Chinese games have no reason to be pessimistic

![]() 09/11 2024

09/11 2024

![]() 511

511

Recently, "Black Myth: Wukong" has become an absolute top game in the gaming industry, to the extent that ETFs related to the industry, led by game ETF (159869), have also attracted significant attention from the capital market. The game's success not only showcases the rise of the Chinese gaming industry in the global market but also provides new directions and examples for industry development.

[An Inspiring Victory]

China's first AAA game, "Black Myth: Wukong," has garnered global attention since its release. In just two weeks, global sales exceeded 18 million copies, generating sales revenue of over 6 billion yuan. Some analysts even predict that, factoring in potential revenue from future updates, paid content, and IP licensing, the game's final sales could exceed 15 billion yuan.

This marks another significant leap for domestic games on the international stage and highlights the commercial value of Chinese traditional culture and IPs.

Based on "Journey to the West," the game meticulously designs 81 levels and corresponding monster characters, allowing players to participate easily without additional learning, thereby expanding the game's audience base.

Furthermore, the game seamlessly integrates Chinese traditional cultural elements into its scenery design and music. Of the 36 scenes, 27 are inspired by famous scenic spots in Shanxi, featuring ancient architecture, sculptures, and murals, providing a profound cultural experience for players worldwide.

Crucially, the character of Wukong is widely known and deeply ingrained in Chinese culture, and his influence has played a pivotal role in the game's success.

Moreover, the game's popularity has provided new directions for the development of China's gaming industry.

On the one hand, it encourages more domestic game developers to prioritize the spread and penetration of Chinese traditional culture. Games are no longer merely entertainment tools but cultural carriers that resonate with players' inner spiritual needs.

In fact, "Journey to the West" and Wukong have always been significant IPs in China's cultural industry and among the most profitable in the global mobile game market. According to Newzoo data, from January 2015 to March 2021, games derived from the "Journey to the West" IP generated over 35 billion yuan in net revenue, more than double that of Marvel IP games, primarily from the contributions of "Fantasy Westward Journey" and "New Westward Journey Online II."

Coupled with the popularity of "Black Myth: Wukong," this will further motivate game developers to tap into China's rich traditional IPs.

On the other hand, it suggests a new path for domestic game developers to avoid internal competition and seek growth – successfully creating IPs through single-player games and then monetizing them through online platforms for long-term revenue.

Previously, single-player games were overlooked due to their short product lifecycles and limited profitability. However, "Black Myth: Wukong" has reframed market perceptions, and future developments could include online games based on the same IP for more stable and sustained revenue streams.

This monetization strategy has proven successful in the past. For instance, Blizzard Entertainment's "Warcraft" series, a single-player game, gained immense popularity upon release, attracting a loyal global fan base. The company subsequently launched the online game "World of Warcraft," which has generated over $10 billion in revenue.

In conclusion, the success of "Black Myth: Wukong" is both significant and far-reaching.

[Going Global: The Ultimate Test]

While "Black Myth: Wukong's" global popularity represents a victory for Chinese games, it does not alter the challenges currently facing the Chinese gaming industry.

For many years, as internet penetration increased and the gaming user base expanded rapidly, China's gaming market experienced rapid growth. This period saw the emergence of superstars like Tencent and NetEase.

Times have changed, and China's gaming industry is transitioning from incremental opportunities to stock-based competition. In the first half of 2024, China's gaming user base reached 674 million, with a year-on-year growth rate of just 0.88%, lower than the 1.26% growth rate for the entire year of 2023. With China's population declining and aging, the penetration rate of gaming users may have peaked.

