BYD no longer wants to engage in a "price war"?

![]() 09/11 2024

09/11 2024

![]() 645

645

Source | BohuFN

At the beginning of this year, BYD took the lead in initiating a price war in new energy vehicles, with the entry-level models of its Qin PLUS series dropping to a starting price of 79,800 yuan. Subsequently, several older models under BYD also saw significant price cuts, causing considerable impact on the domestic automotive industry.

Today, the 2025 model of BYD Han was officially launched with a starting price of 165,800 yuan, representing a 4,000 yuan discount compared to the Honor version; the electric version offers discounts ranging from 4,000 to 14,000 yuan compared to the Honor version. Simultaneously, the new model is equipped with an advanced intelligent driving assistance system, and the top-end version features a lidar, offering both price reductions and upgrades.

When discussing the "price war," BYD has always been confident. At the China Automotive Chongqing Forum held in June this year, Li Yunfei, General Manager of BYD Group Brand and Public Relations Department, illustrated with an analogy, "(The price war is like) playing cards together. If you can follow, follow; if not, pass. Don't get angry or upset, because there's always the next round."

When BYD's Dolphin series faced criticism for allegedly "backstabbing" car owners with price cuts, Zhang Zhuo, General Manager of BYD Ocean Network Sales Business Unit, explained, "BYD did not initiate any price war; it's all within a reasonable pricing range."

Recently, BYD released its half-year results, reporting revenue of 301.13 billion yuan, a year-on-year increase of 15.8%; net profit of 13.63 billion yuan, a year-on-year increase of 24.4%; and a gross margin of 23.94% for automobiles, related products, and other businesses, representing a 3.27 percentage point increase year-on-year.

BYD indeed has the confidence, and even with "small profits but quick turnover," the company's profits remain substantial. However, as the price war in the automotive industry continues to spread, more and more automakers are stepping forward to advocate for "healthy competition." In this context, how long can BYD sustain its price war, and what other strategies can it adopt if it chooses not to engage in price competition?

01 The "King of Intense Competition" in the Automotive Industry

In the automotive circle, BYD has always been regarded as the "King of Intense Competition." Yu Chengdong, Chairman of Huawei Intelligent Automotive Solutions BU, once stated that BYD is the world's number one in this regard due to its ultra-low costs, enabling profitability even with vehicles selling for tens of thousands of yuan.

Regarding the title of "King of Intense Competition," BYD Chairman Wang Chuanfu seems to embrace it. He has said, "Intense competition is the essence of market economics. We must embrace and participate in it to build world-class brands through competition."

At the beginning of this year, BYD launched the Qin PLUS DM-i at a low starting price of 79,800 yuan, dragging the A-segment sedan market into the 70,000 yuan range and triggering a price war in the automotive circle, with brands like Geely, Great Wall, Changan, and even Toyota, Volkswagen, and other fuel-powered vehicle manufacturers joining in.

In March, BYD further expanded the price war to the B-segment market by introducing the Honor edition of its mid-to-high-end Han and Tang models. In July, BYD officially announced a 50,000 yuan price reduction across all models of its premium brand FANGCHENGBAO "BAO 5," with the highest discount reaching 17.25%.

After more than half a year of the "price war," some automakers have chosen to withdraw. BMW was the first to state that the price war was unsustainable, followed by Mercedes-Benz, Audi, Cadillac, Volkswagen, NIO, and others, who gradually scaled back terminal discounts, ending the most intense phase of the price war so far this year.

However, judging from BYD's half-year financial results this year, it appears to be handling the price war with ease. Although BYD's average vehicle price decreased by 14.46% year-on-year to 142,000 yuan, the company's overall net profit still increased by 24.44% year-on-year.

In the first half of this year, BYD's gross margin for automobiles and related products was 23.94%, higher than that of both NIO (18.7%) and Tesla (18.2%). BYD attributed this increase in gross margin primarily to the expansion of its new energy vehicle business.

