The Decline of Tecno: Africa Doesn't Need 'Xiaomi'

![]() 11/12 2024

11/12 2024

![]() 626

626

Last year, Tecno, the "King of African Mobile Phones," was riding high, but this year it has faced a series of setbacks and troubles. First, Qualcomm sued Tecno for patent infringement in India, and then company executives were placed under retention measures and an investigation was launched. Now, the company's third-quarter performance has plummeted.

According to Tecno's 2024 third-quarter report, the company's operating revenue for the first three quarters was 51.252 billion yuan, an increase of 19.13% year-on-year, and its net profit was 3.903 billion yuan, an increase of only 0.5% year-on-year. In the third quarter, the company's net profit fell sharply by 41.02%.

This is somewhat unusual in the global mobile phone industry. Canalys data shows that global smartphone shipments increased by 5% year-on-year in the third quarter of 2024, marking the fourth consecutive quarter of growth. However, Tecno's sales have declined significantly during this period, falling out of the top five globally and being overtaken by OPPO and vivo. It is worth mentioning that Xiaomi remained the third-largest smartphone brand in the global market in the third quarter, accounting for 14% of the market share.

Both following the cost-effective route and rooted in the low-to-mid-end market, Tecno does not seem to have achieved the same "comeback" success as Xiaomi. The particularity of the African market has allowed it to quietly make a fortune but has also trapped it.

Cost-effectiveness has not become Tecno's moat

As early as 2007, when the first iPhone was just released, Tecno had already set its sights on the African market. When Zhu Zhaojiang was working in the mobile phone industry, he discovered a blank space in the African mobile phone market and saw great potential. He later left his job to found Tecno. Therefore, while brands like Apple and Samsung were competing for the European, American, and Chinese markets, Tecno was quietly cultivating this yet-to-be-fully-developed blue ocean market.

Avoiding the most intense competition and being the first to implement a series of localization strategies in the African market were the core reasons for Tecno's successful growth from a small factory to an industry "dark horse." However, while localization was important for Tecno's entry into the African market, the key factor was its low prices.

Tecno's prospectus shows that in 2018, the average selling price of its smartphones was only 454 yuan. Among them, the high-end Infinix, the mass-market TECNO, and the youth brand itel were priced in the ranges of 600 yuan, 500 yuan, and 300 yuan, respectively. Feature phones were even cheaper, with the average price of TECNO feature phones being 77 yuan and itel feature phones being further reduced to 60 yuan. At that time, the average price of smartphones in China's market had already reached 2,523 yuan.

When other mobile phone brands entered Africa, they focused on providing local users with specific types of phones. In contrast, Tecno focused on solving the problem of getting phones into the hands of people who previously had none. Clearly, the latter was a more widespread need in the African market.

With its extremely low pricing, Tecno was virtually unstoppable in Africa and even once "drove out" Xiaomi, which had its eyes on the African market. However, this year, Tecno's "throne" in Africa seems shaky. According to Canalys data, Tecno's market share in the African smartphone market was 51% in the second quarter of 2024, a year-on-year decrease of 3 percentage points. During the same period, Xiaomi's market share increased to 12%, a year-on-year increase of 45%.

Moreover, in the second quarter, Tecno's shipments and market share in major markets such as Southeast Asia, the Middle East, and Latin America also began to shrink.

It is clear that as major mobile phone brands intensify their efforts to expand into overseas markets, Tecno's market share in Africa and other regions is being eroded. This indicates that a one-sided low-price strategy is no longer suitable for the current competitive landscape.

Tecno's low-price strategy was formed under specific market conditions, including local economic levels, consumer demand, and competitive dynamics. The cost-effectiveness advantage built around low prices is essentially the combined result of cost control, supply chain management, technology, and other factors. Although Tecno has been established in Africa for many years, it is evident that it cannot compete with domestic mobile phone manufacturers like Xiaomi in terms of ultimate cost-effectiveness.

Especially as the demand for smartphones in the African market shifts from basic functions to higher performance and multifunctionality, Tecno, which focuses on low prices, appears mediocre among the many domestic mobile phone brands that have ventured overseas. Currently, with only a few models on sale, Xiaomi and Realme have achieved impressive results in Africa, posing an increasingly significant threat to Tecno.

