"Tmall fake transactions and overseas business under renewed scrutiny, Jinghua Optics eagerly vies for Beijing Stock Exchange listing"

![]() 09/15 2024

09/15 2024

![]() 679

679

Produced by | Entrepreneur Frontier

Art Director | Li Yufei

Editor | Song Wen

Jinghua Optics is still waiting in line for its IPO.

On September 4th, Guangzhou Jinghua Precision Optics Co., Ltd. (hereinafter referred to as "Jinghua Optics") disclosed the third round of inquiry letter for review by the Beijing Stock Exchange. On December 28th last year, Jinghua Optics' IPO application was accepted, with Haitong Securities serving as the underwriter and sponsor.

Less than a month after listing on the New Third Board, Jinghua Optics applied for listing on the Beijing Stock Exchange, making it one of the fastest secondary listed companies to be accepted by the Beijing Stock Exchange.

However, behind its rush to list on the Beijing Stock Exchange, Jinghua Optics still faces numerous issues. For example, the company's overseas revenue has been questioned in three rounds of inquiries, casting doubt on the authenticity of its revenue. Additionally, the company relies on outsourced processing for its core products, and its own production and processing capabilities remain questionable.

1. Core products rely on outsourced processing, and R&D expense ratio is lower than peers

Jinghua Optics is primarily engaged in the R&D, design, production, and sales of precision optoelectronic instruments, intelligent automotive sensing systems, and precision optical components.

It is reported that well-known enterprises such as GAC Group, Amazon, and Walmart are customers of Jinghua Optics.

Despite having numerous well-known customers, Jinghua Optics' performance has continued to be under pressure in recent years.

From 2021 to the first half of 2024, Jinghua Optics' operating revenue was 1.221 billion yuan, 1.195 billion yuan, 1.116 billion yuan, and 450 million yuan, respectively, representing year-on-year growth rates of 21.81%, -2.17%, -6.59%, and -1.36%.

During the same period, the company's net profit attributable to shareholders was 63.366 million yuan, 91.5613 million yuan, 64.1574 million yuan, and 12.6373 million yuan, respectively, representing year-on-year growth rates of -54.10%, 44.50%, -29.93%, and -29.93%.

(Figure / Wind (unit: 10,000 yuan))

It can be seen that in recent years, Jinghua Optics' operating revenue and net profit attributable to shareholders have shown an overall downward trend.

The decline in performance is closely related to the fierce competition in the automotive industry. Publicly available information indicates that Jinghua Optics' primary business comprises three segments: precision optoelectronic instruments, intelligent automotive sensing systems, and precision optical components.

In its 2024 interim report, Jinghua Optics stated that due to the intense competition in the automotive industry impacting the supply chain, the company's revenue and profit from its intelligent automotive sensing systems business have declined, dragging down its overall performance.

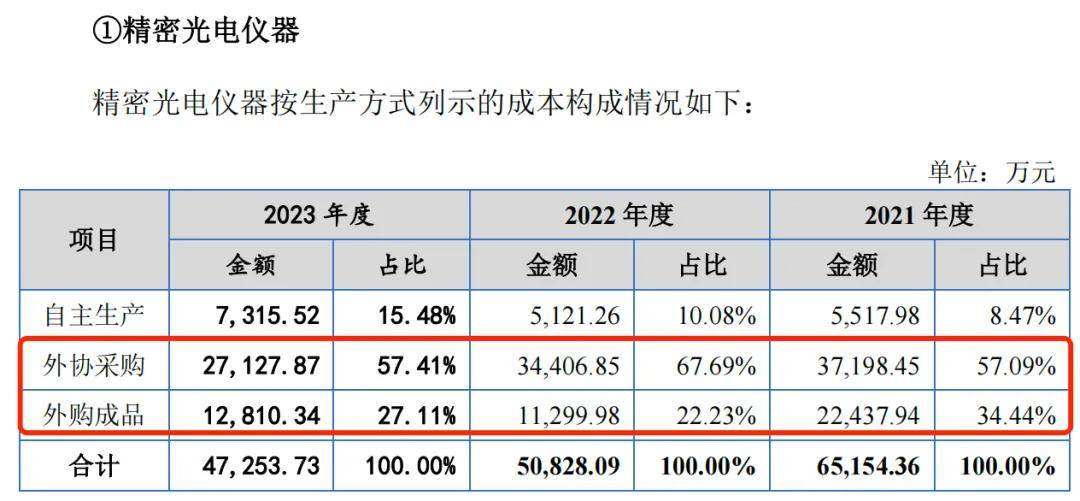

In addition, Jinghua Optics' reliance on outsourced production and procurement of finished products for its core products has often been criticized by outsiders.

The prospectus shows that precision optoelectronic instruments are Jinghua Optics' core products, accounting for more than 60% of its primary business revenue.

(Figure / Jinghua Optics Prospectus)

Classified by production method, precision optoelectronic instruments can be divided into three categories: self-production, outsourced procurement, and purchased finished products. According to Jinghua Optics' response to the inquiry letter, from 2021 to 2023, the proportion of outsourced procurement was as high as 57.09%, 67.69%, and 57.41%, respectively, while the proportion of purchased finished products was 34.44%, 22.23%, and 27.11%, respectively. The proportion of self-production was less than 20%.

