some home appliance products.

In addition, Sharp, backed by Foxconn, has significant advantages in contract manufacturing. Foxconn has invested heavily in the electric vehicle industry globally in recent years, covering China, Southeast Asia, the United States, and other countries or regions.

From this perspective, R&D and manufacturing are not difficult tasks for Sharp. The challenge lies in whether the market will buy into it.

According to Sharp Japan's official statement, the vehicles it develops are likely to be launched in the Japanese market initially.

However, judging from the current new energy landscape, the environment for new energy vehicles in Japan is not favorable. In Japan, local automakers led by Toyota prefer new energy fuel vehicles, such as hydrogen-powered vehicles, believing that pure electric vehicles are merely a transitional technology.

Moreover, top Japanese automakers like Honda and Nissan have not invested heavily in the pure electric vehicle segment until recently, when they have started developing electric vehicles specifically for the Chinese market.

Sony, another Japanese company that has crossed over into automobile manufacturing, also initially targeted North American users when it announced its entry into the automotive sector. This underscores that local automakers in Japan do not prioritize pure electric or plug-in hybrid vehicles.

Now that Sharp has announced its intention to make a pure electric vehicle in Japan, it faces an uphill battle from the start.

Even if it targets the global market and enters China in the future, how many opportunities will this newcomer have without going through the intense competition in the current domestic market?