Poverty Limits the Imagination of the Mid-to-High-End Market

In the second quarter of this year, Xiaomi delivered an extremely impressive financial report. During this quarter, revenue reached 88.9 billion yuan, with significant growth in Xiaomi's smartphones, IoT business, and internet business, all exceeding market expectations. This marked Xiaomi's fourth consecutive quarter of positive year-on-year and quarter-on-quarter growth and its third consecutive quarter of double-digit growth.

Xiaomi has struggled in recent years as it transitioned from relying on cost-effectiveness to striving to shed the cost-effectiveness label. However, the preliminary results of its premiumization strategy are now evident. By separating Redmi, Xiaomi has created opportunities for its brand to continue to move upmarket. Now, through the continuous launch of mid-to-high-end products, Xiaomi has achieved significant results in the mid-to-high-end markets in China, Europe, and the United States. At the same time, its overseas market continues to follow the original "volume for price" strategy, resulting in rapid growth in overseas sales.

Xiaomi's transformation provides a practical path for Tecno, which does not want to rely solely on low-end devices for profit. However, the current situation in the African market seems to prevent Tecno from exploring the mid-to-high-end market.

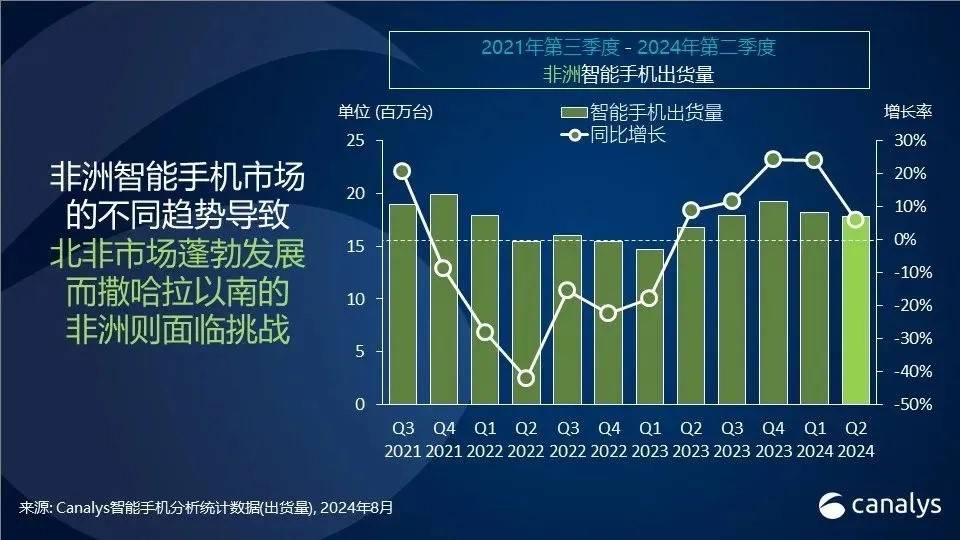

Since 2021, the entire African mobile phone market has experienced significant fluctuations. According to Canalys data, from the third quarter of 2021 to the second quarter of 2022, the year-on-year growth rate of African smartphones declined sharply, with six consecutive quarters of negative growth. Additionally, although shipments resumed growth after the second quarter of 2023, the quarterly shipment volume still has not reached the level of the fourth quarter of 2021.

This is directly related to changes in the African economy in recent years. In 2021, the COVID-19 pandemic caused severe losses to the African economy, leading to increased unemployment and a decline in per capita income. Under these circumstances, the cost of living for local residents has risen significantly, and many people do not have "extra money" to purchase smartphones. This situation has persisted in African countries this year, with the economic and employment outlooks remaining bleak.

For example, South Africa, which originally held a significant share and was the fastest-growing market for smartphones in Africa, is currently experiencing economic depression: companies are reducing production, exports of manufactured goods are decreasing, some manufacturing enterprises are either closing or reducing operations, employees are losing their jobs, and residents' debt is increasing. Even more distressing, according to International Monetary Fund predictions, unemployment in South Africa will rise to 33.5% by the end of 2024.