BYD's cost reduction techniques are an open secret. Covering everything from raw material procurement, component production, to vehicle manufacturing, BYD's highly integrated supply chain has given it a leading cost advantage. Additionally, BYD has consistently reduced battery production costs through mass production, saving significant costs by developing its batteries in-house.

Therefore, even with small profits but quick turnover, BYD can maintain the quality and efficiency of its automotive business, without having to choose between revenue and profit, as many other companies do.

However, due to the price war initiated by BYD itself, its automotive business revenue was 228.3 billion yuan, representing a mere 9.33% increase, a significant slowdown compared to the 91% year-on-year growth in the same period last year.

If automotive sales continue to slow down in the future, BYD needs to find a mechanism to maintain profit growth. Before that happens, BYD must engage in the price war. Only by maintaining sales growth through price cuts can BYD achieve economies of scale in production.

BYD possesses core technologies across the entire new energy vehicle industry chain, including batteries, motors, electronic controls, and automotive-grade semiconductors. However, self-built capacity acts like a lever, bringing cost advantages while also penalizing the company when production scales decrease. Simply put, if sales growth cannot be maintained, idle production lines will result in losses.

According to LatePost, BYD's automotive production capacity for this year is projected to be between 4.1 and 4.7 million units. Based on this, its capacity utilization rate in the first half of the year was 69.4% to 79.6%. Typically, a capacity utilization rate of 90% indicates full utilization. Thus, without boosting sales through price cuts, BYD's capacity utilization rate could be even lower.

Therefore, BYD has both the confidence and reason to cut prices, but for other new energy automakers, BYD becomes the "rule breaker."

02 BYD Begins Loosening the Price Constraints

Currently, automotive industry leaders are divided into two camps: one believes that a price war is inevitable, while the other argues that a prolonged price war will negatively impact the industry's healthy development. For example, Li Shufu, Chairman of Geely, has emphasized that simplistic price wars harm the healthy development of the industry.

After all, just because BYD can produce vehicles at low costs does not mean all automakers can match it. Competitive pressure is imminent, forcing other automakers to follow suit with price cuts.

However, "price cuts" are a double-edged sword. On the one hand, they can quickly boost sales and expand market share. For instance, after introducing the Honor edition in March, BYD's monthly sales rebounded to 300,000 units, roughly equivalent to the combined sales of January and February.