(Figure / Jinghua Optics' First Round Inquiry Letter Response)

Firstly, given that Jinghua Optics' core products rely so heavily on external suppliers, it remains to be seen whether the company has sufficient in-house production capabilities. Secondly, since processing is handled by third-party suppliers, product quality cannot be directly controlled, and Jinghua Optics must bear the risk of product quality issues arising from outsourced processing.

In fact, Jinghua Optics' investment in R&D is not particularly high.

The prospectus shows that from 2020 to the first half of 2023 (hereinafter referred to as the "reporting period"), the company's R&D expenses were 26.8927 million yuan, 31.2896 million yuan, 38.3978 million yuan, and 13.0857 million yuan, respectively, accounting for 2.68%, 2.56%, 3.21%, and 2.87% of operating revenue during the corresponding periods.

During the same period, the average R&D expense ratio of peer companies was 7.21%, 7.49%, 8.56%, and 9.21%, respectively.

(Figure / Jinghua Optics Prospectus)

It can be seen that there is a significant gap between Jinghua Optics' R&D investment and that of its peer companies, with its R&D expense ratio being much lower. Furthermore, among the peer companies disclosed in the prospectus, Jinghua Optics has the lowest R&D expense ratio.

It is worth noting that a significant portion of Jinghua Optics' relatively modest R&D expenses are outsourced.

The prospectus shows that during the reporting period, the company's outsourced R&D expenses accounted for 7.93%, 7.00%, 10.03%, and 15.28% of its R&D expenses for the corresponding periods. Since 2022, the proportion of outsourced R&D undertaken by Jinghua Optics has increased significantly.

Regarding outsourced R&D, Jinghua Optics explained in its prospectus that it selects certain non-core products or non-core technology R&D matters to be handled by commissioned R&D suppliers.

In terms of R&D outcomes, Jinghua Optics has a total of 19 domestic invention patents, of which only 2 were obtained after 2021. It can be seen that Jinghua Optics' R&D outcomes have not been abundant in recent years.

2. Eagerly targeting the Beijing Stock Exchange, multiple gambling agreements have been signed

Founded in 1997, Jinghua Optics was first listed on the New Third Board in March 2015 and delisted on January 22, 2021.

On November 30, 2023, Jinghua Optics was relisted on the New Third Board. Just one month later, the company began applying for an IPO on the Beijing Stock Exchange.

As of the date of signing the prospectus, the company's actual controller is He Jian, who directly holds 55.22% of the shares and controls an additional 1.70% of the voting rights through Jingtou Investment, totaling 56.92% of the voting rights in Jinghua Optics.

Entrepreneur Frontier notes that in addition to its intensive preparations for entering the capital market, Jinghua Optics has previously introduced a considerable amount of external capital and signed multiple gambling agreements.

As early as July 2009, Jinghua Optics introduced investment from Kechuang Investment and Haihui Investment. New shareholders signed agreements with original natural person shareholders such as He Jian, stipulating special rights clauses such as performance compensation, share repurchases, and anti-dilution provisions.

In May 2011, new shareholders Haihui Fortune and Zhishan Venture Capital signed another gambling agreement with He Jian and Jinghua Optics, outlining special rights clauses such as performance compensation, share repurchases, and preferential transfer/assignment rights.

These gambling agreements were terminated on November 18, 2014, just before Jinghua Optics' listing on the New Third Board.

For this listing on the Beijing Stock Exchange, the company continued to attract numerous external investors just before filing its IPO application.

From November 2020 to March 2021, He Jian signed relevant agreements with individuals such as Liu Ruichun, stipulating that if Jinghua Optics did not submit an IPO application by December 31, 2023, it would trigger share repurchase clauses.

In May 2022, Jinghua Optics once again raised capital, with entities such as Kuang Zhenpeng and Li Fusheng subscribing to 3.87 million shares at a price of 13 yuan per share for a total capital increase of 50.31 million yuan. They also signed a gambling agreement requiring Jinghua Optics to submit a listing application by December 31, 2024.

Currently, all of the aforementioned gambling agreements have been terminated.

Entrepreneur Frontier notes that Jinghua Optics' capital increase, signing of gambling agreements, and eager application for listing on the Beijing Stock Exchange may be related to the company's insufficient funds.

According to the prospectus, as of the end of the first half of 2024, Jinghua Optics had short-term borrowings of 72 million yuan and monetary funds of 136 million yuan, leaving limited room for cash flow management.

More importantly, from 2021 to the first half of 2024, Jinghua Optics' net operating cash flow was -54.4499 million yuan, 136 million yuan, 93.725 million yuan, and -30.2486 million yuan, respectively. Notably, both 2021 and the first half of 2024 saw net outflows.

(Figure / Wind (unit: 10,000 yuan))

At this point, going public is undoubtedly a fast track to quickly alleviate financial pressure. It becomes evident why Jinghua Optics quickly targeted the Beijing Stock Exchange soon after listing on the New Third Board.