This economic situation has inhibited the popularity of smartphones. The biggest challenge facing the African market is still making smartphones affordable for more people rather than providing them with high-end devices. Especially for mid-to-high-end smartphones, there may not be a large consumer base willing to pay for them here.

Data supports this point. According to Canalys, the average selling price (ASP) of smartphones in Africa in the second quarter of 2024 was the lowest in the past 11 quarters. The price segment below 100 dollars experienced a surge of 42%, accounting for 33% of total shipments. Consumers are increasingly favoring devices with higher cost-effectiveness.

In fact, since last year, Tecno has intensified its layout in the mid-to-high-end strategy. However, based on current financial reports, mid-to-high-end phones have not increased its profits, but rather increased its research and development costs.

Africa, Abandoned by the Internet, Lacks Business Miracles

Tecno does not want to rely solely on mobile phones for profit. Before going public, it had already begun to lay out a second growth curve, namely the integration of software and hardware, forming a business ecosystem of "mobile phones + mobile internet services + home appliances + digital accessories." In mobile internet services, Tecno has developed its OS based on Android and incubated and launched multiple mobile applications. In other hardware, Tecno has established the digital accessory brand oraimo, the after-sales service brand Carcare, and the home appliance brand Syinix.

Obviously, Tecno is replicating the successful development path explored by domestic mobile phone brands in the Chinese market, bringing users a richer mobile internet experience and obtaining higher profits through business diversification. This business logic is very similar to Xiaomi's model, where hardware products are responsible for attracting customers, internet services are responsible for generating revenue, and IoT services aim to build a larger Internet of Things ecosystem.

The ideal is full, but reality is often cruel. Public information shows that in 2020 and the first half of 2021, Tecno's other main business income only accounted for 2.9% and 3.6% of its total income, respectively. According to its annual report, the mobile phone business still accounted for over 90% of Tecno's total revenue in 2023.

Tecno's layout in the African market is too extensive, and it does not have the ability to independently support such a large-scale operation.

For example, in mobile application development, Tecno has not only launched products such as browsers and app stores, which are common among other mobile phone manufacturers, but has also ventured into various fields such as streaming media, short videos, and mobile payments. Applications like the music app Boomplay, the news aggregator app Scooper, and the mobile payment app Palmpay can be seen as African versions of NetEase Cloud Music, Toutiao, and Alipay, respectively.

These mobile applications are not direct copies of Chinese apps brought to Africa by Tecno. Most of them rely on cooperation with domestic internet giants. For example, the most successful app, Boomplay, is backed by NetEase.

Tecno's own deficiencies are not the biggest limitation. The key factor restricting Tecno from becoming an African internet giant lies in the fact that the African land has not yet embraced the wave of mobile internet or lacks the necessary conditions for its rapid development in the short term.

In Africa, even users in large cities face issues such as inadequate internet infrastructure and unstable network connection speeds. Moreover, the less developed the service area, the higher the basic network fees. In addition to signal issues, electricity is also a problem. In many African countries, especially in remote areas, the power supply lags significantly. Therefore, many mobile phone users face the embarrassment of inconvenient charging even if they have mobile phone signals.

So, forget about improving users' internet experience; ensuring basic mobile phone functionality is the priority. After more than a decade of deep cultivation in the African market, Tecno is still at this stage.

Of course, the smartphone penetration rate in the African market will continue to rise, but it is difficult to make money from users here, not because of their lack of paying ability, but because core monetization methods such as advertising, e-commerce, and gaming may not be widely accepted. In Africa, local consumers have a high level of trust in advertising media, and advertising placements through traditional channels such as FM radio, outdoor advertising (like wall painting), and television are much higher than those for various internet ads alone.

It is undeniable that Africa may be a blue ocean for the smartphone industry and brands, but it is not a blue ocean for the mobile internet business. Here, there is no growth rate imagined by the outside world. Most emerging things or industries move at a snail's pace, with slow and subtle changes.

Tecno still has a long wait ahead.

Dao Zongyouli, formerly known as Waidaodao, is a new media outlet in the internet and technology industry. This article is original and cannot be reproduced in any form without retaining the author's relevant information.