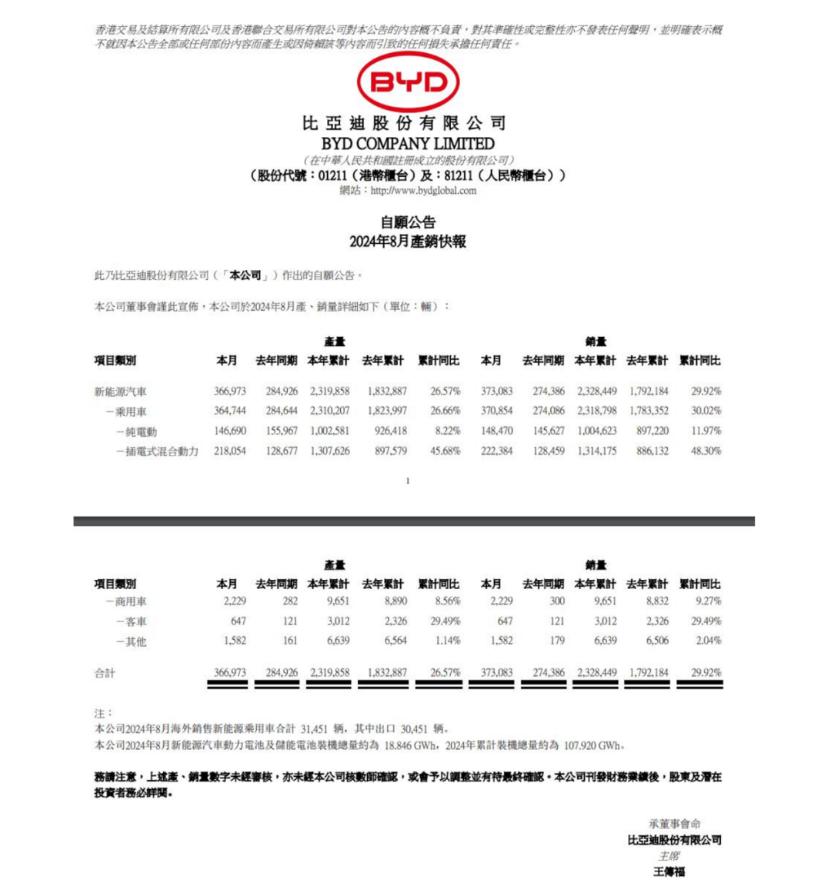

In the first half of this year, BYD sold 1.61 million new vehicles, representing a 28% year-on-year increase. Globally, BYD entered the top three global automakers for the first time, ranking second only to Toyota and Volkswagen in July; domestically, it surpassed SAIC Motor in sales in June, July, and August, becoming China's monthly top-selling automotive group.

However, the drawbacks are also evident. Firstly, there's the "backstabbing" feeling among consumers, as continuous price cuts by automakers in recent years have drawn criticism.

For example, a recent "model change turmoil" saw a car brand revise its models twice within six months, offering more features without increasing prices, essentially encouraging consumers to wait for discounts by delaying purchases. This can dampen consumer enthusiasm and affect purchasing intentions.

Secondly, the shrinking price reduction cycles for new energy automakers indicate a shift from brand premium pricing in the traditional fuel-powered era to competition-driven pricing. When selling cars becomes akin to selling fast-moving consumer goods, with discounts available before the end of the season, it is detrimental to the premium development of brands.

While pursuing sales growth in recent years, BYD has also actively promoted premiumization, with models like the million-yuan-plus YUWANG series and the 300,000 to 600,000 yuan TANG series. However, their sales performance has generally been mediocre.

According to statistics from Yiche.com, in the first half of this year, BYD sold 834,700 vehicles in the 100,000 to 200,000 yuan market segment, accounting for a market share of 18.04%; in the 200,000 to 300,000 yuan segment, it sold 182,800 vehicles, representing a market share of 9.64%.

Apart from the slow pace of introducing new mid-to-high-end BYD products, this segment is already crowded with formidable competitors like NIO, Xpeng, and Geely. To establish a foothold in this market, a brand cannot rely solely on "low prices"; frequent price cuts can even erode consumer goodwill towards the brand.

Lastly, there are implications for the overall new energy vehicle industry. For other automakers, following the price war means no profits, while not following means no orders. Originally, price cuts were merely a marketing tactic, affecting profit margins at most. However, the current price war directly impacts market share and survival, prompting more automakers to speak out against it.

Thus, after enjoying the benefits of price cuts, BYD is attempting to "slow down." Following the Qin L and Dolphin 06 DM-i, BYD's subsequent new models, including Song L, Dolphin, and Dolphin 07 DM-i, are priced higher than market expectations. For instance, the starting price of the 2025 Song PLUS DM-i has been raised from 129,800 yuan to 135,800 yuan.

Of course, this does not mean that BYD intends to abandon its cost advantage and exit the price war entirely; rather, it simply doesn't need to be the sole "King of Intense Competition."

On the one hand, after more than half a year of the price war, BYD has reaped sufficient benefits. On this basis, loosening the price constraints can better protect profit margins and prevent the company from getting caught in a profit vortex due to the price war.

On the other hand, even BYD cannot afford to abandon brand premiums and focus solely on low-priced models. Therefore, after introducing a couple of "shockingly low-priced" models, it must attempt to return to a path of brand premiumization. Adjusting prices for these products can also elevate price expectations for upcoming BYD models like Tang L and Han L.

03 Attempting to "Copy" the "Intelligence" Homework

Looking back at BYD's development history, one reason it has become the leading player in China's new energy vehicle industry is its early anticipation of new energy vehicle trends, technological advancements in hybrid and pure electric fields, and earlier deployments across the battery and chip supply chains, enabling it to quickly establish a market presence and scale advantages.