3. History of fake transactions on Tmall, overseas transactions repeatedly questioned

In fact, Jinghua Optics' main battleground is overseas.

Publicly available information shows that Jinghua Optics' overseas business covers various countries and regions globally, with products primarily exported to Europe and the United States. In particular, the company's core product, precision optoelectronic instruments, is primarily sold overseas.

During the reporting period, the company's overseas primary business revenue accounted for 77.37%, 75.79%, 66.53%, and 61.43% of total primary business revenue, respectively, with overseas regions contributing more than 60% of total primary business revenue each year.

However, the response rate for overseas sales is much lower than that for domestic sales.

Taking precision optoelectronic instruments as an example, from 2021 to 2023, the company's sales revenue confirmation ratio was 86.70%, 94.97%, and 83.78%, respectively, while the overseas sales revenue confirmation ratio was only 43.87%, 42.70%, and 52.69%, respectively.

(Figure / Jinghua Optics Inquiry Letter Response)

In response to the low response rate from overseas customers, the Beijing Stock Exchange also raised inquiries, requiring Jinghua Optics to explain the reasons and rationality for the low response rate from overseas customers, the alternative procedures and their effectiveness for customers who did not respond, and the specific verification and conclusions regarding the authenticity of revenue from overseas offline retailers and end-users.

Jinghua Optics stated that the low response rate for its overseas entities' sales revenue confirmation was primarily due to the following reasons: firstly, overseas customers do not provide confirmation based on cultural habits, legal and internal control requirements, etc.; secondly, Jinghua Optics' major overseas customers are large-scale enterprises, and the transaction amounts have little or no impact on them; and thirdly, the company has a large number of retailers and end-users with small transaction amounts and high randomness.

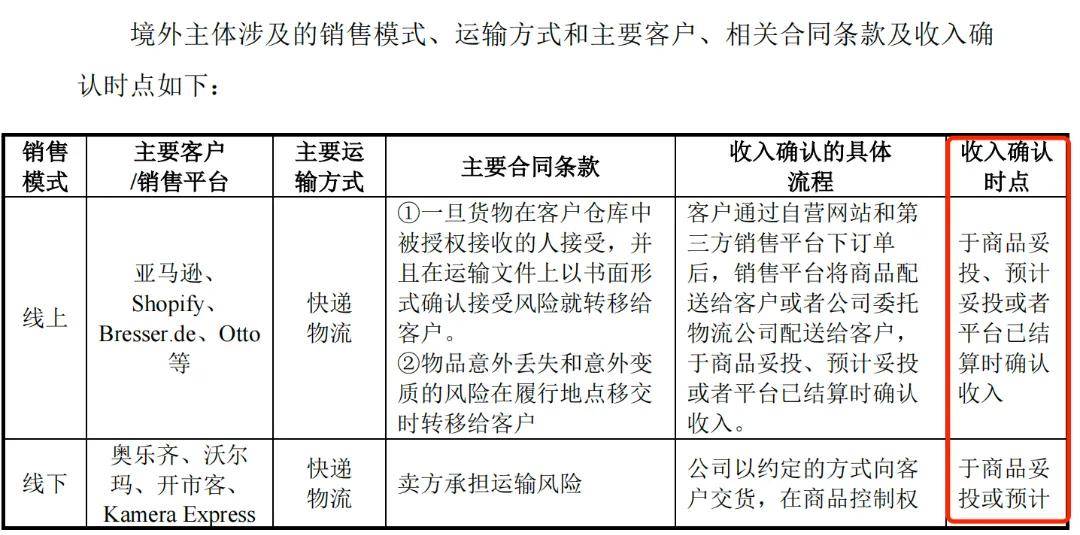

Moreover, Jinghua Optics' overseas revenue recognition method is relatively "casual."

The inquiry letter response shows that the company's overseas sales are divided into online and offline segments. Among them, online customers primarily include Amazon, Bresser.de, Shopify, etc., and revenue is recognized upon successful delivery, expected delivery, or platform settlement.

Offline customers include Aldi, Walmart, Costco, and Kamera Express, and revenue is recognized upon successful delivery or expected delivery.

(Figure / Jinghua Optics Inquiry Letter Response)

In other words, Jinghua Optics recognizes revenue as soon as the customer receives the order shipment, even though overseas customers are entitled to a 30-day no-reason return period.

During the three rounds of inquiries, the regulatory authorities repeatedly questioned the authenticity and adequacy of the company's overseas sales verification. In the first round, the regulatory authorities required Jinghua Optics to verify the authenticity and adequacy of its overseas sales. In the second round, the company was asked to further clarify its control over overseas subsidiaries.

In the latest disclosure of the third round of inquiries, the regulatory authorities required Jinghua Optics to further clarify the situation of its overseas subsidiaries and the authenticity of overseas inventories.

Additionally, regarding domestic revenue, from 2020 to 2021, to optimize product search rankings, Jinghua Optics engaged in fake transactions on the Tmall platform.

If these issues cannot be adequately explained, they may pose a significant obstacle on Jinghua Optics' path to going public.

*Note: The featured image in this article is from Shutterstock, based on the VRF agreement.