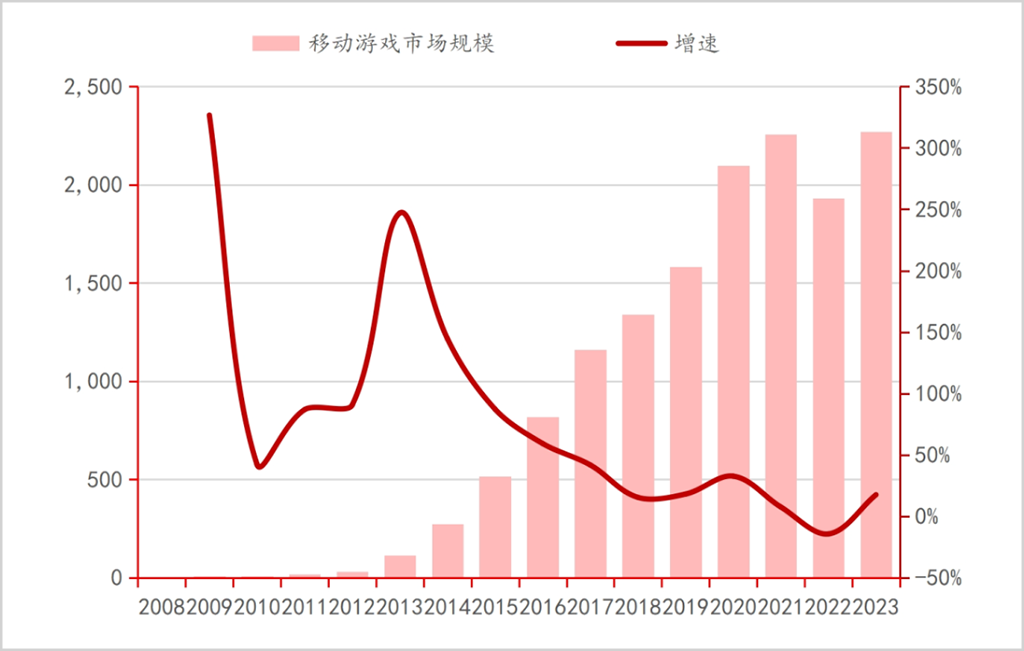

Without user growth and facing regulatory and consumer trends, China's gaming industry's rapid growth may be a thing of the past – from 2020 to 2023, the industry's annual compound growth rate was just 2.8%.

▲ China Mobile Game Market Size, Source: China Merchants Bank Research Institute

So, where does the future lie for Chinese game developers?

Going global is the inevitable answer.

According to Gama Data, the global electronic game market revenue exceeded 1.18 trillion yuan in 2023. China's game market accounted for 303 billion yuan, while the overseas market contributed 887 billion yuan. From a quantitative perspective, there is significant potential for Chinese developers to expand their business overseas.

Leading companies like Tencent, NetEase, and miHoYo have already paved the way for overseas expansion. In fiscal Q2 2024, Tencent's international game revenue reached 13.9 billion yuan, up 9% year-on-year, accounting for nearly 30% of its total game business.

Unlike Tencent's comprehensive "self-development + acquisition + distribution" model, miHoYo adopts a vertical and in-depth "IP + blockbuster" strategy for overseas expansion. In 2023, "Honkai: Star Rail," part of miHoYo's classic "Honkai" series, combined Chinese traditional culture with sci-fi elements, winning praise from players and significant overseas revenue, contributing nearly 40% of the company's overseas income (over $1 billion).

As a leading domestic game developer, NetEase seems to be on the decline, dropping from 3rd to 7th in the Chinese mobile game publisher rankings in 2023, surpassed by companies like 37 Interactive Entertainment and Lilith Games. "Knives Out" is NetEase's flagship overseas product, popular in Japan, but it cannot compete with global hits like Tencent's "PUBG MOBILE" and miHoYo's "Genshin Impact."

Apart from leading companies, Chinese small and medium-sized game developers are also accelerating their overseas expansion.

In the first half of 2024, among 21 A-share game companies, Century Huatong topped the list in overseas revenue, reaching 5 billion yuan, up 115% year-on-year. 37 Interactive Entertainment ranked second with 2.9 billion yuan, a decrease of over 4% year-on-year, while Triquint Semiconductor ranked third with 2.55 billion yuan, up 22.8% year-on-year.

Additionally, eight A-share game companies have overseas revenue accounting for over 50% of their total revenue, including Kunlun Tech, Talking Tom, Baotong Technology, Yozu Interactive, Rastar Group, and Century Huatong.

While Chinese game developers have made some progress in overseas markets, they are far from becoming global leaders. There is still room for further expansion and business growth.

Actually, there's another path for Chinese game companies to enhance their performance growth. Large-scale developers can build their own game distribution platforms, effectively controlling distribution channels, better integrating content, and maximizing profits. It's worth noting that the global game distribution market is dominated by a few platforms like Steam and PlayStation, which take 30% of sales revenue from game developers.

There are successful precedents. Blizzard's Battle.net, which integrates multiple classic Blizzard games, reduces dependence on external platforms and enhances profitability. Of course, building a platform requires continuous investment and operation to break the current monopoly.

[No Reason to Remain Pessimistic]

In recent years, the capital market has been wary of relevant regulatory policies, leading to a decline in the overall valuation of the industry. One example is the "Measures for the Administration of Online Games (Draft for Comments)" issued by the National Press and Publication Administration in December 2023, which initially sparked panic in the capital market before being quickly rectified. Another is the game approval policy, whose impact on the gaming industry is self-evident.