Initially entering the market, BYD chose to compete on cost advantages, taking the fast track of "cost-effectiveness." However, this inevitably branded it as a mid-to-low-end player in consumers' minds.

Yet, BYD does not want to miss out on the mid-to-high-end market. It has attempted to elevate its brand image through the introduction of mid-to-high-end models and logo adjustments, but these efforts seem to have yielded limited results so far.

In recent years, companies like NIO and Xpeng have focused on new product development and technological advancements. For instance, Xpeng became the first Chinese automaker to mass-produce vehicles equipped with end-to-end large models, launching the MONA series with Xpeng's intelligent driving technology, directly competing with BYD's offerings at a starting price of just 119,800 yuan.

Currently, intelligence levels are increasingly becoming a crucial factor in purchasing new energy vehicles, accounting for a growing proportion of consumer decision-making. Consequently, BYD has also begun attempting to "copy homework" in this area.

In August last year, media reported that BYD would terminate its autonomous driving technology cooperation agreement with Baidu and instead focus on developing its intelligent vehicle software in-house. Prior to this, BYD had already launched its advanced intelligent driving system, "Divine Eye."

This August, BYD's FANGCHENGBAO signed a cooperation agreement with Huawei's Qiankun Intelligent Driving in Shenzhen to jointly develop the world's first hardcore exclusive intelligent driving solution.

In fact, BYD Founder Wang Chuanfu has always had a nuanced stance on autonomous driving. While stating that driverless technology is "nonsense," he also emphasized the practicality of advanced driver assistance systems, believing that intelligence is the second half of the automotive revolution.

Industry insiders reveal that BYD's strategy for intelligent driving is to use suppliers for basic solutions and focus on in-house development for advanced systems. However, the exposure of FANGCHENGBAO's cooperation with Huawei's intelligent driving division highlights BYD's current shortcomings in this area, suggesting that it may not yet have a significant lead. Clearly, a dual-track approach combining cooperation and in-house development is the wiser choice at this stage.

Nevertheless, BYD has raised the banner of an "intelligent driving counterattack." Currently, BYD has three major advantages in intelligent driving: first, its in-house vehicle development capabilities enable true vehicle-level integrated perception and control, and it has already deployed in-house intelligent driving chips; second, it boasts the largest deployment of L2 intelligent driving assistance systems in China; and third, it has a wealth of technical talent, which can be understood as "financial muscle." Last year, BYD's R&D investment reached 39.918 billion yuan, marking a doubling growth.

BYD is willing to invest, and it's only a matter of time before it reaps the rewards. In January this year, BYD announced its integrated intelligence strategy, stating that advanced intelligent driving systems will be optional on models priced above 200,000 yuan and standard on those priced above 300,000 yuan.

However, intelligence is merely one factor in a carmaker's brand premiumization. Even Xpeng, with its advanced intelligent driving capabilities, is still perceived as lacking in personality in terms of brand image.

Currently, BYD aims to penetrate the mid-to-high-end market above 300,000 yuan and even the million-yuan level. However, this market demands high standards in brand image, channel marketing capabilities, and intelligence levels. While intelligence can be rapidly improved with significant investments, building a strong brand image takes time.

On its journey towards "premiumization," BYD may need to learn from new energy automakers, winning over consumers with quality and service. As Xpeng's He Xiaopeng puts it, marketing is crucial for product sales, and BYD must excel in this area.

Currently, BYD is striving to address its shortcomings in intelligence and premiumization. However, whether BYD's "financial muscle" can propel it to new heights remains to be seen. Beyond technological challenges, BYD must also confront marketing and product design hurdles. To succeed, BYD must not only overcome technical barriers but also win over consumers' hearts.

*The cover image and accompanying images used in this article belong to their respective copyright owners. If the copyright holders believe that their works are not suitable for public viewing or should not be used for free, please contact us promptly, and we will promptly rectify the situation.