In March 2018, game approvals were suspended for the first time, resulting in a sharp drop of 78% in approvals that year to just 2,105. Since then, the number of approvals has continued to decline, reaching only 464 in 2022. However, starting in 2023, approvals began to rebound, reaching 977. In the first half of 2024, 689 approvals were granted, a year-on-year increase of 26%.

The increasing normalization of game approvals has stabilized market expectations and confidence, to some extent indicating a shift in regulatory policy.

More directly, in August this year, the State Council issued the "Opinions on Promoting High-Quality Development of Service Consumption," which, for the first time, explicitly mentioned online games as a crucial aspect of enhancing the quality of cultural and entertainment consumption.

This move not only signifies a significant elevation of online games' status at the national policy level but also indicates that the gaming industry is unlikely to face policy constraints in the foreseeable future.

Apart from policy shifts, the fundamentals of the A-share game sector are also poised for a turnaround. Previously, the market was concerned that market share for game companies other than Tencent, NetEase, and miHoYo would be squeezed, leading to pessimistic earnings expectations.

In fact, since 2024, many small and medium-sized game companies have launched popular games, leading to an increase in market share, disproving earlier market concerns.

Furthermore, with the upcoming product launch cycle in the second half of the year, A-share game companies' earnings are expected to improve quarter by quarter. For example, Kayin Network's "Slime Island" and "Battle Through the Heavens," Triquint Semiconductor's "Code DL," and G-bits' "Wen Jian Chang Sheng" and "Zhang Jian Chuan Shuo" will be launched successively.

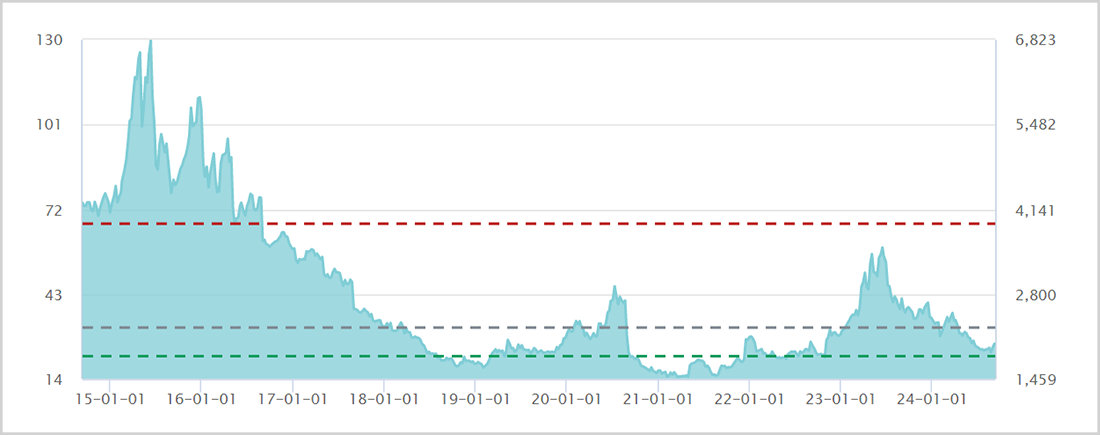

Additionally, since 2024, the A-share game sector has declined by 25%, retracing more than 50% from its 2023 peak, with the latest valuation falling to a multi-year low of 25.9 times. Notably, major companies are valued at just 10-13 times their 2024 earnings.

▲ Game Sector P/E Ratio Trend Chart, Source: Wind

Coupled with potential benefits such as earnings improvement and policy shifts, the game sector offers high investment value. Currently, investing in game index funds, such as Game ETF (159869), which boasts a large scale, good liquidity, and a top 10 portfolio including renowned game developers like Kunlun Tech, Kayin Network, Century Huatong, 37 Interactive Entertainment, Triquint Semiconductor, and Giant Network Group, with notable overseas expansion and strong growth potential, is a prudent choice.

In conclusion, there is no reason to remain pessimistic. Selectively investing in undervalued quality game leaders or the overall sector offers attractive odds and returns, warranting continued attention.

Disclaimer

The content related to listed companies in this article is based on the author's personal analysis and judgment based on information disclosed by listed companies in accordance with legal requirements (including but not limited to interim announcements, periodic reports, and official interaction platforms). The information or opinions expressed herein do not constitute any investment or other business advice. Market Value Observer shall not be liable for any actions taken as a result of adopting this article.

-END-